UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 5, 2015

ROYAL GOLD, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

001-13357 |

84-0835164 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

| 1660 Wynkoop Street, Suite 1000, Denver, CO |

80202-1132 |

| (Address of principal executive offices) |

(Zip Code) |

Registrant’s telephone number, including

area code: 303-573-1660

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Item 2.02 |

Results of Operations and Financial Condition. |

On November 4, 2015,

the Company reported its first fiscal quarter 2016 financial results. A copy of the press release was filed on November 5, 2015.

A copy of the earnings presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished

under this Item 2.02, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as

shall be expressly set forth by reference to such filing.

| |

Item 9.01 |

Financial Statements and Exhibits. |

Exhibit

No. |

|

Description |

| 99.1 |

|

Royal Gold, Inc. November 5, 2015 Earnings Presentation. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Royal Gold, Inc. |

| |

(Registrant) |

| |

|

|

| Dated: November 5, 2015 |

By: |

/s/ Bruce C. Kirchhoff |

| |

|

Name: |

Bruce C. Kirchhoff |

| |

|

Title: |

Vice President, General Counsel and Secretary |

EXHIBIT INDEX

Exhibit

No. |

|

Description |

| 99.1 |

|

Royal Gold, Inc. November 5, 2015 Earnings Presentation. |

Exhibit 99.1

November 5, 2015 First Quarter Fiscal 2016 Results Exhibit 99.1

Cautionary Statement This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from the projections and estimates contained herein and include, but are not limited to : new additions to the Company’s portfolio projected to produce in the lower half of world - wide production costs ; production and mine life estimates from the operators of the Company’s properties ; the production, reserves, resources, sustaining costs, optimization, potential to expand mine life and net GEOs per year over the next five years at Pueblo Viejo ; net GEOs over the next five years at other key mines ; reserves and net GEOs expected from the Andacollo mine ; anticipated near term growth, as well as the ramp - up of production from the Mount Milligan mine ; construction progress, reserves and resources at the Wassa , Bogoso and Prestea , Phoenix Gold and Rainy River projects ; anticipated growth in the volume of metals subject to the Company’s royalty and stream interests ; the impact of exchange rates on the Company’s full year effective tax rate ; and statements or estimates from operators of properties where we have royalty and stream interests regarding the timing of development, construction and commencement of production, or their projections of steady, increasing or decreasing production once in operation . Factors that could cause actual results to differ materially from these forward-looking statements include, among others : the risks inherent in construction, development and operation of mining properties, including those specific to new mines being developed and operated in foreign countries ; changes in gold, silver, copper, nickel and other metals prices ; performance of and production at the Company’s properties ; decisions and activities of the Company’s management ; unexpected operating costs ; decisions and activities of the operators of the Company’s royalty and stream properties ; changes in operators’ mining and processing techniques or royalty calculation methodologies ; resolution of regulatory and legal proceedings (including with Vale regarding Voisey’s Bay) ; unanticipated grade, geological, metallurgical, environmental, processing or other problems at the properties ; inaccuracies in technical reports and reserve estimates ; revisions by operators of reserves, resources, mineralization or production estimates ; changes in project parameters as plans of the operators are refined ; the results of current or planned exploration activities ; discontinuance of exploration activities by operators seeking additional financing, from the Company or third parties ; economic and market conditions ; variations between operators’ production estimates and our estimates of net GEOs ; operations on lands subject to aboriginal rights ; the ability of operators of development properties to finance construction to project completion and bring projects into production and operate them in accordance with feasibility studies ; challenges to the Company’s royalty interests, or title and other defects in the Company’s royalty properties ; errors or disputes in calculating royalty payments or stream deliveries, or payments or deliveries not made in accordance with royalty or stream agreements ; the liquidity and future financial needs of the Company ; the impact of future acquisitions and royalty and stream financing transactions ; adverse changes in applicable laws and regulations ; litigation ; and risks associated with conducting business in foreign countries, including application of foreign laws to contract and other disputes, environmental laws, enforcement and uncertain political and economic environments . These risks and other factors are discussed in more detail in the Company’s public filings with the Securities and Exchange Commission . Statements made herein are as of the date hereof and should not be relied upon as of any subsequent date . The Company’s past performance is not necessarily indicative of its future performance . The Company disclaims any obligation to update any forward-looking statements . Endnotes located on pages 15 and 16 . November 5, 2015 2

Today’s Speakers Tony Jensen President and CEO Bill Heissenbuttel VP Corporate Development & Operations Stefan Wenger CFO and Treasurer November 5, 2015 3

Financial and o perating r esults driven by r ecord volume » Revenue up 7% from a year ago despite a 12% decline in gold price » Record volume of 65,868 Gold Equivalent Ounces (GEOs) 1 ; up 22% from a year ago » Higher volume at Mount Milligan and at Peñasquito, which Goldcorp expects will exceed 2015 production guidance of between 700,000 and 750,000 ounces » New contributions from Golden Star and Andacollo Streams » I nventory of 11,500 ounces of gold at September 30 The most a ctive q uarter for business d evelopment in company history » Closed gold stream agreement at Teck’s Carmen de Andacollo » Sold royalty interest at Teck’s Carmen de Andacollo » Closed gold stream agreement at Golden Star’s Wassa , Bogoso and Prestea » Closed gold and silver stream at Barrick’s Pueblo Viejo » Closed gold and silver s tream agreement at New Gold’s Rainy River New investments proving transformational » $3 billion in total royalty and streaming interests, up 50 % from a year ago » Pro - Forma 6.7 million net GEO precious metal reserves November 5, 2015 First Quarter Fiscal 2016 Highlights 4

Update on New Stream Transactions November 5, 2015 Operator Property Strategic Rationale Estimated Annual Net GEO’s (1 st 5 years) 1 Effective Date or Estimated Startup Current Status Barrick Pueblo Viejo Producing; one of only 3 mines in the world to produce >1m oz per year; first quartile costs; high quality resources with further exploration potential 50,500 AuEq 2 July 1, 2015 - Au Jan 1, 2016 - Ag Gold d eliveries begin December 15 New Gold Rainy River Under construction; quality deposit; significant exploration potential; excellent jurisdiction 17,500 3 Startup expected mid - 2017 Expected mid - 2017 Teck Andacollo Producing; increased economic participation (rate and duration) and expanded area of interest; well regarded jurisdiction 40,000 4 July 1, 2015 July - August deliveries received in Sept quarter; now receiving regular deliveries Golden Star Wassa , Prestea Producing and developing low cost projects, large land package with exploration optionality 18,500 5 April 1, 2015 Now receiving regular deliveries 5

Streams Bring Investment Diversity Mount Milligan Golden Star Pueblo Viejo Andacollo Andacollo Estimated Distribution of Future GEO Volume 1 FY2015 GEO Volume Plus Relative Estimated Contribution From New and Expanding Streams 1 0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% 80.00% 90.00% 100.00% FY2015 Future Mount Milligan Rainy River Golden Star Pueblo Viejo Andacollo 0 200 300 100 Net Gold Equivalent Ounces ( GEOs) in Thousands 0% 5 0% 100% FY2015 Future Percentage of Total Net Revenue November 5, 2015 Mount Milligan Pueblo Viejo Andacollo Peñasquito Golden Star Rainy River Mulatos Phoenix Gold Cortez Robinson Other 6

Strong reserve p rofile a mongst l argest i nvestments, plus significant upside Estimated Years of Remaining Reserves Investment History * Includes proceeds from sale of the Andacollo royalty; see Andacollo stream * November 5, 2015 0 5 10 15 20 25 $- $200,000,000 $400,000,000 $600,000,000 $800,000,000 $1,000,000,000 Initial investment Cumulative net revenue through September 30, 2015 Estimated remaining mine life 7 1

Strong gold production for the September quarter of ~230koz 2 Goldcorp expects to exceed their production guidance of between 700,000 and 750,000 ounces in CY15 Metallurgical Enhancement Project feasibility study on track for completion in early 2016 Recent Operating Updates November 5, 2015 September quarter production of 53.8koz 1 Throughput of 44k tonnes per day Gold recoveries averaged 67% Second SAG discharge screen installation scheduled Mount Milligan Peñasquito Phoenix Underground activities temporarily suspended while Rubicon develops a project implementation plan, which they expect to complete in the second calendar quarter 2016 3 Mill operations continue and ~11,000 tonnes of stockpiles at 4.0 grams per tonne will be processed in November 2015 8

Gold Equivalent Ounce Waterfall November 5, 2015 Gold Equivalent Ounces (GEOs) Includes Mount Milligan, Andacollo , and Golden Star GEO’s net of our stream payment, where applicable Gold Equivalent Ounces (GEOs) 9 40,000 42,000 44,000 46,000 48,000 50,000 52,000 54,000 56,000 Net GEO's Q1FY15 vs Q1FY16 40,000 42,000 44,000 46,000 48,000 50,000 52,000 54,000 56,000 Net GEO's Q4FY15 vs Q1FY16

Calendar 2015 Operator’s Production Estimate 1,2 Calendar 2015 Operator’s Production Actual 3,4 Royalty/ Stream Gold (oz.) Silver (oz.) Base Metals (lbs.) Gold (oz.) Silver (oz.) Base Metals (lbs.) Andacollo 5 52,200 - - 33,600 - - Cortez GSR 1 104,100 - - 101,300 - - Cortez GSR 2 27.900 - - 30,400 - - Cortez GSR 3 132,000 - - 131,700 - - Cortez NVR 1 97,200 - - 97,600 - - Holt 64,000 - - 48,700 - - Mount Milligan 6 200,000 - 220,000 - - 159,800 - - Penasquito 7,8 700,000 - 750,000 24 - 26 million - 690,400 19.5 million - Lead 7,8 - - 175 - 185 million - - 133.4 million Zinc 7,8 - - 400 - 415 million - - 299.5 million Pueblo Viejo 9 625,000 - 675,000 - - 438,000 - - Golden Star 10 205,000 - 215,000 - - 170,300 - - 10 November 5, 2015 CY15 Estimated & Actual Production Pueblo Viejo deliveries expected to begin on December 15, 2015 (gold stream effective July 1) Golden Star and Andacollo streams already delivering physical gold Royal Gold sells gold within several weeks of receipt of physical metal

Revenue of $ 74.1m, an increase of 7% Reported net loss of ($0.69) per share » EPS included a $56m or $0.86 per share discrete expense attributable to termination of the Company’s royalty interest at Andacollo » Absent this discrete expense: » EPS would have been ~$0.17 per share » Our effective tax rate would have been ~22% » Operating cash flow would have been ~$50 million Inventory of 11,500 ounces of gold at September 30 Adjusted EBITDA of $52.5m 1 , or 71% of revenue Cash dividends of $14.3 million, in our 14th straight year of increasing dividends Expected DD&A of $475 - $525 per GEO for FY2016 and effective tax rate of 20 - 25% for the next 3 quarters of fiscal 2016 November 5, 2015 Fiscal 1Q 2016 Financial Results 11

Liquidity November 5, 2015 Date Item ($USD millions) September 30, 2015 Undrawn Revolver $300.0m September 30, 2015 Working Capital $125.2m September 30, 2015 Total Available Liquidity $425.2m Remainder of FY2016 Existing firm commitments expected to be funded through total available liquidity and cash flow from operations $72.5m Remainder of FY2016 Operating cash flow is expected to increase during the remainder of fiscal year 2016 (assuming similar gold prices) as three of the new transactions are expected to deliver incremental operating cash flow during fiscal year 2016 TBD 12

What Makes Royal Gold Unique Quality New portfolio additions such as Pueblo Viejo are projected to produce in the lower half of worldwide production costs, and Mount Milligan is already amongst the world’s lowest cost copper mines Opportunity We have recently deployed capital opportunistically in a period of gold price weakness, with a focus on asset quality and current and near - term production Growth Record volume in first fiscal quarter expected to grow over the near term with incremental contributions from Andacollo , Golden Star, and Pueblo Viejo, plus Mount Milligan ramping towards full capacity and Rainy River in mid - 2017 November 5, 2015 13

Endnotes

Many of the matters in these endnotes and the accompanying slides constitute forward looking statements and are subject to numerous risks, which could cause actual results to differ . See complete Cautionary Statement on page 2 . Endnotes PAGE 4 FIRST QUARTER FISCAL 2016 HIGHLIGHTS 1. The Company defines Gold Equivalent Ounces as revenue divided by the average gold price for the same period. Net of the Company’s st ream payments, GEO’s would have been 55,669 in the first quarter, up 47,999 net GEO’s in the year - ago quarter . 2. Calculated as royalty and stream interests, net on Royal Gold’s balance sheet, divided by pro - forma reserves (December 31, 2014) , subject to Royal Gold’s interest. Does not include per ounce payments for streams. PAGE 5 UPDATE ON FOUR NEW STREAM TRANSACTIONS 1. Estimates are based on future projections provided to Royal Gold by the operators and assuming constant $ 1 , 200 gold price . There can be no assurance that production estimates received from our operators will be achieved . 2. See Royal Gold’s press release dated August 5 , 2015 . 3. See Royal Gold’s press release dated July 20 , 2015 . 4. See Royal Gold’s press release dated July 9 , 2015 . 5. See Royal Gold’s press release dated May 7 , 2015 . PAGE 6 STREAMS BRING INVESTMENT DIVERSITY 1 . Estimates are based on future projections provided to Royal Gold by the operators and assuming constant $ 1 , 100 per ounce gold price . There can be no assurance that production estimates received from our operators will be achieved . Please refer to our cautionary language regarding forward - looking statements at the beginning of this presentation . PAGE 7 QUALITY – INVESTMENT HISTORY 1. Royal Gold’s royalty on the Mulatos mine is capped at 2 million ounces ; remaining life reflects estimated mine life until the cap is reached . PAGE 8 RECENT OPERATING UPDATES 1. See Thompson Creek Metals Company’s press release dated October 13 , 2015 . 2. See Goldcorp’s press release dated October 29 , 2015 . 3. See Rubicon Minerals press release dated November 3 , 2015 . 15 November 5, 2015

Many of the matters in these endnotes and the accompanying slides constitute forward looking statements and are subject to numerous risks, which could cause actual results to differ . See complete Cautionary Statement on page 2 . Endnotes (cont.) PAGE 10 CY15 ESTIMATED & ACTUAL PRODUCTION 1 Production estimates received from our operators are for calendar 2015 . There can be no assurance that production estimates received from our operators will be achieved . Please refer to our cautionary language regarding forward looking statements preceding Table 1 above, as well as the Risk Factors identified in Part I, Item 1 A, of our Fiscal 2015 10 - K for information regarding factors that could affect actual results . 2 The operators of our Voisey’s Bay interest did not release public production guidance for calendar 2015 , thus estimated and actual production information is not shown in the table . 3 Actual production figures shown are for the period January 1 , 2015 through September 30 , 2015 , unless otherwise noted . 4 Actual production figures for Andacollo and Cortez are based on information provided to us by the operators, and actual production figures for Holt, Mount Milligan, Peñasquito (gold) and Wassa / Bogoso / Prestea are the operators’ publicly reported figures . 5 The estimated and actual production figures shown for Andacollo are contained gold in concentrate . 6 The estimated and actual production figures shown for Mount Milligan are payable gold in concentrate . 7 The estimated gold and silver production figures reflect payable gold and silver in concentrate and doré, while the estimated lead and zinc production figures reflect payable metal in concentrate . 8 The actual gold production figure for gold reflects payable gold in concentrate and doré as reported by the operator . The actual production for silver, lead and zinc were not publicly available . The Company’s royalty interest at Peñasquito includes gold, silver, lead and zinc . 9 The gold and silver stream at Pueblo Viejo was acquired during the quarter ended September 30 , 2015 and the first gold delivery is expected in December 2015 for the period July 1 – November 30 , 2015 . The estimated production figure shown is payable gold in doré and represents Barrick’s 60 % interest in Pueblo Viejo . 10 The gold stream at Wassa / Bogoso / Prestea was acquired during the quarter ended September 30 , 2015 . The estimated production figure shown is payable gold in doré . PAGE 11 FISCAL 1Q 2016 FINANCIAL RESULTS 1 The Company defines Adjusted EBITDA, a non - GAAP financial measure, as net income plus depreciation, depletion and amortization, non - cash charges, income tax expense, interest and other expense, and any impairment of mining assets, less non - controlling interests in operating income of consolidated subsidiaries, interest and other income, and any royalty portfolio restructuring gains or losses . 16 November 5, 2015

1660 Wynkoop Street, #1000 Denver, CO 80202 - 1132 303.573.1660 info @royalgold.com www.royalgold.com 1660 Wynkoop Street, #1000 Denver, CO 80202 - 1132 303.573.1660 info @royalgold.com www.royalgold.com

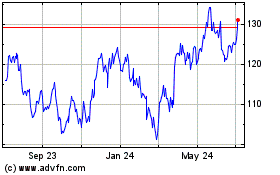

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024