As filed with the Securities and Exchange Commission on March 30 , 2015

Registration No. 333-_____

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

|

|

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

|

|

RADCOM Ltd.

|

|

(Exact name of registrant as specified in its charter)

|

|

Israel

(State or other jurisdiction of incorporation or organization)

|

|

Not Applicable

(I.R.S. Employer Identification No.)

|

|

24 Raoul Wallenberg Street

Tel Aviv 69719, Israel

|

|

(Address of Principal Executive Offices)(Zip Code)

RADCOM LTD. 2013 SHARE OPTION PLAN

|

|

(Full title of the plans)

|

| |

|

RADCOM Equipment, Inc.

Six Forest Avenue

Paramus, New Jersey 07652

(201) 518-0033

|

|

(Name and address of agent for service)(Telephone number, including area code, of agent of service)

|

|

Copies of all communications, including all communications sent to the agent for service, should be sent to:

|

| Omer Mor, Adv.

RADCOM Ltd.

24 Raoul Wallenberg Street

Tel Aviv 69719, Israel

Tel: (972) 77-774-505

Fax: (972) 3-6474681

|

|

Aaron M. Lampert, Adv.

Goldfarb Seligman & Co.

98 Yigal Alon Street

Tel-Aviv 6789141, Israel

Tel: (972) 3-608-9999

|

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o |

|

Accelerated filer o |

| Non-accelerated filer x |

|

Smaller reporting company o |

| (Do not check if a smaller reporting company) |

|

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

Amount To Be Registered (1)

|

Proposed Maximum Offering Price Per Share

|

Proposed Maximum Aggregate Offering Price

|

Amount of Registration Fee (8)

|

|

Ordinary Shares of Radcom Ltd., par value NIS 0.20 per share ("Ordinary Shares")

|

181,750 (2)

|

$5.01 (5)

|

$910,567.50

|

$105.81 (9)

|

|

32,750 (3)

|

$9.80 (6)

|

$320,950.00

|

$37.29 (9)

|

|

35,500 (4)

|

$0.0025 (7)

|

$88.75

|

$0.01 (9)

|

| |

|

|

|

|

Total

|

250,000

|

N/A

|

$1,231,606.25

|

$143.11

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the "Securities Act"), this Registration Statement on Form S-8 (this "Registration Statement") shall also cover any additional Ordinary Shares which become issuable under the Radcom Ltd. 2013 Share Option Plan (the "2013 Plan") by reason of any share dividend, share split, recapitalization or other similar transaction effected without the receipt of consideration which results in an increase in the number of the outstanding ordinary shares of Radcom Ltd. as a result of share splits, share dividends and antidilution provisions.

|

|

(2)

|

Represents Ordinary Shares subject to issuance upon the exercise of options outstanding under the 2013 Plan.

|

|

(3)

|

Represents Ordinary Shares subject to issuance upon the exercise of options to be granted under the 2013 Plan.

|

|

(4)

|

Represents Ordinary Shares subject to issuance upon the exercise of restricted share units to be granted under the 2013 Plan. |

|

(5)

|

Calculated pursuant to Rule 457(h)(1) under the Securities Act. The Proposed Maximum Offering Price Per Share is the weighted average exercise price of outstanding options granted under the Plans, as applicable.

|

|

(6)

|

Estimated pursuant to Rule 457(c) and Rule 457(h) under the Securities Act, solely for the purpose of computing the registration fee, based on the average of the high and low prices reported for an Ordinary Share on the NASDAQ Capital Market on March 27, 2015.

|

|

(7)

|

Calculated pursuant to Rule 457(h)(1) under the Securities Act. The Proposed Maximum Offering Price Per Share is NIS 0.01 (which, is equal to $0.0025based on the exchange rate between the NIS and the U.S. dollar, as published by the Bank of Israel on March 27, 2015), the purchase price

of each restricted share unit to be granted under the 2013 Plan.

|

|

(8)

|

Rounded up to the nearest cent.

|

|

(9)

|

Calculatedpursuant to Section 6 of the Securities Act as follows: proposed maximum aggregate offering price multiplied by 0.0001162.

|

REGISTRATION OF ADDITIONAL SECURITIES – EXPLANATORY NOTE

A Registration Statement was filed with the Securities and Exchange Commission (the "Commission") on July 29, 2013 (File No. 333- 190207), and another Registration Statement was filed with the Commission on April 24, 2014 (File No. 333-195465) (together, the "Prior Registration Statements"), each to register under the Securities Act 250,000 Ordinary Shares, par value NIS 0.20 per share ("Ordinary Shares"), of Radcom Ltd. (the "Company") to be offered and sold pursuant to the Company's 2013 Share Option Plan, as amended (the "2013 Plan").

This Registration Statement has been prepared and filed pursuant to General Instruction E to Form S-8, for the purpose of effecting the registration under the Securities Act of an additional 250,000 Ordinary Shares, to be offered and sold pursuant to the 2013 Plan.

Pursuant to General Instruction E to Form S-8, the contents of the Prior Registration Statements related to the 2013 Plan are incorporated by reference herein, and made a part of this Registration Statement, except as amended hereby.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The Commission allows the Company to "incorporate by reference" the information the Company files with or submits to it, which means that the Company can disclose important information by referring to those documents. The information incorporated by reference is considered to be part of this Registration Statement, and later information filed with or submitted to the Commission will update and supersede this information. The following documents are incorporated herein by reference:

(i) The Company’s Annual Report on Form 20-F for the year ended December 31, 2014, filed with the Commission on March 26, 2015;

(ii) All reports filed or submitted pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), since December 31, 2014, to the extent that such reports identify information therein as being incorporated by reference into previously filed registration statements; and

(iii) The description of the Ordinary Shares, contained in the Company’s Registration Statement on Form F-1 (File No. 333-05022), filed with the Commission on June 12, 1996, and any amendment thereto or report filed for the purpose of amending such description.

All documents subsequently filed by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act, prior to the filing of a post-effective amendment which indicates that all securities offered have been sold or which deregisters all securities then remaining unsold, and any reports on Form 6-K subsequently submitted by the Company to the Commission during such period (or portions thereof) that are identified in such forms as being incorporated into this Registration Statement, shall be deemed to be incorporated by reference herein and to be a part hereof from the date of filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein, (or in any other subsequently filed document which also is incorporated or deemed to be incorporated by reference herein), modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits.

See Exhibit Index, which is incorporated herein by reference.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Tel Aviv, State of Israel, on March 30, 2015.

| |

RADCOM Ltd.

|

|

| |

|

|

|

| |

By:

|

/s/ Uri Birenberg |

|

| |

|

Name: Uri Birenberg |

|

| |

|

Title: Chief Financial Officer |

|

| |

|

|

|

POWER OF ATTORNEY

Know all persons by these presents, that each person whose signature appears below, constitutes and appoints each of Uri Birenberg and David Ripstein as his or her true and lawful attorney-in-fact and agent, upon the action of such appointee, with full power of substitution and resubstitution, to do any and all acts and things and execute, in the name of the undersigned, any and all instruments which each of said attorneys-in-fact and agents may deem necessary or advisable in order to enable Radcom Ltd. to comply with the Securities Act of 1933, as amended (the "Securities Act"), and any requirements of the Securities and Exchange Commission (the "Commission") in respect thereof, in connection with the filing with the Commission of this Registration Statement under the Securities Act, including specifically but without limitation, power and authority to sign the name of the undersigned to such Registration Statement, and any amendments to such Registration Statement (including post-effective amendments), and to file the same with all exhibits thereto and other documents in connection therewith, with the Commission, to sign any and all applications, registration statements, notices or other documents necessary or advisable to comply with applicable state securities laws, and to file the same, together with other documents in connection therewith with the appropriate state securities authorities, granting unto each of said attorneys-in-fact and agents full power and authority to do and to perform each and every act and thing requisite or necessary to be done in and about the premises, as fully and to all intents and purposes as the undersigned might or could do in person, hereby ratifying and confirming all that each of said attorneys-in-fact and agents may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act, this Registration Statement has been signed below by the following persons in the capacities and on the dates indicated.

|

Signature

|

|

Title

|

|

Date

|

| |

|

|

|

|

|

/s/ Zohar Zisapel

Zohar Zisapel

|

|

Chairman of the Board of Directors

|

|

March 30, 2015

|

| |

|

|

|

|

|

/s/ David Ripstein

David Ripstein

|

|

President and Chief Executive Officer

|

|

March 30, 2015

|

| |

|

|

|

|

|

/s/ Uri Birenberg

Uri Birenberg

|

|

Chief Financial Officer

|

|

March 30, 2015

|

| |

|

|

|

|

|

/s/ Uri Har

Uri Har

|

|

Director

|

|

March 30, 2015

|

| |

|

|

|

|

|

/s/ Irit Hillel

Irit Hillel

|

|

Director

|

|

March 30, 2015

|

| |

|

|

|

|

|

/s/ Matty Karp

Matty Karp

|

|

Director

|

|

March 30, 2015

|

| |

|

|

|

|

|

/s/ Rachel Bennun

Rachel Bennun

|

|

Director

|

|

March 30, 2015

|

| |

|

|

|

|

|

Authorized Representative

in the United States:

RADCOM Equipment, Inc.

By: /s/ David Ripstein

Name: David Ripstein

Title: Chief Executive Officer

|

|

|

|

March 30, 2015

|

EXHIBIT INDEX

|

Exhibit

Number

|

|

Description

|

|

| |

|

|

|

|

5.1

|

–

|

Opinion of Goldfarb Seligman & Co.

|

|

|

23.1

|

–

|

Consent of Kost Forer Gabbay & Kasierer, A Member of Ernst and Young Global, dated March 30, 2015.

|

|

|

23.3

|

–

|

Consent of Goldfarb Seligman & Co. (included in Exhibit 5.1).

|

|

|

24

|

–

|

Power of Attorney (included in the signature pages hereof).

|

|

|

99.1

|

–

|

Radcom Ltd. 2013 Share Option Plan (1).

|

|

_______________

(1) Incorporated herein by reference to the Annual Report on Form 20-F of the Company for the fiscal year ended December 31, 2014, filed with the Commission on March 26, 2015.

Exhibit 5.1

OPINION OF COUNSEL

Goldfarb Seligman & Co.

Electra Tower

98 Yigal Alon Street

Tel Aviv 6789141, Israel

March 30, 2015

Radcom Ltd.

24 Raoul Wallenberg Street

Tel Aviv 69710

Israel

Ladies and Gentlemen:

We refer to the Registration Statement on Form S-8 (the "Registration Statement") to be filed on or about the date hereof with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the "Act"), on behalf of Radcom Ltd. (the "Company"), relating to an additional 250,000 of the Company’s Ordinary Shares, par value NIS 0.20 per share (the "Shares"), issuable upon the exercise of options or conversion of restricted share units granted and/or to be granted under the Company’s 2013 Share Option Plan (the "2013 Plan").

We are members of the Israel Bar and we express no opinion as to any matter relating to the laws of any jurisdiction other than the laws of Israel.

In connection with this opinion, we have examined such corporate records, other documents and such questions of Israeli law as we have considered necessary or appropriate for the purposes of this opinion. In such examination, we have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents of all copies submitted to us, the authenticity of the originals of such copies, and, as to matters of fact, the accuracy of all statements and representations made by the directors and officers of the Company. We have also assumed that each individual grant under the 2013 Plan that will be made after the date hereof will be duly authorized by all necessary corporate action.

Based on the foregoing and subject to the limitations, qualifications and assumptions stated herein, we advise you that, in our opinion, the Shares have been duly authorized and when, and if, paid for and issued upon the exercise of options and/or the conversion of restricted share units in accordance with the terms of the 2013 Plan, will be validly issued, fully paid and non-assessable.

This opinion is rendered as of the date hereof, and we undertake no obligation to advise you of any changes in applicable law or any other matters that may come to our attention after the date hereof that may affect this opinion.

We hereby consent to the filing of this opinion as an exhibit to the Registration Statement. This consent is not to be construed as an admission that we are a person whose consent is required to be filed with the Registration Statement under the provisions of the Act.

| |

Sincerely, |

| |

|

| |

/s/ Goldfarb Seligman & Co.

Goldfarb Seligman & Co.

|

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statement on Form S-8 of Radcom Ltd. for the registration of an additional 250,000 of its ordinary shares under its 2013 Share Option Plan, of our report dated March 26, 2015, with respect to the consolidated financial statements of Radcom Ltd., included in its Annual Report (Form 20-F) for the year ended December 31, 2014, filed with the Securities and Exchange Commission on March 26, 2015.

|

Tel-Aviv, Israel

March 30, 2015

|

/s/ Kost Forer Gabbay & Kasierer

Kost Forer Gabbay & Kasierer

A Member of Ernst & Young Global

|

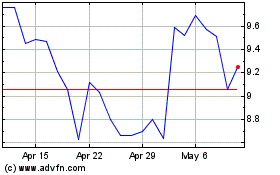

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Radcom (NASDAQ:RDCM)

Historical Stock Chart

From Apr 2023 to Apr 2024