Royal Gold Announces Agreement to Acquire Gold and Silver Stream on Barrick’s Interest in the Pueblo Viejo Mine

August 05 2015 - 5:02PM

Business Wire

Royal Gold, Inc. (NASDAQ:RGLD; TSX:RGL) (“RGI”) announces

that its wholly owned subsidiary, RGLD Gold AG (“Royal Gold”),

entered into a $610 million Precious Metals Purchase and Sale

Agreement with a wholly owned subsidiary of Barrick Gold

Corporation, BGC Holdings Ltd. (“Barrick”), to purchase a

percentage of the gold and silver production attributable to

Barrick’s 60% interest in the Pueblo Viejo mine located in the

Dominican Republic (“Pueblo Viejo”).

Pueblo Viejo is an open-pit mining operation located 100

kilometers northwest of Santo Domingo. It is managed by a joint

venture between two of the world’s largest gold producers, with

Barrick owning 60% and responsible for operations and Goldcorp Inc.

(“Goldcorp”) owning the remaining 40%. The mine began production in

2013, and is the only primary gold mine in the world with annual

production of more than one million ounces of gold (100% basis), at

all-in sustaining costs below $700 per ounce. On a 100% basis, 2014

gold production was approximately 1.11 million ounces, silver

production was 3.85 million ounces, and all-in sustaining costs

were $588 per ounce. Total mine proven and probable reserves1 were

15.50 million ounces of gold and 97.20 million ounces of silver,

while measured and indicated resources2 were 10.50 million ounces

of gold and 61.20 million ounces of silver as of December 31,

2014.

Tony Jensen, President and Chief Executive Officer of Royal

Gold, Inc. commented, “This agreement adds revenue from yet another

high quality, long lived asset to Royal Gold’s portfolio and, when

coupled with three other transactions in recent months,

significantly diversifies our revenue sources. It provides our

shareholders with substantial resource conversion optionality and a

favorable entry point in the commodity cycle. Opportunities of this

caliber and magnitude are rare and we are pleased to partner with

Barrick on this world-class operation.”

Precious Metals Stream

- Royal Gold will make a single $610

million advance payment to Barrick at closing, subject to certain

conditions precedent

- Barrick will deliver gold and silver to

Royal Gold in an amount equal to:

- 7.5% of Barrick’s interest in the gold

produced at Pueblo Viejo until 990,000 ounces of gold have been

delivered, and 3.75% thereafter

- 75% of Barrick’s interest in the silver

produced at Pueblo Viejo (with silver deliveries based on a fixed

70% recovery rate) until 50.00 million ounces have been delivered,

and 37.5% thereafter

- Royal Gold will pay Barrick:

- 30% of the spot price per ounce of gold

until 550,000 ounces of gold have been delivered, and 60% of the

spot price per ounce thereafter

- 30% of the spot price per ounce of

silver until 23.10 million ounces of silver have been delivered,

and 60% of the spot price per ounce thereafter

- Closing of the transaction and funding

is expected within 90 days

Transaction Highlights for Royal Gold

- Transaction effective July 1, 2015 for

gold and January 1, 2016 for silver

- By design, deliveries of gold and

silver are accelerated in the early years of mine production:

- Estimated gross annual gold deliveries

of approximately 46,500 ounces during the first five full years of

production, or annual average life of mine gold deliveries of

nearly 34,000 ounces

- Estimated gross annual silver

deliveries of 1.9 million ounces of silver during the first five

full years of production, or annual average life of mine silver

deliveries of nearly 1.5 million ounces

- 18 years of mine life based on current

reserves to 2032

- Proven and probable gold reserves

attributable to Barrick of 9.3 million contained ounces at 3.3

grams per tonne (“g/t”) as of December 31, 2014

- Proven and probable silver reserves

attributable to Barrick of 58.3 million contained ounces grading

20.7 g/t as of December 31, 2014

- High quality resources (as of December

31, 2014):

- 6.3 million contained ounces of

measured and indicated gold resources attributable to Barrick

grading 2.6 g/t

- 36.7 million contained ounces of

measured and indicated silver resources attributable to Barrick

grading 15.2 g/t

Under the terms of the Purchase and Sale Agreement, Barrick will

deliver gold and silver to Royal Gold on a quarterly basis. Royal

Gold expects to sell the gold and silver shortly after receiving

each delivery, and will recognize revenue from the sale of the

delivered gold and silver after the sale has occurred.

CORPORATE PROFILE

Royal Gold, Inc. is a precious metals royalty and stream company

engaged in the acquisition and management of precious metal

royalties, streams, and similar production based interests. RGI

owns interests on 198 properties on six continents, including

interests on 38 producing mines and 25 development stage projects.

Royal Gold, Inc. is publicly traded on the NASDAQ Global Select

Market under the symbol “RGLD,” and on the Toronto Stock Exchange

under the symbol “RGL.” RGI’s website is located at

www.royalgold.com.

Cautionary “Safe Harbor” Statement Under the Private

Securities Litigation Reform Act of 1995: With the exception of

historical matters, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from

projections or estimates contained herein. Such forward-looking

statements include statements about the stream and Royal Gold’s

Precious Metals Purchase and Sale Agreement with Barrick, as well

as its expectations concerning reserves, measured and indicated

gold resources, production and mine life at the Pueblo Viejo mine.

Factors that could cause actual results to differ materially from

the projections include, among others, precious metals prices;

actual tax rates; performance of and production at the Pueblo Viejo

mine subject to our stream interests; decisions and activities of

the operators of the mine; operators’ delays in securing or

inability to secure necessary governmental permits; political and

social risks inherent in investments in foreign jurisdictions;

changes in operators’ project parameters and timelines as

operations continue to be refined; economic and market conditions;

unanticipated grade, geological, metallurgical, processing,

regulatory and legal or other problems that the operators of the

mine may encounter; and other subsequent events, as well as other

factors described in RGI's Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q, and other filings with the Securities

and Exchange Commission. Most of these factors are beyond RGI’s

ability to predict or control. RGI disclaims any obligation to

update any forward-looking statement made herein. Readers are

cautioned not to put undue reliance on forward-looking

statements.

____________________________

i Cautionary Note to U.S. Investors Concerning Estimates of

Proven and Probable Mineral Reserves and Measured and Indicated

Mineral Resources: The mineral reserve estimates reported by

Barrick were prepared in accordance with Canadian Institute of

Mining, Metallurgy and Petroleum Definition Standards for Mineral

Resources and Mineral Reserves, as incorporated by reference in

National Instrument 43-101. RGI has not reconciled the reserve

estimates provided by Barrick with definitions of reserves used by

the U.S. Securities and Exchange Commission.

ii While the terms “Mineral Resource,” “Measured Mineral

Resource” and “Indicated Mineral Resource” are recognized and

required by Canadian securities regulations, they are not defined

terms under standards of the United States Securities and Exchange

Commission. Under United States standards, mineralization may not

be classified as a “Reserve” unless the determination has been made

that the mineralization could be economically and legally produced

or extracted at the time the reserve estimation is made. The

mineral resources reported herein are estimates previously

disclosed by Barrick, without reference to the underlying data used

to calculate the estimates. Accordingly, RGI is not able to

reconcile the estimates prepared in reliance on Canadian National

Instrument 43-101 with terms recognized by the United States

Securities and Exchange Commission. Readers are cautioned not to

assume that all or any part of the measured or indicated mineral

resources will ever be converted into mineral reserves.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150805006685/en/

Royal Gold, Inc.Karli Anderson, 303-575-6517Vice

President Investor Relations

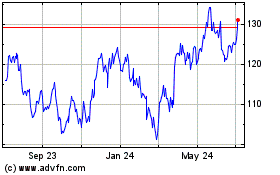

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024