Current Report Filing (8-k)

October 09 2015 - 4:53PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 6, 2015

ROYALE ENERGY, INC.

(Exact name of registrant as specified in its charter)

|

California

|

|

0-22750

|

|

33-02224120

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

3777 Willow Glen Drive

El Cajon, California 92019-4601

(Address of principal executive office)

Issuer's telephone number: (619) 383-6600

Item 3.01 Notice of Failure to Satisfy a Continued Listing Rule or Standard

On October 6, 2015, Royale Energy, Inc., received a letter from the NASDAQ Listing Qualifications Staff (the “Staff”) of The NASDAQ Stock Market LLC (“NASDAQ”) notifying the Company that the Staff has determined that the Company has not regained compliance with the minimum $2.5 million stockholders’ equity for continued listing set forth in Listing Rule 5550(b)(1).1 The Company’s securities would be subject to delisting unless the Company requests a hearing on the delisting notice before the NASDAQ Listing Qualifications Panel (the “Panel”) by October 13, 2015. The Company intends to timely request a hearing before the Panel, at which the Company will present its plan to regain and thereafter sustain compliance with all applicable listing requirements. The Company’s securities will continue to be listed on The NASDAQ Capital Market pending the completion of the hearing process and the expiration of any extension granted by the Panel. However, there can be no assurance that the Panel will grant the Company’s request for continued listing.

1 The Staff had previously notified the Company that it did not comply with this listing requirement on June 4, 2015, and had granted the Company’s request for an extension until October 5, 2015, to regain compliance with this requirement.

On August 31, 2015, the Staff notified the Company that it failed to meet the minimum $1 bid price requirement in Listing Rule 5550(a)(2). On September 11, 2015, the Staff notified the Company by letter that it is not currently in compliance with NASDAQ Marketplace Rule 5605(b)(1) and 5605(c)(2). Rule 5605(b)(1) requires that Royale’s Board of Directors be composed of a majority of independent directors, as defined by NASDAQ rules. Rule 5605(c)(2) requires that Royale’s Audit Committee consist of at least three members, each of whom must be an independent director. At a hearing to appeal the October 6, 2015, delisting notice, the Company must also address the deficiencies based on the minimum bid price and independent director requirements.

To address the $1 minimum bid requirement, the Company has scheduled a shareholders’ meeting for November 19, 2015, to ask the shareholders to vote to approve a reverse stock split of between 1.5-for-1 and 5-for-1 shares of the Company’s common stock to help regain compliance with the minimum bid requirement. At the meeting, the shareholders will also be asked to approve an increase in the number of authorized shares of common stock from 20 million to 30 million shares to allow for the sale of additional equity to help regain compliance with the minimum stockholders’ equity requirement. The shareholders’ meeting notice is more fully described in the Company’s Definitive Proxy Statement filed with the SEC on Schedule 14A on October 6, 2015.

To address the requirement that the Audit Committee consist of at least three directors, each of whom must be an independent director, on September 24, 2015, the Company’s Board of Directors appointed Ronald Verdier as a Director of the Company and member of the Audit Committee. The Company’s Board has determined that Mr. Verdier is an independent director and an audit committee financial expert. The Company believes that it has regained compliance with the requirement that the Audit Committee consist of at least three members, each of whom must be an independent director. The Company is working to regain compliance with the requirement that the Board of Directors be composed of a majority of independent directors.

Attached is a press release regarding the notice received from NASDAQ on October 6, 2015.

Item 9.01 – Financial Statements and Exhibits

Exhibit 99.1 Press Release

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ROYALE ENERGY, INC.

|

| |

|

|

Date: October 9, 2015

|

/s/ Jonathan Gregory

|

| |

Jonathan Gregory, Chief Executive Officer

|

EXHIBIT 99.1

ROYAL ENERGY ANNOUNCES RECEIPT OF NASDAQ STAFF DETERMINATION LETTER; INTENDS TO REQUEST HEARING

San Diego, October 9, 2015 - Royale Energy, Inc. (NASDAQ: ROYL) today announced that, on October 6, 2015, the Company received a letter from the NASDAQ Listing Qualifications Staff (the “Staff”) of The NASDAQ Stock Market LLC (“NASDAQ”) notifying the Company that the Staff has determined that the Company is non-compliant with the stockholders’ equity, majority independent director and audit committee requirements for continued listing, as set forth in NASDAQ Listing Rules 5550(b), 5605(b)(1) and 5605(c)(2). As a result of the foregoing, the Company’s securities would be subject to delisting unless the Company requests a hearing before the NASDAQ Listing Qualifications Panel (the “Panel”) by October 13, 2015. The Company intends to timely request a hearing before the Panel at which it will present its plan to regain and thereafter sustain compliance with all applicable listing requirements. The Company’s securities will continue to be listed on The NASDAQ Capital Market pending the completion of the hearing process and the expiration of any extension granted by the Panel. However, there can be no assurance that the Panel will grant the Company’s request for continued listing.

Forward Looking Statements

In addition to historical information contained herein, this news release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, subject to various risks and uncertainties that could cause the company’s actual results to differ materially from those in the “forward-looking” statements. While the company believes its forward looking statements are based upon reasonable assumptions, there are factors that are difficult to predict and that are influenced by economic and other conditions beyond the company’s control. Investors are directed to consider such risks and other uncertainties discussed in documents filed by the company with the Securities and Exchange Commission.

Contact:

Royale Energy, Inc.

Chanda Idano

Director of Marketing & PR

619-383-6600

chanda@royl.com

http://www.royl.com

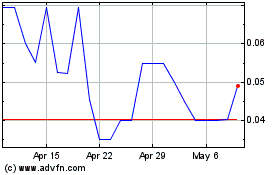

Royale Energy (QB) (USOTC:ROYL)

Historical Stock Chart

From Mar 2024 to Apr 2024

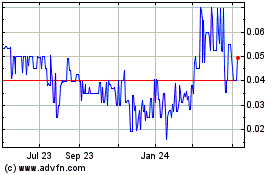

Royale Energy (QB) (USOTC:ROYL)

Historical Stock Chart

From Apr 2023 to Apr 2024