UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

August 6, 2015

ROYAL GOLD, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-13357 |

|

84-0835164 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 1660 Wynkoop Street, Suite 1000, Denver, CO |

|

80202-1132 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 303-573-1660

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition. |

On August 5, 2015,

the Company reported its fiscal 2015 financial results. A copy of the Company’s press release was filed on August 6, 2015.

A copy of the earnings presentation is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished

under this Item 2.02, including the exhibit, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as

shall be expressly set forth by reference to such filing.

| Item 9.01 | Financial Statements and Exhibits. |

Exhibit

No. |

|

Description |

| 99.1 |

|

Royal Gold, Inc. August 6, 2015 Earnings Presentation. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Royal Gold, Inc. |

|

| |

(Registrant) |

|

| |

|

|

| Dated: August 6, 2015 |

By: |

/s/ Bruce C. Kirchhoff |

| |

|

Name: |

Bruce C. Kirchhoff |

| |

|

Title: |

Vice President, General Counsel and Secretary |

| |

|

|

|

|

EXHIBIT INDEX

Exhibit

No. |

|

Description |

| 99.1 |

|

Royal Gold, Inc. August 6, 2015 Earnings Presentation. |

Exhibit 99.1

Fiscal 2015 and Fourth Quarter Results August 6, 2015 SOLID PORTFOLIO. SOLID FUTURE. Exhibit 99.1

2 Cautionary Statement This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from the projections and estimates contained herein and include, but are not limited to : new additions to the Company’s portfolio projected to produce in the lower half of world - wide production costs ; production and mine life estimates from the operators of the Company’s properties ; the production, reserves, resources, sustaining costs, optimization, potential to expand mine life and net GEOs per year over the next five years at Pueblo Viejo ; net GEOs over the next five years at other key mines ; reserves and net GEOs expected from the Andacollo mine ; the ramp - up of production from the Mount Milligan mine ; construction progress, reserves and resources at the Wassa , Bogoso and Prestea , Phoenix Gold and Rainy River projects ; anticipated growth in the volume of metals subject to the Company’s royalty and stream interests ; the impact of exchange rates on the Company’s full year effective tax rate ; and statements or estimates from operators of properties where we have royalty and stream interests regarding the timing of development, construction and commencement of production, or their projections of steady, increasing or decreasing production once in operation . Factors that could cause actual results to differ materially from these forward-looking statements include, among others : the risks inherent in construction, development and operation of mining properties, including those specific to new mines being developed and operated in foreign countries ; changes in gold, silver, copper, nickel and other metals prices ; performance of and production at the Company’s properties ; decisions and activities of the Company’s management ; unexpected operating costs ; decisions and activities of the operators of the Company’s royalty and stream properties ; changes in operators’ mining and processing techniques or royalty calculation methodologies ; resolution of regulatory and legal proceedings (including with Vale regarding Voisey’s Bay) ; unanticipated grade, geological, metallurgical, environmental, processing or other problems at the properties ; inaccuracies in technical reports and reserve estimates ; revisions by operators of reserves, resources, mineralization or production estimates ; changes in project parameters as plans of the operators are refined ; the results of current or planned exploration activities ; discontinuance of exploration activities by operators ; economic and market conditions ; variations between operators’ production estimates and our estimates of net GEOs ; operations on lands subject to aboriginal rights ; the ability of operators to bring non-producing and not - yet - in - development projects into production and operate in accordance with feasibility studies ; challenges to the Company’s royalty interests, or title and other defects in the Company’s royalty properties ; errors or disputes in calculating royalty payments or stream deliveries, or payments or deliveries not made in accordance with royalty or stream agreements ; the liquidity and future financial needs of the Company ; the impact of future acquisitions and royalty and stream financing transactions ; adverse changes in applicable laws and regulations ; litigation ; and risks associated with conducting business in foreign countries, including application of foreign laws to contract and other disputes, environmental laws, enforcement and uncertain political and economic environments . These risks and other factors are discussed in more detail in the Company’s public filings with the Securities and Exchange Commission . Statements made herein are as of the date hereof and should not be relied upon as of any subsequent date . The Company’s past performance is not necessarily indicative of its future performance . The Company disclaims any obligation to update any forward-looking statements . Endnotes located on pages 22 and 23 . August 6, 2015

Today’s Speakers August 6, 2015 3 Tony Jensen President and CEO Bill Heissenbuttel VP Corporate Development & Operations Stefan Wenger CFO and Treasurer

Record Operating Cash Flow in FY2015 August 6, 2015 Cash from operations (in millions) 4 $0 $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $0 $50 $100 $150 $200 $250 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015 Cash from Operations Average Gold Price Average Gold Price/ oz

Record Volume in FY2015 5 Other Mt Milligan August 6, 2015 Net Gold Equivalent Ounces (GEOs) 1 (in thousands) 8% Compounded Annual Growth Rate FY2010 through FY2015 0 50 100 150 200 250 FY2010 FY2011 FY2012 FY2013 FY2014 FY2015

Investment Summary Four new streams added to the portfolio in recent months Opportunistically reinvesting in our business » Favorable point in the commodity cycle » Focusing on high quality producing or near - term producing assets » Diversifying revenue August 6, 2015 6 Pueblo Viejo Rainy River Golden Star Andacollo

Operator Property Strategic Rationale Estimated Annual Net GEO’s (1 st 5 years) Effective Date or Estimated Startup Total Investment Barrick Pueblo Viejo Producing; one of only 3 mines in the world to produce >1m oz per year; first quartile costs; high quality resources with further exploration potential 50,500 AuEq 1 July 1, 2015 - Au Jan 1, 2016 - Ag $610m New Gold Rainy River Under construction; quality deposit; significant exploration potential; proven management team; Canada 17,500 2 Startup expected mid - 2017 $175m Teck Andacollo Producing; increased economic participation (rate and duration) and expanded area of interest 40,000 3 July 1, 2015 $525m* Golden Star Wassa , Prestea Producing and developing low cost projects, large land package with exploration optionality 18,500 4 April 1, 2015 $150m Four New Streams Added to the Portfolio August 6, 2015 *In a separate transaction, Royal Gold terminated its prior royalty interest in Andacollo and received $345 million gross proceeds from Teck in July 2015. 7

Opportunistically Deploying Capital $700 $900 $1,100 $1,300 $1,500 $1,700 $1,900 Jul-30-2010 Jul-30-2011 Jul-30-2012 Jul-30-2013 Jul-30-2014 Jul-30-2015 Mt. Milligan II Mt. Milligan III El Morro Phoenix Ilovitza Wassa / Prestea Andacollo Stream Rainy River Gold Price When Royal Gold Made Investments, 2010 - present August 6, 2015 Mt. Milligan I Spot Gold Price in US Dollars Includes investments >$30 million 8 Pueblo Viejo

0.00% 10.00% 20.00% 30.00% 40.00% 50.00% 60.00% 70.00% 80.00% 90.00% 100.00% FY2015 Future Enhanced Revenue Diversity with New Investments August 6, 2015 9 FY2015 Volume Plus Relative Contribution from New Streams Mount Milligan Rainy River Golden Star Pueblo Viejo Andacollo Stream Andacollo 0 200 300 100 Net Gold Equivalent Ounces ( GEOs) (in thousands) 0% 5 0% 100% FY2015 Future Percentage of Total Net Revenue

10 New Business Transforming the RGLD Portfolio Pueblo Viejo – Barrick Gold (60% interest), Dominican Republic Project (100% basis): » 2014 production of 1.1 million ounces (“ Moz ”) of gold and 3.8 Moz silver at all - in sustaining costs of $588 per ounce » Proven and probable reserves of 15.5 Moz gold and 97.2 Moz silver 1 » Measured and indicated resources of 10.5 Moz gold and 61.2 Moz silver 2 » The only mine in the world with annual production of more than 1.0 Moz gold at all - in sustaining costs below $700 per ounce for the next three years 2015 - 2017 3 » Barrick’s technical experts have identified multiple opportunities to further optimize operations including increasing plant throughput by optimizing ore blending and autoclave ability; and reducing costs by optimizing maintenance programs » Pueblo Viejo has significant reserves and resources with potential to expand the mine life August 6, 2015

11 New Business Transforming the RGLD Portfolio Pueblo Viejo – Barrick Gold (60% interest), Dominican Republic Stream: 1 » 7.5% of Barrick’s gold interest until 990,000 ounces, and 3.75% thereafter » 75% of Barrick’s silver interest until 50.00 Moz , and 37.5% thereafter, with silver deliveries based on a fixed 70% recovery rate » Royal Gold will pay 30% of the spot price per ounce of gold until 550,000 ounces of gold, and 60% of the spot price per ounce thereafter; and 30% of the spot price per ounce of silver until 23.10 Moz silver, and 60% of the spot price per ounce thereafter » Closing expected within 90 days August 6, 2015

12 Project: » Over its first nine years of full production, the 21,000 tonne per day, combined open pit - underground operation is expected to produce an average of 325,000 ounces of gold per year at all - in sustaining costs of approximately $670 per ounce » Proven and probable reserves of 3.1 Moz gold and 8.0 Moz silver » Measured and indicated gold resource of 2.9 Moz and 10.0 Moz silver Stream: 1 » 6.5% gold stream to 230koz, 3.25% thereafter; 60% silver stream to 3.1 Moz , 30% thereafter » Royal Gold will pay 25% of the spot price per ounce Rainy River – New Gold, Canada August 6, 2015 New Business Transforming the RGLD Portfolio

13 Project: » Long operating history » Well - respected partner in Teck, Canada’s largest diversified resource company » Proven and probable reserves of 1.6 Moz gold and a 22 year mine life Stream: 1 » 100% gold stream to 900koz; 50% thereafter, subject to 89% payable factor » Royal Gold will pay 15% of spot price per ounce » Larger economic interest in terms of duration and gold interest vs. prior royalty » Expanded footprint encompassing additional mineral rights and a 1.5 kilometer area of interest relative to prior royalty Andacollo – Teck, Chile August 6, 2015 New Business Transforming the RGLD Portfolio

14 Wassa and Prestea – Golden Star Resources, Ghana Projects: » Higher quality Wassa and Prestea underground projects under construction » Proven and probable reserves of 1.9 Moz gold across all deposits » Measured and indicated gold resources of 3.5 Moz at Wassa and 3.1 Moz at Bogoso and Prestea Stream: 1 » 8.5% gold stream to 185koz; 5% for an additional 22.5koz; 3% thereafter » Royal Gold will pay 20% of the spot price per ounce to 207.5koz; 30% thereafter » Investment is funding underground development at Wassa and Prestea August 6, 2015 New Business Transforming the RGLD Portfolio

20 25 30 35 40 45 50 55 Net GEOs Q315 vs Q415 20 25 30 35 40 45 50 55 Net GEOs Q4FY14 vs Q4FY15 Gold Equivalent Ounce Waterfall 15 Gold Equivalent Ounces (GEOs) (thousands) Includes Mount Milligan GEOs net of our stream payment Gold Equivalent Ounces (GEOs) (thousands) August 6, 2015

16 August 6, 2015 Full Year Estimates vs Production CYTD Royalty/Stream Calendar 2015 Operator’s Production Estimate 1 First 6 months of 2015 Operator's Production Actual 2 Gold Silver Base Metals Gold Silver Base Metals (oz.) (oz.) (lbs.) (oz.) (oz.) (lbs.) Andacollo 3 52,200 - - 22,200 - - Cortez GSR 1 104,100 - - 82,900 - - Cortez GSR 2 27,900 - - 26,300 - - Cortez GSR 3 132,000 - - 109,200 - - Cortez NVR 1 97,200 - - 81,600 - - Holt 64,000 - - 32,100 - - Mount Milligan 4 200,000 - 220,000 - - 106,000 - - Peñasquito 5,6 700,000 - 750,000 24 - 26 million - 453,600 12.0 million Lead 175 - 185 million 84.2 million Zinc 400 - 415 million 188.0 million

Record gold production for the June quarter of 297koz 2 The Metallurgical Enhancement Project feasibility study on track for completion in early 2016; permit applications submitted in May Recent Operating Highlights 17 August 6, 2015 June quarter production of 59.9koz 1 May and June mill throughput of 49.9k TPD (~83% of capacity) June quarter gold recoveries of 72.7% Mount Milligan Peñasquito Phoenix First gold pour (741 oz ) on June 24 3 Commissioning of the mill circuit continues with the processing of low - grade material

Q4 2015 Financial Highlights » Revenue of $73.6 million, an increase of 5% » Operating cash flow of $43.9 million, an increase of 37% » Record volume of 61,700 GEOs , an increase of 13% » Reported net income of $0.23 per share – Impacted by a non - cash $0.06/share remeasurment of deferred tax liabilities » Adjusted EBITDA of $55.2 million, a decrease of 3% 1 Fiscal 2015 Financial Highlights » FY2015 Reported net income of $0.80 per share – Impacted by $ 0.37/share non - cash charge related to an impairment taken in the December quarter » Adjusted EBITDA of $3.33 per basic share, or 78% of revenue » Cash dividends of $ 56.1 million – Payout ratio of 29 % of operating cash flow – Our 14th straight year of increasing dividends 18 August 6, 2015 $ 650M Revolver $ 650 M Revolver Q4 2015 and FY2015 Financial Highlights

Liquidity 19 * For illustrative purposes: Does not include new revenue from PV stream, Andacollo stream or Golden Star streams, or any operating cash flow August 6, 2015 Date Item ($USD millions) June 30, 2015 Working Capital $766m Undrawn Revolver 650m June 30, 2015 Total Available Liquidity $1,416m FY2016 Commitments Andacollo Stream Purchase Andacollo Royalty Sale Rainy River 1 st Advanced Payment Golden Star Stream and Loan Puebo Viejo Stream Other - 525m 300m - 100m - 120m - 610m - 16m June 30, 2016 Total Expected Liquidity $345m

20 What Makes Royal Gold Unique Mount Milligan continues to produce at below world average production costs, new additions to the portfolio are all projected to produce in the lower have of worldwide production costs Growth Quality Opportunity Existing Portfolio Delivered Record Volume in FY2015; and the four new streams will extend that growth for the next several years Mount Milligan continues to produce at below world average production costs; new additions to the portfolio are all projected to produce in the lower half of worldwide production costs We are deploying capital opportunistically in a period of gold price weakness, with a focus on asset quality and current and near - term production August 6, 2015

Endnotes SOLID PORTFOLIO. SOLID FUTURE.

Endnotes 22 August 6, 2015 PAGE 5 RECORD VOLUME IN FY 2015 1 . Royal Gold defines Gold Equivalent Ounces as revenue divided by the average gold price for the same period . PAGE 7 FOUR NEW STREAMS ADDED TO THE PORTFOLIO 1 . See Royal Gold’s press release dated August 5 , 2015 . 2 . See Royal Gold’s press release dated July 20 , 2015 . 3. See Royal Gold’s press release dated July 9 , 2015 . 4. See Royal Gold’s press relese dated May 7 , 2015 . PAGE 10 NEW BUSINESS TRANSFORMING THE RGLD PORTFOLIO – PUEBLO VIEJO 1. Cautionary Note to U.S. Investors Concerning Estimates of Proven and Probable Mineral Reserves and Measured and Indicated Mineral Resources: The mineral reserve estimates reported by the operators were prepared in accordance with Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves, as incorporated by reference in National Instr ume nt 43 - 101. RGI has not reconciled the reserve estimates provided by the operatorswith definitions of reserves used by the U.S. Securities and Exchange Commission. 2. While the terms “Mineral Resource,” “Measured Mineral Resource” and “Indicated Mineral Resource” are recognized and required by Can adi an securities regulations, they are not defined terms under standards of the United States Securities and Exchange Commission. Und er United States standards, mineralization may not be classified as a “Reserve” unless the determination has been made that the mineral iza tion could be economically and legally produced or extracted at the time the reserve estimation is made. The mineral resources reported he rei n are estimates previously disclosed by the operator, without reference to the underlying data used to calculate the estimates. Accordingly, RGI is not able to reconcile the estimates prepared in reliance on Canadian National Instrument 43 - 101 with terms recognized by the United States S ecurities and Exchange Commission. Readers are cautioned not to assume that all or any part of the measured or indicated mineral resources wi ll ever be converted into mineral reserves . 3. See Barrick Gold Corporation’s press release dated August 5, 2015. PAGE 11 NEW BUSINESS TRANSFORMING THE RGLD PORTFOLIO – PUEBLO VIEJO 1 . See Royal Gold’s press release dated August 5 , 2015 . PAGE 12 NEW BUSINESS TRANSFORMING THE RGLD PORTFOLIO – RAINY RIVER 1. See Royal Gold’s press release dated July 20 , 2015 . PAGE 13 NEW BUSINESS TRANSFORMING THE RGLD PORTFOLIO – ANDACOLLO 1. See Royal Gold’s press release dated July 9 , 2015 . Many of the matters in these endnotes and the accompanying slides constitute forward looking statements and are subject to numerous risks, which could cause actual results to differ . See complete Cautionary Statement on page 2 .

Endnotes (cont.) 23 August 6, 2015 PAGE 14 NEW BUSINESS TRANSFORMING THE RGLD PORTFOLIO – WASSA AND PRESTEA 1. See Royal Gold’s press relese dated May 7 , 2015 . PAGE 16 FULL YEAR ESTIMATES VS PRODUCTION CYTD 1. There can be no assurance that production estimates received from our operators will be achieved. Please refer to our cautio nary language regarding forward - looking statements t the beginning of this presentation. 2 . Actual production figures for Andacollo and Cortez are based on information provided to us by the operators, and actual produ ct ion figures for Holt, Mount Milligan, and Peñasquito (gold) are the operators’ publicly reported figures. 3 . The estimated and actual production figures shown for Andacollo are contained gold in concentrate. 4 . The estimated and actual production figures shown for Mount Milligan are payable gold in concentrate. 5 . The estimated gold and silver production figures reflect payable gold and silver in concentrate and doré , while the estimated lead and zinc production figures reflect payable metal in concentrate. 6 . The actual gold production figure for gold reflects payable gold in concentrate and doré as reported by the operator. The actual production for silver, lead and zinc were not publicly available. The Company’s royalty interest at Peñasquito includes gold, silver, lead and zinc. PAGE 17 RECENT OPERATING HIGHLIGHTS 1. See Thompson Creek Metals Company’s press release dated July 8 , 2015 . 2. See Goldcorp’s press release dated July 30 , 2015 . 3. See Rubicon Minerals’ press release dated June 24 , 2015 . PAGE 18 Q 4 2015 AND FY 2015 FINANCIAL HIGHLIGHTS 1 . The Company defines Adjusted EBITDA, a non - GAAP financial measure, as net income plus depreciation, depletion and amortization, non - cash charges, income tax expense, interest and other expense, and any impairment of mining assets, less non - controlling interests in operating income of consolidated subsidiaries, interest and other income, and any royalty portfolio restructuring gains or losses . Many of the matters in these endnotes and the accompanying slides constitute forward looking statements and are subject to numerous risks, which could cause actual results to differ . See complete Cautionary Statement on page 2 .

1660 Wynkoop Street Denver, CO 80202 - 1132 303.573.1660 info @royalgold.com www.royalgold.com SOLID PORTFOLIO. SOLID FUTURE.

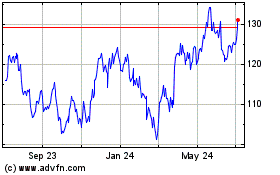

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024