Penn National Gaming, Inc. Announces Expiration & Results of Its Previously Announced Tender Offer for Its 5.875% Senior Note...

January 18 2017 - 7:45PM

Business Wire

Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn”) announced

today the expiration of its previously announced tender offer for

any and all of the $300 million aggregate outstanding principal

amount of its 5.875% senior notes due 2021 (CUSIP No. 707569 AR0).

The tender offer was made pursuant to the terms and conditions set

forth in the offer to purchase dated January 6, 2017, and the

related letter of transmittal and notice of guaranteed delivery

(collectively, the “Tender Offer Documents”).

The tender offer expired at 5:00 p.m. New York City time on

January 18, 2017 (the “Expiration Date”). As of the Expiration

Date, $148,749,000 million aggregate principal amount of notes,

representing approximately 49.6% of the aggregate principal amount

of notes outstanding, had been validly tendered, and not validly

withdrawn. These amounts include $9,173,000 aggregate principal

amount of notes tendered pursuant to the guaranteed delivery

procedures described in the Tender Offer Documents, which remain

subject to the holder’s performance of the delivery requirements

under such procedures. Subject to the terms of and the satisfaction

of the conditions to the tender offer, including the financing

condition described therein, Penn expects to accept for purchase on

January 19, 2017 all notes validly tendered and not validly

withdrawn at or prior to the Expiration Date, subject, in the case

of notes tendered pursuant to the guaranteed delivery procedures

described in the Tender Offer Documents, to the holder’s

performance of the delivery requirements under such procedures. The

settlement date (other than for notes tendered pursuant to

guaranteed delivery procedures) is expected to be January 19, 2017,

and the settlement date for notes tendered pursuant to guaranteed

delivery procedures is expected to be January 23, 2017.

It is Penn’s current intention to effect the satisfaction and

discharge of the indenture governing the notes concurrently with or

following the settlement date and to redeem on the redemption date

any notes that are not tendered and accepted for purchase pursuant

to the tender offer, assuming the satisfaction of the financing

condition and the other conditions to such redemption. Any

redemption would be made solely pursuant to the notice of

redemption, including the conditions set forth therein, delivered

pursuant to the indenture governing the notes, and the information

in this press release is qualified in its entirety by such

notice.

If the financing condition or any of the other conditions to the

tender offer are not satisfied, Penn is not obligated to accept for

purchase or pay for, and may delay the acceptance for purchase of,

any tendered notes and may terminate the tender offer. In addition,

if the financing condition is not satisfied, Penn is not obligated

to redeem any of the notes and may revoke the conditional

redemption notice.

This press release is for informational purposes only and does

not constitute a notice of redemption under the optional redemption

provisions of the indenture governing the notes, nor does it

constitute an offer or solicitation to sell or buy any security. No

such offer or solicitation will be made in any jurisdiction in

which such offer or solicitation would be unlawful

About Penn National Gaming

Penn is a leading, diversified, multi-jurisdictional owner and

manager of gaming and racing facilities and video gaming terminal

(“VGT”) operations. Penn has also recently expanded into social

online gaming offerings via its Penn Interactive Ventures, LLC

division and Penn’s recent acquisition of Rocket Speed, Inc.

(formerly known as Rocket Games, Inc. (“Rocket Speed”)). Penn

currently owns, manages, or has ownership interests in twenty-seven

facilities in the following seventeen jurisdictions: California,

Florida, Illinois, Indiana, Kansas, Maine, Massachusetts,

Mississippi, Missouri, Nevada, New Jersey, New Mexico, Ohio,

Pennsylvania, Texas, West Virginia, and Ontario, Canada.

Forward-Looking Statements

This press release and the documents referred to herein include

“forward looking statements,” including statements about the tender

offer and the acceptance for purchase of any tendered notes, the

conditional redemption, the satisfaction and discharge of the

indenture governing the notes and the satisfaction of the financing

and other conditions to the tender offer and the redemption. These

statements can be identified by the use of forward looking

terminology such as “expects,” “believes,” “estimates,” “projects,”

“intends,” “plans,” “seeks,” “may,” “will,” “should” or

“anticipates” or the negative or other variation of these or

similar words, or by discussions of future events, strategies or

risks and uncertainties. Actual results may vary materially from

expectations. Although Penn believes that its expectations are

based on reasonable assumptions, within the bounds of its knowledge

of its business, there can be no assurance that actual results will

not differ materially from Penn’s expectations, and accordingly,

Penn’s forward looking statements are qualified in their entirety

by reference to the factors described in the Penn’s Annual Report

on Form 10-K for the year ended December 31, 2015, subsequent

Quarterly Reports on Form 10-Q and Current Reports on Form 8-K as

filed with the Securities and Exchange Commission (the “SEC”).

Meaningful factors that could cause actual results to differ

materially from the forward looking statements include, without

limitation, risks related to the satisfaction of the financing

condition or the other conditions to the tender offer ; and other

factors discussed in Penn’s filings with the SEC. All subsequent

written and oral forward looking statements attributable to Penn or

persons acting on Penn’s behalf are expressly qualified in their

entirety by the cautionary statements included in this press

release. Penn undertakes no obligation to publicly update or revise

any forward looking statements contained or incorporated by

reference herein, whether as a result of new information, future

events or otherwise, except as required by law. In light of these

risks, uncertainties and assumptions, the forward looking events

discussed in this press release may not occur.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170118006390/en/

Penn National Gaming, Inc.William J. Fair, 610-373-2400Chief

Financial OfficerorJCIRJoseph N. Jaffoni, Richard

Land212-835-8500penn@jcir.com

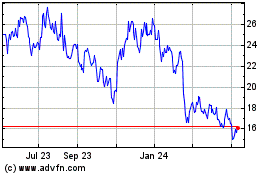

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

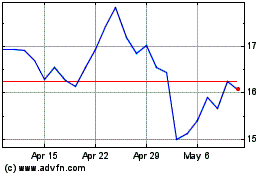

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024