UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

July 9, 2015

ROYAL GOLD, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-13357 |

|

84-0835164 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 1660 Wynkoop Street, Suite 1000, Denver, CO |

|

80202-1132 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 303-573-1660

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 1.01 Entry into a Material Definitive Agreement.

On July 9, 2015, RGLD

Gold AG (“RGLD”), a wholly owned subsidiary of Royal Gold, Inc. (“RGI”), entered into a Long Term Offtake

Agreement (the “Stream Agreement”) with Compañía Minera Teck Carmen de Andacollo (“CMCA”),

a 90% owned subsidiary of Teck Resources Limited.

Pursuant to the Stream

Agreement, CMCA will deliver to RGLD 100% of payable gold from the Carmen de Andacollo copper-gold mine until 900,000 ounces have

been delivered, and 50% thereafter, subject to a fixed payable percentage of 89%. RGLD made a $525 million advance payment in cash

to CMCA upon entry into the Stream Agreement, and RGLD will also pay CMCA 15% of the monthly average gold price for the month preceding

the delivery date for all gold purchased under the Stream Agreement.

The transaction will

encompass CMCA’s presently owned mining concessions on the Carmen de Andacollo mine, as well as any other mining concessions

presently owned or acquired by CMCA or any of its affiliates within a 1.5 kilometer area of interest, and certain other mining

concessions that CMCA or its affiliates may acquire. The Stream Agreement is effective July 1, 2015, and applies to all final settlements

of gold received on or after that date. Deliveries to RGLD will be made monthly, and RGLD expects to begin receiving gold deliveries

in its first fiscal quarter of 2016, ending September 30, 2015.

The Stream Agreement

contains customary representations and warranties that each party made to the other. The assertions embodied in those representations

and warranties were made solely for the purpose of the Stream Agreement, which governs the contractual rights and relationships,

and allocates risks, among the parties thereto, and may be subject to important qualifications and limitations agreed to by RGLD

and CMCA in connection with negotiating their respective terms. Moreover, the representations and warranties may be subject to

a contractual standard of materiality that may be different from that which may be viewed as material to stockholders. For the

foregoing reasons, no person should rely on the representations and warranties made by the parties to the Stream Agreement as statements

of factual information at the time they were made or otherwise. The Stream Agreement also contains customary covenants and events

of default.

Item 1.02 Termination of a Material Definitive Agreement.

On July 9, 2015, Royal

Gold Chile Limitada (“RG Chile”), a wholly owned subsidiary of RGI, entered into a Royalty Termination Agreement (the

“Royalty Termination Agreement”) with CMCA. The Royalty Termination Agreement terminated an amended Royalty Agreement

originally dated January 12, 2010, which provided RG Chile with a royalty equivalent to 75% of the gold produced from the sulfide

portion of the Carmen de Andacollo mine until 910,000 payable ounces have been produced, and 50% of the gold produced thereafter.

Approximately 248,000 ounces of payable gold subject to the royalty were produced through March 31, 2015, resulting in approximately

662,000 payable ounces remaining as of that date, before the step down to the 50% royalty rate.

CMCA paid total consideration

of $345 million to RG Chile in connection with the Royalty Termination Agreement. The transaction will be taxable to RG Chile,

with net proceeds estimated at approximately $300 million. RG Chile will receive payment for the royalty through June 30, 2015,

the economic effective date of the termination. In addition to the $345 million termination payment, a post-closing final royalty

payment of approximately $9 million is expected in mid-July to finalize all outstanding shipments for which final settlements had

not been received as of July 1, 2015.

Also on July 9, 2015,

RGI entered into a Master Agreement Termination Agreement (the “Master Agreement Termination Agreement”) with CMCA.

The Master Agreement Termination Agreement terminated a Master Agreement, dated April 3, 2009, as amended August 12, 2009, and

as amended and restated on January 12, 2010, between RGI and CMCA which governed certain matters in connection with the above mentioned

Royalty Agreement. Upon termination of the Royalty Agreement, no commercial reason remained for the Master Agreement to remain

in force and the parties therefore agreed to terminate the Master Agreement.

Item 2.01 Completion of Acquisition or Disposition of

Assets.

The information set

forth in Item 1.01 of this Current Report on Form 8-K with respect to the right and obligation of RGLD to purchase payable gold

produced from the Carmen de Andacollo copper-gold mine pursuant to the Stream Agreement is incorporated into this Item 2.01 by

reference.

The information set

forth in Item 1.02 of this Current Report on Form 8-K with respect to the termination of the royalty held by RG Chile on the Carmen

de Andacollo copper-gold mine pursuant to the Royalty Termination Agreement and the related payment from CMCA to RG Chile is incorporated

into this Item 2.01 by reference.

Item 7.01 Regulation FD Disclosure.

On July 9, 2015, RGI

announced the entry of RGLD into the Stream Agreement. The press release is furnished as Exhibit 99.1 hereto.

On July 9, 2015, RGI

announced the entry of RG Chile into the Royalty Termination Agreement. The press release is furnished as Exhibit 99.2 hereto.

The information furnished

under this Item 7.01, including the exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as

shall be expressly set forth by reference to such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release dated July 9, 2015 regarding RGLD entry into Stream Agreement. |

| 99.2 |

|

Press Release dated July 9, 2015 regarding RG Chile entry into Royalty Termination Agreement. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Royal Gold, Inc. |

| |

(Registrant) |

| |

|

|

| Dated: July 10, 2015 |

By: |

/s/ Bruce C. Kirchhoff |

| |

|

Name: |

Bruce C. Kirchhoff |

| |

|

Title: |

Vice President, General Counsel and Secretary |

EXHIBIT INDEX

| Exhibit No. |

|

Description |

| 99.1 |

|

Press Release dated July 9, 2015 regarding RGLD entry into Stream Agreement. |

| 99.2 |

|

Press Release dated July 9, 2015 regarding RG Chile entry into Royalty Termination Agreement. |

EXHIBIT 99.1

Royal Gold Acquires Gold Stream on Teck’s

Carmen de Andacollo Mine

DENVER, COLORADO.

JULY 9, 2015: ROYAL GOLD, INC. (NASDAQ:RGLD; TSX: RGL) (“RGI”) announces that its wholly owned subsidiary

RGLD Gold AG (“Royal Gold” or the “Company”) entered into a $525 million gold offtake agreement with Compañía

Minera Teck Carmen de Andacollo (“CMCA”), a 90% owned subsidiary of Teck Resources Limited (“Teck”). The

transaction will encompass certain exploitation concessions by CMCA on the Carmen de Andacollo copper-gold mine, any mining concessions

acquired within a 1.5 kilometer area of interest, and certain other mining concessions that CMCA may acquire.

The offtake agreement

on Carmen de Andacollo is separate and distinct from the former royalty of Royal Gold Chile Limitada, a wholly owned subsidiary

of RGI (“RG Chile”), on the Carmen de Andacollo mine, which was terminated with an economic effective date of June

30, 2015.

Tony Jensen, President

and Chief Executive Officer of RGI, commented, “This stream gives Royal Gold a larger interest in gold from Andacollo for

a longer period and increases our optionality to new discoveries through an expanded area of interest. This transaction is yet

another step towards our goal of adding new business to diversify and balance our revenue sources, and we are pleased to do so

with a high quality partner such as Teck.”

Transaction Details

| · | Royal Gold made a $525 million advance payment in cash to CMCA |

| · | CMCA will deliver to Royal Gold 100% of payable gold from Carmen de Andacollo until 900,000 ounces

have been delivered, and 50% thereafter, subject to a fixed payable percentage of 89% |

| · | Royal Gold will also pay CMCA 15% of the monthly average gold price for the month preceding the

delivery date |

Transaction Highlights for Royal

Gold

| · | Larger economic interest in terms of duration and gold interest in Carmen de Andacollo relative

to RG Chile’s prior royalty |

| · | Expanded footprint encompassing additional mineral rights and a 1.5 kilometer area of interest

relative to RG Chile’s prior royalty |

| · | Estimated average annual deliveries of approximately 41,000 payable gross gold ounces over the

life of mine (50,000 payable gross ounces over the first five years) |

| · | Proven and probable reserves of 1.6 million contained gold ounces grading 0.11 g/t gold and a 22

year mine life reported by Teck as of December 31, 2014 |

| · | Long operating history including 5+ years of concentrator operations and prior relationship with

RG Chile |

| · | Well-respected partner in Teck, Canada’s largest diversified resource company |

| · | Adds to the Company’s strong geopolitical footprint with another investment in Chile |

About the Offtake Agreement between

Royal Gold and CMCA

| · | The offtake agreement is effective July 1, 2015, and applies to all final settlements of gold received

on or after that date |

| · | Deliveries to Royal Gold will be made monthly |

| · | Royal Gold plans to sell the gold within a few weeks of receiving each delivery |

| · | Revenue from the delivered gold will be recognized after the sale has occurred |

| · | Royal Gold expects to begin receiving gold deliveries in its first fiscal quarter of 2016 (ended September 30, 2015) |

About the Carmen de Andacollo Mine

Carmen de Andacollo

is located in Region IV in central Chile, approximately 350 kilometers north of Santiago, near the southern limit of the Atacama

Desert. In operation since 1996, Carmen de Andacollo is an open pit mine which currently produces primarily copper in concentrates

from the hypogene portion of the orebody. In 2010, the mine’s life was extended by approximately 20 years with the achievement

of commercial production at its new copper concentrator.

CORPORATE PROFILE

Royal Gold, Inc. is

a precious metals royalty and stream company engaged in the acquisition and management of precious metal royalties, streams, and

similar production based interests. RGI owns interests on 196 properties on six continents, including interests on 37 producing

mines and 24 development stage projects. Royal Gold, Inc. is publicly traded on the NASDAQ Global Select Market under the

symbol “RGLD,” and on the Toronto Stock Exchange under the symbol “RGL.” RGI’s website is located

at www.royalgold.com.

About Teck

Teck is a diversified

resource company committed to responsible mining and mineral development with major business units focused on copper, steelmaking

coal, zinc and energy. Headquartered in Vancouver, Canada, its shares are listed on the Toronto Stock Exchange under the symbols

TCK.A and TCK.B and the New York Stock Exchange under the symbol TCK.

For further information, please

contact:

Karli Anderson

Vice President Investor Relations

(303) 575-6517

Cautionary

“Safe Harbor” Statement Under the Private Securities Litigation Reform Act of 1995: With the exception of historical

matters, the matters discussed in this press release are forward-looking statements that involve risks and uncertainties that could

cause actual results to differ materially from projections or estimates contained herein. Such forward-looking statements include

statements about Royal Gold’s offtake agreement with CMCA, as well as expectations concerning development, production and

mine life at the Carmen de Andacollo mine. Factors that could cause actual results to differ materially from the projections include,

among others, precious metals prices; actual tax rates; performance of and production at the properties subject to our royalty

and stream interests; decisions and activities of the operators of these properties; operators’ delays in securing or inability

to secure necessary governmental permits; changes in operators’ project parameters and timelines as plans continue to be

refined; economic and market conditions; unanticipated grade, geological, metallurgical, processing, regulatory and legal or other

problems that the operators of mining properties may encounter; completion of feasibility studies; the ability of the various operators

to bring projects into production as expected; and other subsequent events, as well as other factors described in RGI's Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the Securities and Exchange Commission. Most of

these factors are beyond RGI’s ability to predict or control. RGI disclaims any obligation to update any forward-looking

statement made herein. Readers are cautioned not to put undue reliance on forward-looking statements.

Cautionary Note to U.S. Investors Concerning

Estimates of Proven and Probable Mineral Reserves: The mineral reserve estimates reported

by Teck were prepared in accordance with Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral

Resources and Mineral Reserves, as incorporated by reference in National Instrument 43-101. RGI has not reconciled the reserve

estimates provided by Teck with definitions of reserves used by the U.S. Securities and Exchange Commission.

EXHIBIT 99.2

Royal Gold Sells Royalty at Carmen de

Andacollo

DENVER, COLORADO. JULY

9, 2015: ROYAL GOLD, INC. (NASDAQ:RGLD; TSX: RGL) (“RGI”) announces that its wholly owned subsidiary Royal

Gold Chile Limitada (“Royal Gold” or the “Company”) entered into a Royalty Termination Agreement (“Agreement”)

with Compañía Minera Teck Carmen de Andacollo (“CMCA”), a 90% owned subsidiary of Teck Resources Limited.

The Agreement terminates

Royal Gold’s royalty equivalent to 75% of the gold produced from the sulfide portion of the Carmen de Andacollo mine until

910,000 payable ounces have been produced, and 50% of the gold produced thereafter. Approximately 248,000 ounces of payable gold

subject to the royalty have been produced through March 31, 2015, resulting in approximately 662,000 payable ounces remaining as

of that date, before the step down to the 50% royalty rate.

Details of the Agreement

| · | CMCA paid total consideration of $345 million to Royal Gold |

| · | The sale will be taxable to Royal Gold with net proceeds estimated at approximately $300 million |

| · | Royal Gold will receive payment for the royalty through June 30, 2015, the economic effective date

of the sale |

| · | In addition to the $345 million termination payment, a post-closing final royalty payment of approximately

$9 million is expected in mid-July to finalize all outstanding shipments for which final settlements had not been received as of

July 1, 2015 |

CORPORATE PROFILE

Royal Gold, Inc. is

a precious metals royalty and stream company engaged in the acquisition and management of precious metal royalties, streams, and

similar production based interests. RGI owns interests on 196 properties on six continents, including interests on 37 producing

mines and 24 development stage projects. Royal Gold, Inc. is publicly traded on the NASDAQ Global Select Market under the

symbol “RGLD,” and on the Toronto Stock Exchange under the symbol “RGL.” RGI’s website is

located at www.royalgold.com.

About Teck

Teck is a diversified

resource company committed to responsible mining and mineral development with major business units focused on copper, steelmaking

coal, zinc and energy. Headquartered in Vancouver, Canada, its shares are listed on the Toronto Stock Exchange under the symbols

TCK.A and TCK.B and the New York Stock Exchange under the symbol TCK.

For further information, please

contact:

Karli Anderson

Vice President Investor Relations

(303) 575-6517

Cautionary “Safe Harbor”

Statement Under the Private Securities Litigation Reform Act of 1995: With the exception of historical matters, the matters

discussed in this press release are forward-looking statements that involve risks and uncertainties that could cause actual results

to differ materially from projections or estimates contained herein. Such forward-looking statements include statements about

the Company’s royalty on Carmen de Andacollo, estimated royalty payments, estimated proceeds from the sale of the royalty

and tax treatment of those proceeds. Factors that could cause actual results to differ materially from the projections include,

among others, precious metals prices; actual tax rates; performance of and production at the properties subject to our royalty

and stream interests; decisions and activities of the operators of these properties; operators’ delays in securing or inability

to secure necessary governmental permits; changes in operators’ project parameters and timelines as plans continue to be

refined; economic and market conditions; unanticipated grade, geological, metallurgical, processing, regulatory and legal or other

problems that the operators of mining properties may encounter; completion of feasibility studies; the ability of the various

operators to bring projects into production as expected; and other subsequent events, as well as other factors described in RGI's

Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, and other filings with the Securities and Exchange Commission.

Most of these factors are beyond RGI’s ability to predict or control. RGI disclaims any obligation to update any forward-looking

statement made herein. Readers are cautioned not to put undue reliance on forward-looking statements.

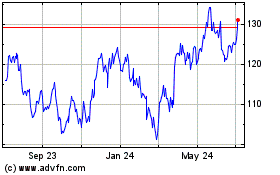

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024