Notification That Quarterly Report Will Be Submitted Late (nt 10-q)

November 09 2015 - 12:19PM

Edgar (US Regulatory)

|

|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 12b-25

NOTIFICATION OF LATE FILING |

|

|

|

|

|

SEC FILE NUMBER

0-24206

CUSIP NUMBER

707569 10 9 |

|

(Check one): |

|

o Form 10-K |

o Form 20-F |

o Form 11-K |

x Form 10-Q |

o Form 10-D |

|

|

|

o Form N-SAR |

o Form N-CSR |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For Period Ended: |

September 30, 2015 |

|

|

|

o Transition Report on Form 10-K |

|

|

|

|

|

o Transition Report on Form 20-F |

|

|

|

|

|

o Transition Report on Form 11-K |

|

|

|

|

|

o Transition Report on Form 10-Q |

|

|

|

|

|

o Transition Report on Form N-SAR |

|

|

|

|

|

For the Transition Period Ended: |

|

|

|

|

|

|

|

|

|

|

Read Instructions (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein. |

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

|

Penn National Gaming, Inc. |

|

Full Name of Registrant |

|

|

|

|

|

Former Name if Applicable |

|

|

|

825 Berkshire Blvd, Suite 200 |

|

Address of Principal Executive Office (Street and Number) |

|

|

|

Wyomissing, PA 19610 |

|

City, State and Zip Code |

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate)

|

|

(a) |

The reason described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense |

|

o |

(b) |

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and |

|

|

(c) |

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable. |

PART III — NARRATIVE

State below in reasonable detail why Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR, or the transition report or portion thereof, could not be filed within the prescribed time period.

Penn National Gaming, Inc. (the “Company”) is unable to file its Quarterly Report on Form 10-Q for the period ending September 30, 2015 within the prescribed time period for the reasons set forth below.

As described in Item 4.02 of the Company’s Current Report on Form 8-K filed on October 22, 2015, the Company is changing the classification of its master lease (the “Master Lease”) with Gaming and Leisure Properties, Inc. (“GLPI”) from an operating lease to a financing transaction. Accordingly, the Audit Committee has determined that the Company will restate previously issued financial statements for its fiscal years ended December 31, 2013 and 2014, and interim financial statements for the fiscal quarters ended March 31, 2014, June 30, 2014, September 30, 2014, March 31, 2015 and June 30, 2015, and, as a result, those financial statements should no longer be relied upon. Additionally, management’s evaluation of disclosure controls and procedures and management’s report on internal controls over financial reporting for the year ended December 31, 2014, the opinion of Ernst & Young LLP (“EY”), the Company’s independent registered public accounting firm, on the consolidated financial statements for each of the two years in the period ended December 31, 2014, as well as EY’s opinion on the effectiveness of the Company’s internal controls over financial reporting as of December 31, 2014 should also no longer be relied upon.

The Company is currently evaluating the effects that the restatement will have on the Company’s previously recorded goodwill and other intangible asset impairment charges in 2013 and 2014 and is not in a position to timely file the Quarterly Report on Form 10-Q for the period ended September 30, 2015 without unreasonable effort or expense.

The Company anticipates that it will complete and file the restated financial statements (inclusive of the September 30, 2015 Quarterly Report on Form 10-Q) at or about the time by which it typically files its Annual Report on Form 10-K, or sooner if possible. The Company anticipates that it will disclose a material weakness in internal controls over financial reporting in its restated Annual Report on Form 10-K/A for the year ended December 31, 2014.

PART IV — OTHER INFORMATION

|

(1) |

Name and telephone number of person to contact in regard to this notification |

|

|

Saul V. Reibstein |

|

(610) |

|

373-2400 |

|

|

(Name) |

|

(Area Code) |

|

(Telephone Number) |

|

|

|

|

(2) |

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). |

|

|

|

|

|

|

|

|

|

x Yes o No |

|

|

|

|

|

|

|

|

(3) |

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? |

|

|

|

|

|

|

|

|

|

x Yes o No |

|

|

|

|

|

|

|

|

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made. |

On October 22, 2015, the Company reported revenue of $739.3 million for the three months ended September 30, 2015, compared to revenue of $645.9 million for the three months ended September 30, 2014. The increase in revenue reflects year-over-year improvements in regional gaming trends and a benefit from the first full quarterly contributions from Plainridge Park Casino and the Company’s two Ohio racing and video lottery terminal facilities that opened in the third quarter of 2014. The Company also continued to grow during the quarter with the completed acquisitions of Tropicana Las Vegas, Inc. and Illinois Gaming Investors, LLC (d/b/a Prairie State Gaming), for which the Company realized a partial quarter of contributions to operations, net of transaction costs.

As noted in Part III, the Company is currently evaluating the effects that the restatement will have on the Company’s previously recorded goodwill and other intangible asset impairment charges in 2013 and 2014.

On October 28, 2015, the Company disclosed that it anticipates that, as a result of a change in lease classification, it will report additional liabilities of approximately $3.5 billion as of September 30, 2015, which represents the present value of the future minimum lease payments to GLPI under the Master Lease at the lease inception date of November 1, 2013, less principal reductions to this obligation since that time. Additionally, the Company anticipates reporting assets of approximately $2.0 billion as of September 30, 2015 on its balance sheet for the real property leased from GLPI under the Master Lease.

The Company does not expect the adjustments in the restatement to have an impact on its cash position, cash flows, leverage ratios under its senior credit facility and other debt instruments (as the terms of those obligations require the Master Lease to be treated as an operating lease regardless of the treatment required under GAAP), revenues and rental payments or other obligations under the Master Lease. At September 30, 2015, the Company had cash and cash equivalents of $223.5 million and total debt (excluding the financing obligation to GLPI under the Master Lease of approximately $3.5 billion) of $1.67 billion.

This Form 12b-25 contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the use of forward looking terminology such as “expects,” “believes,” “estimates,” “projects,” “intends,” “plans,” “seeks,” “may,” “will,” “should” or “anticipates” or the negative or other variations of these or similar words. Although the Company believes that its expectations are based on reasonable assumptions within the bounds of the Company’s knowledge of its business, there can be no assurance that actual results, including the impact of the restatement, will not differ materially from our expectations. Meaningful factors that could cause actual results to differ from expectations include, but are not limited to, risks relating to the final impact of the restatement on the Company’s financial statements; the impact of the restatement on the Company’s evaluation of the effectiveness of its internal control over financial reporting; delays in the preparation of the financial statements; the risk that additional information will come to light during the course of the preparation of restated financial statements that alters the scope or magnitude of the restatement; potential reviews, litigation or other proceedings by governmental authorities, stockholders or other parties; the risk that the Company will be unable to obtain any required waivers under the Company’s note indenture with respect to a significant delay in filing periodic reports with the Securities and Exchange Commission; risks relating to the Company’s liquidity and ability to raise capital; risks related to the impact of the restatement on the Company’s reputation, development projects, joint ventures and other commercial contracts; and other factors as discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2014, subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K, each as filed with the United States Securities and Exchange Commission. The Company does not intend to update publicly any forward-looking statements except as required by law. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this Form 12b-25 may not occur.

Penn National Gaming, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date |

November 9, 2015 |

|

By |

/s/ Saul V. Reibstein |

|

|

|

|

|

Saul V. Reibstein

Chief Financial Officer and Treasurer |

INSTRUCTION: The form may be signed by an executive officer of the registrant or by any other duly authorized representative. The name and title of the person signing the form shall be typed or printed beneath the signature. If the statement is signed on behalf of the registrant by an authorized representative (other than an executive officer), evidence of the representative’s authority to sign on behalf of the registrant shall be filed with the form.

|

|

ATTENTION |

|

|

Intentional misstatements or omissions of fact constitute Federal Criminal Violations (See 18 U.S.C. 1001). |

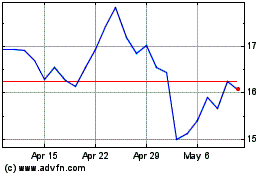

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

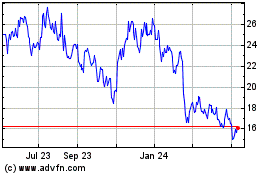

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024