UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 4, 2016

Patterson-UTI Energy, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware |

|

0-22664 |

|

75-2504748 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

|

|

|

450 Gears Road, Suite 500, Houston, Texas |

|

|

|

77067 |

|

(Address of principal executive offices) |

|

|

|

(Zip Code) |

Registrant’s telephone number, including area code: 281-765-7100

Not Applicable

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Top of the Form

Item 2.02 Results of Operations and Financial Condition.

On February 4, 2016, Patterson-UTI Energy, Inc. (the "Company") announced financial results for the three and twelve months ended December 31, 2015. The press release, dated February 4, 2016, is furnished as Exhibit 99.1 to this report and incorporated by reference herein.

The information furnished pursuant to Item 2.02, including Exhibit 99.1 shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, shall not otherwise be subject to the liabilities of that section and shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is furnished herewith:

|

99.1 |

|

Press Release dated February 4, 2016 announcing financial results for the three and twelve months ended December 31, 2015. |

Top of the Form

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Patterson-UTI Energy, Inc. |

|

|

|

|

|

|

|

February 4, 2016 |

|

By: |

|

/s/ John E. Vollmer III |

|

|

|

|

|

Name: John E. Vollmer III |

|

|

|

|

|

Title: Senior Vice President - Corporate Development, Chief Financial Officer and Treasurer |

Top of the Form

Exhibit Index

|

Exhibit No. |

|

Description |

|

|

|

|

|

99.1 |

|

Press Release dated February 4, 2016 announcing financial results for the three and twelve months ended December 31, 2015. |

Exhibit 99.1

Contact: Mike Drickamer

Director, Investor Relations

Patterson-UTI Energy, Inc.

(281) 765-7170

Patterson-UTI Energy Reports Financial Results for Three and Twelve

Months Ended December 31, 2015

HOUSTON, Texas – February 4, 2016 – PATTERSON-UTI ENERGY, INC. (NASDAQ: PTEN) today reported financial results for the three and twelve months ended December 31, 2015. The Company reported a net loss of $58.7 million, or $0.40 per share, for the fourth quarter of 2015, compared to net income of $57.6 million, or $0.39 per share, for the quarter ended December 31, 2014. Revenues for the fourth quarter of 2015 were $339 million, compared to $901 million for the fourth quarter of 2014.

For the twelve months ended December 31, 2015, including the charges discussed later in this release, the Company reported a net loss of $294 million, or $2.00 per share, compared to net income of $163 million, or $1.11 per share, for the twelve months ended December 31, 2014. Revenues for the twelve months ended December 31, 2015, were $1.9 billion, compared to $3.2 billion for the same period in 2014.

Andy Hendricks, Patterson-UTI’s Chief Executive Officer, stated, “During the fourth quarter, our rig count averaged 88 rigs in the United States and three rigs in Canada, compared to the third quarter average of 105 rigs in the United States and four in Canada.”

Mr. Hendricks added, “We recognized $9.2 million of revenues related to early contract terminations in contract drilling during the fourth quarter. These early termination revenues positively impacted our total average rig revenue per day of $24,240 by $1,100. Excluding early termination revenue from both the third and fourth quarters, total average rig revenue per day during the fourth quarter would have been unchanged from the third quarter at $23,140.

“Total average rig operating costs per day during the fourth quarter decreased $940 to $12,640 from $13,580 in the third quarter. Approximately a third of this decrease is related to cost savings with the remainder due to a higher proportion of rigs on standby in the fourth quarter than the third quarter of 2015. Total average rig margin per day, excluding the positive impact from early termination revenues in both the third and fourth quarters, increased to $10,500 during the fourth quarter, from $9,560 during the third quarter.

“At the end of the fourth quarter our rig fleet included 161 APEX® rigs. We have no plans to build rigs in 2016. As of December 31, 2015, we had term contracts for drilling rigs providing for approximately $710 million of future dayrate drilling revenue. Based on contracts currently in place, we expect an average of 59 rigs operating under term contracts during the first quarter, and an average of 46 rigs operating under term contracts during 2016.

“In pressure pumping, activity decreased during the fourth quarter, but was better than we expected. Pressure pumping revenue during the fourth quarter was $132 million compared to $154 million in the third quarter. Gross margin as a percentage of revenues improved slightly during the fourth quarter to 10.4%, and pressure pumping Adjusted EBITDA was $10.9 million in the fourth quarter compared to $11.8 million during the third quarter,” he concluded.

Mark S. Siegel, Chairman of Patterson-UTI, stated, “2015 was a challenging year for the energy sector. Geopolitics, combined with the resilience of U.S. crude oil production, weighed heavily on oil prices. Low oil prices, combined with low natural gas prices, resulted in the U.S. land drilling rig count decreasing more than 60% during 2015, and it is now almost 70% lower than the peak in 2014.

“In this market environment, we remain focused on operational execution and preserving the strength of our balance sheet. During the downturn, we have consistently scaled our business to activity levels while maintaining high-quality operations. Financially, our cash balance increased to $113 million as of December 31, 2015, and our $500 million revolving line of credit remains fully available.

“While there is no visibility currently into a recovery, we remain confident in the long-term outlook for our company. We are financially strong, and with 161 APEX® rigs and more than one million horsepower of pressure pumping equipment, we have the kind of high-quality equipment that we expect to be in greatest demand during a recovery," he concluded.

The financial results for the twelve months ended December 31, 2015 include pretax charges totaling $301 million, of which $288 million was non-cash and related to the impairment of all goodwill associated with the Company’s pressure pumping business, the write-down of equipment, and the impairment of certain oil and natural gas properties. The financial results for the twelve months ended December 31, 2014, include pretax non-cash charges totaling $98.8 million related to the retirement of mechanical rigs, the write-off of excess spare rig components, and the impairment of certain oil and natural gas properties.

The Company declared a quarterly dividend on its common stock of $0.10 per share, to be paid on March 24, 2016, to holders of record as of March 10, 2016.

All references to "net income per share" in this press release are diluted earnings per common share as defined within Accounting Standards Codification Topic 260.

The Company's quarterly conference call to discuss the operating results for the quarter ended December 31, 2015, is scheduled for today, February 4, 2016, at 9:00 a.m. Central Time. The dial-in information for participants is 866-372-0638 (Domestic) and 678-509-7533 (International). The Conference ID for both numbers is 76307856. The call is also being webcast and can be accessed through the Investor Relations section at www.patenergy.com. A replay of the conference call will be on the Company’s website for two weeks. A telephonic replay will be available through February 8, 2016, at 855-859-2056 (Domestic) and 404-537-3406 (International) with the Conference ID 76307856.

About Patterson-UTI

Patterson-UTI Energy, Inc. subsidiaries provide onshore contract drilling and pressure pumping services to exploration and production companies in North America. Patterson-UTI Drilling Company LLC and its subsidiaries operate land-based drilling rigs in oil and natural gas producing regions of the continental United States and western Canada. Universal Pressure Pumping, Inc. and Universal Well Services, Inc. provide pressure pumping services primarily in Texas and the Appalachian region.

Location information about the Company’s drilling rigs and their individual inventories is available through the Company’s website at www.patenergy.com.

Statements made in this press release which state the Company's or management's intentions, beliefs, expectations or predictions for the future are forward-looking statements. It is important to note that actual results could differ materially from those discussed in such forward-looking statements. Important factors that could cause actual results to differ materially include, but are not limited to, volatility in customer spending and in oil and natural gas prices, which could adversely affect demand for our services and their associated effect on rates, utilization, margins and planned capital expenditures; global economic conditions; excess availability of land drilling rigs and pressure pumping equipment, including as a result of low commodity prices, reactivation or construction; liabilities from operations; decline in, and ability to realize, backlog; equipment specialization and new technologies; adverse industry conditions; adverse credit and equity market conditions; difficulty in building and deploying new equipment; difficulty in integrating acquisitions; shortages, delays in delivery and interruptions of supply of equipment, supplies and materials; weather; loss of, or reduction in business with, key customers; legal proceedings; ability to effectively identify and enter new markets; governmental regulation; and ability to retain management and field personnel. Additional information concerning factors that could cause actual results to differ materially from those in the forward-looking statements is contained from time to time in the Company's SEC filings, which may be obtained by contacting the Company or the SEC. These filings are also available through the Company's web site at http://www.patenergy.com or through the SEC's Electronic Data Gathering and Analysis Retrieval System (EDGAR) at http://www.sec.gov. We undertake no obligation to publicly update or revise any forward-looking statement.

PATTERSON-UTI ENERGY, INC.

Condensed Consolidated Statements of Operations

(unaudited, in thousands, except per share data)

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

REVENUES |

|

$ |

338,566 |

|

|

$ |

901,219 |

|

|

$ |

1,891,277 |

|

|

$ |

3,182,291 |

|

|

COSTS AND EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct operating costs |

|

|

226,819 |

|

|

|

599,277 |

|

|

|

1,232,369 |

|

|

|

2,116,071 |

|

|

Depreciation, depletion, amortization and impairment |

|

|

175,302 |

|

|

|

180,157 |

|

|

|

864,759 |

|

|

|

718,730 |

|

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

124,561 |

|

|

|

— |

|

|

Selling, general and administrative |

|

|

16,578 |

|

|

|

22,028 |

|

|

|

87,173 |

|

|

|

80,145 |

|

|

Net gain on asset disposals |

|

|

(3,337 |

) |

|

|

(7,076 |

) |

|

|

(10,613 |

) |

|

|

(15,781 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total costs and expenses |

|

|

415,362 |

|

|

|

794,386 |

|

|

|

2,298,249 |

|

|

|

2,899,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING INCOME (LOSS) |

|

|

(76,796 |

) |

|

|

106,833 |

|

|

|

(406,972 |

) |

|

|

283,126 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME (EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

40 |

|

|

|

361 |

|

|

|

964 |

|

|

|

979 |

|

|

Interest expense |

|

|

(9,431 |

) |

|

|

(8,395 |

) |

|

|

(36,475 |

) |

|

|

(29,825 |

) |

|

Other |

|

|

18 |

|

|

|

— |

|

|

|

34 |

|

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total other expense |

|

|

(9,373 |

) |

|

|

(8,034 |

) |

|

|

(35,477 |

) |

|

|

(28,843 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INCOME (LOSS) BEFORE INCOME TAXES |

|

|

(86,169 |

) |

|

|

98,799 |

|

|

|

(442,449 |

) |

|

|

254,283 |

|

|

INCOME TAX EXPENSE (BENEFIT) |

|

|

(27,511 |

) |

|

|

41,216 |

|

|

|

(147,963 |

) |

|

|

91,619 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) |

|

$ |

(58,658 |

) |

|

$ |

57,583 |

|

|

$ |

(294,486 |

) |

|

$ |

162,664 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET INCOME (LOSS) PER COMMON SHARE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

(0.40 |

) |

|

$ |

0.39 |

|

|

$ |

(2.00 |

) |

|

$ |

1.12 |

|

|

Diluted |

|

$ |

(0.40 |

) |

|

$ |

0.39 |

|

|

$ |

(2.00 |

) |

|

$ |

1.11 |

|

|

WEIGHTED AVERAGE NUMBER OF COMMON

SHARES OUTSTANDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

145,709 |

|

|

|

144,922 |

|

|

|

145,416 |

|

|

|

144,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Diluted |

|

|

145,709 |

|

|

|

145,593 |

|

|

|

145,416 |

|

|

|

145,376 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH DIVIDENDS PER COMMON SHARE |

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.40 |

|

|

$ |

0.40 |

|

PATTERSON-UTI ENERGY, INC.

Additional Financial and Operating Data

(unaudited, dollars in thousands)

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Contract Drilling: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

202,276 |

|

|

$ |

492,132 |

|

|

$ |

1,153,892 |

|

|

$ |

1,838,830 |

|

|

Direct operating costs |

|

$ |

105,472 |

|

|

$ |

282,087 |

|

|

$ |

608,848 |

|

|

$ |

1,066,659 |

|

|

Margin (1) |

|

$ |

96,804 |

|

|

$ |

210,045 |

|

|

$ |

545,044 |

|

|

$ |

772,171 |

|

|

Selling, general and administrative |

|

$ |

1,123 |

|

|

$ |

1,845 |

|

|

$ |

17,840 |

|

|

$ |

6,297 |

|

|

Depreciation, amortization and impairment |

|

$ |

121,219 |

|

|

$ |

115,190 |

|

|

$ |

618,434 |

|

|

$ |

524,023 |

|

|

Operating income (loss) |

|

$ |

(25,538 |

) |

|

$ |

93,010 |

|

|

$ |

(91,230 |

) |

|

$ |

241,851 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating days – United States |

|

|

8,092 |

|

|

|

19,281 |

|

|

|

43,685 |

|

|

|

74,099 |

|

|

Operating days – Canada |

|

|

252 |

|

|

|

858 |

|

|

|

1,457 |

|

|

|

2,901 |

|

|

Operating days – Total |

|

|

8,344 |

|

|

|

20,139 |

|

|

|

45,142 |

|

|

|

77,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average revenue per operating day – United States |

|

$ |

24.14 |

|

|

$ |

24.22 |

|

|

$ |

25.55 |

|

|

$ |

23.64 |

|

|

Average direct operating costs per operating day – United States |

|

$ |

12.42 |

|

|

$ |

13.81 |

|

|

$ |

13.27 |

|

|

$ |

13.64 |

|

|

Average margin per operating day – United States (1) |

|

$ |

11.72 |

|

|

$ |

10.41 |

|

|

$ |

12.28 |

|

|

$ |

10.00 |

|

|

Average rigs operating – United States |

|

|

88 |

|

|

|

210 |

|

|

|

120 |

|

|

|

203 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average revenue per operating day – Canada |

|

$ |

27.45 |

|

|

$ |

29.35 |

|

|

$ |

25.75 |

|

|

$ |

30.16 |

|

|

Average direct operating costs per operating day – Canada |

|

$ |

19.75 |

|

|

$ |

18.46 |

|

|

$ |

19.98 |

|

|

$ |

19.37 |

|

|

Average margin per operating day – Canada (1) |

|

$ |

7.70 |

|

|

$ |

10.89 |

|

|

$ |

5.77 |

|

|

$ |

10.79 |

|

|

Average rigs operating – Canada |

|

|

3 |

|

|

|

9 |

|

|

|

4 |

|

|

|

8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average revenue per operating day – Total |

|

$ |

24.24 |

|

|

$ |

24.44 |

|

|

$ |

25.56 |

|

|

$ |

23.88 |

|

|

Average direct operating costs per operating day – Total |

|

$ |

12.64 |

|

|

$ |

14.01 |

|

|

$ |

13.49 |

|

|

$ |

13.85 |

|

|

Average margin per operating day – Total (1) |

|

$ |

11.60 |

|

|

$ |

10.43 |

|

|

$ |

12.07 |

|

|

$ |

10.03 |

|

|

Average rigs operating – Total |

|

|

91 |

|

|

|

219 |

|

|

|

124 |

|

|

|

211 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

104,178 |

|

|

$ |

224,984 |

|

|

$ |

527,054 |

|

|

$ |

771,593 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pressure Pumping: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

131,702 |

|

|

$ |

397,735 |

|

|

$ |

712,454 |

|

|

$ |

1,293,265 |

|

|

Direct operating costs |

|

$ |

117,943 |

|

|

$ |

313,509 |

|

|

$ |

612,021 |

|

|

$ |

1,036,310 |

|

|

Margin (2) |

|

$ |

13,759 |

|

|

$ |

84,226 |

|

|

$ |

100,433 |

|

|

$ |

256,955 |

|

|

Selling, general and administrative |

|

$ |

2,855 |

|

|

$ |

5,463 |

|

|

$ |

16,318 |

|

|

$ |

20,279 |

|

|

Depreciation, amortization and impairment |

|

$ |

48,678 |

|

|

$ |

41,343 |

|

|

$ |

214,552 |

|

|

$ |

147,595 |

|

|

Impairment of goodwill |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

124,561 |

|

|

$ |

— |

|

|

Operating income (loss) |

|

$ |

(37,774 |

) |

|

$ |

37,420 |

|

|

$ |

(254,998 |

) |

|

$ |

89,081 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fracturing jobs |

|

|

109 |

|

|

|

352 |

|

|

|

610 |

|

|

|

1,224 |

|

|

Other jobs |

|

|

410 |

|

|

|

1,087 |

|

|

|

2,080 |

|

|

|

4,253 |

|

|

Total jobs |

|

|

519 |

|

|

|

1,439 |

|

|

|

2,690 |

|

|

|

5,477 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Average revenue per fracturing job |

|

$ |

1,162.70 |

|

|

$ |

1,069.53 |

|

|

$ |

1,117.95 |

|

|

$ |

991.89 |

|

|

Average revenue per other job |

|

$ |

12.12 |

|

|

$ |

19.56 |

|

|

$ |

14.66 |

|

|

$ |

18.62 |

|

|

Average revenue per total job |

|

$ |

253.76 |

|

|

$ |

276.40 |

|

|

$ |

264.85 |

|

|

$ |

236.13 |

|

|

Average costs per total job |

|

$ |

227.25 |

|

|

$ |

217.87 |

|

|

$ |

227.52 |

|

|

$ |

189.21 |

|

|

Average margin per total job (2) |

|

$ |

26.51 |

|

|

$ |

58.53 |

|

|

$ |

37.34 |

|

|

$ |

46.92 |

|

|

Margin as a percentage of revenues (2) |

|

|

10.4 |

% |

|

|

21.2 |

% |

|

|

14.1 |

% |

|

|

19.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures and acquisitions |

|

$ |

28,349 |

|

|

$ |

79,257 |

|

|

$ |

197,577 |

|

|

$ |

241,359 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and Natural Gas Production and Exploration: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues – Oil |

|

$ |

4,085 |

|

|

$ |

10,059 |

|

|

$ |

22,318 |

|

|

$ |

44,436 |

|

|

Revenues – Natural gas and liquids |

|

$ |

503 |

|

|

$ |

1,293 |

|

|

$ |

2,613 |

|

|

$ |

5,760 |

|

|

Revenues – Total |

|

$ |

4,588 |

|

|

$ |

11,352 |

|

|

$ |

24,931 |

|

|

$ |

50,196 |

|

|

Direct operating costs |

|

$ |

3,404 |

|

|

$ |

3,681 |

|

|

$ |

11,500 |

|

|

$ |

13,102 |

|

|

Margin (3) |

|

$ |

1,184 |

|

|

$ |

7,671 |

|

|

$ |

13,431 |

|

|

$ |

37,094 |

|

|

Depletion |

|

$ |

2,632 |

|

|

$ |

5,671 |

|

|

$ |

15,573 |

|

|

$ |

21,697 |

|

|

Impairment of oil and natural gas properties |

|

$ |

1,405 |

|

|

$ |

16,819 |

|

|

$ |

10,728 |

|

|

$ |

20,879 |

|

|

Operating income (loss) |

|

$ |

(2,853 |

) |

|

$ |

(14,819 |

) |

|

$ |

(12,870 |

) |

|

$ |

(5,482 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

2,531 |

|

|

$ |

9,768 |

|

|

$ |

16,625 |

|

|

$ |

36,683 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate and Other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative |

|

$ |

12,600 |

|

|

$ |

14,720 |

|

|

$ |

53,015 |

|

|

$ |

53,569 |

|

|

Depreciation |

|

$ |

1,368 |

|

|

$ |

1,134 |

|

|

$ |

5,472 |

|

|

$ |

4,536 |

|

|

Net gain on asset disposals |

|

$ |

(3,337 |

) |

|

$ |

(7,076 |

) |

|

$ |

(10,613 |

) |

|

$ |

(15,781 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital expenditures |

|

$ |

498 |

|

|

$ |

542 |

|

|

$ |

2,520 |

|

|

$ |

2,706 |

|

|

Total capital expenditures |

|

$ |

135,556 |

|

|

$ |

314,551 |

|

|

$ |

743,776 |

|

|

$ |

1,052,341 |

|

|

|

(1) |

For Contract Drilling, margin is defined as revenues less direct operating costs and excludes depreciation, amortization and impairment and selling, general and administrative expenses. Average margin per operating day is defined as margin divided by operating days. |

|

|

(2) |

For Pressure Pumping, margin is defined as revenues less direct operating costs and excludes depreciation, amortization and impairment and selling, general and administrative expenses. Total average margin per job is defined as margin divided by total jobs. Margin as a percentage of revenues is defined as margin divided by revenues. |

|

|

(3) |

For Oil and Natural Gas Production and Exploration, margin is defined as revenues less direct operating costs and excludes depletion and impairment. |

|

|

|

December 31, |

|

|

December 31, |

|

|

Selected Balance Sheet Data (unaudited, dollars in thousands): |

|

2015 |

|

|

2014 |

|

|

Cash and cash equivalents |

|

$ |

113,346 |

|

|

$ |

43,012 |

|

|

Current assets |

|

$ |

486,536 |

|

|

$ |

909,092 |

|

|

Current liabilities |

|

$ |

308,132 |

|

|

$ |

568,404 |

|

|

Working capital |

|

$ |

178,404 |

|

|

$ |

340,688 |

|

|

Current portion of long-term debt |

|

$ |

63,750 |

|

|

$ |

12,500 |

|

|

Borrowings under revolving credit facility |

|

$ |

— |

|

|

$ |

303,000 |

|

|

Other long-term debt |

|

$ |

791,250 |

|

|

$ |

670,000 |

|

PATTERSON-UTI ENERGY, INC.

Non-U.S. GAAP Financial Measures

(unaudited, dollars in thousands)

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

|

December 31, |

|

|

December 31, |

|

|

|

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

|

Adjusted Earnings Before Interest, Taxes, Depreciation

and Amortization (Adjusted EBITDA)(1): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

(58,658 |

) |

|

$ |

57,583 |

|

|

$ |

(294,486 |

) |

|

$ |

162,664 |

|

|

Income tax expense (benefit) |

|

|

(27,511 |

) |

|

|

41,216 |

|

|

|

(147,963 |

) |

|

|

91,619 |

|

|

Net interest expense |

|

|

9,391 |

|

|

|

8,034 |

|

|

|

35,511 |

|

|

|

28,846 |

|

|

Depreciation, depletion, amortization and impairment |

|

|

175,302 |

|

|

|

180,157 |

|

|

|

864,759 |

|

|

|

718,730 |

|

|

Impairment of goodwill |

|

|

— |

|

|

|

— |

|

|

|

124,561 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA |

|

$ |

98,524 |

|

|

$ |

286,990 |

|

|

$ |

582,382 |

|

|

$ |

1,001,859 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenue |

|

$ |

338,566 |

|

|

$ |

901,219 |

|

|

$ |

1,891,277 |

|

|

$ |

3,182,291 |

|

|

Adjusted EBITDA margin |

|

|

29.1 |

% |

|

|

31.8 |

% |

|

|

30.8 |

% |

|

|

31.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA by operating segment: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract drilling |

|

$ |

95,681 |

|

|

$ |

208,200 |

|

|

$ |

527,204 |

|

|

$ |

765,874 |

|

|

Pressure pumping |

|

|

10,904 |

|

|

|

78,763 |

|

|

|

84,115 |

|

|

|

236,676 |

|

|

Oil and natural gas |

|

|

1,184 |

|

|

|

7,671 |

|

|

|

13,431 |

|

|

|

37,094 |

|

|

Corporate and other |

|

|

(9,245 |

) |

|

|

(7,644 |

) |

|

|

(42,368 |

) |

|

|

(37,785 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Adjusted EBITDA |

|

$ |

98,524 |

|

|

$ |

286,990 |

|

|

$ |

582,382 |

|

|

$ |

1,001,859 |

|

|

|

(1) |

Adjusted EBITDA is not defined by accounting principles generally accepted in the United States of America (“U.S. GAAP”). We present Adjusted EBITDA (a non-U.S. GAAP measure) because we believe it provides additional information with respect to both the performance of our fundamental business activities and our ability to meet our capital expenditures and working capital requirements. Adjusted EBITDA should not be construed as an alternative to the U.S. GAAP measures of net income (loss) or operating cash flow. |

PATTERSON-UTI ENERGY, INC.

Impact of Early Termination Revenues

(unaudited, dollars in thousands)

|

|

|

2015 |

|

|

|

|

Fourth |

|

|

Third |

|

|

|

|

Quarter |

|

|

Quarter |

|

|

Contract drilling revenues |

|

$ |

202,276 |

|

|

$ |

261,817 |

|

|

Operating days - Total |

|

|

8,344 |

|

|

|

10,067 |

|

|

Average revenue per operating day - Total |

|

$ |

24.24 |

|

|

$ |

26.01 |

|

|

Early termination revenues - Total |

|

$ |

9,173 |

|

|

$ |

28,869 |

|

|

Early termination revenues per operating day - Total |

|

$ |

1.10 |

|

|

$ |

2.87 |

|

|

Average revenue per operating day excluding early termination revenues - Total |

|

$ |

23.14 |

|

|

$ |

23.14 |

|

|

Direct operating costs - Total |

|

$ |

105,472 |

|

|

$ |

136,718 |

|

|

Average direct operating costs per operating day - Total |

|

$ |

12.64 |

|

|

$ |

13.58 |

|

|

Average margin per operating day excluding early termination revenues - Total |

|

$ |

10.50 |

|

|

$ |

9.56 |

|

PATTERSON-UTI ENERGY, INC.

Pressure Pumping Margin and Adjusted EBITDA

(unaudited, dollars in thousands)

|

|

|

2015 |

|

|

|

|

Fourth |

|

|

Third |

|

|

|

|

Quarter |

|

|

Quarter |

|

|

|

|

|

|

|

|

|

|

|

|

Pressure pumping revenues |

|

$ |

131,702 |

|

|

$ |

154,407 |

|

|

Direct operating costs |

|

|

117,943 |

|

|

|

138,597 |

|

|

Margin |

|

|

13,759 |

|

|

|

15,810 |

|

|

Selling, general and administrative |

|

|

2,855 |

|

|

|

4,019 |

|

|

Adjusted EBITDA |

|

$ |

10,904 |

|

|

$ |

11,791 |

|

|

Margin as a percentage of revenues |

|

|

10.4 |

% |

|

|

10.2 |

% |

PATTERSON-UTI ENERGY, INC.

Pretax Charges

(unaudited, dollars in thousands)

|

|

|

Twelve Months Ended |

|

|

|

|

December 31, |

|

|

|

|

2015 |

|

|

2014 |

|

|

Impairment of goodwill |

|

$ |

124,561 |

|

|

$ |

— |

|

|

Write-down of drilling equipment |

|

|

131,062 |

|

|

|

77,879 |

|

|

Write-down of pressure pumping equipment and closed facilities |

|

|

22,048 |

|

|

|

— |

|

|

Impairment of oil and natural gas properties |

|

|

10,728 |

|

|

|

20,879 |

|

|

Total non-cash pretax charges |

|

|

288,399 |

|

|

|

98,758 |

|

|

Legal settlement |

|

|

12,260 |

|

|

|

— |

|

|

Total pretax charges |

|

$ |

300,659 |

|

|

$ |

98,758 |

|

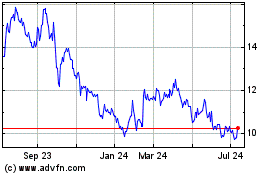

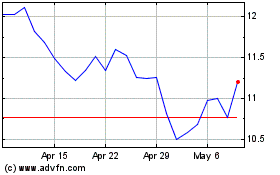

Patterson UTI Energy (NASDAQ:PTEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Patterson UTI Energy (NASDAQ:PTEN)

Historical Stock Chart

From Apr 2023 to Apr 2024