UDATE: Darden: Conditions `Improving`; Sales Sequentially Rising

December 18 2009 - 11:18AM

Dow Jones News

Darden Restaurants Inc.'s (DRI) said conditions are improving

for the casual-dining restaurant company, with same-store sales

gradually getting better and some signs that consumers are shaking

off worries over job losses.

"Overall conditions are improving," Darden's Chairman and Chief

Executive Clarence Otis said on Friday's second-quarter earnings

call.

Executives at Darden, which operates the Red Lobster, Olive

Garden and LongHorn Steakhouse, laid out several hopeful signs that

the full-service restaurant industry could begin, after several

false-starts, a sustained improvement in sales and claw out of a

multi-year slump.

Investors took note, driving up shares of Darden $1.95, or 6%,

in recent trading to $34.60. Competitors like Brinker International

Inc. (EAT) rose 4.5% to $14.96, while smaller chains like Red Robin

Gourmet Burger Inc. (RRGB), Cheesecake Factory Inc. (CAKE) and

Buffalo Wild Wings Inc. (BWLD) also posted solid gains.

Darden, which late Thursday said second-quarter earnings rose 1%

on lower costs, said that same-store sales in December are so far

showing another month of sequential improvement. While it is

partially due to an easy comparison from last year, Otis said it

was a promising start to the current quarter.

"We expect that this would be the beginning of another quarter

of sequential improvement," Otis said.

While lower prices for ingredients and utilities are helping

profits, Darden's brands still have a hole to climb out of on

sales. Same-store sales for its three largest brands fell 3.9% in

its second-quarter, including an impact for a calendar shift that

brought Thanksgiving into the quarter.

Darden's laggard remained Red Lobster, stung by a promotional

strategy that company executives admit lacked a compelling price

point. The seafood chain focused on its seasonal Endless Shrimp

promotion, priced at $15.99 to $16.99, at a time when other chains

could point toward more attractively priced deals, including at

Darden's other brands. Darden executive said future promotions at

the seafood chain would highlight lower-priced entrees.

Still, the company pledged to stay away from much of the deep

discounts that have spread across the broader casual-dining sector,

hoping to keep its average check up and not train its customers to

pay less.

Discounts also appear to be waning to a degree, as Darden said

industry wide number showed the average check per diner improving

slightly and traffic also improving, implying that guests aren't

coming in just for discounts. "It was a different dynamic in terms

of what was leading to an increasing guest count," Otis said.

Darden also saw improvement at its higher-end brand Capital

Grille, a sign that the higher-end consumer and business spending

is picking up.

Darden also said it was also on track for its full-year earnings

target, even as it forecast same-store sales to fall 3% to 4% for

the year.

-By Paul Ziobro, Dow Jones Newswires; 212-416-2194;

paul.ziobro@dowjones.com

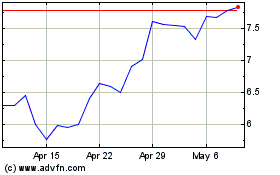

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Mar 2024 to Apr 2024

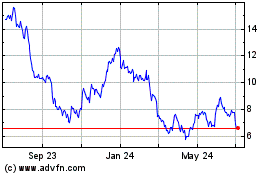

Red Robin Gourmet Burgers (NASDAQ:RRGB)

Historical Stock Chart

From Apr 2023 to Apr 2024