- Establishes 2016 Second Quarter Guidance

and Updates 2016 Full Year Guidance -

Penn National Gaming, Inc. (PENN: Nasdaq):

Conference Call:

Today, April 28, 2016 at 9:00 a.m.

ET

Dial-in number:

212/231-2929

Webcast:

www.pngaming.com

Replay information provided

below

Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National

Gaming,” “Penn National,” “Penn,” or the “Company”) today reported

operating results for the three months ended March 31, 2016, as

summarized below.

Summary of First Quarter

Results

(in millions, except per share data)

Three Months Ended March

31,

2016 Actual 2016 Guidance (2)

2015 Actual Net revenues $ 756.5 $ 756.9 $ 664.1

Adjusted EBITDA (1) 212.9 203.1 184.4

Less: Impact of stock compensation,

non-operating items forKansas JV, depreciation and amortization,

changes in the estimatedfair value of contingent purchase price,

gain/loss on disposalof assets, interest expense - net, income

taxes, and other expenses

(189.2) (191.0) (182.5)

Net income $

23.7 $ 12.1 $ 1.9

Diluted earnings

per common share $ 0.26 $ 0.13 $ 0.02 (1)

Adjusted EBITDA is income (loss) from operations, excluding the

impact of stock compensation, impairment charges, insurance

recoveries and deductible charges, depreciation and amortization,

changes in the estimated fair value of the contingent purchase

price payable to the previous owners of Plainridge Racecourse and

gain or loss on disposal of assets. Adjusted EBITDA is also

inclusive of income or loss from unconsolidated affiliates, with

our share of the non-operating items added back for our joint

venture in Kansas Entertainment, LLC (“Kansas Entertainment” or

“Kansas JV”). Adjusted EBITDA excludes payments pursuant to the

Company’s Master Lease (the “Master Lease”) with Gaming and Leisure

Properties, Inc. (“GLPI”), as the transaction was accounted for as

a financing obligation. Payments to GLPI totaled $111.4 million and

$108.8 million for the three months ended March 31, 2016 and 2015,

respectively. (2) The guidance figures in the table above

present the guidance Penn National Gaming provided on February 4,

2016 for the three months ended March 31, 2016.

Review of First Quarter 2016 Results

vs. Guidance

Three Months Ended March 31,

2016 Pre-tax After-tax (in thousands)

(unaudited) Income, per guidance (1) $ 21,280 $ 12,130

Adjusted EBITDA variances: Positive operating segment

variance 8,680 5,294 Favorable litigation settlement for Joliet and

Aurora 667 422 Other 477 304 Total Adjusted EBITDA

variances from guidance 9,824 6,020 Gain on sale of Raceway

Park assets 1,099 695 Contingent purchase price variance 1,479 942

Foreign currency translation losses (2,426) (1,546) Other 186 113

Tax variance - 5,354 Income, as reported $ 31,442 $

23,708 (1) The guidance figure in the table above

presents the guidance Penn National Gaming provided on February 4,

2016 for the three months ended March 31, 2016.

Timothy J. Wilmott, President and Chief Executive Officer,

commented, “The 15.5% year-over-year increase in 2016 first quarter

adjusted EBITDA to $212.9 million, exceeded guidance based on our

continued progress in driving operating efficiencies and margins

combined with meaningful contributions from our expansion

initiatives over the last year, including Plainridge Park Casino,

Tropicana Las Vegas and Prairie State Gaming. Notably, first

quarter adjusted EBITDA exceeded guidance by 4.3% even after

excluding the favorable litigation settlements and other positive

non-operating adjusted EBITDA variances.

“Adjusted EBITDA margin growth in the East/Midwest segment

reflects year-over-year revenue and adjusted EBITDA improvements at

all four of our Ohio properties, which continue to ramp, and led to

an overall 15.7% increase in this segment’s adjusted EBITDA. The

12.2% increase in our West segment adjusted EBITDA reflects the

contribution from last August’s acquisition of Tropicana Las Vegas.

Our Southern Plains segment delivered a 6.7% year-over-year

increase in first quarter adjusted EBITDA as margin strength across

our casinos in this segment were offset by the lower margin Prairie

State Gaming video gaming terminal operations which were acquired

last September. On an overall basis, Penn National’s ongoing

execution of strategies to improve operating efficiencies drove

consolidated first quarter 2016 adjusted EBITDA margin growth of

approximately 58 basis points on a year-over-year basis to 32.0%,

excluding the favorable property litigation settlements and the

impact of the lower margin Tropicana Las Vegas and Prairie State

Gaming operations. Notably, on a same facility basis, all three

operating segments delivered year-over-year improvements in

adjusted EBITDA margins.

“Since acquiring Tropicana Las Vegas for $360 million, we’ve

reconfigured the gaming floor with updated slots, altered game

placements and refined the table game mix. In addition, earlier

this month, we launched Sky Beach Day Club, the property’s outdoor

day club at the pool. Our initial facility enhancements and

operational improvements have already strengthened the property’s

results and we are now focused on improving the food and beverage

offerings at the property.

“With the recent introduction of Marquee Rewards at the

Tropicana Las Vegas, we have begun marketing the property to our

database of nearly three million active regional gaming customers,

a significant percentage of which regularly visit Las Vegas. We

expect that over time, this transition will enable us to attract

new and more profitable customer segments to Tropicana Las Vegas.

In addition, the property is poised to benefit from the improving

Las Vegas economic environment, including the new attractions and

activity on the south end of the Strip, such as the new 20,000-seat

capacity arena that opened earlier this month. Longer-term, we

continue to evaluate additional non-gaming amenities and other

potential enhancements, with the scope, budget and timing of any

such improvements to be based upon property results as well as

customer demand.

“One of Penn National’s key growth catalysts this year is the

mid-summer opening of the $390 million Hollywood Casino Jamul-San

Diego, for which we are acting as developer, manager and lender.

The property is a spectacular three-story gaming and entertainment

facility, with the region’s most convenient access to the local

downtown San Diego population. Hollywood Casino Jamul-San Diego

will open with more than 1,700 slot machines, 43 live table games,

an upscale lounge featuring national and regional entertainment, a

beer garden, a broad range of dining amenities including a

four-venue food court and Tony Gwynn’s Sports Pub, and an

eight-story partially subterranean parking garage with over 1,800

parking spaces. Earlier this month, the County of San Diego Board

of Supervisors approved a Memorandum of Understanding between the

County and the Jamul Indian Village, which, along with a Fire

Services Agreement, provides funding to the County for fire and

public safety services, and for County roadway improvements.

Throughout the first quarter we continued to pursue third party

financing for the Jamul Indian Village note and remain confident in

the overall economics of this project and prospects for permanent

financing at a time that is optimal for both the Jamul Indian

Village and Penn National.

“We also continue to advance our initiatives in social gaming,

which represent emerging growth platforms that complement our

expanding regional gaming portfolio. Last week we announced the

launch of our new mobile social casino game, Hollywood Slots, which

features exclusive content incorporating entertaining elements of

Penn National’s popular Hollywood brand. The launch of Hollywood

Slots further expands Penn National’s presence in the social casino

marketplace, providing players with an outstanding suite of mobile

games which we expect to generate incremental revenue as well as

increase customer engagement through anytime, anywhere social

casino games available for any screen.

“In addition, we are encouraged by the results being achieved by

the deployment of Scientific Games’ Play4Fun platform,

HollywoodCasino.com. Since its launch during the third quarter of

2015, this offering has begun to generate revenues, enhance our

customer data base analytics and has been rolled out across all of

our gaming properties as we seek to address the significant portion

of our database members that already participate in social and

online gaming.

“Our first quarter results mark a strong start to 2016 and with

regional gaming trends remaining solid, we are confident in our

prospects for continued growth this year based on the

macro-economic environment, the abilities of our operating teams to

drive improved adjusted EBITDA margins from existing properties,

the mid-summer opening of Hollywood Casino Jamul-San Diego, and the

ongoing ramp of our recently opened or acquired operations in Ohio,

Massachusetts, Nevada and Illinois.”

Development and Expansion

Projects

The table below summarizes Penn

National Gaming’s ongoing development project:

Project/Scope

NewGamingPositions

Planned Total

Budget

Amount Expendedthrough

March31, 2016

Expected Opening

Date

(in millions) (unaudited)

Jamul Indian Village project (CA) -

Construction continues at the site for thisnew Hollywood Casino

branded gaming operation which Penn will manage.The facility is

anticipated to feature over 1,700 slot machines, 43 live tablegames

including poker, multiple restaurants, bars and lounges.

1,958 $390 (1) $209.9 (1) mid-summer 2016 (1) As

disclosed previously, funds advanced for this project are accounted

for as a loan. The budget and expended amounts exclude the purchase

of a $60 million subordinated promissory note from the previous

developer of the project during the fourth quarter of 2015 for $24

million.

Financial Guidance

Reflecting the current operating and competitive environment,

the table below sets forth 2016 second quarter and full year

guidance targets for financial results based on the following

assumptions:

- A mid-summer opening of Hollywood

Casino Jamul-San Diego and no third party financing obtained for

the facility during 2016;

- MGM National Harbor opens in the fourth

quarter of 2016 impacting Hollywood Casino at Charlestown

Races;

- A full year contribution from the

Company’s management contract for Casino Rama;

- Full year corporate overhead expenses

of $81.5 million, with $20.2 million to be incurred in the second

quarter of 2016;

- Depreciation and amortization charges

in 2016 of $267.5 million, with $67.3 million in the second quarter

of 2016, which includes depreciation expense related to real

property leased from GLPI;

- Payments to GLPI of $445.4 million in

2016, with $111.8 million in the second quarter of 2016, which will

reduce our March 31, 2016 financing obligation by $13.0 million at

June 30, 2016 and $37.9 million at December 31, 2016, respectively,

with the remaining payments recorded as interest expense.

- Our rent coverage ratio for year three

of the Master Lease at March 31, 2016 is 1.80 and we expect to

incur the maximum rent escalation of $5.1 million at October 31,

2016, which is the conclusion of year three of the Master Lease, of

which $0.9 million will be incurred in 2016 and is reflected within

interest expense;

- Interest expense in 2016 of $466.9

million, with $115.9 million in the second quarter of 2016, which

includes the interest expense related to the Master Lease financing

obligation with GLPI;

- Non-cash accrued interest income on the

loan to the Jamul Tribe of $11.5 million, with $6.5 million accrued

in the second quarter of 2016;

- Our share of non-operating items (such

as depreciation and amortization expense) associated with our

Kansas JV will total $10.3 million for 2016, with $2.6 million to

be incurred in the second quarter of 2016;

- Estimated non-cash stock compensation

expenses of $7.6 million for 2016, with $2.0 million to be incurred

in the second quarter of 2016;

- LIBOR is based on the forward yield

curve;

- A diluted share count of approximately

91.9 million shares for the full year 2016; and

- There will be no material changes in

applicable legislation, regulatory environment, world events,

weather, recent consumer trends, economic conditions, oil prices,

competitive landscape (other than listed above) or other

circumstances beyond our control that may adversely affect the

Company’s results of operations.

(in millions, except per share data) Three

Months Ending June 30, Full Year Ending December 31,

2016 Guidance 2015 Actual

2016 RevisedGuidance

2016 PriorGuidance (1)

2015 Actual Net revenues $ 786.8 $ 701.0 $

3,053.5 $ 3,053.9 $ 2,838.4

Adjusted EBITDA 225.5

195.4 851.0 841.2 796.3

Less: Impact of stock compensation,

impairment charges,insurance recoveries, non-operating items for

Kansas JV,depreciation and amortization, changes in the estimated

fair valueof contingent purchase price, gain/loss on disposal of

assets,interest expense - net, income taxes, and other expenses

(200.4) (192.4) (771.0) (771.4)

(795.6)

Net income (loss) $ 25.1 $ 3.0 $ 80.0 $ 69.8 $ 0.7

Diluted earnings

(loss) per common share $ 0.27 $ 0.03 $ 0.87 $ 0.76 $ 0.01

(1) The guidance figures in the table above present

the guidance Penn National Gaming provided on February 4, 2016 for

the full year ended December 31, 2016.

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIESSegment Information – Operations(in thousands)

(unaudited)

NET REVENUES ADJUSTED EBITDA Three

Months Ended March 31, Three Months Ended March 31,

2016 2015 2016 2015

East/Midwest (1) $ 437,457 $ 386,544 $ 134,798 $ 116,477 West (2)

87,559 62,585 20,055 17,879 Southern Plains (3) 225,235 210,269

77,694 72,806 Other (4) 6,200 4,740 (19,664)

(22,783)

Total $ 756,451 $

664,138 $ 212,883 $ 184,379

(1) The East/Midwest reportable segment consists of

the following properties: Hollywood Casino at Charles Town Races,

Hollywood Casino Bangor, Hollywood Casino at Penn National Race

Course, Hollywood Casino Lawrenceburg, Hollywood Casino Toledo,

Hollywood Casino Columbus, Hollywood Gaming at Dayton Raceway,

Hollywood Gaming at Mahoning Valley Race Course, and Plainridge

Park Casino, which opened on June 24, 2015. It also includes the

Company’s Casino Rama management service contract. Our East/Midwest

segment results for the three months ended March 31, 2015 included

preopening costs of $2.5 million, partially offset by a property

tax refund of approximately $2.0 million. (2) The West

reportable segment consists of the following properties: Zia Park

Casino, the M Resort and Tropicana Las Vegas, which was acquired on

August 25, 2015, as well as the Jamul Indian Village project, which

the Company anticipates completing mid-summer of 2016. (3)

The Southern Plains reportable segment consists of the following

properties: Hollywood Casino Aurora, Hollywood Casino Joliet,

Argosy Casino Alton, Argosy Casino Riverside, Hollywood Casino

Tunica, Hollywood Casino Gulf Coast, Boomtown Biloxi, and Hollywood

Casino St. Louis and Prairie State Gaming, which was acquired on

September 1, 2015, and includes the Company’s 50% investment in

Kansas Entertainment, which owns the Hollywood Casino at Kansas

Speedway. (4) The Other category consists of the Company’s

standalone racing operations, namely Rosecroft Raceway,

Sanford-Orlando Kennel Club, and the Company’s joint venture

interests in Sam Houston Race Park, Valley Race Park, and Freehold

Raceway. If the Company is successful in obtaining gaming

operations at these locations, they would be assigned to one of the

Company’s regional executives and reported in their respective

reportable segment. The Other category also includes Penn

Interactive Ventures, the Company’s interactive division which

represents Penn’s social gaming initiatives. The Other

category also includes the Company’s corporate overhead costs,

which were $20.6 million for the three months ended March 31, 2016,

as compared to corporate overhead costs of $23.2 million for the

three months ended March 31, 2015. Corporate overhead costs

included cash-settled stock-based compensation charges of $4.9

million for the three months ended March 31, 2016 compared to $9.0

million for the corresponding period in the prior year. Results for

the first quarter of 2016 also included severance costs of $0.5

million.

The Company recently announced a realignment of its reporting

structure that will result in certain changes to our reportable

segments. We plan to finalize these changes to our internal

management reporting system in the second quarter which will result

in the following three geographic regions: Northeast, Midwest and

South/West. Therefore, we anticipate providing supplemental

disclosures that will restate our historical segment information

for each quarter in 2014 and 2015 as well as the first quarter of

2016 in the first quarter Form 10-Q to conform to our new

structure. The changes in the segment reporting will have no effect

on the Company’s previously reported consolidated operating

results.

Reconciliation of Net income (GAAP) to

Adjusted EBITDA

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIES(in thousands) (unaudited)

Three Months Ended March 31, 2016

2015 Net income $ 23,708

$ 1,869 Income tax provision 7,734 10,415 Other 2,426

(3,089) Income from unconsolidated affiliates (4,609) (3,982)

Interest income (5,240) (1,870) Interest expense 116,512

108,346

Income from operations $

140,531 $ 111,689 (Gain) loss on disposal of

assets (1,101) 153 Charge for stock compensation 1,455 2,084

Contingent purchase price (1,201) 351 Depreciation and amortization

66,020 63,369 Income from unconsolidated affiliates 4,609 3,982

Non-operating items for Kansas JV 2,570 2,751

Adjusted EBITDA $ 212,883 $

184,379

Reconciliation of Income (loss) from

operations (GAAP) to Adjusted EBITDA

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIESSegment Information(in thousands) (unaudited)

Three Months Ended March 31,

2016

East/Midwest West

Southern Plains Other Total Income (loss) from

operations $ 111,140 $ 13,833 $ 60,158 $ (44,600)

$

140,531 Charge for stock compensation - - - 1,455

1,455 Depreciation and amortization 24,840 6,205 10,281

24,694

66,020 Contingent purchase price (1,201) - - -

(1,201) Loss (gain) on disposal of assets 19 17 (33) (1,104)

(1,101) Income from unconsolidated affiliates - - 4,718

(109)

4,609 Non-operating items for Kansas JV (1) -

- 2,570 -

2,570 Adjusted

EBITDA $ 134,798 $ 20,055 $

77,694 $ (19,664) $ 212,883

Three Months Ended March 31,

2015

East/Midwest West Southern Plains

Other Total Income (loss) from operations $ 90,863 $

15,526 $ 55,385 $ (50,085)

$ 111,689 Charge for stock

compensation - - - 2,084

2,084 Depreciation and amortization

25,385 2,172 10,782 25,030

63,369 Contigent purchase price

351 - - -

351 (Gain) loss on disposal of assets (122) 181

100 (6)

153 Income from unconsolidated affiliates - - 3,788

194

3,982 Non-operating items for Kansas JV (1) -

- 2,751 -

2,751 Adjusted

EBITDA $ 116,477 $ 17,879 $

72,806 $ (22,783) $ 184,379

(1) Adjusted EBITDA excludes our share of the impact

of non-operating items (such as depreciation and amortization) from

our joint venture in Kansas Entertainment.

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIESConsolidated Statements of Operations(in thousands,

except per share data) (unaudited)

Three Months Ended March 31, 2016

2015 Revenues Gaming $ 656,701 $

591,336 Food, beverage, hotel and other 137,848 108,763 Management

service fee 2,473 1,927 Revenues 797,022 702,026 Less

promotional allowances (40,571) (37,888) Net revenues

756,451 664,138

Operating expenses

Gaming 335,317 294,895 Food, beverage, hotel and other 98,079

77,929 General and administrative 116,504 116,256 Depreciation and

amortization 66,020 63,369 Total operating expenses

615,920 552,449 Income from operations 140,531

111,689

Other income (expenses) Interest

expense (116,512) (108,346) Interest income 5,240 1,870 Income from

unconsolidated affiliates 4,609 3,982 Other (2,426)

3,089 Total other expenses (109,089) (99,405)

Income from operations before income taxes 31,442 12,284

Income tax provision 7,734 10,415

Net income $

23,708 $ 1,869

Earnings per common share: Basic

earnings per common share $ 0.26 $ 0.02 Diluted earnings per common

share $ 0.26 $ 0.02

Weighted-average common shares

outstanding: Basic 80,968 79,400 Diluted 91,091 90,392

PENN NATIONAL GAMING, INC. AND

SUBSIDIARIESSupplemental information(in thousands)

(unaudited)

March 31, 2016 December 31, 2015

Cash and cash equivalents $ 214,238 $ 237,009 Bank

Debt $ 1,230,031 $ 1,239,049 Notes 296,413 296,252 Other long term

obligations (1) 167,968 175,658 Total Debt (2) $

1,694,412 $ 1,710,959 Financing obligation with GLPI (3) $

3,551,981 $ 3,564,629 1) Other long term obligations

at March 31, 2016 include $125.3 million for the present value of

the relocation fees due for both Hollywood Gaming at Dayton Raceway

and Hollywood Gaming at Mahoning Valley Race Course, $14.4 million

related to our repayment obligation on a hotel and event center

located near Hollywood Casino Lawrenceburg and $28.2 million

related to capital lease obligations primarily attributable to a

corporate airplane lease. 2) Although our joint venture in

Kansas Entertainment is accounted for as an equity method

investment and is not consolidated, this joint venture had no debt

outstanding at March 31, 2016 or December 31, 2015. 3) The

financing obligation is calculated based on the present value of

the future minimum lease payments over the remaining lease term,

which includes all renewal options since they were reasonably

assured of being exercised at lease inception.

The Company’s Master Lease with GLPI is accounted for as a

financing obligation. As such, payments to GLPI are recorded as

interest expense and a reduction to our financing obligation. The

table below reflects the total payments to GLPI for the three

months ended March 31, 2016 and 2015 and the treatment of these

payments on Penn’s financial statements.

Three Months Ended March 31, 2016

2015 Reduction in GLPI financing obligation $ 12,648

$ 12,475 Amount attributable to interest expense 98,748

96,370 Total payments to GLPI $ 111,396 $ 108,845

The Company’s definition of adjusted EBITDA adds back our share

of the impact of non-operating items (such as depreciation and

amortization) at our joint ventures that have gaming operations. At

this time, Kansas Entertainment, the operator of Hollywood Casino

at Kansas Speedway, is Penn’s only joint venture that meets this

definition. Kansas Entertainment does not currently have, nor has

it ever had, any indebtedness. The table below presents cash flow

distributions we have received from this investment for the three

months ended March 31, 2016 and 2015.

Three Months Ended March 31, 2016

2015 Cash flow distributions $ 7,400 $ 8,000

Diluted Share Count Methodology

In connection with the spin-off, Penn National Gaming completed

its exchange and repurchase transaction with an affiliate of

Fortress Investment Group, LLC (“Fortress”) on October 11, 2013,

which resulted in the repurchase of $627 million of its Series B

Preferred Stock and the issuance of 8,624 shares of Series C

Preferred Stock, which is equivalent to 8,624,000 common shares

upon sale by Fortress to a third party.

Reconciliation of GAAP to Non-GAAP Measures

Adjusted EBITDA is used by management as the primary measure of

the Company’s operating performance. We define adjusted EBITDA as

earnings before interest, taxes, stock compensation, debt

extinguishment charges, impairment charges, insurance recoveries

and deductible charges, depreciation and amortization, changes in

the estimated fair value of contingent purchase price to the

previous owners of Plainridge Racecourse, gain or loss on disposal

of assets, and other income or expenses. Adjusted EBITDA is also

inclusive of income or loss from unconsolidated affiliates, with

our share of non-operating items (such as depreciation and

amortization) added back for our joint venture in Kansas

Entertainment. Adjusted EBITDA excludes payments associated with

our Master Lease agreement with GLPI as the transaction was

accounted for as a financing obligation. Adjusted EBITDA has

economic substance because it is used by management as a

performance measure to analyze the performance of our business, and

is especially relevant in evaluating large, long lived casino

projects because they provide a perspective on the current effects

of operating decisions separated from the substantial non

operational depreciation charges and financing costs of such

projects. We also present adjusted EBITDA because it is used by

some investors and creditors as an indicator of the strength and

performance of ongoing business operations, including our ability

to service debt, fund capital expenditures, acquisitions and

operations. These calculations are commonly used as a basis for

investors, analysts and credit rating agencies to evaluate and

compare operating performance and value companies within our

industry. In addition, gaming companies have historically reported

adjusted EBITDA as a supplement to financial measures in accordance

with GAAP. In order to view the operations of their casinos on a

more stand-alone basis, gaming companies, including us, have

historically excluded from their adjusted EBITDA calculations

certain corporate expenses that do not relate to the management of

specific casino properties. However, adjusted EBITDA is not a

measure of performance or liquidity calculated in accordance with

GAAP. Adjusted EBITDA information is presented as a supplemental

disclosure, as management believes that it is a widely used measure

of performance in the gaming industry, is the principal basis for

the valuation of gaming companies, and that it is considered by

many to be a better indicator of the Company’s operating results

than net income (loss) per GAAP. Management uses adjusted EBITDA as

the primary measures of the operating performance of its segments,

including the evaluation of operating personnel. Adjusted EBITDA

should not be construed as alternatives to operating income, as

indicators of the Company’s operating performance, as alternatives

to cash flows from operating activities, as measures of liquidity,

or as any other measures of performance determined in accordance

with GAAP. The Company has significant uses of cash flows,

including capital expenditures, interest payments, taxes and debt

principal repayments, which are not reflected in adjusted EBITDA.

It should also be noted that other gaming companies that report

adjusted EBITDA information may calculate adjusted EBITDA in a

different manner than the Company and therefore, comparability may

be limited.

A reconciliation of the Company’s net income (loss) per GAAP to

adjusted EBITDA, as well as the Company’s income (loss) from

operations per GAAP to adjusted EBITDA, is included above.

Additionally, a reconciliation of each segment’s income (loss) from

operations to adjusted EBITDA is also included above. On a segment

level, income (loss) from operations per GAAP, rather than net

income (loss) per GAAP is reconciled to adjusted EBITDA due to,

among other things, the impracticability of allocating interest

expense, interest income, income taxes and certain other items to

the Company’s segments on a segment by segment basis. Management

believes that this presentation is more meaningful to investors in

evaluating the performance of the Company’s segments and is

consistent with the reporting of other gaming companies.

Conference Call, Webcast and Replay Details

Penn National Gaming is hosting a conference call and

simultaneous webcast at 9:00 am ET today, both of which are open to

the general public. The conference call number is 212/231-2929.

Please call five minutes in advance to ensure that you are

connected prior to the presentation. Questions will be reserved for

call-in analysts and investors. Interested parties may also access

the live call on the Internet at www.pngaming.com. Please allow 15

minutes to register and download and install any necessary

software. A replay of the call can be accessed for thirty days on

the Internet at www.pngaming.com.

This press release, which includes financial information to be

discussed by management during the conference call and disclosure

and reconciliation of non-GAAP financial measures, is available on

the Company’s web site, www.pngaming.com, in the “Investors”

section (select link for “Press Releases”).

About Penn National Gaming

Penn National Gaming owns, operates or has ownership interests

in gaming and racing facilities and video gaming terminal

operations with a focus on slot machine entertainment. At March 31,

2016, the Company operated twenty-seven facilities in seventeen

jurisdictions, including Florida, Illinois, Indiana, Kansas, Maine,

Massachusetts, Maryland, Mississippi, Missouri, Nevada, New Jersey,

New Mexico, Ohio, Pennsylvania, Texas, West Virginia, and Ontario.

At March 31, 2016, in aggregate, Penn National Gaming operated

approximately 33,400 gaming machines, 800 table games and 4,600

hotel rooms.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements can be identified by the use of forward

looking terminology such as “expects,” “believes,” “estimates,”

“projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should” or

“anticipates” or the negative or other variations of these or

similar words, or by discussions of future events, strategies or

risks and uncertainties, including future plans, strategies,

performance, developments, acquisitions, capital expenditures, and

operating results. Actual results may vary materially from

expectations. Although the Company believes that its expectations

are based on reasonable assumptions within the bounds of its

knowledge of its business, there can be no assurance that actual

results will not differ materially from our expectations.

Meaningful factors that could cause actual results to differ from

expectations include, but are not limited to, risks related to the

following: the assumptions included in our financial guidance; the

ability of our operating teams to drive improved adjusted EBITDA

margins; our ability to obtain timely regulatory approvals required

to own, develop and/or operate our facilities, or other delays or

impediments to completing our planned acquisitions or projects, our

ability to secure federal, state and local permits and approvals

necessary for our construction projects; construction factors,

including delays, unexpected remediation costs, local opposition,

organized labor, and increased cost of labor and materials; the

passage of state, federal or local legislation (including

referenda) that would expand, restrict, further tax, prevent or

negatively impact operations in or adjacent to the jurisdictions in

which we do or seek to do business (such as a smoking ban at any of

our facilities); the effects of local and national economic,

credit, capital market, housing, and energy conditions on the

economy in general and on the gaming and lodging industries in

particular; the activities of our competitors and the rapid

emergence of new competitors (traditional, internet, sweepstakes

based and taverns); increases in the effective rate of taxation at

any of our properties or at the corporate level; our ability to

identify attractive acquisition and development opportunities

(especially in new business lines) and to agree to terms with, and

maintain good relationships with partners/municipalities for such

transactions; the costs and risks involved in the pursuit of such

opportunities and our ability to complete the acquisition or

development of, and achieve the expected returns from, such

opportunities; our ability to maintain market share in established

markets and ramp up operations at our recently opened facilities;

our expectations for the continued availability and cost of

capital; the outcome of pending legal proceedings, for example, the

ongoing litigation by the Ohio Roundtable addressing the legality

of gaming in Ohio; changes in accounting standards; the impact of

weather; with regard to our recent Restatement, risks relating the

remediation of any material weaknesses and the costs to strengthen

our internal control structure, potential investigations,

litigation or other proceedings by governmental authorities,

stockholders or other parties, and the risks related to the impact

of the recent restatement of the Company’s financial statements on

the Company’s reputation, development projects, joint ventures and

other commercial contracts; the ability of the Company to generate

sufficient future taxable income to realize its deferred tax

assets; with respect to the proposed Jamul project near San Diego,

California, particular risks associated with financing/refinancing

a project of this type, sovereign immunity, local opposition

(including several pending lawsuits), building a complex project on

a relatively small parcel and the receipt of all necessary permits

and licenses; with respect to our Massachusetts project, the

ultimate location and timing of the other gaming facilities in the

state and region; with respect to our social and other interactive

gaming endeavors, risks related to ultimate profitability,

cyber-security, data privacy, intellectual property and legal and

regulatory challenges; with respect to Prairie State Gaming, risks

relating to our ability to successfully compete in the VGT market,

our ability to retain existing customers and secure new customers,

risks relating to municipal authorization of VGT operations and the

implementation and the ultimate success of the products and

services being offered; and other factors as discussed in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2015, subsequent Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K, each as filed with the United States

Securities and Exchange Commission. The Company does not intend to

update publicly any forward-looking statements except as required

by law. In light of these risks, uncertainties and assumptions, the

forward-looking events discussed in this press release may not

occur.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160428005380/en/

Penn National Gaming, Inc.Saul V. Reibstein, 610-401-2049Chief

Financial OfficerorJCIRJoseph N. Jaffoni / Richard

Land212-835-8500penn@jcir.com

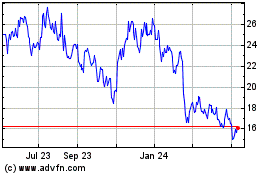

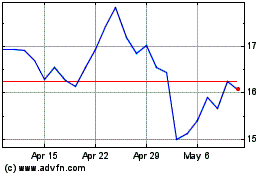

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024