Current Report Filing (8-k)

February 24 2015 - 10:46AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Date of Report: February 24, 2015

(Date of earliest event reported)

Rosetta Resources Inc.

(Exact name of registrant as specified in its charter)

|

DE

|

000-51801

|

43-2083519

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification Number)

|

| |

|

|

|

1111 Bagby Street, Suite 1600

Houston, TX

|

|

77002

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

713-335-4000

(Registrant's telephone number, including area code)

Not Applicable

(Former Name or Former Address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure |

On February 24, 2015, Rosetta Resources Inc. (the “Company”) filed an updated company presentation. A copy of the presentation can be found on the Company’s website in the “Investor – Events” section.

The presentation is furnished as Exhibit 99.1 to this Current Report. Exhibit 99.1 shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and will not be incorporated by reference into any registration statement filed under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

| Item 9.01. |

Financial Statements and Exhibits |

|

(a)

|

Financial statements:

|

None

|

(b)

|

Pro forma financial information:

|

None

|

(c)

|

Company transactions:

|

None

Exhibits. The Registrant includes a copy of the presentation as Exhibit 99.1.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: February 24, 2015

|

ROSETTA RESOURCES INC.

|

| |

|

| |

By:

|

/s/ John E. Hagale

|

| |

|

|

| |

|

John E. Hagale

|

| |

|

Executive Vice President and Chief Financial Officer

|

Exhibit Index

|

Exhibit No.

|

|

Description

|

|

|

|

Presentation of Rosetta Resources Inc. dated February 24, 2015.

|

Exhibit 99.1

Rosetta Resources Inc. Fourth Quarter & Full Year 2014

Earnings Call Agenda Overview Jim CraddockFinancial Update John HagaleOperational Update John ClaytonClosing Remarks Jim Craddock 2

2015 Strategic Update 3 Drill & Complete 80% Central Facilities & Other20% Focused on disciplined execution Two-year capital program of up to $350 million per yearOperate within cash flow; no additional debtDefend an average production level of roughly 60 MBoe/d to preserve inventory for price recoveryAmended credit facility covenants through April 2018No fixed senior note maturities until May 2021Monitor market conditions for increased capital spending when commodity prices warrant Other12% Permian 41% Eagle Ford47% Capital by Category Capital by Division

Unconventional Well Performance Metrics Projected well life ±40 yrs Gates Ranch Far South % EUR % Total Produced PV10 30% 47% Year 2 Note: Cash flows exclude capital costs. EUR = Estimated ultimate recoveries in Mboe. PV10 = Present value at an annual discount rate of 10 percent. Assumes constant pricing scenario throughout well life ($70/bbl; $3.50/Mcf; $24.35/bbl NGL) 4

Reserves and Production Net Production(MBoe/d) 5 Year-End Net Risked Resource Potential (MMBoe) *Post-Divestiture

2015 Guidance 6 2015 First Quarter 2015 Full-Year Production Guidance (MBoe/d) Average daily production 64 - 67 58 - 62 Expense Guidance ($/Boe) Direct Lease Operating Expense $ 2.90 - $ 3.05 $ 3.25 - $ 3.50 Workover Expenses 1.10 - 1.15 0.90 - 1.00 Insurance 0.05 - 0.05 0.05 - 0.05 Treating and Transportation 4.00 - 4.25 4.25 - 4.65 Taxes, other than income 1.35 - 1.45 1.55 - 1.70 DD&A* 16.85 - 17.40 *17.00 - *18.00 G&A, excluding Stock-Based Compensation 3.20 - 3.35 3.60 - 3.90 Interest Expense 3.60 - 3.75 4.20 - 4.55 * Rosetta expects to record impairments during 2015 as a result of the depressed commodity price environment. Due to uncertainty in the timing and amount of these impairments, the Company anticipates changes to the full-year 2015 DD&A guidance range provided.

Retain Core Acreage Positions 7 Asset Name 12/31/2014 12/31/2016 Change Liquids Rich 49,900 46,900 (3,000)1 Dry Gas 12,700 3,800 (8,900) Eagle Ford Total 62,600 50,700 (11,900) Reeves County 47,000 41,800 (5,200)2 Gaines County 10,200 - (10,200) Permian Total 57,200 41,800 (15,400) COMPANY TOTAL 119,800 92,500 (27,300) 1 Central Gonzales County.2 Primarily non-operated low working interest acreage on westernmost position.

Economics of PortfolioBFIT Returns and PV10’s in the current environment Rate of Return Note: Current Capital and Commodity Prices as of 1/12/2015; assumes 5,000 ft lateral well (%) Individual Well PV10 Change ($MM) 8

Permian – 4Q Horizontal Delineation Activity 9 Wolfcamp ‘A’ WellIntrepid 27-38 #2H7 Day IP (Boe) = 1,91330 Day IP (Boe) = 1,714Lateral Length ~7,000 Wolfcamp ‘A’ WellRodeo State 12 3H7 Day IP (Boe) = 1,12030 Day IP (Boe) = 917Lateral Length ~4,000 Wolfcamp ‘A’ WellBlue Duck 35 1H7 Day IP (Boe) = 1,06930 Day IP (Boe) = 915Lateral Length ~4,000

Completion Design ImprovementsWolfcamp ‘A’ Wells Rate Comparisons 10 290 Denotes old completion design(Gelled initial fluid) Denotes new completion design – Excludes Deacon Jim step-out(Slickwater initial fluid) 4Q 2013 – 1Q 2014 2Q 2014 3Q 2014 4Q 2014

3-stream Production (BOE/d) Days 11 Note: All production normalized to 5000’ lateral length Permian – Reeves County 4Q 2014 CompletionsFlowback Rates vs Upper Wolfcamp Horizontal Type Curve

2nd Half 2014 Wolfcamp ‘A’ Completions 3-stream Production (BOE/d) Days 12 Note: All production normalized to 5000’ lateral length

Reserves and Production 13 Total CompanyEstimate Ranges Year-End Net Risked Resource Potential (MMBoe) Net Production(MBoe/d) *Post-Divestiture

Cautionary Statements This presentation includes forward-looking statements. Forward-looking statements related to future events, such as expectations regarding our capital program, development plans, production rates, resource potential, transportation capacity, net present value and projected liquidity. These statements are not guarantees of future performance and actual outcomes may differ materially. Factors that could affect the Company's business include, but are not limited to: oil and gas prices, operating hazards, drilling risks, unsuccessful exploratory activities; unexpected cost increases; potential liability for remedial actions under existing or future environmental regulations; potential liability resulting from pending or future litigation; limited access to capital or significantly higher cost of capital related to illiquidity or uncertainty in the domestic or international financial markets; as well as changes in tax, environmental and other laws applicable to our business. Other factors that could cause actual results to differ materially from those described in the forward-looking statements include other economic, business, competitive and/or regulatory factors affecting our business generally as set forth in our filings with the Securities and Exchange Commission. Unless legally required, the Company undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. For filings reporting year-end 2014 reserves, the SEC permits the optional disclosure of probable and possible reserves. The Company has elected not to report probable and possible reserves in its filings with the SEC. We use the term “net risked resources” or “inventory” to describe the Company’s internal estimates of volumes of natural gas and oil that are not classified as proved reserves but are potentially recoverable through exploratory drilling or additional drilling or recovery techniques. Estimates of unproved resources are by their nature more speculative than estimates of proved reserves and accordingly are subject to substantially greater risk of actually being realized by the Company. Estimates of unproved resources may change significantly as development provides additional data, and actual quantities that are ultimately recovered may differ substantially from prior estimates. 14

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Mar 2024 to Apr 2024

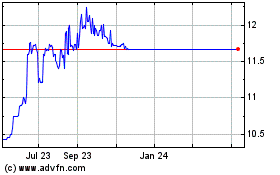

Rose Hill Acquisition (NASDAQ:ROSE)

Historical Stock Chart

From Apr 2023 to Apr 2024