Q2 FY’16 Conference Call Rentrak

November 4, 2015 Filed by Rentrak Corporation pursuant to Rule 425 under the Securities Act of 1933 and deemed filed pursuant to Rule 14a-12 under the Securities Exchange Act of 1934 Subject Company: Rentrak Corporation Commission File No.:

000-15159 Date: November 5, 2015

Safe Harbor Statement Forward-Looking

Statements This communication contains forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, including with respect to the anticipated timing, completion

and effects of the proposed merger between comScore and Rentrak. These statements are based on management’s current expectations and beliefs, and are subject to a number of factors and uncertainties that could cause actual results to differ

materially from those described in the forward-looking statements. These forward-looking statements include statements about future financial and operating results; benefits of the transaction to customers, shareholders and employees; potential

synergies and cost savings; the ability of the combined company to drive growth and expand customer and partner relationships; and other statements regarding the proposed transaction. Forward-looking statements may contain words such as “will

be,” “will,” “expected,” “anticipate,” “continue,” or similar expressions, and include the assumptions that underlie such statements. The following factors, among others, could cause actual

results to differ materially from those described in the forward-looking statements: failure of the comScore stockholders or Rentrak shareholders to approve the proposed merger; failure to achieve regulatory approval; the challenges and costs of

closing, integrating, restructuring and achieving anticipated synergies; the ability to retain key employees, customers and suppliers; and other factors, including those set forth in the most current Annual Report on Form 10-K, Quarterly Report on

Form 10-Q and Current Reports on Form 8-K filed by comScore and Rentrak with the SEC. All forward-looking statements are based on management’s estimates, projections and assumptions as of the date hereof, and comScore and Rentrak are under no

obligation (and expressly disclaim any such obligation) to update or revise their forward-looking statements whether as a result of new information, future events, or otherwise. Second quarter summary revenue, gross margin and operating income

included in this presentation are derived from financial information that was provided in Rentrak’s 2Q16 earnings press release on Form 8-K filed with the Securities and Exchange Commission on November 4, 2015, and which is available at

www.sec.gov. Please note that this presentation includes a discussion of certain items that are not calculated or presented in accordance with generally accepted accounting principles (GAAP), including adjusted EBITDA and non-GAAP diluted EPS. A

reconciliation of these non-GAAP financial measures to their most comparable GAAP financial measures, as well as a further explanation about non-GAAP items, is included within this presentation. No Offer or Solicitation This communication does not

constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the proposed merger or otherwise. No offer of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

Safe Harbor Statement (cont.) Participants

in the Solicitation Each of Rentrak and comScore and their respective executive officers and directors may be deemed to be participants in the solicitation of proxies from their respective shareholders or stockholders with respect to the

transactions contemplated by the merger agreement. Information regarding the persons who may, under the rules of the SEC, be deemed participants in the solicitation of comScore or Rentrak security holders in connection with the proposed merger is

set forth in the preliminary registration statement and the preliminary joint proxy statement/prospectus that has been filed with the SEC, and will also be set forth in the final registration statement and joint proxy statement/prospectus when filed

with the SEC. Information regarding Rentrak’s executive officers and directors is included in Rentrak’s Proxy Statement for its 2015 Annual Meeting of Shareholders, filed with the SEC on July 9, 2015, and information regarding

comScore’s executive officers and directors is included in comScore’s Proxy Statement for its 2015 Annual Meeting of Stockholders, filed with the SEC on June 8, 2015. Copies of the foregoing documents may be obtained as provided above.

Certain executive officers and directors of comScore and Rentrak have interests in the transaction that may differ from the interests of comScore stockholders and Rentrak shareholders generally. These interests are described in the preliminary joint

proxy statement/prospectus. Additional Information and Where to Find It In connection with the proposed merger, comScore has filed a preliminary registration statement on Form S-4, which includes a preliminary prospectus and related materials to

register the shares of comScore common stock to be issued in the merger, a preliminary joint proxy statement/prospectus of comScore and Rentrak, and other documents concerning the proposed merger, with the SEC. This material is not a substitute for

the final registration statement and joint proxy statement/prospectus regarding the proposed merger. The preliminary registration statement and joint proxy statement/prospectus contain, and the final registration statement and joint proxy

statement/prospectus will contain, important information about the proposed merger and related matters. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS FILED, OR TO BE FILED, WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT COMSCORE, RENTRAK, AND THE PROPOSED MERGER. Investors and security holders will be able to obtain free copies of

the preliminary registration statement and the preliminary joint proxy statement/prospectus and any other documents filed by comScore and Rentrak with the SEC at the SEC’s website at www.sec.gov. They may also be obtained for free by

contacting comScore Investor Relations by mail at comScore, Inc., 11950 Democracy Drive, Suite 600, Reston, Virginia 20190, Attention: Investor Relations, by telephone at (703) 438-2100, or by going to comScore’s Investor Relations page at

http://ir.comscore.com/contactus.cfm, or by contacting Rentrak Investor Relations by mail at Rentrak Corporation, 7700 N.E. Ambassador Place, Portland, Oregon 97220, Attention: Investor Relations, by telephone at (503) 284-7581, or by going to

Rentrak’s Investor Relations page at http://investor.rentrak.com. The contents of the websites referenced above are not deemed to be incorporated by reference into the registration statement or the joint proxy statement/prospectus.

Great Partners & Great Clients Partial

client list Partial list

Welcoming all 164 Stations to

Rentrak

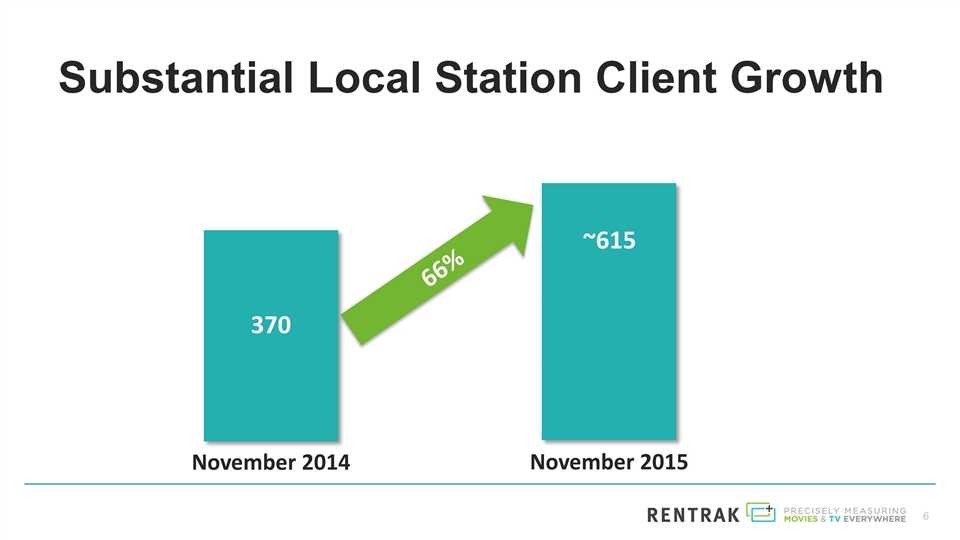

Substantial Local Station Client Growth

November 2015 November 2014 ~615 370 66%

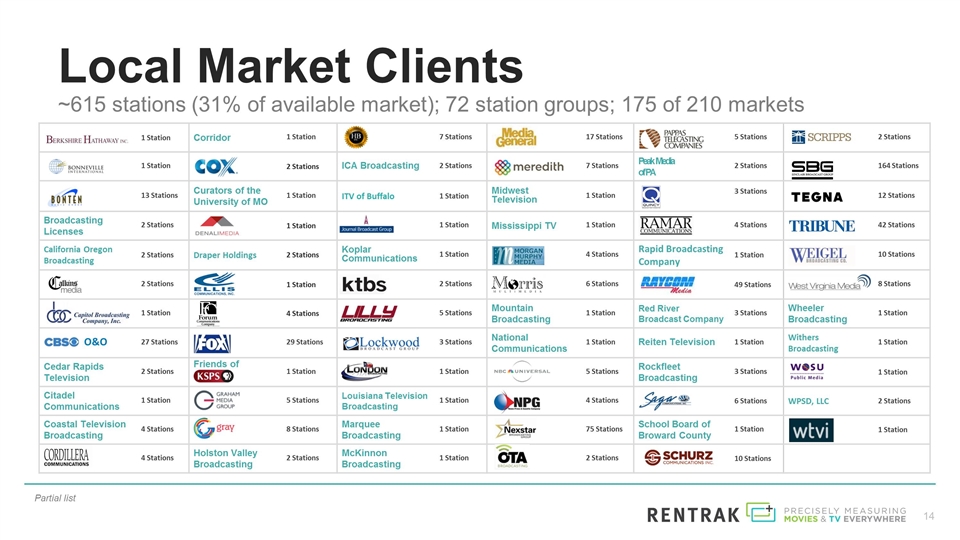

1 Station Corridor 1 Station 7 Stations 17

Stations 5 Stations 2 Stations 1 Station 2 Stations ICA Broadcasting 2 Stations 7 Stations Peak Media of PA 2 Stations 164 Stations 13 Stations Curators of the University of MO 1 Station ITV of Buffalo 1 Station Midwest Television 1 Station 3

Stations 12 Stations Broadcasting Licenses 2 Stations 1 Station 1 Station Mississippi TV 1 Station 4 Stations 42 Stations California Oregon Broadcasting 2 Stations Draper Holdings 2 Stations Koplar Communications 1 Station 4 Stations Rapid

Broadcasting Company 1 Station 10 Stations 2 Stations 1 Station 2 Stations 6 Stations 49 Stations 8 Stations 1 Station 4 Stations 5 Stations Mountain Broadcasting 1 Station Red River Broadcast Company 3 Stations Wheeler Broadcasting 1 Station 27

Stations 29 Stations 3 Stations National Communications 1 Station Reiten Television 1 Station Withers Broadcasting 1 Station Cedar Rapids Television 2 Stations Friends of 1 Station 1 Station 5 Stations Rockfleet Broadcasting 3 Stations 1 Station

Citadel Communications 1 Station 5 Stations Louisiana Television Broadcasting 1 Station 4 Stations 6 Stations WPSD, LLC 2 Stations Coastal Television Broadcasting 4 Stations 8 Stations Marquee Broadcasting 1 Station 75 Stations School Board of

Broward County 1 Station 1 Station 4 Stations Holston Valley Broadcasting 2 Stations McKinnon Broadcasting 1 Station 2 Stations 10 Stations Local Market Clients ~615 stations (31% of available market); 72 station groups; 175 of 210 markets O&O

Partial list

Strategic Rationale Provide trusted

currency for transactions in cross-platform media buying and selling Combines innovative SaaS big data organizations with similar census-like approaches to measurement Unparalleled combination of information assets with expansive measurement of the

digital consumer, TV and movies everywhere

TV Everywhere™

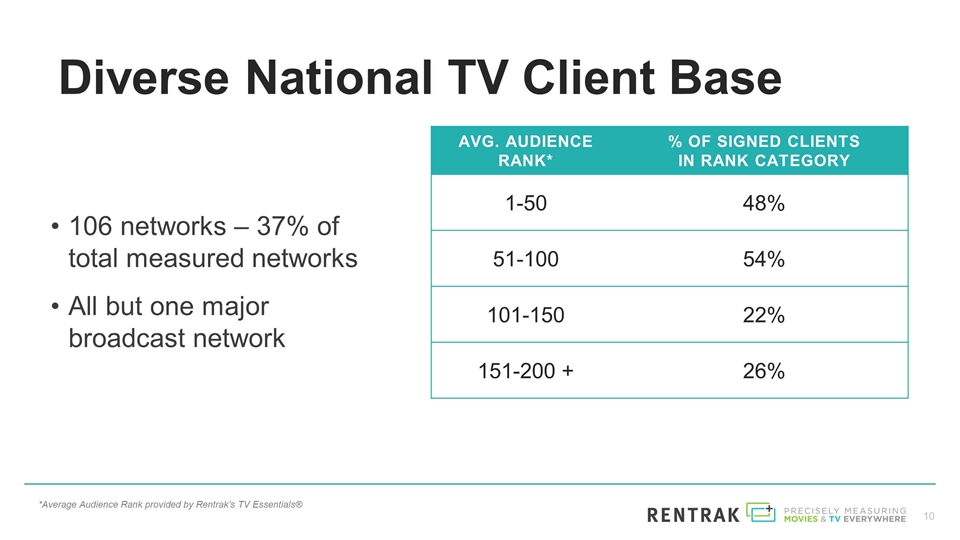

AVG. AUDIENCE RANK* % OF SIGNED CLIENTS

IN RANK CATEGORY 1-50 48% 51-100 54% 101-150 22% 151-200 + 26% Diverse National TV Client Base 106 networks – 37% of total measured networks All but one major broadcast network *Average Audience Rank provided by Rentrak’s TV

Essentials®

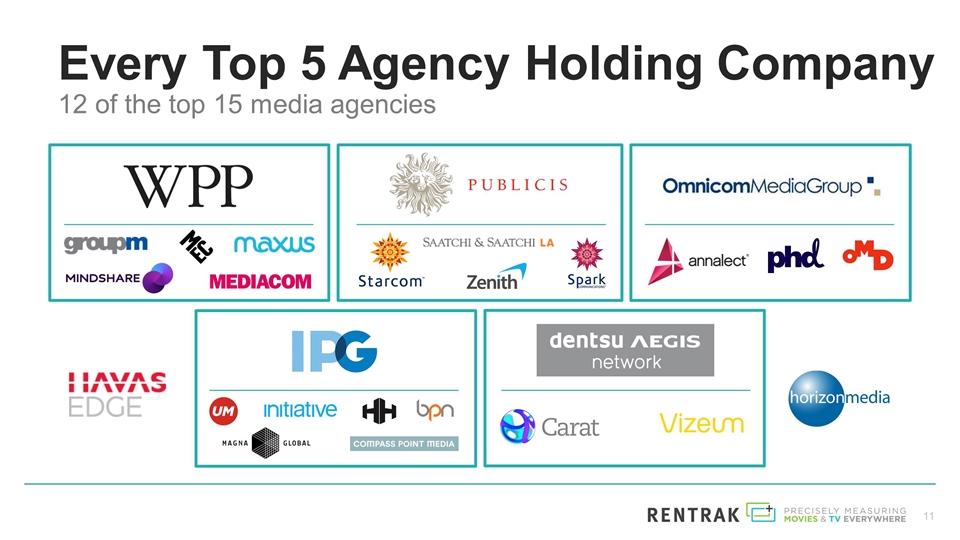

Every Top 5 Agency Holding Company 12

of the top 15 media agencies

Local Agency Clients 110+ Agencies 25%

of all local agencies using Rentrak as exclusive or primary currency; 40% of all new local agency clients using Rentrak as exclusive currency Partial list

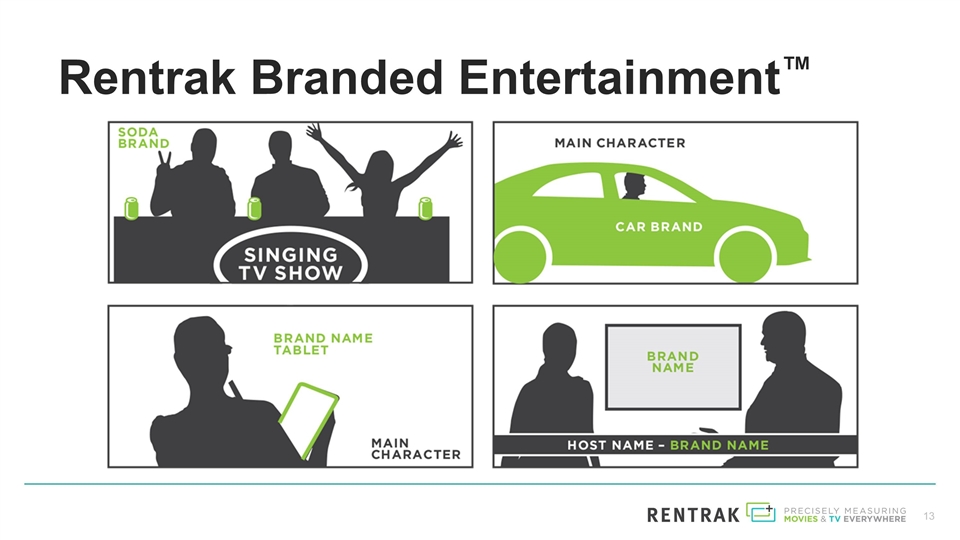

Rentrak Branded

Entertainment™

1 Station Corridor 1 Station 7 Stations

17 Stations 5 Stations 2 Stations 1 Station 2 Stations ICA Broadcasting 2 Stations 7 Stations Peak Media of PA 2 Stations 164 Stations 13 Stations Curators of the University of MO 1 Station ITV of Buffalo 1 Station Midwest Television 1 Station 3

Stations 12 Stations Broadcasting Licenses 2 Stations 1 Station 1 Station Mississippi TV 1 Station 4 Stations 42 Stations California Oregon Broadcasting 2 Stations Draper Holdings 2 Stations Koplar Communications 1 Station 4 Stations Rapid

Broadcasting Company 1 Station 10 Stations 2 Stations 1 Station 2 Stations 6 Stations 49 Stations 8 Stations 1 Station 4 Stations 5 Stations Mountain Broadcasting 1 Station Red River Broadcast Company 3 Stations Wheeler Broadcasting 1 Station 27

Stations 29 Stations 3 Stations National Communications 1 Station Reiten Television 1 Station Withers Broadcasting 1 Station Cedar Rapids Television 2 Stations Friends of 1 Station 1 Station 5 Stations Rockfleet Broadcasting 3 Stations 1 Station

Citadel Communications 1 Station 5 Stations Louisiana Television Broadcasting 1 Station 4 Stations 6 Stations WPSD, LLC 2 Stations Coastal Television Broadcasting 4 Stations 8 Stations Marquee Broadcasting 1 Station 75 Stations School Board of

Broward County 1 Station 1 Station 4 Stations Holston Valley Broadcasting 2 Stations McKinnon Broadcasting 1 Station 2 Stations 10 Stations Local Market Clients ~615 stations (31% of available market); 72 station groups; 175 of 210 markets O&O

Partial list

Movies Everywhere™

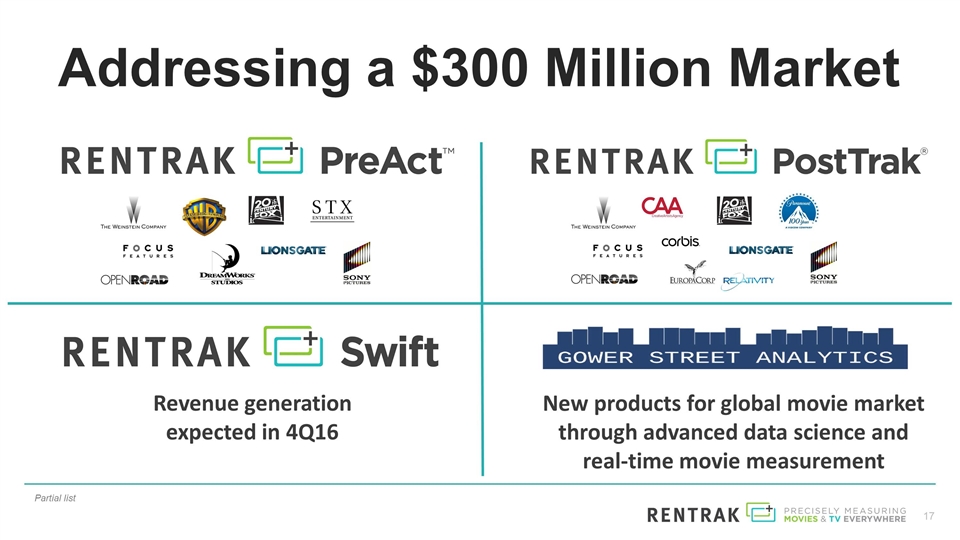

Addressing a $300 Million Market

Revenue generation expected in 4Q16 New products for global movie market through advanced data science and real-time movie measurement Partial list

Financials

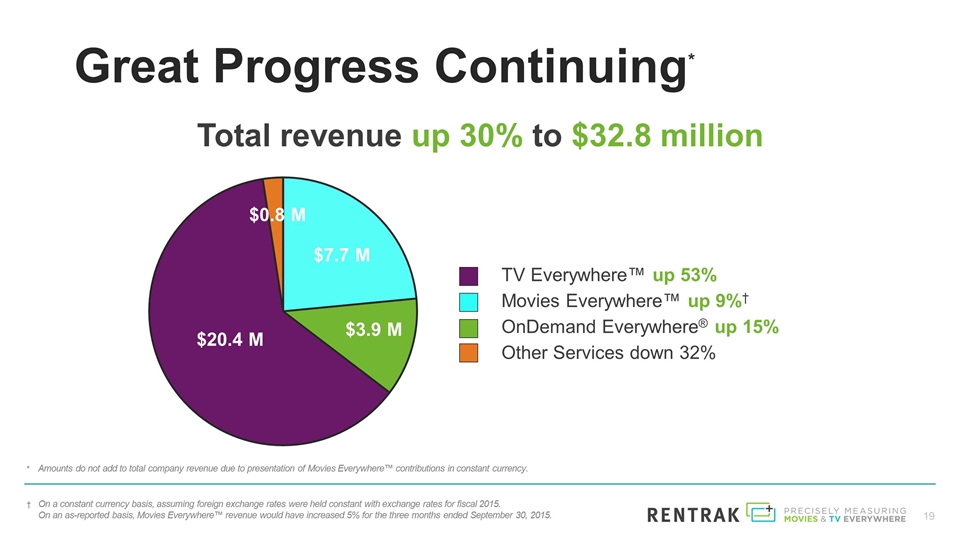

On a constant currency basis, assuming

foreign exchange rates were held constant with exchange rates for fiscal 2015. On an as-reported basis, Movies Everywhere™ revenue would have increased 5% for the three months ended September 30, 2015. TV Everywhere™ up 53% Movies

Everywhere™ up 9%† OnDemand Everywhere® up 15% Other Services down 32% Total revenue up 30% to $32.8 million Great Progress Continuing* Amounts do not add to total company revenue due to presentation of Movies Everywhere™

contributions in constant currency.

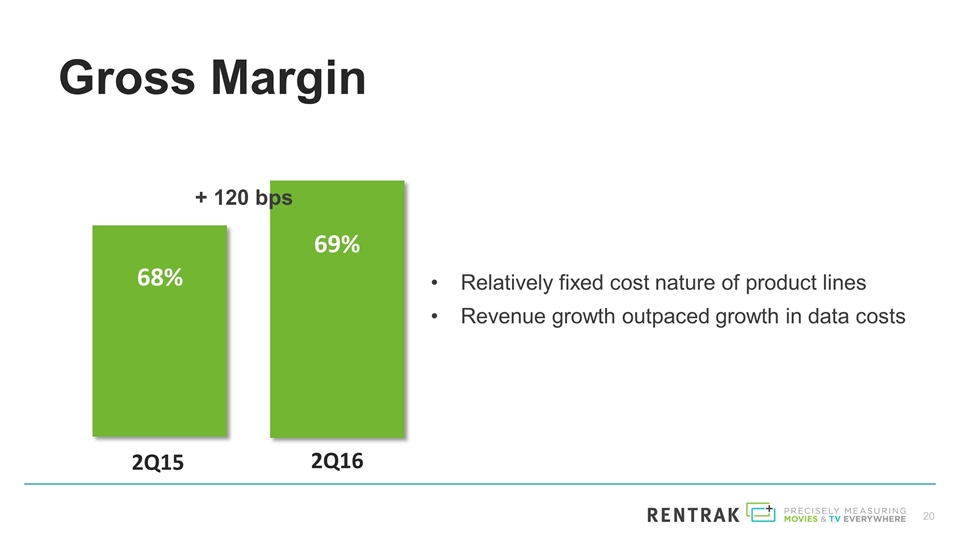

Gross Margin Relatively fixed cost

nature of product lines Revenue growth outpaced growth in data costs 66.0% 2Q16 2Q15 69% 68% + 120 bps

Strong Operating Leverage $ in millions

Operating income for the second quarter of fiscal 2016 included $2.1 million in stock-based compensation costs, $1.3 million in acquisition and reorganization costs and $46,000 related to the settlement of the earn-out associated with the

company’s acquisition of iTVX in August 2013. Operating loss for the second quarter of fiscal 2015 included $2.1 million in stock-based compensation costs, $600,000 in costs related to the iTVX earn-out and $270,000 in acquisition costs.

Additional information about adjusted EBITDA, a non-GAAP, measure, can be found on slides 25 and 26 of this presentation. ($ in millions) 2Q16 2Q15 Operating income (loss) $1.7 ($0.4) Operating income excluding one-time items and other adjustments*

$5.1 $2.5 Adjusted EBITDA† $7.6 $4.3 Adjusted EBITDA/Revenue† 23.2% 17.0%

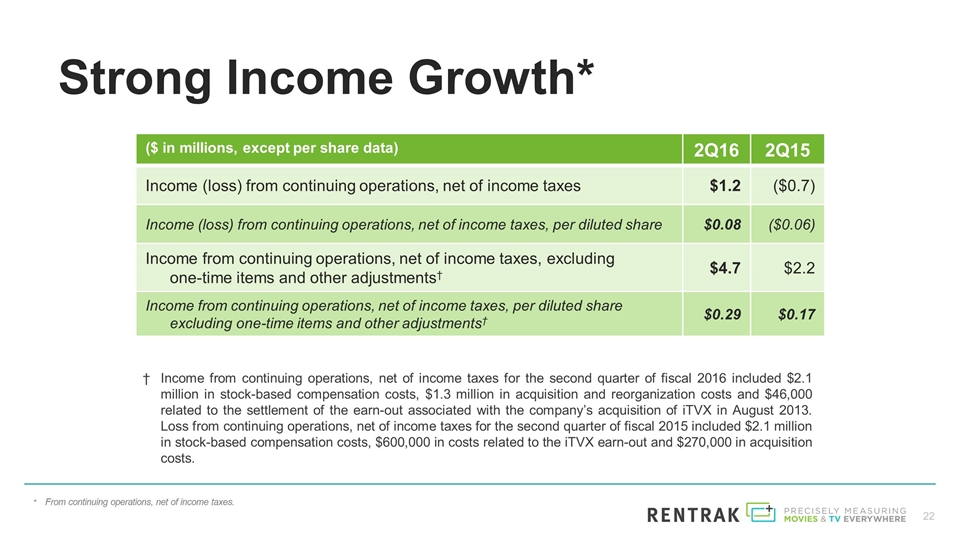

Strong Income Growth* Income from

continuing operations, net of income taxes for the second quarter of fiscal 2016 included $2.1 million in stock-based compensation costs, $1.3 million in acquisition and reorganization costs and $46,000 related to the settlement of the earn-out

associated with the company’s acquisition of iTVX in August 2013. Loss from continuing operations, net of income taxes for the second quarter of fiscal 2015 included $2.1 million in stock-based compensation costs, $600,000 in costs related to

the iTVX earn-out and $270,000 in acquisition costs. ($ in millions, except per share data) 2Q16 2Q15 Income (loss) from continuing operations, net of income taxes $1.2 ($0.7) Income (loss) from continuing operations, net of income taxes, per

diluted share $0.08 ($0.06) Income from continuing operations, net of income taxes, excluding one-time items and other adjustments† $4.7 $2.2 Income from continuing operations, net of income taxes, per diluted share excluding one-time items

and other adjustments† $0.29 $0.17 From continuing operations, net of income taxes.

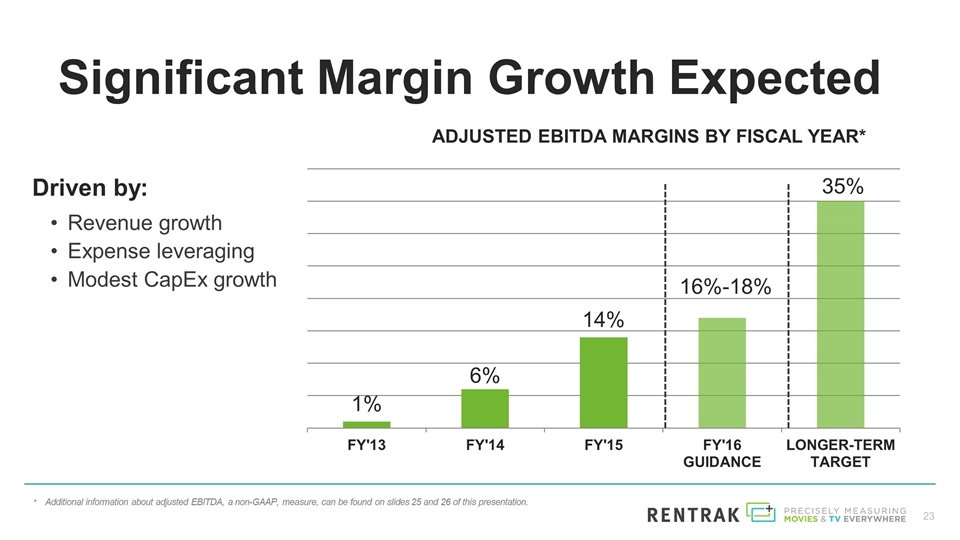

Significant Margin Growth Expected

Driven by: Revenue growth Expense leveraging Modest CapEx growth Additional information about adjusted EBITDA, a non-GAAP, measure, can be found on slides 25 and 26 of this presentation. 16%-18%

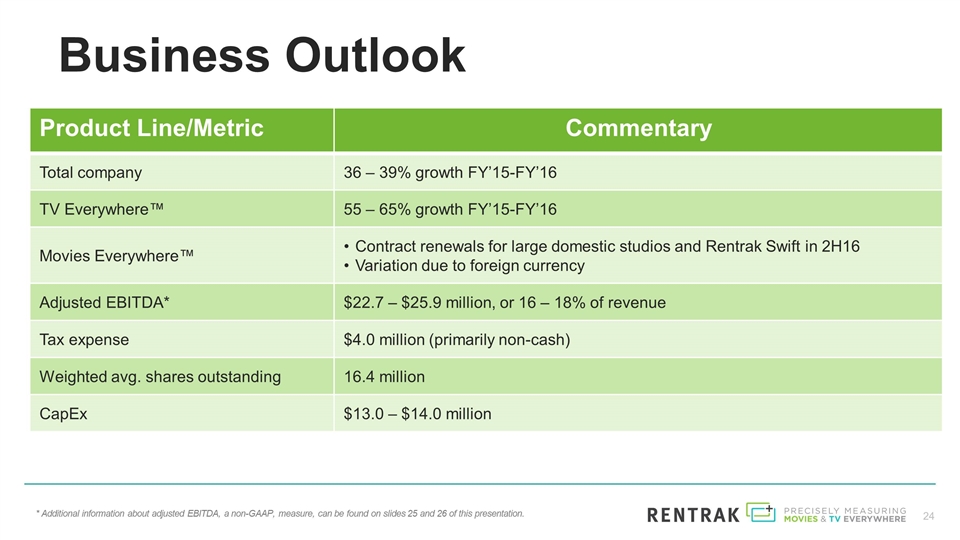

Business Outlook Product Line/Metric

Commentary Total company 36 – 39% growth FY’15-FY’16 TV Everywhere™ 55 – 65% growth FY’15-FY’16 Movies Everywhere™ Contract renewals for large domestic studios and Rentrak Swift in 2H16 Variation due

to foreign currency Adjusted EBITDA* $22.7 – $25.9 million, or 16 – 18% of revenue Tax expense $4.0 million (primarily non-cash) Weighted avg. shares outstanding 16.4 million CapEx $13.0 – $14.0 million * Additional information

about adjusted EBITDA, a non-GAAP, measure, can be found on slides 25 and 26 of this presentation.

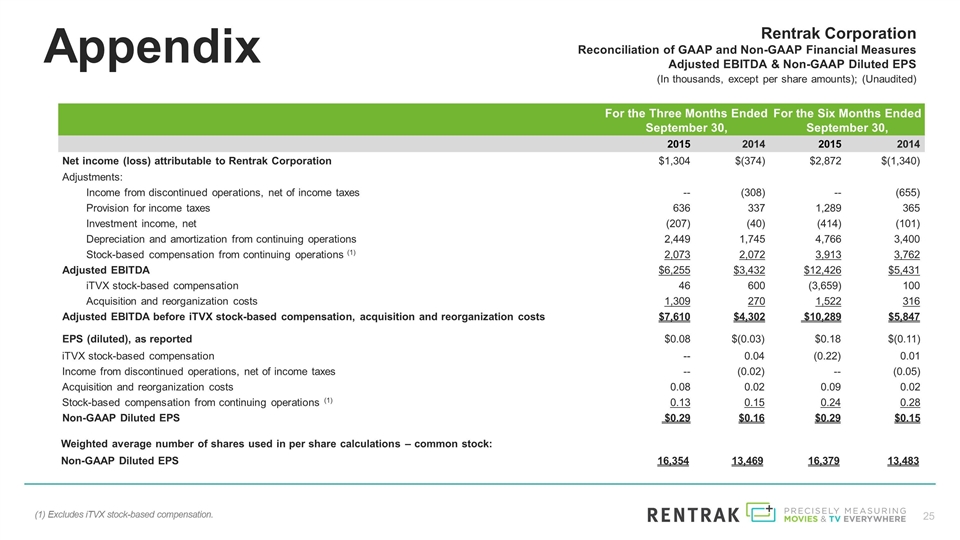

Appendix Rentrak Corporation

Reconciliation of GAAP and Non-GAAP Financial Measures Adjusted EBITDA & Non-GAAP Diluted EPS (In thousands, except per share amounts); (Unaudited) (1) Excludes iTVX stock-based compensation. For the Three Months Ended September 30, For the Six

Months Ended September 30, 2015 2014 2015 2014 Net income (loss) attributable to Rentrak Corporation $1,304 $(374) $2,872 $(1,340) Adjustments: Income from discontinued operations, net of income taxes -- (308) -- (655)

Provision for income taxes 636 337 1,289 365 Investment income, net (207) (40) (414) (101) Depreciation and amortization from continuing operations 2,449 1,745 4,766 3,400 Stock-based compensation from continuing operations (1) 2,073 2,072 3,913

3,762 Adjusted EBITDA $6,255 $3,432 $12,426 $5,431 iTVX stock-based compensation 46 600 (3,659) 100 Acquisition and reorganization costs 1,309 270 1,522 316 Adjusted EBITDA before iTVX stock-based compensation, acquisition and reorganization costs

$7,610 $4,302 $10,289 $5,847 EPS (diluted), as reported $0.08 $(0.03) $0.18 $(0.11) iTVX stock-based compensation -- 0.04 (0.22) 0.01 Income from discontinued operations, net of income taxes -- (0.02) -- (0.05) Acquisition and

reorganization costs 0.08 0.02 0.09 0.02 Stock-based compensation from continuing operations (1) 0.13 0.15 0.24 0.28 Non-GAAP Diluted EPS $0.29 $0.16 $0.29 $0.15 Weighted average number of shares used in per share calculations – common

stock: Non-GAAP Diluted EPS 16,354 13,469 16,379 13,483

Appendix (cont.) About Adjusted EBITDA

and Non-GAAP Diluted EPS From time to time, Rentrak may refer to Adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, Amortization and Stock-based Compensation) and “non-GAAP diluted EPS” in its conference calls and

discussions with investors and analysts in connection with the company’s reported historical financial results. Adjusted EBITDA does not represent cash flows from operations as defined by generally accepted accounting principles

(“GAAP”), is not derived in accordance with GAAP and should not be considered by the reader as an alternative to net income (the most comparable GAAP financial measure to Adjusted EBITDA). Non-GAAP diluted EPS does not measure diluted

EPS as defined by GAAP, is not derived in accordance with GAAP and should not be considered by the reader as an alternative to reported diluted EPS. The reconciliation of GAAP and non-GAAP financial measures for the three and six month periods ended

September 30, 2015 and 2014 are included in the above table. Rentrak’s management believes that Adjusted EBITDA is helpful as an indicator of the current financial performance of the company and its capacity to operationally fund capital

expenditures and working capital requirements. Due to the nature of the company’s internally-developed software policies and its use of stock-based compensation, Rentrak incurs significant non-cash charges for depreciation, amortization and

stock-based compensation expense that may not be indicative of its operating performance from a cash perspective. Rentrak also adjusts for non-cash items, such as stock-based compensation, as well as cash-settled items, such as acquisition and

non-recurring costs, as we believe these are not representative of our ongoing operating performance and we believe excluding these costs provide a useful metric by which to compare performance from period to period. In addition, Rentrak’s

management believes that these costs as well as stock-based compensation should be factored out of reported EPS in order to provide a more useful indicator of the current financial performance of the company. No tax rate was applied to these

adjustments because the company has established a valuation reserve against its deferred tax assets. Due to the nature of the company’s equity and stock-based compensation plans and arrangements, costs associated with acquisitions and items

which are considered nonrecurring in nature, the company’s diluted EPS, which includes these items, may not be indicative of its on-going operating performance.

Rentrak November 4, 2015

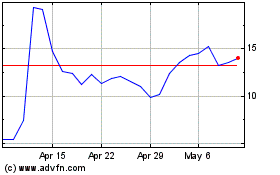

Rent the Runway (NASDAQ:RENT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rent the Runway (NASDAQ:RENT)

Historical Stock Chart

From Apr 2023 to Apr 2024