Penn National Gaming Updates Timing for Restatement of Financial Statements & Reiterates 2015 Fourth Quarter & Full Year Guid...

December 30 2015 - 7:00AM

Business Wire

Penn National Gaming, Inc. (PENN: Nasdaq) (“Penn National” or

the “Company”) provided an update today on the expected timing for

the filing with the Securities and Exchange Commission (“SEC”) of

the restatement of its financial statements filed since the

spin-off (the “Spin-off”) of its real estate assets to Gaming and

Leisure Properties, Inc. (“GLPI”) on November 1, 2013 (the

“Restatement”). Penn National now expects to submit the restated

filings by no later than February 29, 2016, the date by which its

audited financial statements for the year-ended December 31, 2015

are due.

As previously disclosed, the Restatement arose from the

Company’s change in the classification of its Master Lease (the

“Master Lease”) with GLPI from an operating lease to a financing

obligation. The updated timing for the submission of the restated

filings reflects an ongoing review undertaken in connection with

the Restatement. While this review is ongoing, the Company

currently expects to make adjustments to its previously recorded

2014 and 2013 goodwill and intangible asset impairment charges, to

report the fees paid to relocate its Ohio racetracks as an

indefinite lived intangible asset as opposed to a depreciating

asset, and to report Hollywood Casino Baton Rouge and Hollywood

Casino Perryville, which were spun off to GLPI, as discontinued

operations.

The Company’s cash flows for all prior and future periods will

not be affected by any of the above-noted changes in accounting,

nor will its current tax treatment with respect to the Spin-off

transaction. In addition, the adjustments in the Restatement will

have no impact on the following indicators of the Company’s

performance:

- the Company’s cash position;

- the Company’s leverage ratios under its

senior credit facility and other debt instruments (as the terms of

those obligations require the Master Lease to be treated as an

operating lease regardless of the treatment required under

GAAP);

- the Company’s revenues from continuing

operations; or

- the Company’s rental payments or other

obligations under the Master Lease.

As previously disclosed, the Company also anticipates that, as a

result of the change in lease classification, it will report

additional liabilities which represent the present value of the

future minimum lease payments to GLPI under the Master Lease. The

Company approximates this liability will amount to $3.58 billion as

of September 30, 2015.

On November 13, 2015, the Company disclosed that it received a

notice from The Nasdaq Stock Market (“NASDAQ”) that it is not in

compliance with NASDAQ Listing Rule 5250(c)(1) because the Company

did not file its Quarterly Report on Form 10-Q for the quarter

ended September 30, 2015 in a timely manner. Penn National also

confirmed today that it will submit a plan to regain compliance

with NASDAQ listing requirements by January 8, 2016. This plan is

expected to extend compliance for an additional 180 days. Further,

the Company is currently in discussions with its lenders under the

Company’s senior secured credit facility to secure a waiver to

further extend the period for the Company to file its financial

statements for the quarter ended September 30, 2015.

Reiterates 2015 Fourth Quarter and Full Year Guidance

Penn National also announced today that, based on the

performance of the business to date in the fourth quarter of 2015,

it is reiterating the Company’s 2015 fourth quarter and full year

financial guidance initially provided on October 22, 2015. The

Company continues to expect that net revenues and Adjusted EBITDA

for the three months ending December 31, 2015 will be $722.5

million and $181.6 million, respectively. For the full year ending

December 31, 2015, the Company expects to report net revenues of

$2,786.3 million and Adjusted EBITDA of $754.5 million.

About Penn National Gaming, Inc.

Penn National owns, operates or has ownership interests in

gaming and racing facilities and video gaming terminal operations

with a focus on slot machine entertainment. At September 30, 2015,

the Company operated twenty-seven facilities in seventeen

jurisdictions, including Florida, Illinois, Indiana, Kansas, Maine,

Massachusetts, Maryland, Mississippi, Missouri, Nevada, New Jersey,

New Mexico, Ohio, Pennsylvania, Texas, West Virginia, and Ontario.

At September 30, 2015, in aggregate, Penn National operated

approximately 34,000 gaming machines, 800 table games and 4,600

hotel rooms.

Forward-looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements can be identified by the use of forward

looking terminology such as “expects,” “believes,” “estimates,”

“projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should” or

“anticipates” or the negative or other variations of these or

similar words. Although the Company believes that our expectations

are based on reasonable assumptions within the bounds of our

knowledge of our business, there can be no assurance that actual

results, including the impact of the Restatement, will not differ

materially from our expectations. Meaningful factors that could

cause actual results to differ from expectations include, but are

not limited to, risks relating to the final impact of the

Restatement on the Company’s financial statements; the impact of

the Restatement on the Company’s evaluation of the effectiveness of

its internal control over financial reporting; delays in the

preparation of the financial statements; the risk that the Company

will not be able to file its periodic reports with the Securities

and Exchange Commission by the deadlines imposed by the NASDAQ

listing requirements; the risk that additional information will

come to light during the course of the preparation of restated

financial statements that alters the scope or magnitude of the

Restatement; potential reviews, litigation or other proceedings by

governmental authorities, stockholders or other parties; the risk

that the Company will be unable to obtain any required waivers

under the Company’s senior credit facility or its note indenture

with respect to a significant delay in filing periodic reports with

the Securities and Exchange Commission and the associated risk of

additional incidental interest expense; the risk that the Company

will not achieve its fourth quarter and full year guidance due to

changes in our expected operating performance or due to one-time

non-operational charges; risks relating to our liquidity and

ability to raise capital; risks related to the impact on the

Restatement on the Company’s reputation, development projects,

joint ventures and other material commercial contracts; and other

factors as discussed in the Company’s Annual Report on

Form 10-K for the year ended December 31, 2014,

subsequent Quarterly Reports on Form 10-Q and Current Reports

on Form 8-K, each as filed with the United States Securities

and Exchange Commission. The Company does not intend to update

publicly any forward-looking statements except as required by law.

In light of these risks, uncertainties and assumptions, the

forward-looking events discussed in this press release may not

occur.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20151230005048/en/

Penn National Gaming, Inc.Saul V. Reibstein, 610-401-2049Chief

Financial OfficerorJCIRJoseph N. Jaffoni, Richard

Land212-835-8500penn@jcir.com

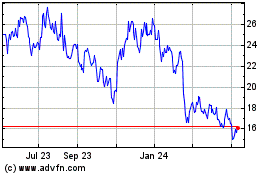

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

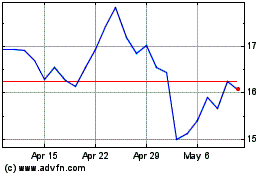

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024