UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C.

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [ X ]

Check the appropriate box:

[ X ] Preliminary Proxy Statement

[ ] Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Sec. 240.14a-12

ROYALE ENERGY, INC.

(Name of Registrant as Specified in its Charter)

Filed on Behalf of the Board of Directors

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[ X ] No fee required.

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

Royale Energy, Inc.

DATE: October __, 2015

PLACE: Royale Energy, Inc.

3777 Willow Glen Dr.

El Cajon CA 92019

Matters to be Voted on:

|

1.

|

An amendment to our amended and restated articles of incorporation to increase the number of authorized shares of our common stock from 20,000,000 to 30,000,000;

|

|

2.

|

An amendment to our amended and restated articles of incorporation to effect, at the discretion of the board of directors, a reverse stock split of all of the outstanding shares of our common stock at a ratio of not less than 1-for-2 and not greater than 1-for-4 shares; and

|

|

3.

|

The transaction of such other business as may properly come before the meeting and any adjournment thereof.

|

Who May Attend and Vote at the Meeting

Shareholders of record at the close of business on September __, 2015, and valid proxy holders may attend and vote at the meeting. If your shares are registered in the name of a brokerage firm or trustee and you plan to attend the meeting, please obtain from the firm or trustee a letter or other evidence of your beneficial ownership of those shares to facilitate your admittance to the meeting.

This proxy statement and the accompanying proxy form are being mailed on or about _______________, 2015, to shareholders entitled to vote at the meeting.

|

By Order of the Board of Directors,

|

| Jonathan Gregory |

|

Chief Executive Officer

|

| Date: September __, 2015 |

PROXY STATEMENT

Royale Energy’s board of directors solicits your proxy, using the enclosed proxy card, for use at the special meeting of shareholders to be held October __, 2015, and at any adjournment thereof. This proxy statement has information about the special meeting and was prepared by Royale Energy’s management for the board of directors. Your vote at the special meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed envelope.

As used in this proxy statement, “Royale Energy,” “Royale,” “the Company,” “we,” “our” and “us” refer to Royale Energy, Inc., a California corporation.

GENERAL INFORMATION

The only items of business which management intends to present at the meeting are listed in the preceding Notice of Special meeting of Shareholders and are explained in more detail on the following pages. By returning your signed proxy, you authorize management to vote your shares as you indicate on these items of business and to vote your shares in accordance with management’s best judgment in response to any proposals initiated by others at the meeting.

1) Changing or Revoking Your Proxy Vote

You may revoke your signed proxy at any time before it is exercised at the special meeting. You may do this by advising Royale Energy’s secretary in writing of your desire to revoke your proxy, or by submitting a duly executed proxy bearing a later date. We will honor the proxy card with the latest date. You may also revoke your proxy by attending the special meeting and indicating that you wish to vote in person.

2) Who may Vote

Each shareholder of record at the close of business on September __, 2015, is entitled, for each share then held, to one vote on each proposal or item that comes before the special meeting. On September 14, 2015, Royale Energy had outstanding 15,187,260 shares of common stock and 46,662 shares of Series AA convertible preferred stock entitled to vote at the meeting.

3) Voting in Person

Although we encourage you to complete and return your proxy to ensure that your vote is counted, you can attend the special meeting and vote your shares in person.

4) Voting by Street Name Holders

If your shares are held in a brokerage account or by another nominee, you are considered the “beneficial owner” of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee (the “record holder”) along with a voting instruction card. As the beneficial owner, you have the right to direct your record holder how to vote your shares, and the record holder is required to vote your shares in accordance with your instructions. If you do not give instructions to your record holder by 11:59 pm on October __, 2015, the record holder will not be able to vote your shares on any of the proposals, and your shares will be considered a “broker non-vote” on those proposals.

As the beneficial owner of shares, you are invited to attend the special meeting. Please note, however, that if you are a beneficial owner, you may not vote your shares in person at the meeting unless you obtain a “legal proxy” from the record holder that holds your shares.

5) How your Votes are Counted

We will hold the special meeting on October __, 2015, if holders of a majority of the shares of common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card,

your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the matters listed on the proxy card.

If you mark “Abstain” with respect to any proposal on your proxy, your shares will be counted in the number of votes cast, and will have the effect as votes counted against the proposals. If a broker or other nominee holding shares for a beneficial owner does not vote on a proposal, the shares will not be counted in the number of votes cast.

6) Votes Required to Approve Proposals

Each proposal is subject to the approval of the holders of a majority in voting power of the outstanding common stock and Series AA preferred stock entitled to vote on the Proposals.

ITEMS OF BUSINESS

|

PROPOSAL 1: AMENDMENT TO OUR AMENDED AND RESTATED ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK FROM 20,000,000 TO 30,000,000

|

As of September 14, 2015, Royale Energy had authorized 20,000,000 shares of no par value common stock and had 15,187,260 shares issued and outstanding. On that date, Royale Energy also had authorized 10,000,000 shares of no par value preferred stock and had 46,662 shares of Series AA preferred stock issued and outstanding.

Stockholders are being asked to approve an amendment to Royale Energy’s Amended and Restated Articles of Incorporation providing for a ten million share increase in the number of authorized shares of common stock in order make additional shares available for capital formation by means of equity investments in the Company.

On April 7, 2015, NASDAQ notified Royale Energy, by letter that Royale is not currently in compliance with the requirement that companies listed on the NASDAQ Capital Market are required by Marketplace Rule 4450(a)(3) to maintain a minimum of $2.5 million in stockholders’ equity for continued listing. Royale’s Form 10-K for the year ended December 31, 2014, reported stockholders’ equity at December 31, 2014, of ($1,141,227). In response, the company has filed with NASDAQ a plan to increase stockholders equity by selling additional shares of common stock.

On June 4, 2015, NASDAQ granted Royale Energy an extension through October 5, 2015, to file financial statements demonstrating compliance with the minimum stockholders’ equity requirement. The fulfillment of this plan will allow Royale Energy’s stock to continue trading on the NASDAQ Capital Market. Royale Energy plans to sell additional shares of common stock as part of its plan to increase stockholders’ equity, and it may need authority to issue additional shares which exceed the current 20 million share authorization.

On May 20, 2015, a registration statement on Form S-3, filed by the Company to sell common stock sufficient to raise net stockholder’s equity to a level above $2.5 million, became effective with the SEC. Also on May 20, 2015, the Company, entered into a Sales Agreement (the “Sales Agreement”) with Roth Capital Partners, LLC (“Roth”), under which the Company may issue and sell shares of its common stock for aggregate consideration of up to $7,726,103, from time to time in an at the market equity offering program with Roth acting as the Company’s sales agent (the “Offering”). From May 20 until September 14, 2015, the Company has sold 152,869 shares of its common stock pursuant to the Offering and has received net offering proceeds of $106,701 from these sales.

The additional shares of common stock will, if and when issued, be identical to the shares of the Company’s common stock now authorized and outstanding. The holders of the Company’s common stock do not have preemptive rights to purchase shares of stock in the event of a sale or issuance of stock by the Company.

The increase in authorized shares will not affect the rights of current stockholders, but issuance of the shares could decrease each existing stockholder's proportionate equity ownership. In addition, Royale Energy is considering the possibility of acquiring additional oil and gas properties, either directly or by way of a merger or share exchange with other oil and gas producers, and the company may need to issue shares in excess of the current 20 million share

authorization to accomplish those acquisitions. As of the date of this proxy statement, no specific target companies or properties have been identified for acquisitions.

After shareholder approval of the proposed increase in authorized shares, the additional shares can be issued by the board without further stockholder action except as required by law or stock exchange regulations. The board believes that this flexibility is in the best interests of the Company and its stockholders.

An amendment to the Company’s Amended and Restated Articles of Incorporation is required to increase the number of authorized shares. The text of the proposed amendment is attached to this proxy statement as Appendix A. The affirmative vote of the holders of a majority of Royale Energy’s Common Stock is required to approve the proposal.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE AMENDMENT TO OUR AMENDED AND RESTATED ARTICLES OF INCORPORATION TO INCREASE THE NUMBER OF AUTHORIZED SHARES OF OUR COMMON STOCK FROM 20,000,000 TO 30,000,000.

|

|

PROPOSAL 2: AMENDMENT TO OUR AMENDED AND RESTATED ARTICLES OF INCORPORATION TO EFFECT, AT THE DISCRETION OF OUR BOARD OF DIRECTORS, A REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A RATIO OF NOT LESS THAN 1-FOR-1.5 AND NOT GREATER THAN 1-FOR-3

|

Our Board has adopted a resolution declaring advisable, and recommending to our stockholders for their approval, an amendment to Article III of our Articles of Incorporation authorizing a reverse stock split of all of the outstanding shares of our Common Stock at a ratio of not less than 1-for-1.5 and not greater than 1-for-3, with the exact ratio to be established at the discretion of the Board (a “Reverse Stock Split”), and granting the Board the discretion to file a Certificate of Amendment to our Articles of Incorporation with the Secretary of State of the State of California. The form of the proposed amendment is attached to this proxy statement as Appendix B (the “Reverse Stock Split Amendment”).

If this Proposal is approved, the Board would have the sole discretion to elect to effect the Reverse Stock Split, or not to effect the Reverse Stock Split if they concluded it was not in the best interest of the stockholders of the Company. Providing this authority to the Board rather than mere approval of an immediate Reverse Stock Split, as well as the availability of a range of Reverse Stock Split ratios, would give the Board flexibility to react to market conditions and act in the best interests of the Company and our stockholders. The Company believes that giving the Board the authority, but not the mandate, to execute the Reverse Stock Split will provide it with the flexibility to implement the Reverse Stock Split, if it does at all, in a ratio and at a time that it believes would be advantageous for the Company and its stockholders. In determining which Reverse Stock Split ratio to implement, the Board may consider, among other things, factors such as:

|

·

|

the listing requirements of the NASDAQ Capital Market and other stock exchanges;

|

|

·

|

the approval by our shareholders to grant the Board authority to effect a Reverse Stock Split;

|

|

·

|

the historical trading price and trading volume of our Common Stock;

|

|

·

|

the number of shares of our Common Stock outstanding;

|

|

·

|

the then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Stock Split on the trading market for our Common Stock;

|

|

·

|

the likely effect on the market price of our Common Stock; and

|

|

·

|

prevailing general market and economic conditions.

|

If the Board determines to effect the Reverse Stock Split, the Company would file an amendment to our Articles of Incorporation with the California Secretary of State, which would be substantially in the form of the Reserve Stock Split Amendment attached to this proxy statement as Appendix B. The Company would also obtain a new CUSIP number for the Common Stock at the time of the Reverse Stock Split. The Company must provide the Financial Industry Regulatory Authority with at least ten (10) calendar days advance notice of the record date of the Reverse Stock Split in compliance with Rule 10b-17 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

a) Reasons for the Reverse Stock Split Amendment

On the date of the mailing of this proxy statement, our common stock was listed on the Nasdaq Capital Market under the symbol “ROYL.” The continued listing requirements of the Nasdaq Capital Market provide, among other things, that our common stock must maintain a closing bid price in excess of $1.00 per share. Our common stock has not maintained a minimum bid price of $1.00 per share since July 17, 2015. A failure to meet the continued listing requirement for minimum bid price will be determined by Nasdaq to exist if the deficiency continues for 30 consecutive business days, following which we would expect to receive a notice of non-compliance from Nasdaq. If we fail to achieve compliance within 180 calendar days from the date of such notification, we may be delisted.

Our Board has determined that the continued listing of our common stock on the Nasdaq Capital Market is beneficial for our stockholders. If our common stock is delisted from the Nasdaq Capital Market, the Board believes that the trading market for our common stock could become significantly less liquid, which could reduce the trading price of our common stock and increase the transaction costs of trading in shares of our common stock.

The purpose of the Reverse Stock Split is to decrease the total number of shares of our common stock outstanding and increase the market price of our common stock. The Board directors intends to effect the Reverse Stock Split only if it believes that a decrease in the number of shares outstanding is in the best interests of the Company and our stockholders and is likely to improve the trading price of our common stock and improve the likelihood that we will be allowed to maintain our listing on the Nasdaq Capital Market.

If the Reverse Stock Split proposal is approved by our stockholders, the Board will have the discretion to implement the Reverse Stock Split or to not effect the Reverse Stock Split at all. The Board currently intends to effect the Reverse Stock Split unless it determines that doing so would not have the desired effect of maintaining the listing of our common stock on the Nasdaq Capital Market. If the trading price of our common stock increases without the Reverse Stock Split, the Reverse Stock Split may not be necessary. Following the Reverse Stock Split, if implemented, there can be no assurance that the market price of our common stock will rise in proportion to the reduction in the number of outstanding shares resulting from the Reverse Stock Split or that the market price of the post-split common stock can be maintained above $1.00. There also can be no assurance that our common stock will not be delisted from the Nasdaq Capital Market for other reasons.

The market price of our common stock is dependent upon our performance and other factors, some of which are unrelated to the number of shares outstanding. If the Reverse Stock Split is effected and the market price of our common stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Furthermore, the reduced number of shares that will be outstanding after the Reverse Stock Split could significantly reduce the trading volume and otherwise adversely affect the liquidity of our common stock.

If our stockholders approve the Reverse Stock Split proposal at the special meeting, the Reverse Stock Split will be effected, if at all, only upon a determination by the Board that the Reverse Stock Split is in the best interests of the Company and its stockholders at that time. No further action on the part of the stockholders will be required to either effect or abandon the Reverse Stock Split.

If our stockholders do not approve the Reverse Stock Split proposal and the minimum closing bid price of our common stock does not otherwise increase to at least $1.00 per share, we expect that our common stock will be delisted from the Nasdaq Capital Market.

We have not proposed the Reverse Stock Split in response to any effort of which we are aware to accumulate our shares of common stock or obtain control of the Company, nor is it a plan by management to recommend a series of similar actions to our Board or our stockholders. Notwithstanding the decrease in the number of outstanding shares of common stock following the Reverse Stock Split, our Board does not intend for this transaction to be the first step in a “going private transaction” within the meaning of Rule 13e-3 of the Securities Exchange Act of 1934 (the “Exchange Act”). In addition, we have not proposed the Reverse Stock Split, with its corresponding increase in the authorized and unissued number of shares of common stock, with the intention of using the additional shares for anti-takeover purposes, although we could theoretically use the additional shares to make more difficult or to discourage an attempt to acquire control of the Company.

We do not believe that our officers or directors have interests in this proposal that are different from or greater than those of any other of our stockholders.

b) Effects of the Reverse Stock Split

After the effective date of a proposed Reverse Stock Split, each stockholder will own a reduced number of shares of Common Stock. As of September 14, 2015, approximately 15,187,260 shares of Common Stock were issued and outstanding. The table below shows, as of the Record Date, the number of outstanding shares of Common Stock (excluding treasury shares) that would result from the Reverse Stock Split ratios (without giving effect to the treatment of fractional shares):

|

Reverse Stock Split Ratio

|

Approximate Number of Outstanding Shares of Common Stock Following the Reverse Stock Split

|

Percent Reduction in Number of Outstanding Shares of Common Stock Following the Reverse Stock Split

|

|

1-for-1.5

|

10,124,840

|

33.3%

|

|

1-for-3

|

5,062,420

|

66.7%

|

If implemented, the number of shares of our Common Stock owned by each of our stockholders will be reduced by the same proportion as the reduction in the total number of shares of our Common Stock outstanding. The Reverse Stock Split will affect all common stockholders uniformly and will not affect any stockholders’ percentage interest in the Company (except for stockholders receiving one whole share for a fractional share interest). Neither the authorized but unissued shares of Common Stock nor the par value for our Common Stock will adjust as a result of the Reverse Stock Split. None of the rights currently accruing to holders of our Common Stock will be affected by the Reverse Stock Split. The Reverse Stock Split will also not affect the ability of the Board to designate preferred stock, and the par value and authorized shares of the Company’s preferred stock will not be adjusted as a result of the Reverse Stock Split.

Stockholders should also recognize that once the Reverse Stock Split is effected, they will own a fewer number of shares than they currently own (a number equal to the number of shares owned immediately prior to the Reverse Stock Split divided by a number between 1.5 and 3). While we expect that the Reverse Stock Split will result in an increase in the per share price of our Common Stock, the Reverse Stock Split may not increase the per share price of our Common Stock in proportion to the reduction in the number of shares of our Common Stock outstanding. It also may not result in a permanent increase in the per share price, which depends on many factors, including our performance, prospects and other factors that may be unrelated to the number of shares outstanding. The history of similar reverse stock split for companies in similar circumstances is varied. We cannot predict the effect of the Reverse Stock Split upon the market price over an extended period and, in some cases, the market value of a company’s common stock declines following a reverse stock split.

Once the Reverse Stock Split is effected and should the per-share price of our Common Stock decline, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Reverse Stock Split. Furthermore, the liquidity of our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Stock Split.

Further, an effect of the existence of authorized but un-issued capital stock may be to enable the Board to render more difficult or to discourage an attempt to obtain control of the Company by means of a merger, tender offer, proxy contest, or otherwise, and thereby to protect the continuity of the Company’s management. If, in the due

exercise of its fiduciary obligations, for example, the Board were to determine that a takeover proposal was not in the Company’s best interests, such shares could be issued by the Board without stockholder approval in one or more private placements or other transactions that might prevent, or render more difficult or costly, completion of the takeover transaction by diluting the voting or other rights of the proposed acquirer or insurgent stockholder or stockholder group, by creating a substantial voting block in institutional or other hands that might undertake to support the position of the incumbent Board, by effecting an acquisition that might complicate or preclude the takeover, or otherwise. The Company does not have any current plans, proposals, or arrangements to propose any amendments to its amended and restated certificate of incorporation or its bylaws that would have a material anti-takeover effect.

Moreover, as a result of the Reverse Stock Split, some stockholders may own less than 100 shares of the Common Stock. A purchase or sale of less than 100 shares, known as an “odd lot” transaction, may result in incrementally higher trading costs through certain brokers, particularly “full service” brokers. Therefore, those stockholders who own less than 100 shares following the Reverse Stock Split may be required to pay higher transaction costs if they sell their shares of Common Stock.

No fractional shares of post-Reverse Stock Split Common Stock will be issued to any stockholder. In lieu of any such fractional share interest, each holder of pre-Reverse Stock Split Common Stock who would otherwise be entitled to receive a fractional share of post-Reverse Stock Split Common Stock will in lieu thereof receive one full share upon surrender of certificates formerly representing pre-Reverse Stock Split Common Stock held by such holder.

The proposed amendment to the Company’s amended and restated certificate of incorporation to effect the Reverse Stock Split will not affect the par value of our Common Stock per share, which will remain no par value per share.

c) Effects of the Reverse Stock Split on Outstanding Series AA Preferred Stock

If the Reverse Stock Split is effected, any outstanding shares of Series AA Preferred Stock entitling their holders to convert such preferred shares into our shares of Common Stock will have their conversion ratio decreased in direct proportion to the Reverse Stock Split ratio determined by the Board. This decrease will reduce the number of shares of common stock each Series AA Preferred shareholder will receive upon conversion. Currently, each share of Series AA Preferred stock is convertible into a number of shares of Common Stock at a rate of 1 share of Common Stock for each 2 shares of Series AA Preferred Stock. As of September 14, 2015, there were 46,662 shares of Series AA Preferred Stock outstanding convertible into 23,331 shares of Common Stock. If, for example, the board determined to effectuate a 1-for-3 Reverse Stock Split, the 46,662 shares of Series AA Preferred Stock would become convertible into 7,777 shares of Common Stock.

d) Effects of the Reverse Stock Split on Outstanding Options and Warrants to Purchase Common Stock

If the Reverse Stock Split is effected, any outstanding options or warrants entitling their holders to purchase shares of our Common Stock will be proportionately changed by our Board in the same ratio as the reduction in the number of shares of outstanding Common Stock, except that any fractional shares resulting from such reduction will be rounded down to the nearest whole share to comply with the requirements of Code Section 409A. Correspondingly, the per share exercise price of such options or warrants will be increased in direct proportion to the Reverse Stock Split ratio determined by the Board, so that the aggregate dollar amount payable for the purchase of the shares subject to such securities will remain unchanged.

The Company currently has outstanding Series “E” warrants (the “Series E Warrants”) to purchase ______ shares of Common Stock. The Series E Warrants provide that, in the event of the announcement or consummation of a transaction such as the Reverse Stock Split, in addition to the changes in the number of shares purchasable under the Series E Warrants described in the preceding paragraph, the holders of the Series E Warrants have the right to require the Company to repurchase the Series E Warrants at a price based on the value of the Series E Warrants at the time of the Reverse Split, determined by a formula based on the then-current value of the Warrants using the Black-Scholes pricing model for valuation of warrants and other convertible securities.

e) No Appraisal Rights

No stockholder will have appraisal or dissenter’s rights with respect to the Proposal.

f) Increase of Shares of Common Stock Available for Future Issuance

As a result of the Reverse Stock Split, there will be a reduction in the number of shares of our Common Stock issued and outstanding, resulting in an increase in the number of authorized shares that will be unissued and available for future issuance after the Reverse Stock Split. The Board will have the authority, subject to applicable securities laws and, to the extent applicable, securities exchange listing requirements, to issue all authorized and unissued shares without further stockholder approval, upon such terms and conditions as the Board deems appropriate. The Company does not presently have any definitive agreement(s) to issue any shares of Common Stock available as a result of the Reverse Stock Split. Moreover, the Reverse Split is being requested by the Board at the same time as a request to increase the number of authorized shares of Common and Preferred Stock, which will further increase the Board’s authority to issue additional shares without further stockholder approval, subject to requirements imposed by NASDAQ’s continued listing requirements.

Holders of our Common Stock have no preemptive or other subscription rights.

g) Certain Federal Income Tax Consequences of the Reverse Stock Split

The following is a discussion of certain material U.S. federal income tax consequences of the Reverse Stock Split to U.S. holders (as defined below). This discussion is included for general information purposes only and does not purport to address all aspects of U.S. federal income tax law that may be relevant to U.S. holders in light of their particular circumstances. This discussion is based on the Internal Revenue Code of 1986, as amended (the “Code”), and current Treasury regulations, administrative rulings and court decisions, all of which are subject to change, possibly on a retroactive basis, and any such change could affect the continuing validity of this discussion.

STOCKHOLDERS ARE URGED TO CONSULT THEIR TAX ADVISORS AS TO THE PARTICULAR FEDERAL, STATE, LOCAL, OR FOREIGN TAX CONSEQUENCES TO THEM OF THE REVERSE STOCK SPLIT.

This discussion does not address tax consequences to stockholders that are subject to special tax rules, such as banks, insurance companies, regulated investment companies, personal holding companies, U.S. holders whose functional currency is not the U.S. dollar, partnerships (or other flow-through entities for U.S. federal income purposes and their partners or members), persons who acquired their shares in connection with employment or other performance of services, broker-dealers, foreign entities, nonresident alien individuals and tax-exempt entities. This summary also assumes that the shares of Common Stock are held as a “capital asset,” as defined in Section 1221 of the Code.

As used herein, the term “U.S. holder” means a holder that is, for U.S. federal income tax purposes:

| |

|

|

|

|

·

|

an individual citizen or resident of the United States ;

|

| |

|

|

|

|

·

|

a corporation or other entity taxed as a corporation created or organized in or under the laws of the United States or any political subdivision thereof ;

|

| |

|

|

|

|

·

|

an estate the income of which is subject to U.S. federal income tax regardless of its source ; or

|

| |

|

|

|

|

·

|

a trust (A) if a U.S. court is able to exercise primary supervision over the administration of the trust and one or more “ U.S. persons ” (as defined in the Code) have the authority to control all substantial decisions of the trust or (B) that has a valid election in effect to be treated as a U.S. person.

|

Pursuant to the Reverse Stock Split, each holder of our Common Stock outstanding immediately prior to the effectiveness of the Reverse Stock Split will become the holder of fewer shares of our Common Stock after consummation of the Reverse Stock Split.

Other than with respect to any stockholder that receives a full share for a fractional share, a stockholder generally will not recognize a gain or loss by reason of such stockholder’s receipt of post-Reverse Stock Split shares pursuant to the Reverse Stock Split solely in exchange for pre-Reverse Stock Split shares held by such stockholder immediately prior to the Reverse Stock Split. A stockholder’s aggregate tax basis in the post-Reverse Stock Split shares received pursuant to the Reverse Stock Split (including any fractional shares) will equal the stockholder’s aggregate basis in pre-Reverse Stock Split shares exchanged therefore and will be allocated among the post-Reverse Stock Split shares received in the Reverse Stock Split on a pro-rata basis. Stockholders who have used the specific identification method to identify their basis in the pre-Reverse Stock Split shares held immediately prior to the Reverse Stock Split should consult their own tax advisers to determine their basis in the post-Reverse Stock Split shares received in exchange therefor in the Reverse Stock Split. A stockholder’s holding period in the post-Reverse Stock Split shares received pursuant to the Reverse Stock Split will include the stockholder’s holding period in the pre-Reverse Stock Split shares surrendered in exchange therefore, provided the pre-Reverse Stock Split shares surrendered are held as capital assets at the time of the Reverse Stock Split.

A stockholder that receives a full share for a fractional share may be treated as though it received a distribution from the Company to the extent that the value of the full share exceeds the value of the fractional share the stockholder otherwise would have received. Such distribution would be a dividend to the extent of the Company’s current or accumulated earnings and profits. Any amount in excess of earnings and profits would reduce the shareholder’s basis in his or her shares by the amount of such excess. The portion of the full share in excess of the fractional share would have a basis equal to the amount recognized as a dividend and the holding period for such share would begin on the date of the deemed distribution. Stockholders should consult their own tax advisors to determine the consequences to them of receiving a full share in exchange for a fractional share.

No gain or loss will be recognized by us as a result of the Reverse Stock Split.

h) Exchange Act Matters

Our Common Stock is currently registered under the Exchange Act, and we are subject to the periodic reporting and other requirements of the Exchange Act. The Reverse Stock Split, if implemented, will not affect the registration of our Common Stock under the Exchange Act or our reporting or other requirements thereunder. The CUSIP number for our Common Stock will also change in connection with the Reverse Stock Split and will be reflected on new certificates issued by the Company and in electronic entry systems.

i) Effective Date

A proposed Reverse Stock Split, if approved by our stockholders, would become effective when a certificate of amendment to our Articles of Incorporation is filed with the California Secretary of State, which would be substantially in the form of the Reverse Stock Split Amendment attached to this proxy statement as Appendix B. On the effective date of the Reverse Stock Split, shares of Common Stock issued and outstanding immediately prior thereto will be combined and converted, automatically and without any action on the part of the stockholders, into new shares of Common Stock in accordance with the Reverse Stock Split ratio determined by the Board. As soon as practical after the effective date, the stockholders will be notified that the Reverse Stock Split has been effected.

j) Effect on Registered and Beneficial Stockholders

Upon the Reverse Stock Split, the Company intends to treat stockholders holding shares of our Common Stock in “street name” (that is, held through a bank, broker or other nominee) in the same manner as stockholders of record whose shares of Common Stock are registered in their names. Banks, brokers or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding shares of our Common Stock in “street name”; however, these banks, brokers or other nominees may apply their own specific procedures for processing the Reverse Stock Split. If you hold your shares of our Common Stock with a bank, broker or other nominee, and have any questions in this regard, we encourage you to contact your nominee.

k) Effect on “Book-Entry” Stockholders of Record

The Company’s stockholders of record may hold some or all of their shares electronically in book-entry form. These stockholders will not have stock certificates evidencing their ownership of our Common Stock. They

are, however, provided with a statement reflecting the number of shares of Common Stock registered in their accounts.

If you hold registered pre-Reverse Stock Split shares in a book-entry form, you do not need to take any action to receive your post-Reverse Stock Split shares in registered book-entry form, if applicable. A transaction statement will automatically be sent to your address of record as soon as practicable after the effective time of the Reverse Stock Split indicating the number of post-Reverse Stock Split shares you hold.

l) Exchange of Stock Certificates

Some stockholders of record hold their shares of our Common Stock in certificate form or a combination of certificate and book-entry form. If any of your shares of our Common Stock are held in certificate form, our transfer agent will act as exchange agent for purposes of implementing the exchange of stock certificates. As soon as practicable after the effective time, a letter of transmittal will be sent to our stockholders of record as of the effective time for purposes of surrendering to the transfer agent certificates representing pre-Reverse Stock Split shares in exchange for certificates representing post- Reverse Stock Split shares in accordance with the procedures set forth in the letter of transmittal. No new certificates will be issued to a stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s), together with the properly completed and executed letter of transmittal, to the exchange agent. From and after the effective time of the Reverse Stock Split, any certificates formerly representing pre-Reverse Stock Split shares which are submitted for transfer, whether pursuant to a sale, other disposition or otherwise, will be exchanged for certificates representing post-Reverse Stock Split shares.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

m) Security Ownership of Officers, Directors and 5% Stockholders

Common Stock

On September 14, 2015, 15,187,260 shares of Royale Energy’s common stock were outstanding.

The following table contains information regarding the ownership of Royale Energy’s common stock as of September 14, 2015, by:

|

i)

|

each person who is known by Royale Energy to own beneficially more than 5% of the outstanding shares of each class of equity securities;

|

|

ii)

|

each director of Royale Energy; and

|

|

iii)

|

all directors and officers of Royale Energy as a group. Except pursuant to applicable community property laws and except as otherwise indicated, each shareholder identified in the table possesses sole voting and investment power with respect to its or his shares. The holdings reported are based on reports filed with the Securities and Exchange Commission and the Company by the officers, directors and 5% shareholders pursuant to Section 16 of the Securities Exchange Act of 1934.

|

|

Stockholder (1)

|

|

Number (2)

|

|

|

Percent

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Stephen M. Hosmer, (3) (4)

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

All officers and directors as a group

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) The mailing address of each listed stockholder is 3777 Willow Glen Drive, El Cajon, California 92019.

(2) Includes options to purchase the following number of shares of common stock which were vested and exercisable on September 14, 2015: Harry E. Hosmer 70,000, Donald H. Hosmer 70,000; Stephen M. Hosmer 70,000; Gary Grinsfelder 60,000; Jonathan Gregory 20,000.

(3) Donald H. Hosmer and Stephen M. Hosmer are sons of Harry E. Hosmer, Chairman of the Board.

(4) Includes 24,000 shares owned by Stephen M. Hosmer’s minor children.

Preferred Stock

Holders Series AA convertible preferred stock have voting rights equal to the number of shares into which they are convertible. On September 14, 2015, 46,662 shares of Series AA convertible preferred stock were outstanding. The shares of each series of preferred shares are convertible into shares of Royale Energy's common stock at the option of the security holder, at the rate of two shares of Series AA convertible preferred stock for each share of common stock. The preferred stock is not registered under the Securities Exchange Act of 1934, and no market exists for the preferred stock. The total number of shares of common stock issuable on conversion of all outstanding shares of preferred stock equals less than 1% of the outstanding common stock of Royale Energy. To Royale Energy's knowledge, none of the preferred shareholders would own more than 1% of Royale Energy's common stock, if their preferred shares were converted to common shares.

n) Required Vote

The approval of the amendment to our certificate of incorporation to effect a reverse stock split of our common stock at a ratio of not less than 1-for-2 and not greater than 1-for-4, with the exact ratio to be determined by the board requires the affirmative “FOR” vote of a majority of the shares of common stock and Series AA preferred stock voting together as a single class present in person or represented by proxy at the Annual Meeting and entitled to vote thereon. Unless marked to the contrary, proxies received will be voted “FOR” the proposal to amend our certificate of incorporation to effect a reverse stock split of our common stock at a ratio of not less than 1-for-2 and not greater than 1-for-4, with the exact ratio to be determined by the board.

|

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” APPROVAL OF THE AMENDMENT TO OUR AMENDED AND RESTATED ARTICLES OF INCORPORATION TO EFFECT, AT THE DISCRETION OF OUR BOARD OF DIRECTORS, A REVERSE STOCK SPLIT OF OUR COMMON STOCK AT A RATIO OF NOT LESS THAN 1-FOR-2 AND NOT GREATER THAN 1-FOR-4.

|

|

PROPOSAL 3: THE TRANSACTION OF SUCH OTHER BUSINESS AS MAY PROPERLY COME BEFORE THE SPECIAL MEETING AND ANY ADJOURNMENTS THEREOF

|

At the date of mailing of this proxy statement, we are not aware of any business to be presented at the special meeting other than those items previously discussed. The proxy being solicited by the board of directors provides authority for the proxy holders, Donald H. Hosmer and Stephen M. Hosmer, to use their discretion to vote on such other matters as may lawfully come before the meeting, including matters incidental to the conduct of the meeting, and any adjournment thereof.

OTHER INFORMATION

a) Proposals by Shareholders – 2016

Any proposal by a shareholder to be submitted for inclusion in proxy soliciting material for the 2016 annual shareholders meeting must be received by the corporate secretary of Royale Energy no later than February 5, 2016.

b) Householding

The SEC permits a single copy of the proxy statement to be sent to any household at which two or more stockholders reside if they appear to be members of the same family. This procedure, referred to as householding, reduces the volume of duplicate information stockholders receive and reduces mailing and printing expenses. A number of brokerage firms have instituted householding.

As a result, if you hold your shares through a broker and you reside at an address at which two or more stockholders reside, you will likely be receiving only one copy of the proxy statement unless any stockholder at that address has given the broker contrary instructions. However, if any such beneficial stockholder residing at such an address wishes to receive a separate copy of the proxy statement in the future, or if any such beneficial stockholder that elected to continue to receive separate copies of the proxy statement wishes to receive a single copy of the proxy statement in the future, that stockholder should contact their broker or send a request to Secretary, Royale Energy, Inc., 3777 Willow Glen Dr., El Cajon CA 92019, telephone number (619) 383-6600. We will deliver, promptly upon written or oral request to the corporate secretary, a separate copy of the proxy statement to a beneficial stockholder at a shared address to which a single copy of the proxy statement was delivered.

| |

By Order of the Board of Directors,

|

| Date: September __ 2015 |

Jonathan Gregory |

| |

Chief Executive Officer |

APPENDIX A

Proposed Amendment to Article III

of the

Articles of Incorporation

of

Royale Energy, Inc.

Upon Adoption of Proposal 1

Amend the first paragraph of Article III as follows:

This corporation is authorized to issue two classes of shares, which shall be known as Common Stock and Preferred stock. The total number of shares of Common Stock which this corporation is authorized to issue is [30,000,000] {20,000,000}, no par value per share, and the total number of Preferred Stock this corporation is authorized to issue is 10,000,000, no par value per share.

APPENDIX B

Proposed Amendment to Article III

of the

Articles of Incorporation

of

Royale Energy, Inc.

Upon Adoption of Proposal 1

Amend Article III by adding the following paragraphs at the end of the Article:

Effective on [October __, 2015] (the “Effective Time”), each [1.5 to 3] shares of the Corporation’s common stock, no par value per share, issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be converted into one share of new common stock, no par value per share, of the Corporation. No fractional shares will be issued and, in lieu thereof, the holding of each holder of common shares who would be entitled to receive a fractional share shall have their holdings rounded up to the next whole share of common stock.

Effective upon the Effective Time, each [3 to 6] shares of the Corporation’s authorized Series AA preferred stock, no par value per share, issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the respective holders thereof, be converted into one share of new Series AA preferred stock, no par value, of the Corporation. Upon conversion of any shares of Series AA preferred stock to common stock at the option of the holder thereof pursuant to the Certificate of Designation authorizing the issuance of Series AA preferred stock, no fractional shares of common stock will be issued and, in lieu thereof, the holding of each holder of shares of Series AA preferred stock who would be entitled to receive a fractional share of common stock upon conversion shall have their common stock holdings rounded up to the next whole share of common stock.

ROYALE ENERGY, INC.

PROXY FOR SPECIAL MEETING OF SHAREHOLDERS

SOLICITED BY THE BOARD OF DIRECTORS

The undersigned hereby appoints Stephen M. Hosmer and Donald H. Hosmer as Proxies with the power to appoint their substitutes, and hereby authorizes them to represent and to vote, as designated below, all the shares of common stock of Royale Energy, Inc. held on record by the undersigned on September ___, 2015, at the special meeting of Shareholders to be held in at the office of the Company, 3777 Willow Glen Drive, El Cajon, California 92019, on October __, 2015, at 11:00 a.m., Pacific Daylight Time.

|

1.

|

To approve the amendment to our amended and restated articles of incorporation to increase the number of authorized shares of our common stock from 20,000,000 to 30,000,000.

|

| |

For

|

|

|

|

Against

|

|

|

|

Abstain

|

|

|

| |

|

|

2.

|

To approve the amendment to our amended and restated articles of incorporation to effect, at the discretion of the board of directors, a reverse stock split of all of the outstanding shares of our common stock at a ratio of not less than 1-for-1.5 and not greater than 1-for-3 shares

|

| |

For

|

|

|

|

Against

|

|

|

|

Abstain

|

|

|

| |

|

|

3.

|

To transact such other business as may properly come before the special meeting and any adjournments thereof.

|

| |

For

|

|

|

|

Against

|

|

|

|

Abstain

|

|

|

| |

|

THE SHARES REPRESENTED HEREBY SHALL BE VOTED AS SPECIFIED. IF NO SPECIFICATION IS MADE, SUCH SHARES SHALL BE VOTED FOR PROPOSALS 1, 2, AND 3.

Please sign and date this Proxy. When signing as attorney, executor, administrator, trustee, guardian, corporate officer, etc., please indicate your full title. Proxies received in this office later than 11:59 P.M. on October __, 2015, will not be voted upon unless the shareholders are present to vote their shares.

Dated:

----------------------

(Please mark, sign, date and return the Proxy Card promptly.)

| |

|

|

| |

|

|

| Signature |

|

Signature if held jointly |

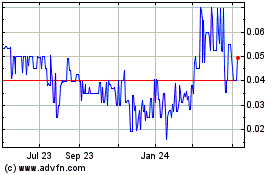

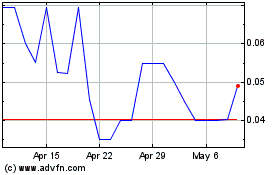

Royale Energy (QB) (USOTC:ROYL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royale Energy (QB) (USOTC:ROYL)

Historical Stock Chart

From Apr 2023 to Apr 2024