UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January

29, 2015

ROYAL GOLD, INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-13357 |

|

84-0835164 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| 1660 Wynkoop Street, Suite 1000, Denver, CO |

|

80202-1132 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: 303-573-1660

(Former name or

former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 | Results of Operations and Financial Condition. |

On January 29, 2015,

Royal Gold, Inc. (the “Company”) reported its second quarter fiscal 2015 results. Copies of the press release and an

earnings presentation are furnished as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K.

The information furnished

under this Item 2.02, including the exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as

shall be expressly set forth by reference to such filing.

| Item 9.01 | Financial Statements and Exhibits. |

| Exhibit No. |

Description |

| 99.1 |

Press Release dated January 29, 2015 regarding Second Quarter 2015 Results. |

| 99.2 |

Royal Gold, Inc. January 29, 2015, Earnings Presentation. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act

of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Royal Gold, Inc. |

|

| |

|

|

|

| |

|

|

|

| Dated: January 29, 2015 |

By: |

/s/ Bruce C. Kirchhoff |

|

| |

|

Bruce C. Kirchhoff |

|

| |

|

Vice President, General Counsel and Secretary |

|

EXHIBIT INDEX

| Exhibit No. |

Description |

| 99.1 |

Press Release dated January 29, 2015 regarding Second Quarter 2015 Results. |

| 99.2 |

Royal Gold, Inc. January 29, 2015, Earnings Presentation. |

Exhibit 99.1

Royal Gold Reports Second Fiscal Quarter

2015 Results

DENVER, COLORADO. JANUARY 29, 2015:

ROYAL GOLD, INC. (NASDAQ:RGLD; TSX:RGL) (together with its subsidiaries, “Royal Gold” or the “Company”)

reports results for its second quarter of fiscal 2015, ended December 31, 2014 (“second quarter”), including revenue

of $61.3 million, up 16% from the same period a year ago, and Adjusted EBITDA1

of $48.0 million, up 5% from the prior year quarter. Streaming revenue was $17.3 million, while royalty revenue was $44.0 million.

The Company reports a net loss attributable

to Royal Gold stockholders (“net loss”) of $6.5 million, or ($0.10) per basic share for the second quarter, compared

with net income attributable to Royal Gold stockholders of $10.7 million, or $0.16 per share from the same period a year ago. The

decrease in our earnings per share was primarily attributable to a non-cash impairment charge of approximately $26.0 million related

to our Wolverine royalty interest and a non-cash $3.0 million write down of a royalty receivable at Wolverine. Absent the ($0.33)

non-cash items related to Wolverine, net income would have been approximately $0.23 per basic share, after taxes.

The average gold price was $1,201 per ounce

for the second quarter, down 6% from $1,276 per ounce in the year ago quarter.

Tony Jensen, President and CEO, commented,

“Mount Milligan and Cortez posted significantly higher production than in the year ago period, which more than offset lower

metal prices. In calendar 2015, we look forward to continued growth at Mount Milligan where Thompson Creek expects gold production

to increase by 25% to 35%, while 20% to 30% higher gold production is expected at Peñasquito, according to Goldcorp. In

addition, we look forward to the startup of operations at the Phoenix Gold Project, which is projected for mid-year. We are pleased

to have layered in two new pieces of business during the quarter and remain active in evaluating additional business opportunities.”

Adjusted EBITDA for the second quarter

was $48.0 million ($0.74 per basic share), representing 78% of revenue, compared with Adjusted EBITDA of $45.6 million ($0.70 per

basic share), or 86% of revenue, for the year ago quarter. Adjusted EBITDA, as a percentage of revenue, was lower in the second

quarter due to the inclusion of ongoing stream payments to Mount Milligan of $435 per ounce of gold, which are recorded as a cost

of sales and totaled $6.2 million during the second quarter.

| 1 | The Company defines Adjusted EBITDA, a non-GAAP financial

measure, as net income plus depreciation, depletion and amortization, non-cash charges, income tax expense, interest and other

expense, and any impairment of mining assets, less non-controlling interests in operating income of consolidated subsidiaries,

interest and other income, and any royalty portfolio restructuring gains or losses (see Schedule A). |

As of December 31, 2014, the Company had

a working capital surplus of $732.4 million. Current assets were $751.9 million compared to current liabilities of $19.5 million,

for a current ratio of 39 to 1.

During the second quarter, the Company

had an effective tax rate of 22.4%, compared with 36.9% in the prior year quarter. The decrease in the effective tax rate

is primarily attributable to an increase in revenue from lower tax jurisdictions and the impairment charge on the Wolverine royalty

interest. Absent the Wolverine impairment charge, Royal Gold’s effective tax rate would have been approximately 26% for the

quarter.

The Company owns a 0.00% to 9.445% sliding-scale

NSR royalty on all gold and silver produced from the Wolverine underground mine and milling operation located in Yukon Territory,

Canada, and operated by the privately held Yukon Zinc Corporation. Yukon Zinc recently announced a decision to put the mine on

care and maintenance, and the Company has been notified of an updated mine plan at Wolverine that includes a significant reduction

in reserves and resources. For the twelve months ended September 30, 2014, Wolverine contributed approximately 1.4% of Royal Gold’s

total revenues. Following the impairment charge, the Wolverine royalty interest has a carrying value of $5.3 million.

RECENT DEVELOPMENTS

Mount Milligan Gold Stream

Thompson Creek reported that the ramp-up

at Mount Milligan continues to progress as expected, with production of approximately 41,000 ounces of payable gold in the quarter

ended December 31, 2014.

During the second quarter, Royal Gold,

through a wholly owned subsidiary, purchased approximately 13,000 ounces of physical gold, which came from a combination of provisional

and final settlements associated with five shipments of concentrate from Mount Milligan. The Company sold approximately 14,300

ounces of gold during the second quarter at an average price of $1,208 per ounce, and had approximately 4,800 ounces of gold in

inventory as of December 31, 2014.

For the month of December 2014, average

daily mill throughput was 44,734 tonnes per day, which represents approximately 75% of design capacity. Thompson Creek reports

that it plans to utilize contractor services to add secondary crushing capacity during 2015, with plans for a permanent addition

to crushing capacity when market conditions improve. For calendar year 2015, Thompson Creek is forecasting annual payable

gold production of 220,000 to 240,000 ounces, an increase of approximately 25% to 35% over calendar year 2014 production of approximately

178,000 ounces.

Thompson Creek also filed an updated technical

report for the Mount Milligan mine that reflects 6.2 million ounces of estimated proven and probable gold reserves at $1,250/ounce

gold, up from 6.0 million ounces in the previous technical report. The updated mineral reserve estimates include forecasted average

annual gold production of approximately 285,800 ounces in years 2015 through 2019, which is a 9% increase over the previous technical

report annual estimates for the first six years of gold production. Life of mine average annual gold production is estimated to

be 186,700 ounces.

Peñasquito

The Company notes that Goldcorp reported

approximately 567,800 ounces of gold production at Peñasquito for the year ended December 31, 2014. Goldcorp is forecasting

gold production of 700,000 to 750,000 ounces at Peñasquito for the calendar year 2015, which is an increase of approximately

20% to 30% over calendar 2014 gold production. On a gold equivalent basis, Goldcorp forecasts production to total 1.5 million to

1.6 million ounces. Royal Gold has a 2% royalty on all metals at Peñasquito.

Goldcorp reports that Pre-Feasibility Studies

for the Concentrate Enrichment Process (CEP) and Pyrite Leach Process at Peñasquito were essentially complete at the end

of 2014 and are undergoing internal review. Goldcorp highlighted that preliminary economic results continue to demonstrate the

robust economics of these projects and their potential to significantly increase the mine life at Peñasquito. The two

projects are being integrated as they enter the feasibility study phase, which Goldcorp expects to commence by the end of the first

calendar quarter 2015 and be completed in early 2016.

Phoenix Gold Project Stream

On December 18, 2014, Rubicon Minerals

reiterated that the Phoenix Gold Project remains on track for production in mid-2015, with mill construction on schedule and on

budget. Lateral and vertical development was 45% complete at the 685 meter level and above. Results from its 38,000 meter infill

drilling program were released in early January, and confirmed Rubicon Minerals’ expectations of the upper portion of the

F2 Deposit with respect to continuity of mineralization and grade. As of December 31, 2014, Royal Gold had a remaining funding

commitment of $12.8 million as part of its Phoenix Gold Project stream acquisition.

Peak Gold Joint Venture

On January 8, 2015, Royal Gold, through

its wholly owned subsidiary, Royal Alaska, LLC, formed the Peak Gold, LLC joint venture (“JV”) with Contango ORE, Inc.

(“CORE”) to advance exploration and development of the Tetlin project. CORE contributed its Tetlin lease and state

mining claims, and Royal Gold Alaska, LLC made its initial $5 million investment to fund exploration activity, with the option

to earn up to a 40% economic interest in the JV by investing up to $30 million (including the initial $5 million investment) prior

to October 2018, for further exploration and development of the project.

Tulsequah Chief Gold Stream

On December 22, 2014, RGLD Gold AG (“RGLD

Gold”) terminated the Amended and Restated Gold and Silver Purchase and Sale Agreement (the “Agreement”), between

RGLD Gold, the Company, Chieftain Metals Inc. and Chieftain Metals Corp. (together, “Chieftain”), relating to Chieftain’s

Tulsequah Chief polymetallic mining project located in British Columbia, Canada. Pursuant to the terms of the Agreement, Chieftain

repaid RGLD Gold’s original $10.0 million advance payment. The payment was received in January 2015. RGLD Gold holds

a right of first refusal over the creation by Chieftain of any royalty, production payment, stream or similar interest on gold

or silver production from the project for a period of two years from December 22, 2014.

Ilovitza Project Gold Stream

On October 20, 2014, RGLD Gold entered

into a $175.0 million gold stream transaction with Euromax Resources Ltd (“Euromax”) that will finance a definitive

feasibility study, permitting work, early stage engineering and a significant portion of the construction at Euromax’s Ilovitza

gold-copper project. RGLD Gold will make two advance deposit payments to Euromax totaling $15.0 million, which will be used for

completion of the definitive feasibility study and permitting of the project, followed by payments aggregating $160 million towards

project construction, in each case subject to certain conditions. Payment of the first $7.5 million deposit is conditioned upon

Euromax raising an additional $5 million in equity, which was completed in January, 2015, and the satisfaction of certain other

conditions. RGLD Gold’s decision to proceed with the second $7.5 million deposit and the construction payments is conditioned

upon, among other things, progress of the definitive feasibility study and environmental evaluations, demonstrated project viability

and, in the case of the construction payments, sufficient project financing and permits to construct and operate the mine. The

construction payments would be paid pro-rata with the balance of the project funding. In exchange, Euromax will deliver physical

gold equal to 25% of gold produced from the Ilovitza project until 525,000 ounces have been delivered, and 12.5% thereafter (in

each case subject to adjustment). RGLD Gold’s purchase price per ounce will be 25% of the spot price at time of delivery.

PROPERTY HIGHLIGHTS

Highlights at certain of the Company’s

principal producing and development properties during the second quarter, compared with the prior fiscal quarter ended December

31, 2013, are listed below. Production for our producing properties reflects the actual production subject to our interests reported

to us by the various operators through December 31, 2014.

Principal Producing Properties

Andacollo – Gold production

decreased 16% over the prior year quarter primarily due to lower grades mined, consistent with the mine plan. Teck expects that

Andacollo’s grades will return to near-reserve levels over the next few quarters and that current reserves will sustain operations

until 2037; however, processing of the reserves beyond 2033 will require permitting and construction of an expansion to the existing

tailings facility.

Cortez – Gold production at

Cortez increased significantly over the prior year quarter as surface mining activity continued at the Pipeline and Gap pits, where

our royalty applies, while no significant mining activity occurred in these areas during the prior year quarter.

Holt – Gold production at

Holt increased 11% over the prior year quarter. Mill throughput from the Holt ores increased and grades processed decreased during

the current quarter. St Andrew Goldfields reported throughput increased 20% in calendar 2014 compared to calendar 2013 as the operation

has now established Zone 6 at the 77m Level.

Mount Milligan – Gold

production was 41,000 ounces compared to 20,400 ounces for the 2013 period. The increase reflected the continuing ramp-up of the

Mount Milligan mine, which commenced production in late 2013. Average mill throughput during the most recent quarter was 43,781

metric tonnes per day, representing 73% of capacity, although the mill achieved 48,426 metric tonnes per day during the latter

half of December.

Mulatos – Gold production

at Mulatos decreased 14% over the prior year quarter as the mine transitioned between ore bodies, and a slower than anticipated

commissioning of the upgraded mill circuit impacted high grade gold production.

The upgrades to the mill circuit, completed

in early October 2014, are designed to optimize recoveries from the various ore types within San Carlos to ensure the budgeted

recovery of 75% is achievable. While the mill improvements were ongoing in the September 2014 quarter, Alamos stockpiled high grade

development ore from the San Carlos deposit. At the end of the September 2014 quarter, the stockpile reached a total of 25,000

tonnes, with average grades above the current mineral reserve grade. The upgraded mill circuit began processing the high grade

stockpile during the first week of October 2014.

Peñasquito – Gold,

silver and lead production decreased 14%, 18% and 37%, respectively, while reported zinc production increased by 19% over the prior

year quarter. Goldcorp expects relatively low first quarter calendar 2015 production followed by steady production growth over

the course of calendar 2015 as mining continues deeper into higher-grade portions of the Peñasco pit at Peñasquito.

Robinson – Gold and copper

production decreased 41% and 13%, respectively, over the prior year quarter. KGHM completed mining in the Kimbley pit in October

2014, and ore is now being delivered from the Ruth 2 East pit, which KGHM expects can be blended or sent directly to the mill with

improved processing results. In calendar 2015, ore is anticipated to be mined from the Ruth East, Ruth North and Ruth West

pits.

Voisey’s Bay – Nickel

production decreased 31%, while reported copper production increased 14% over the prior year quarter. In July, Long Harbour achieved

a major milestone with the production of the first finished nickel from the facility. Initially, Long Harbour will process primarily

nickel matte from PT Vale Indonesia, and transition to processing solely concentrate from Voisey´s Bay at a later stage.

In anticipation of the transition from

processing Voisey’s Bay nickel concentrates at Vale’s Sudbury and Thompson smelters to processing at the Long Harbour

hydrometallurgical plant, the Company engaged in discussions with Vale concerning calculation of the royalty once Voisey’s

Bay nickel concentrates are processed at Long Harbour. Vale proposed a calculation of the royalty that the Company estimates could

result in the substantial reduction of royalty payable to the Company on Voisey’s Bay nickel concentrates processed at Long

Harbour. While the Company may continue to engage in discussions concerning calculation of the royalty on nickel concentrates processed

at Long Harbour, there is no guaranty that the Company and Vale will reach agreement on the proper calculation under the terms

of the royalty agreement. If no agreement is reached, the Company intends to vigorously pursue all legal remedies to ensure the

appropriate calculation of the royalty and to enforce our royalty interests at Voisey’s Bay.

Second quarter production and revenue

for the Company’s principal royalty and stream interests are shown in Table 1 and historical production data is shown in

Table 2. For more detailed information about each of our principal royalty and stream properties, please refer to the Company’s

most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K filed with the SEC

and available on the SEC’s website located at www.sec.gov, or our website located at www.royalgold.com.

CORPORATE PROFILE

Royal Gold is a precious metals royalty

and stream company engaged in the acquisition and management of precious metal royalties, streams, and similar production based

interests. The Company owns interests on 198 properties on six continents, including interests on 37 producing mines and

24 development stage projects. Royal Gold is publicly traded on the NASDAQ Global Select Market under the symbol “RGLD,”

and on the Toronto Stock Exchange under the symbol “RGL.” The Company’s website is located at www.royalgold.com.

QUALIFIED PERSON

The mineral reserve estimates reported

by Thompson Creek were prepared in accordance with CIM Definition Standards for Mineral Resources and Mineral Reserves, as incorporated

by reference in National Instrument 43-101, by Robert Clifford, Director, Mine Engineering of Thompson Creek, a “qualified

person” under National Instrument 43-101. Thompson Creek reported that Mr. Clifford verified the data disclosed in their

news release dated January 19, 2015 that pertain to the mineral reserve estimates.

For further information, please contact:

Karli Anderson

Vice President Investor Relations

(303) 575-6517

Note: Management’s

conference call reviewing the first quarter results will be held Thursday, January 29, at 10:00 a.m. Mountain Time (noon

Eastern Time) and will be available by calling (866) 270-1533 (North America) or (412) 317-0797 (international),

conference title “Royal Gold.” The call will be simultaneously broadcast on the Company’s website at www.royalgold.com under

the “Presentations” section. A replay of this webcast will be available on the Company’s website

approximately two hours after the call ends.

Cautionary “Safe Harbor”

Statement Under the Private Securities Litigation Reform Act of 1995: With the exception of historical matters, the matters

discussed in this press release are forward-looking statements that involve risks and uncertainties that could cause actual results

to differ materially from projections or estimates contained herein. Such forward-looking statements include statements about the

Company’s ability to invest in additional quality properties; and the operators’ expectation of construction, ramp

up, production, mine life, resolution of regulatory and legal proceedings (including with Vale regarding Voisey’s Bay) and

other developments at various mines. Factors that could cause actual results to differ materially from the projections include,

among others, precious metals, copper and nickel prices; performance of and production at the Company's royalty properties; the

ability of the various operators to bring projects into production as expected; delays in the operators securing or their inability

to secure necessary governmental permits; decisions and activities of the operators of the Company's royalty properties; unanticipated

grade, geological, metallurgical, processing, liquidity or other problems the operators of the mining properties may encounter;

completion of feasibility studies; changes in operators’ project parameters as plans continue to be refined; changes in estimates

of reserves and mineralization by the operators of the Company’s royalty properties; contests to the Company’s royalty

interests and title and other defects to the Company’s royalty properties; errors or disputes in calculating royalty payments,

or payments not made in accordance with royalty agreements; economic and market conditions; risks associated with conducting business

in foreign countries; changes in laws governing the Company and its royalty properties or the operators of such properties; and

other subsequent events; as well as other factors described in the Company's Annual Report on Form 10-K, Quarterly Reports on Form

10-Q, and other filings with the Securities and Exchange Commission. Most of these factors are beyond the Company’s ability

to predict or control. The Company disclaims any obligation to update any forward-looking statement made herein. Readers are cautioned

not to put undue reliance on forward-looking statements.

TABLE 1

Second Quarter Fiscal 2015

Revenue and Reported Production for Principal

Royalty and Stream Interests

Three Months Ended December 31, 2014

and December 31, 2013

(In thousands, except reported production

in oz. and lbs.)

| | |

| |

Three Months Ended

December 31, 2014 |

| | |

Three Months Ended

December 31, 2013 |

| |

|

| Royalty/Stream | |

Metal(s) | |

Revenue | | |

Reported

Production1 |

| | |

Revenue | | |

Reported

Production1 |

| |

|

| Stream: | |

| |

| | | |

| |

| | |

| | | |

| |

| |

|

| Mount

Milligan | |

Gold | |

$ | 17,318 | | |

| 14,300 |

| oz. | |

$ | 2,638 | | |

| 2,100

|

| oz. |

|

| Royalty: | |

| |

| | | |

| |

| | |

| | | |

| |

| |

|

| Andacollo | |

Gold | |

$ | 9,594 | | |

| 10,500 |

| oz. | |

$ | 11,736 | | |

| 12,500

|

| oz. |

|

| Peñasquito | |

| |

$ | 5,573 | | |

| |

| | |

$ | 7,003 | | |

| |

| |

|

| | |

Gold | |

| | | |

| 125,000 |

| oz. | |

| | | |

| 145,800

|

| oz. |

|

| | |

Silver | |

| | | |

| 5.1 |

| Moz. | |

| | | |

| 6.2

|

| Moz. |

|

| | |

Lead | |

| | | |

| 29.5 |

| Mlbs. | |

| | | |

| 47.1

|

| Mlbs. |

|

| | |

Zinc | |

| | | |

| 84.0 |

| Mlbs. | |

| | | |

| 70.3

|

| Mlbs. |

|

| Voisey's Bay | |

| |

$ | 6,117 | | |

| |

| | |

$ | 5,900 | | |

| |

| |

|

| | |

Nickel | |

| | | |

| 19.6 |

| Mlbs. | |

| | | |

| 28.5

|

| Mlbs. |

|

| | |

Copper | |

| | | |

| 30.1 |

| Mlbs. | |

| | | |

| 26.4

|

| Mlbs. |

|

| Cortez | |

Gold | |

$ | 5,001 | | |

| 60,400 |

| oz. | |

$ | 1,078 | | |

| 8,300

|

| oz. |

|

| Holt | |

Gold | |

$ | 2,676 | | |

| 14,300 |

| oz. | |

$ | 2,717 | | |

| 12,900

|

| oz. |

|

| Robinson | |

| |

$ | 1,464 | | |

| |

| | |

$ | 2,287 | | |

| |

| |

|

| | |

Gold | |

| | | |

| 5,100 |

| oz. | |

| | | |

| 8,700

|

| oz. |

|

| | |

Copper | |

| | | |

| 19.3 |

| Mlbs. | |

| | | |

| 22.1

|

| Mlbs. |

|

| Mulatos | |

Gold | |

$ | 2,001 | | |

| 34,500 |

| oz. | |

$ | 2,477 | | |

| 40,200

|

| oz. |

|

| Other | |

Various | |

$ | 11,560 | | |

| N/A |

| | |

$ | 16,949 | | |

| N/A |

| |

|

| Total Revenue | |

| |

$ | 61,304 | | |

| |

| | |

$ | 52,785 | | |

| |

| |

|

TABLE 2

Second Quarter Fiscal 2015

Revenue and Reported Production for Principal

Royalty and Stream Interests

Six Months Ended December 31, 2014 and

December 31, 2013

(In thousands, except reported production

in oz. and lbs.)

| |

|

|

|

Six Months Ended

December 31, 2014 |

|

|

|

Six Months Ended

December 31, 2013 |

|

|

|

| Royalty/Stream |

|

Metal(s) |

|

Revenue |

|

|

Reported

Production1 |

|

|

|

Revenue |

|

|

Reported

Production1 |

|

|

|

| Stream: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mount Milligan |

|

Gold |

|

$ |

36,975 |

|

|

29,700 |

|

oz. |

|

$ |

2,638 |

|

|

2,100 |

|

oz. |

|

| Royalty: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Andacollo |

|

Gold |

|

$ |

20,093 |

|

|

21,500 |

|

oz. |

|

$ |

28,892 |

|

|

29,900 |

|

oz. |

|

| Peñasquito |

|

|

|

$ |

12,684 |

|

|

|

|

|

|

$ |

13,561 |

|

|

|

|

|

|

| |

|

Gold |

|

|

|

|

|

268,100 |

|

oz. |

|

|

|

|

|

247,300 |

|

oz. |

|

| |

|

Silver |

|

|

|

|

|

11.6 |

|

Moz. |

|

|

|

|

|

12.7 |

|

Moz. |

|

| |

|

Lead |

|

|

|

|

|

70.8 |

|

Mlbs. |

|

|

|

|

|

86.9 |

|

Mlbs. |

|

| |

|

Zinc |

|

|

|

|

|

169.4 |

|

Mlbs. |

|

|

|

|

|

143.8 |

|

Mlbs. |

|

| Voisey's Bay |

|

|

|

$ |

11,726 |

|

|

|

|

|

|

$ |

12,934 |

|

|

|

|

|

|

| |

|

Nickel |

|

|

|

|

|

36.7 |

|

Mlbs. |

|

|

|

|

|

56.9 |

|

Mlbs. |

|

| |

|

Copper |

|

|

|

|

|

52.1 |

|

Mlbs. |

|

|

|

|

|

61.2 |

|

Mlbs. |

|

| Cortez |

|

Gold |

|

$ |

9,736 |

|

|

119,900 |

|

oz. |

|

$ |

1,519 |

|

|

14,000 |

|

oz. |

|

| Holt |

|

Gold |

|

$ |

5,835 |

|

|

29,100 |

|

oz. |

|

$ |

6,604 |

|

|

29,900 |

|

oz. |

|

| Robinson |

|

|

|

$ |

3,734 |

|

|

|

|

|

|

$ |

3,886 |

|

|

|

|

|

|

| |

|

Gold |

|

|

|

|

|

11,700 |

|

oz. |

|

|

|

|

|

17,900 |

|

oz. |

|

| |

|

Copper |

|

|

|

|

|

45.4 |

|

Mlbs. |

|

|

|

|

|

39.8 |

|

Mlbs. |

|

| Mulatos |

|

Gold |

|

$ |

3,763 |

|

|

62,800 |

|

oz. |

|

$ |

5,178 |

|

|

81,800 |

|

oz. |

|

| Other |

|

Various |

|

$ |

25,784 |

|

|

N/A |

|

|

|

$ |

34,060 |

|

|

N/A |

|

|

|

| Total Revenue |

|

|

|

$ |

130,330 |

|

|

|

|

|

|

$ |

109,272 |

|

|

|

|

|

|

TABLE 3

Historical Production

| | |

| |

| |

| |

Reported Production For The Quarter Ended1 | |

|

| Property | |

Royalty/Stream | |

Operator | |

Metal(s) | |

Dec. 31, 2014 | | |

Sep. 30, 2014 | | |

Jun. 30, 2014 | | |

Mar. 31, 2014 | | |

Dec. 31, 2013 | |

|

| Andacollo2 | |

75% | |

Teck | |

Gold | |

| 10,500 | | |

oz. | |

| 11,000 | | |

oz. | |

| 10,000 | | |

oz. | |

| 10,400 | | |

oz. | |

| 12,500 | | |

oz. |

|

| Cortez3 | |

GSR1 and GSR2, GSR3, NVR1 | |

Barrick | |

Gold | |

| 60,400 | | |

oz. | |

| 59,500 | | |

oz. | |

| 40,300 | | |

oz. | |

| 41,100 | | |

oz. | |

| 8,300 | | |

oz. |

|

| Holt | |

0.00013 x quarterly average gold price | |

St Andrew Goldfields | |

Gold | |

| 14,300 | | |

oz. | |

| 14,800 | | |

oz. | |

| 15,600 | | |

oz. | |

| 17,600 | | |

oz. | |

| 12,900 | | |

oz. |

|

| Mount Milligan4 | |

Gold stream - 52.25% of payable gold | |

Thompson Creek | |

Gold | |

| 14,300 | | |

oz. | |

| 15,300 | | |

oz. | |

| 14,400 | | |

oz. | |

| 4,500 | | |

oz. | |

| 2,100 | | |

oz. |

|

| Mulatos5 | |

1.0% - 5.0% NSR | |

Alamos | |

Gold | |

| 34,500 | | |

oz. | |

| 28,400 | | |

oz. | |

| 33,600 | | |

oz. | |

| 34,400 | | |

oz. | |

| 40,200 | | |

oz. |

|

| Peñasquito | |

2.0% NSR | |

Goldcorp | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

|

|

| | |

| |

| |

Gold | |

| 125,000 | | |

oz. | |

| 143,100 | | |

oz. | |

| 168,100 | | |

oz. | |

| 118,700 | | |

oz. | |

| 145,800 | | |

oz. |

|

| | |

| |

| |

Silver | |

| 5.1 | | |

Moz. | |

| 6.5 | | |

Moz. | |

| 7.8 | | |

Moz. | |

| 7.1 | | |

Moz. | |

| 6.2 | | |

Moz. |

|

| | |

| |

| |

Lead | |

| 29.5 | | |

Mlbs. | |

| 41.3 | | |

Mlbs. | |

| 43.2 | | |

Mlbs. | |

| 45.3 | | |

Mlbs. | |

| 47.1 | | |

Mlbs. |

|

| | |

| |

| |

Zinc | |

| 84.0 | | |

Mlbs. | |

| 85.4 | | |

Mlbs. | |

| 77.0 | | |

Mlbs. | |

| 90.1 | | |

Mlbs. | |

| 70.3 | | |

Mlbs. |

|

| Robinson | |

3.0% NSR | |

KGHM | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

|

|

| | |

| |

| |

Gold | |

| 5,100 | | |

oz. | |

| 6,600 | | |

oz. | |

| 5,800 | | |

oz. | |

| 3,900 | | |

oz. | |

| 8,700 | | |

oz. |

|

| | |

| |

| |

Copper | |

| 19.3 | | |

Mlbs. | |

| 26.1 | | |

Mlbs. | |

| 19.1 | | |

Mlbs. | |

| 10.7 | | |

Mlbs. | |

| 22.1 | | |

Mlbs. |

|

| Voisey's Bay | |

2.7% NSR | |

Vale | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

| |

| | | |

|

|

| | |

| |

| |

Nickel | |

| 19.6 | | |

Mlbs. | |

| 17.1 | | |

Mlbs. | |

| 26.9 | | |

Mlbs. | |

| 39.9 | | |

Mlbs. | |

| 28.5 | | |

Mlbs. |

|

| | |

| |

| |

Copper | |

| 30.1 | | |

Mlbs. | |

| 22.0 | | |

Mlbs. | |

| 9.7 | | |

Mlbs. | |

| 9.7 | | |

Mlbs. | |

| 26.4 | | |

Mlbs. |

|

| 1 | Reported production relates to the amount of metal sales that are subject to our royalty and stream

interests for the stated period, as reported to us by operators of the mines. |

| 2 | The royalty rate is 75% until 910,000 payable ounces of gold have been produced – 50% thereafter.

There have been approximately 239,000 cumulative payable ounces produced as of December 31, 2014. Gold is produced as a by-product

of copper. |

| 3 | Royalty percentages: GSR1 and GSR2 – 0.40 to 5.0% (sliding-scale): GSR3 – 0.71%; NVR1

– 1.0140% excluding Crossroads and 0.6186% for Crossroads. |

| 4 | For our streaming interest at Mount Milligan, our revenue is a product of the reported production,

our 52.25% stream interest, an applicable provisional percentage (for the first 12 shipments only) and an average gold sale price

for the period. |

| 5 | The Company’s royalty is subject to a 2.0 million ounce cap on gold production. There have

been approximately 1.33 million ounces of cumulative production as of December 31, 2014. NSR sliding-scale schedule (price of gold

per ounce – royalty rate): $0.00 to $299.99 – 1.0%; $300 to $324.99 – 1.50%; $325 to $349.99 – 2.0%; $350

to $374.99 – 3.0%; $375 to $399.99 – 4.0%; $400 or higher – 5.0%. |

ROYAL GOLD, INC.

Consolidated Balance Sheets

(Unaudited, in thousands except share data)

| | |

December 31, | | |

June 30, | |

| | |

2014 | | |

2014 | |

| ASSETS | |

| | | |

| | |

| Cash and equivalents | |

$ | 675,128 | | |

$ | 659,536 | |

| Royalty receivables | |

| 37,314 | | |

| 46,654 | |

| Income tax receivable | |

| 23,800 | | |

| 21,947 | |

| Prepaid expenses and other | |

| 15,626 | | |

| 7,840 | |

| Total current assets | |

| 751,868 | | |

| 735,977 | |

| | |

| | | |

| | |

| Royalty and stream interests, net | |

| 2,067,152 | | |

| 2,109,067 | |

| Available-for-sale securities | |

| 7,788 | | |

| 9,608 | |

| Other assets | |

| 35,780 | | |

| 36,892 | |

| Total assets | |

$ | 2,862,588 | | |

$ | 2,891,544 | |

| | |

| | | |

| | |

| LIABILITIES | |

| | | |

| | |

| Accounts payable | |

| 2,742 | | |

| 3,897 | |

| Dividends payable | |

| 14,342 | | |

| 13,678 | |

| Foreign withholding taxes payable | |

| 200 | | |

| 2,199 | |

| Other current liabilities | |

| 2,182 | | |

| 2,730 | |

| Total current liabilities | |

| 19,466 | | |

| 22,504 | |

| | |

| | | |

| | |

| Debt | |

| 316,874 | | |

| 311,860 | |

| Deferred tax liabilities | |

| 152,762 | | |

| 169,865 | |

| Uncertain tax positions | |

| 14,752 | | |

| 13,725 | |

| Other long-term liabilities | |

| 700 | | |

| 1,033 | |

| Total liabilities | |

| 504,554 | | |

| 518,987 | |

| | |

| | | |

| | |

| Commitments and contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| EQUITY | |

| | | |

| | |

| Preferred stock, $.01 par value, authorized 10,000,000 shares authorized; and 0 shares issued | |

| - | | |

| - | |

| Common stock, $.01 par value, 100,000,000 shares authorized; and 64,653,967 and 64,578,401 shares outstanding, respectively | |

| 647 | | |

| 646 | |

| Exchangeable shares, no par value, 1,806,649 shares issued, less 1,427,069 and 1,426,792 redeemed shares, respectively | |

| 16,705 | | |

| 16,718 | |

| Additional paid-in capital | |

| 2,151,335 | | |

| 2,147,650 | |

| Accumulated other comprehensive loss | |

| (1,980 | ) | |

| (160 | ) |

| Accumulated earnings | |

| 173,972 | | |

| 189,871 | |

| Total Royal Gold stockholders’ equity | |

| 2,340,679 | | |

| 2,354,725 | |

| Non-controlling interests | |

| 17,355 | | |

| 17,832 | |

| Total equity | |

| 2,358,034 | | |

| 2,372,557 | |

| Total liabilities and equity | |

$ | 2,862,588 | | |

$ | 2,891,544 | |

ROYAL GOLD, INC.

Consolidated Statements of Operations and

Comprehensive Income

(Unaudited, in thousands)

| | |

For The Three Months Ended | | |

For The Six Months Ended | |

| | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Revenue | |

$ | 61,304 | | |

$ | 52,785 | | |

$ | 130,330 | | |

$ | 109,272 | |

| | |

| | | |

| | | |

| | | |

| | |

| Costs and expenses | |

| | | |

| | | |

| | | |

| | |

| Cost of sales | |

| 6,236 | | |

| 935 | | |

| 12,910 | | |

| 935 | |

| General and administrative | |

| 8,511 | | |

| 4,661 | | |

| 15,652 | | |

| 11,227 | |

| Production taxes | |

| 1,731 | | |

| 1,603 | | |

| 3,421 | | |

| 3,386 | |

| Depreciation, depletion and amortization | |

| 20,278 | | |

| 22,670 | | |

| 42,490 | | |

| 45,071 | |

| Impairment of royalty and stream interests | |

| 26,570 | | |

| - | | |

| 28,339 | | |

| - | |

| Total costs and expenses | |

| 63,326 | | |

| 29,869 | | |

| 102,812 | | |

| 60,619 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| (2,022 | ) | |

| 22,916 | | |

| 27,518 | | |

| 48,653 | |

| | |

| | | |

| | | |

| | | |

| | |

| Interest and other income | |

| 228 | | |

| 168 | | |

| 279 | | |

| 216 | |

| Interest and other expense | |

| (6,358 | ) | |

| (5,995 | ) | |

| (13,070 | ) | |

| (11,658 | ) |

| (Loss) income before income taxes | |

| (8,152 | ) | |

| 17,089 | | |

| 14,727 | | |

| 37,211 | |

| | |

| | | |

| | | |

| | | |

| | |

| Income tax benefit (expense) | |

| 1,827 | | |

| (6,311 | ) | |

| (2,131 | ) | |

| (11,152 | ) |

| Net (loss) income | |

| (6,325 | ) | |

| 10,778 | | |

| 12,596 | | |

| 26,059 | |

| Net income attributable to non-controlling interests | |

| (223 | ) | |

| (111 | ) | |

| (462 | ) | |

| (197 | ) |

| Net (loss) income attributable to Royal Gold common stockholders | |

$ | (6,548 | ) | |

$ | 10,667 | | |

$ | 12,134 | | |

$ | 25,862 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

$ | (6,325 | ) | |

$ | 10,778 | | |

$ | 12,596 | | |

$ | 26,059 | |

| Adjustments to comprehensive (loss) income, net of tax Unrealized change in market value of available-for-sale securities | |

| (481 | ) | |

| (3,419 | ) | |

| (1,820 | ) | |

| (2,288 | ) |

| Comprehensive (loss) income | |

| (6,806 | ) | |

| 7,359 | | |

| 10,776 | | |

| 23,771 | |

| Comprehensive income attributable to non-controlling interests | |

| (223 | ) | |

| (111 | ) | |

| (462 | ) | |

| (197 | ) |

| Comprehensive (loss) income attributable to Royal Gold stockholders | |

$ | (7,029 | ) | |

$ | 7,248 | | |

$ | 10,314 | | |

$ | 23,574 | |

| | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income per share available to Royal Gold common stockholders: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic (loss) earnings per share | |

$ | (0.10 | ) | |

$ | 0.16 | | |

$ | 0.19 | | |

$ | 0.40 | |

| Basic weighted average shares outstanding | |

| 65,002,307 | | |

| 64,897,757 | | |

| 64,982,595 | | |

| 64,878,056 | |

| Diluted (loss) earnings per share | |

$ | (0.10 | ) | |

$ | 0.16 | | |

$ | 0.19 | | |

$ | 0.40 | |

| Diluted weighted average shares outstanding | |

| 65,002,307 | | |

| 64,990,771 | | |

| 65,122,185 | | |

| 64,982,689 | |

| Cash dividends declared per common share | |

$ | 0.22 | | |

$ | 0.21 | | |

$ | 0.43 | | |

$ | 0.41 | |

ROYAL GOLD, INC.

Consolidated Statements of Cash Flows

(Unaudited, in thousands)

| | |

For The Three Months Ended | | |

For The Six Months Ended | |

| | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| Cash flows from operating activities: | |

| | | |

| | | |

| | | |

| | |

| Net (loss) income | |

$ | (6,325 | ) | |

$ | 10,778 | | |

$ | 12,596 | | |

$ | 26,059 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | |

| | | |

| | | |

| | | |

| | |

| Depreciation, depletion and amortization | |

| 20,278 | | |

| 22,670 | | |

| 42,490 | | |

| 45,071 | |

| Non-cash employee stock compensation expense | |

| 375 | | |

| 147 | | |

| 2,824 | | |

| 1,759 | |

| Amortization of debt discount | |

| 2,540 | | |

| 2,380 | | |

| 5,013 | | |

| 4,720 | |

| Impairment of royalty and stream interests | |

| 26,570 | | |

| - | | |

| 28,339 | | |

| - | |

| Tax benefit of stock-based compensation exercises | |

| (377 | ) | |

| (236 | ) | |

| (74 | ) | |

| (208 | ) |

| Deferred tax benefit | |

| (11,729 | ) | |

| (5,181 | ) | |

| (17,103 | ) | |

| (8,038 | ) |

| Changes in assets and liabilities: | |

| | | |

| | | |

| | | |

| | |

| Royalty receivables | |

| 5,913 | | |

| 5,137 | | |

| 9,340 | | |

| 7,330 | |

| Prepaid expenses and other assets | |

| 1,197 | | |

| 2,704 | | |

| 3,344 | | |

| 13,001 | |

| Accounts payable | |

| 388 | | |

| (86 | ) | |

| (1,182 | ) | |

| (811 | ) |

| Foreign withholding taxes payable | |

| (679 | ) | |

| (1,852 | ) | |

| (1,999 | ) | |

| (10,108 | ) |

| Income taxes receivable | |

| (7,151 | ) | |

| 1,384 | | |

| (1,778 | ) | |

| (7,626 | ) |

| Other liabilities | |

| (1,184 | ) | |

| (3,126 | ) | |

| 464 | | |

| (943 | ) |

| Net cash provided by operating activities | |

$ | 29,816 | | |

$ | 34,719 | | |

$ | 82,274 | | |

$ | 70,206 | |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | | |

| | | |

| | |

| Acquisition of royalty and stream interests | |

| (32,525 | ) | |

| (61 | ) | |

| (38,734 | ) | |

| (48,089 | ) |

| Other | |

| (390 | ) | |

| (30 | ) | |

| (517 | ) | |

| (54 | ) |

| Net cash used in investing activities | |

$ | (32,915 | ) | |

$ | (91 | ) | |

$ | (39,251 | ) | |

$ | (48,143 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | | |

| | | |

| | |

| Net proceeds from issuance of common stock | |

| 576 | | |

| 94 | | |

| 775 | | |

| 94 | |

| Common stock dividends | |

| (13,691 | ) | |

| (13,022 | ) | |

| (27,369 | ) | |

| (26,032 | ) |

| Distribution to non-controlling interests | |

| (446 | ) | |

| (546 | ) | |

| (911 | ) | |

| (1,079 | ) |

| Tax expense of stock-based compensation exercises | |

| 377 | | |

| 236 | | |

| 74 | | |

| 208 | |

| Net cash used in financing activities | |

$ | (13,184 | ) | |

$ | (13,238 | ) | |

$ | (27,431 | ) | |

$ | (26,809 | ) |

| Net (decrease) increase in cash and equivalents | |

| (16,283 | ) | |

| 21,390 | | |

| 15,592 | | |

| (4,746 | ) |

| Cash and equivalents at beginning of period | |

| 691,411 | | |

| 637,899 | | |

| 659,536 | | |

| 664,035 | |

| Cash and equivalents at end of period | |

$ | 675,128 | | |

$ | 659,289 | | |

$ | 675,128 | | |

$ | 659,289 | |

SCHEDULE A

Non-GAAP Financial Measures

The Company computes and discloses Adjusted

EBITDA. Adjusted EBITDA is a non-GAAP financial measure. Adjusted EBITDA is defined by the Company as net income plus depreciation,

depletion and amortization, non-cash charges, income tax expense, interest and other expense, and any impairment of mining assets,

less non-controlling interests in operating income of consolidated subsidiaries, interest and other income, and any royalty portfolio

restructuring gains or losses. Other companies may define and calculate this measure differently. Management believes that Adjusted

EBITDA is a useful measure of the performance of our royalty and stream portfolio. Adjusted EBITDA identifies the cash generated

in a given period that will be available to fund the Company's future operations, growth opportunities, shareholder dividends and

to service the Company's debt obligations. This information differs from measures of performance determined in accordance with

U.S. generally accepted accounting principles (“GAAP”) and should not be considered in isolation or as a substitute

for measures of performance determined in accordance with U.S. GAAP. Below is a reconciliation of net income to Adjusted EBITDA.

Royal Gold, Inc.

Adjusted EBITDA Reconciliation

| | |

For The Three Months Ended | | |

For The Six Months Ended | |

| | |

December 31, | | |

December 31, | |

| | |

(Unaudited, in thousands) | | |

(Unaudited, in thousands) | |

| | |

2014 | | |

2013 | | |

2014 | | |

2013 | |

| | |

| | |

| | |

| | |

| |

| Net (loss) income | |

$ | (6,325 | ) | |

$ | 10,778 | | |

$ | 12,596 | | |

$ | 26,059 | |

| Depreciation, depletion and amortization | |

| 20,278 | | |

| 22,670 | | |

| 42,490 | | |

| 45,071 | |

| Non-cash employee stock compensation | |

| 375 | | |

| 147 | | |

| 2,824 | | |

| 1,759 | |

| Allowance for uncollectible royalty receivables | |

| 2,997 | | |

| - | | |

| 2,997 | | |

| | |

| Impairment of royalty and stream interests | |

| 26,570 | | |

| - | | |

| 28,339 | | |

| - | |

| Interest and other income | |

| (228 | ) | |

| (168 | ) | |

| (279 | ) | |

| (216 | ) |

| Interest and other expense | |

| 6,358 | | |

| 5,995 | | |

| 13,070 | | |

| 11,658 | |

| Income tax (benefit) expense | |

| (1,827 | ) | |

| 6,311 | | |

| 2,131 | | |

| 11,152 | |

| Non-controlling interests in operating income of consolidated subsidiaries | |

| (223 | ) | |

| (111 | ) | |

| (462 | ) | |

| (197 | ) |

| Adjusted EBITDA | |

$ | 47,975 | | |

$ | 45,622 | | |

$ | 103,706 | | |

$ | 95,286 | |

Second Quarter 2015 Results January 29, 2015 SOLID PORTFOLIO. SOLID FUTURE. Exhibit 99.2

2 Cautionary Statement This presentation contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 . Such forward - looking statements involve known and unknown risks, uncertainties, and other factors that could cause actual results to differ materially from the projections and estimates contained herein and include, but are not limited to : the production estimates from the operators of the Company’s properties ; the ramp - up of the Mount Milligan mine ; construction progress at the Phoenix Gold project ; anticipated growth in the volume of metals subject to the Company’s royalty interests ; and statements or estimates regarding projected steady, increasing or decreasing production ; and estimates of timing of commencement of production from operators of properties where we have royalty interests, including operator estimates . Factors that could cause actual results to differ materially from these forward-looking statements include, among others : the risks inherent in construction, development and operation of mining properties, including those specific to a new mine being developed and operated by a base metals company ; changes in gold, silver, copper, nickel and other metals prices ; performance of and production at the Company’s royalty properties ; decisions and activities of the Company’s management ; unexpected operating costs ; decisions and activities of the operators of the Company’s royalty and stream properties ; changes in operators’ mining and processing techniques or royalty calculation methodologies ; resolution of regulatory and legal proceedings (including with Vale regarding Voisey’s Bay) ; unanticipated grade, geological, metallurgical, environmental, processing or other problems at the properties ; inaccuracies in technical reports and reserve estimates ; revisions by operators of reserves, mineralization or production estimates ; changes in project parameters as plans of the operators are refined ; the results of current or planned exploration activities ; discontinuance of exploration activities by operators ; economic and market conditions ; operations on lands subject to First Nations or Native American jurisdiction in Canada and the United States ; the ability of operators to bring non-producing and not yet in development projects into production and operate in accordance with feasibility studies ; challenges to the Company’s royalty interests, or title and other defects in the Company’s royalty properties ; errors or disputes in calculating royalty payments, or payments not made in accordance with royalty agreements ; future financial needs of the Company ; the impact of future acquisitions and royalty and streaming financing transactions ; adverse changes in applicable laws and regulations ; litigation ; and risks associated with conducting business in foreign countries, including application of foreign laws to contract and other disputes, environmental laws, enforcement and uncertain political and economic environments . These risks and other factors are discussed in more detail in the Company’s public filings with the Securities and Exchange Commission . Statements made herein are as of the date hereof and should not be relied upon as of any subsequent date . The Company’s past performance is not necessarily indicative of its future performance . The Company disclaims any obligation to update any forward-looking statements . Endnotes located on page 13 . January 29, 2015

Today’s Speakers January 29, 2015 3 Tony Jensen President and CEO Bill Heissenbuttel VP Corporate Development & Operations Stefan Wenger CFO and Treasurer

Financial Results compared to prior year quarter: Revenue of $61.3 million, up 16% » Streaming revenue of $17.3 million » Royalty revenue of $44.0 million Adjusted EBITDA 1 of $48.0 million, up 5% $ 13.7 million in dividends paid, up 5% Operating Results: Gold Equivalent Ounces (GEO’s) up 23% on a gross basis (net GEO’s up 13%) Strong performance at Mount Milligan and Cortez Key Developments since January 1: Mount Milligan’s first five years ’ annual gold production estimates up 9% to 285koz per year Peak Gold Joint Venture formed Second Quarter 2015 Highlights 4 January 29, 2015

Calendar year 2014 production of 178 koz of payable gold Daily mill throughput averaging 48 . 5 k tonnes per day ( 80 % ) in late December Strong 2015 expected unit cash costs of $ 0 . 60 - $ 0 . 85 / lb copper, by - product basis Calendar year 2015 guidance of 220 koz to 240 koz payable gold production 5 Growth January 29, 2015 0 50 100 150 200 250 CQ4 '13 CQ1 '14 CQ2 '14 CQ3 '14 CQ4 '14 Mt. Milligan reported payable production Production subject to RGLD stream (payable production *.5225) RGLD gold received to date Cumulative Gold Ounces (000’s) Mount Milligan Ramp - Up Gold in the system ~50k

6 Growth As of mid - December 2014: » Over half of the project has been completed » Stockpiling of mineralized material from underground stopes underway » 45% of lateral and vertical development complete » C$299 million of total capital spent with ~C$85 million remaining » Projected mid - 2015 start - up targeted Rubicon Minerals’ photo of Phoenix Project, Summer 2014 January 29, 2015 Rubicon Minerals’ photo of SAG and Ball mill, December 2014 Phoenix Project Construction

Gold Equivalent Ounce Waterfall 7 Gold Equivalent Ounces (GEO’s) January 29, 2015 Includes Mount Milligan GEO’s net of our stream payment 25,000 30,000 35,000 40,000 45,000 50,000 Net GEO’s Q1FY15 vs Q2 FY15 25,000 30,000 35,000 40,000 45,000 50,000 Net GEO’s Q2FY14 vs Q2FY15 Gold Equivalent Ounces (GEO’s)

8 Financial Overview January 29, 2015 Financial Results compared to prior year quarter: Revenue of $61.3 million, up 16% DD&A rate of $397/ oz for the quarter, down 28% Effective tax rate of 22% EPS of ($0.10) per share » Non - cash charges related to Wolverine royalty of ($0.33) per share » Absent this adjustment, EPS would have been $0.23 per share and tax rate would have been 26%

Capital to invest… Over $950 million uncommitted at a time when royalty/stream financing is needed • Includes current commitments outstanding for Goldrush ($ 6 M), Phoenix Gold ($12.8M), Ilovitza ($7.5M) and Peak Gold ($5M) • Conditional commitments for Ilovitza ($ 167.5M) and Peak Gold ($25M) are in the dotted lines $US millions $450M Undrawn Credit $ 1,185.0 Working capital & undrawn credit at 12 - 31 - 14 - $7.5 Ilovitza initial payment - $6.0 Goldrush - $12.8 Phoenix Gold remaining payments - $5.0 Peak Gold J oint Venture payment $ 1,154.0 Estimated liquidity balance before conditional commitments - $ 167.5 Ilovitza 2nd payment and construction payments - $ 25.0 Peak Gold Joint Venture payment $961.2 Estimated l iquidity b alance inclusive of conditional commitments Net of future commitments ($m) Current commitments Conditional commitments $0 $500 $1,000 $1,500 Liquidity at 12/31/2014 Debt and Commitments LTM Operating Cash Flow $ 160M $370M converts due 2019 * $ 734M Working Capita l Opportunity January 29, 2015 $450M Revolver 9

$0 $100 $200 $300 $400 $500 $600 $700 $800 $900 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Net Book Value in Millions Quality Portfolio Gross Margin, 9 months ended Sept 30, 2014 1 Average gross margin of 55% Gross Margin and Carrying Value Amongst Operating Properties 10 January 29, 2015

11 What Makes Royal Gold Unique January 29, 2015 Growth Quality Opportunity

Endnotes SOLID PORTFOLIO. SOLID FUTURE.

Many of the matters in these endnotes and the accompanying slides constitute forward looking statements and are subject to numerous risks, which could cause actual results to differ . See complete Cautionary Statement on page 2 . Endnotes PAGE 4 SECOND QUARTER RESULTS 1 . The Company defines Adjusted EBITDA, a non - GAAP financial measure, as net income plus depreciation, depletion and amortization, non - cash charges, income tax expense, interest and other expense, and any impairment of mining assets, less non - controlling interests in operating income of consolidated subsidiaries, interest and other income, and any royalty portfolio restructuring gains or losses (see Schedule A) . PAGE 10 QUALITY PORTFOLIO 1. Gross margin calculated by subtracting the operators’ reported operating cost per unit of production from the relevant metals’ average price per unit during the first three calendar quarters of 2014 . Only operators reporting operating costs are included . 13 January 29, 2015

Property Portfolio

1660 Wynkoop Street Denver, CO 80202 - 1132 303.573.1660 info @royalgold.com www.royalgold.com SOLID PORTFOLIO. SOLID FUTURE.

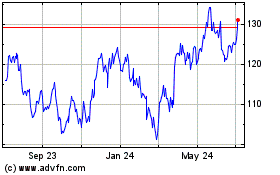

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Gold (NASDAQ:RGLD)

Historical Stock Chart

From Apr 2023 to Apr 2024