Royal Gold Acquires Gold Streams on Wassa, Bogoso and Prestea from Golden Star Resources

May 07 2015 - 7:15AM

Business Wire

Transaction provides immediate cash flow from

well-established operator

ROYAL GOLD, INC. (NASDAQ: RGLD; TSX: RGL) (“RGI”)

announces that its wholly owned subsidiary RGLD Gold AG (“Royal

Gold” or the “Company”) has entered into a $130

million gold stream transaction with a wholly owned

subsidiary (“Golden Star”) of Golden Star Resources Ltd. that will

finance underground development projects at the Wassa and Prestea

mines in Ghana. Separate from the stream transaction, RGI will

provide a $20 million, four-year term loan to Golden Star, and

Golden Star Resources Ltd. will issue warrants to purchase 5

million shares of its common stock to RGI.

Stream Transaction Details

- Royal Gold will make $130 million

in advance payments to Golden Star in stages, including a $55

million upfront payment, subject to certain conditions, and the

balance on a pro rata basis with spending on the Wassa and Prestea

underground projects, which Royal Gold expects to make in five, $15

million payments quarterly beginning September 1, 2015, and ending

on September 1, 2016;

- Golden Star will deliver to Royal Gold

8.5% of gold produced from Wassa, Bogoso and Prestea until 185,000

ounces have been delivered, 5.0% until an additional 22,500 ounces

have been delivered, and 3.0% thereafter; and

- Royal Gold will pay Golden Star 20% of

the spot price at the time of delivery until 207,500 ounces have

been delivered, and 30% of the spot price thereafter.

Transaction Highlights for Royal Gold

- Gold stream applies to all production

from April 1, 2015;

- Estimated average annual deliveries of

approximately 15,000-20,000 gross gold ounces;

- Investment supporting brownfield

expansion of established deposits with excellent exploration

potential;

- Proven and probable reserves of 1.9

million gold ounces across both deposits, and Measured and

indicated resources of 3.5 million ounces at Wassa and 3.1 million

ounces at Bogoso and Prestea;

- Stable political jurisdiction with

strong history of gold mining in the Ashanti Gold belt; and

- Experienced management team with 15

years of production history in Ghana.

Loan Details

- Subject to certain conditions, RGI will

provide a $20 million, four-year term loan to Golden Star;

- Golden Star will pay interest to RGI

quarterly, at an interest rate calculated at 62.5% of the average

daily gold price for the relevant quarter divided by 10,000 (for

example, 7.5% at US$1200), but not to exceed 11.5%; and

- The loan will be subject to mandatory

prepayments that will range between 25-50% of excess cash flow

after the development period for the projects.

Warrants

- Subject to certain conditions, RGI will

be granted warrants to purchase 5 million shares of Golden Star

Resources Ltd. common stock at a price equal to a 30% premium on

the weighted average share price for the 10 day period ending two

days prior to announcement of the transaction; and

- The warrants will have a four-year

term.

About Wassa, Bogoso and Prestea

The Wassa mine is located 150km west of Accra and has operated

continuously since 2005. Golden Star Resources Ltd. forecasts

calendar 2015 production of 113,000 ounces of gold from the single

Wassa open pit. Open pit proven and probable reserves are 831,000

ounces at 1.39 grams per tonne. Royal Gold’s investment will fund

development of the Wassa underground deposit, which has 746,000

ounces of proven and probable gold reserves at 4.27 grams per

tonne. Golden Star Resources Ltd. estimates $41 million of capital

investment will be needed for the underground development.

Processing will leverage the existing Wassa plant. Golden Star

Resources Ltd. forecasts first underground gold production from

Wassa in the first half of 2016.

Bogoso and Prestea are located 200km west of Accra and have

produced over 9 million ounces from both open pit and underground

sources over the last 100 years. Underground development on the

Prestea underground is already well advanced and Golden Star

Resources Ltd. plans to modify the Bogoso plant to process Prestea

material. Golden Star Resources Ltd. expects to spend $40 million

of capital investment on Prestea, which includes hoist and shaft

upgrades, electrical infrastructure, ventilation and a process

plant upgrade. Once in full production, Golden Star Resources Ltd.

expects annual production of approximately 75,000 ounces from

Prestea, with estimated life of mine production of 620,000 ounces.

Golden Star Resources Ltd. forecasts first underground gold

production from the Prestea underground in the second half of

2016.

About the Purchase and Sale Agreement between Royal Gold and

Golden Star

- Royal Gold will make $130 million in

advance payments to Golden Star in stages, including a $55 million

upfront payment, subject to certain conditions, and the balance on

a pro rata basis with spending on the Wassa and Prestea underground

projects, which Royal Gold expects to make in five, $15 million

payments quarterly beginning September 1, 2015, and ending on

September 1, 2016;

- Until the advance payment is offset

against deliveries of physical gold, Royal Gold will hold a first

priority security interest in all the assets of Golden Star

Resources Ltd.’s two operating companies that own the Wassa and

Prestea mines, as well as charges over the equity of all associated

holding companies;

- Royal Gold will subordinate its

security over assets and charges over equity in support of up to

US$25 million in financing for the projects; and

- Golden Star may offer to repurchase up

to 50% of the tail stream percentage after 207,500 ounces have been

delivered; Royal Gold retains the right to either accept the

repurchase offer or pay the same amount for an increase of up to

50% in the stream percentage.

Tony Jensen and Chris M.T. Thompson, who serve as directors of

both RGI and Golden Star Resources Ltd., and in the case of Mr.

Jensen, President and CEO of RGI, recused themselves from the

transaction process.

CORPORATE PROFILE

Royal Gold, Inc. is a precious metals royalty and stream company

engaged in the acquisition and management of precious metal

royalties, streams, and similar production based interests. The

Company owns interests on 196 properties on six continents,

including interests on 38 producing mines and 23 development stage

projects. Royal Gold, Inc. is publicly traded on the NASDAQ Global

Select Market under the symbol “RGLD,” and on the Toronto Stock

Exchange under the symbol “RGL.” The Company’s website is located

at www.royalgold.com.

About Golden Star Resources

Golden Star Resources Ltd. (NYSE MKT: GSS; TSX: GSC; GSE: GSR)

is an established gold mining company that holds a 90% interest in

the Wassa, Prestea and Bogoso gold mines in Ghana. In 2014, Golden

Star Resources Ltd. produced 261,000 ounces of gold and is expected

to produce 250,000 – 275,000 ounces in 2015. They are pursuing

brownfield development projects at its Wassa and Prestea mines that

are expected to transform these mines into lower cost producers

from 2016 onwards. As such, Golden Star Resources Ltd. offers

investors leveraged exposure to the gold price in a stable African

mining jurisdiction with significant development upside

potential.

Qualified Person

Information on reserves and resources were published in Golden

Star Resources, Ltd.’s press release dated March 26, 2015. The

technical contents of that press release were reviewed and approved

by S. Mitchel Wasel, BSc Geology, a Qualified Person pursuant to NI

43-101. Mr. Wasel is Vice President Exploration for Golden Star

Resources Ltd. and an active member of the Australasian Institute

of Mining and Metallurgy. The 2014 estimates of Mineral Resources

were prepared under the supervision of Mr. Wasel. The 2014

estimates of Mineral Reserves were prepared under the supervision

of Dr. Martin Raffield, Senior Vice President Technical Services

for Golden Star Resources. Dr. Raffield is a "Qualified Person" as

defined by NI 43-101.

Cautionary “Safe Harbor” Statement Under the Private

Securities Litigation Reform Act of 1995: With the exception of

historical matters, the matters discussed in this press release are

forward-looking statements that involve risks and uncertainties

that could cause actual results to differ materially from

projections or estimates contained herein. Such forward-looking

statements include statements about the Company’s stream and RGI’s

loan transactions with Golden Star and Golden Star Resources Ltd.,

and Golden Star Resources Ltd.’s expectations concerning

development, production and mine life at the projects. Factors that

could cause actual results to differ materially from the

projections include, among others, precious metals prices; actual

tax rates; performance of and production at the properties subject

to our royalty and stream interests; decisions and activities of

the operators of these properties; operators’ delays in securing or

inability to secure necessary governmental permits; changes in

operators’ project parameters and timelines as plans continue to be

refined; economic and market conditions; unanticipated grade,

geological, metallurgical, processing, regulatory and legal or

other problems that the operators of mining properties may

encounter; completion of feasibility studies; the ability of the

various operators to bring projects into production as expected;

and other subsequent events, as well as other factors described in

the Company's Annual Report on Form 10-K, Quarterly Reports on Form

10-Q, and other filings with the Securities and Exchange

Commission. Most of these factors are beyond the Company’s ability

to predict or control. The Company disclaims any obligation to

update any forward-looking statement made herein. Readers are

cautioned not to put undue reliance on forward-looking

statements.

Royal Gold, Inc.Karli Anderson, 303-575-6517Vice

President Investor Relations

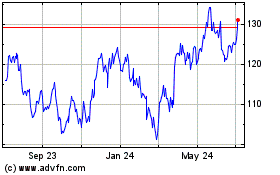

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024