Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

|

| |

Filed by the Registrant ý |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

|

o |

|

Preliminary Proxy Statement |

|

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

|

Definitive Proxy Statement |

|

o |

|

Definitive Additional Materials |

|

o |

|

Soliciting Material Pursuant to §240.14a-12

|

|

|

|

|

|

PENN NATIONAL GAMING, INC. |

(Name of Registrant as Specified In Its Charter) |

N/A |

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

|

|

|

|

| Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| |

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

| |

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| |

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

| |

|

(5) |

|

Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration

statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| |

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

| |

|

(3) |

|

Filing Party:

|

| |

|

(4) |

|

Date Filed:

|

Table of Contents

Penn National Gaming, Inc.

825 Berkshire Boulevard, Suite 200

Wyomissing, Pennsylvania 19610

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on June 17, 2015

NOTICE IS HEREBY GIVEN that the 2015 Annual Meeting of Shareholders (the "Annual Meeting") of Penn

National Gaming, Inc. (the "Company"), a Pennsylvania corporation, will be held on Wednesday, June 17, 2015, at 10 a.m., local time, at the offices of Ballard Spahr LLP,

1735 Market Street, 51st Floor, Philadelphia, PA 19103 for the following purposes:

- 1.

- To

elect two Class I directors to serve until the 2018 Annual Meeting of Shareholders and until their respective successors are duly elected and

qualified;

- 2.

- To

ratify the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the 2015 fiscal year;

- 3.

- To

hold an advisory vote to approve the compensation paid to the Company's named executive officers; and

- 4.

- To

consider and transact such other business as may properly come before the Annual Meeting.

Only

shareholders of record at the close of business on April 17, 2015 are entitled to notice of, and to vote at, the Annual Meeting and any postponement or adjournment thereof.

On

April 28, 2015, we began mailing to certain shareholders a Notice Regarding the Availability of Proxy Materials for the 2015 Annual Meeting of Shareholders to be held on

June 17, 2015 (the "Notice") containing instructions on how to access this proxy statement and our annual report and how to vote online. The notice of annual meeting, proxy statement and annual

report are available at www.proxyvote.com.

All

shareholders are cordially invited to attend the Annual Meeting in person. We look forward to either greeting you personally at the Annual Meeting or receiving your proxy.

|

|

|

| |

|

By order of the Board of Directors, |

|

|

Carl Sottosanti

Senior Vice President, General Counsel and Secretary |

Wyomissing,

Pennsylvania

April 28, 2015

Your vote is very important. Whether or not you plan to attend the annual meeting, we encourage you to read this proxy statement and submit your proxy or voting instructions as

soon as possible. You may vote by telephone or Internet (instructions are on your proxy card, voter instruction form or the Notice, as applicable) or, if you received your materials by mail, by

completing, signing and mailing the enclosed proxy card in the enclosed envelope.

Table of Contents

TABLE OF CONTENTS

i

Table of Contents

ii

Table of Contents

Penn National Gaming, Inc.

825 Berkshire Boulevard, Suite 200

Wyomissing, Pennsylvania 19610

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

June 17, 2015

Penn National Gaming, Inc. (the "Company" or "PENN") first made these materials available to shareholders on or about April 28, 2015

on the Internet, or, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies for the Company's 2015 Annual Meeting of Shareholders (the "Annual

Meeting") to be held on June 17, 2015 at 10:00 a.m., local time, or at any adjournment or postponement thereof, for the purposes set forth herein and in the accompanying Notice of Annual

Meeting. The Annual Meeting will be held at the offices of Ballard Spahr LLP, 1735 Market Street, 51st Floor, Philadelphia, PA 19103. This solicitation is being made

on behalf of the Board of Directors of the Company (the "Board of Directors" or the "Board").

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of printed proxy materials?

In accordance with rules adopted by the Securities and Exchange Commission ("SEC"), we may furnish proxy materials, including this

Proxy Statement and our 2014 Annual Report, to our shareholders by providing access to such documents on the Internet instead of mailing printed copies. Most shareholders will not receive printed

copies of the proxy materials unless they request them. Instead, the Notice Regarding the Availability of Proxy Materials for the 2015

Annual Meeting (the "Notice"), which was mailed to most of our shareholders, will instruct you as to how you may access and review all of the proxy materials on the Internet. The Notice also instructs

you as to how you may submit your proxy on the Internet. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such materials in

the Notice. In addition, you may request to receive all future proxy materials in printed form by mail or electronically by email by following the instructions contained in the Notice. We encourage

shareholders to take advantage of the availability of our proxy materials on the Internet to help reduce the environmental impact of our annual meetings of shareholders.

Who is entitled to vote at the Annual Meeting?

The Board of Directors has set the close of business on April 17, 2015 as the record date (the "Record Date") for the

determination of shareholders of the Company entitled to notice of, and to vote at, the Annual Meeting. On the Record Date, 79,717,554 shares of the Company's common stock were issued and outstanding

and entitled to vote at the Annual Meeting.

Table of Contents

How many votes do I have?

You have one vote for each share of common stock you owned as of the Record Date for the Annual Meeting.

Do shareholders have cumulative voting rights with respect to the election of directors?

No, shareholders do not have cumulative voting rights with respect to the election of directors.

What am I voting on and what votes are required?

Assuming a quorum is present, the following votes will be required for approval:

|

|

|

|

|

Proposal

|

|

Matter

|

|

Vote Required

|

| Proposal 1 |

|

Election of Class I Directors |

|

The two nominees for director receiving the highest number of votes cast will be elected |

Proposal 2 |

|

Ratification of selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the 2015 fiscal year |

|

Majority of votes cast |

Proposal 3 |

|

Advisory vote to approve the compensation paid to the Company's named executive officers |

|

Majority of votes cast |

For

purposes of determining the number of votes cast, only those cast "for" or "against" are counted. Abstentions, "withhold" votes and broker non-votes are not considered "cast" but are

counted for purposes of determining whether a quorum is present at the Annual Meeting.

Will any other matter be voted on?

As of the date of this Proxy Statement, we know of no matter that will be presented for consideration at the Annual Meeting other than

those matters discussed in this Proxy Statement. If any other matters properly come before the meeting and call for a vote of the shareholders, the appointed proxies may use their discretion to vote

on any such matters.

What constitutes a quorum?

In order for business to be conducted at the Annual Meeting, a quorum must be present. The presence, in person or by valid proxy, of

shareholders entitled to cast at least a majority of the votes that all shareholders are entitled to cast is necessary for a quorum to be present at the Annual Meeting.

What is the difference between holding shares as a shareholder of record and as a beneficial owner?

If your shares are registered directly in your name with the Company's transfer agent, Continental Stock Transfer & Trust

("Continental"), you are considered a "registered shareholder" and are considered, with respect to those shares, the "shareholder of record." If you are a shareholder of record, the Notice or proxy

materials were sent to you directly by the Company, and you may vote by any of the methods described below under "How do I vote?".

If

your shares are registered in the name of a stock brokerage account or by a broker, bank, or other nominee on your behalf (referred to as being held in "street name"), you are

considered a "beneficial owner" of shares held in street name, and the broker, bank, or other nominee forwarded the Notice and, if you requested them, the proxy materials to you. As the beneficial

owner, you have

2

Table of Contents

the

right to direct your broker, bank, or other nominee holding your shares how to vote and you are also invited to attend the Annual Meeting. However, since you are not a shareholder of record, you

may not vote these shares in person at the Annual Meeting unless you bring with you a legal proxy from the shareholder of record.

How do I vote?

If you are a registered shareholder, there are four different ways you can

vote:

- 1.

- By

Internet—You can vote via the Internet at www.proxyvote.com by following the instructions provided on the Notice

or your proxy card (you will need the Control Number from the Notice or proxy card you received);

- 2.

- By

Telephone—You can vote by telephone by calling the toll-free telephone number indicated on your proxy card or voting instruction card (you

will need the Control Number from the Notice or proxy card you received);

- 3.

- By

Mail—If you received your proxy materials by mail, you can vote by signing, dating and returning the accompanying proxy card in the envelope

provided; or

- 4.

- In

Person—You can vote in person by written ballot at the Annual Meeting.

When

your proxy is properly submitted, your shares will be voted as you indicate. If you do not indicate your voting preferences, the appointed proxies will vote your shares FOR the

nominees in Proposal 1 and FOR Proposals 2 and 3. If your shares are owned in joint names, all joint owners must vote by the same method, and if joint owners vote by mail, all of the joint owners must

sign the proxy card. The deadline for voting by telephone or via the Internet is 11:59 p.m. Eastern time on June 16, 2015.

If

you are a beneficial owner of shares held in street name, your brokerage firm is the registered shareholder of your shares but is required to vote your shares in accordance with your

instructions. In order to do so, you will need to follow the instructions for voting provided by your broker.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our Board of Directors, and the persons named in the proxy have been designated as proxies by

our Board of Directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the Annual Meeting in accordance with the instructions of the

shareholder. If no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our Board of Directors as described above. If any matters not described

in this Proxy Statement are properly presented at the Annual Meeting, the proxy holders will use their own judgment to determine how to vote the shares. If the Annual Meeting is adjourned, the proxy

holders can vote the shares on the new

Annual Meeting date as well, unless you have properly revoked your proxy instructions, as described above.

What are broker non-votes?

A broker non-vote occurs when a broker, bank, or other nominee holding shares on behalf of a beneficial owner is prohibited from

exercising discretionary voting authority for a beneficial owner who has not provided voting instructions. Brokers, banks, and other nominees may vote without instruction only on "routine" proposals.

On "non-routine" proposals, nominees cannot vote without instructions from the beneficial owner, resulting in so-called "broker non-votes." Proposal 2, the ratification of Ernst &

Young LLP as the Company's independent registered public accounting firm, is the only routine proposal on the ballot for the Annual Meeting. All other proposals are non-routine. If you hold

your shares with a broker, bank, or other nominee, they will not be voted on non-routine proposals unless you give voting instructions to such nominee.

3

Table of Contents

May I change my vote?

You may revoke your proxy and change your vote at any time before the voting deadline for the Annual Meeting. After your initial vote,

you may vote again on a later date any time prior to the Annual Meeting via the Internet or by telephone (only your latest Internet or telephone proxy submitted prior to the voting deadline for the

Annual Meeting will be counted), by signing and returning a new proxy card or voting instruction form with a later date, or by attending the Annual Meeting and voting in person (a legal proxy is

required if you hold your shares in street name and you plan to vote in person at the Annual Meeting). However, your attendance at the Annual Meeting will not automatically revoke your proxy unless

you vote again at the Annual Meeting or specifically request in writing that your prior proxy be revoked. If your shares are held in street name by a broker, bank, or other nominee, you must contact

that nominee to change your vote.

What are the voting recommendations of the Board of Directors?

Our Board of Directors recommends that you vote your shares as follows:

|

|

|

|

|

Proposal

|

|

Matter

|

|

Board Recommendation

|

| Proposal 1 |

|

Election of Class I Directors |

|

FOR EACH OF THE NOMINEES |

Proposal 2 |

|

Ratification of selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the 2015 fiscal year |

|

FOR THE RATIFICATION OF THE SELECTION OF ERNST & YOUNG LLP |

Proposal 3 |

|

Advisory vote to approve the compensation paid to the Company's named executive officers |

|

FOR THE ADVISORY VOTE ON NAMED EXECUTIVE OFFICER COMPENSATION |

May I attend the meeting?

All shareholders, properly appointed proxy holders, and invited guests of the Company may attend the Annual Meeting. Shareholders who

plan to attend the meeting may be required to present valid photo identification. If you hold your shares in street name, please also bring proof of your share ownership, such as a broker's statement

showing that you beneficially owned shares of the Company on the Record Date, or a legal proxy from your broker, bank, or other nominee (a legal proxy is required if you hold your shares in street

name and you plan to vote in person at the Annual Meeting). Shareholders of record will be verified against an official list available at the registration area. The Company reserves the right to deny

admittance to anyone who cannot adequately show proof of share ownership as of the Record Date.

Who will bear the costs of this solicitation and how will proxies be solicited?

The Company has engaged the services of Innisfree M&A Incorporated, a third party proxy solicitation firm, to assist in its proxy

solicitation efforts. The Company estimates that the fees to be paid to Innisfree M&A Incorporated for this service will be approximately $15,000, plus reimbursement for out-of-pocket expenses. The

Company will bear the cost of this solicitation. In addition, the Company may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding

solicitation material to such beneficial owners. Proxies also may be solicited by certain directors, officers and employees of the Company, without additional compensation, personally or by telephone,

telegram, telecopy or via the Internet.

4

Table of Contents

What is the Company's Internet address?

The Company's Internet address is www.pngaming.com. The Company's filings with the SEC are available free

of charge via the "Investors" link at this website (click on the "SEC Filings" link), and may also be found at the SEC's website, www.sec.gov.

Where can I find the voting results of the Annual Meeting?

We will announce preliminary voting results at the Annual Meeting. We will also disclose voting results on a Current Report on

Form 8-K that we will file with the SEC within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Current Report on

Form 8-K, we will file a Current Report on Form 8-K to publish preliminary

results and will provide the final results in an amendment to the Current Report on Form 8-K as soon as they become available.

5

Table of Contents

GOVERNANCE OF THE COMPANY

Board of Directors

Overview

The Company is a growth-oriented, publicly traded, multi-jurisdictional gaming and racing company that has consistently generated

attractive returns for its shareholders through both a variety of transactions and prudent capital investment, including the development of new facilities, the expansion of existing facilities and the

strategic acquisition of existing gaming and racing properties. The Company deploys disciplined operating strategies by managing existing properties with a focus on maximizing profitability and free

cash flow, while at the same time endeavoring to deliver outstanding gaming and entertainment experiences for customers. The Company operates in a highly specialized and rigorously regulated industry,

which demands a high level of integrity and an unusually high level of transparency and accountability in all key aspects of its operations, its management team and its Board of Directors.

Over

time, the Company has demonstrated a commitment to pursuing innovative transactions to create additional value for shareholders. Most significantly, on November 1, 2013, the

Company completed its almost three year project of separating its gaming operating assets from its real property assets by creating a separate, newly formed, publicly traded real estate investment

trust, known as Gaming and Leisure Properties, Inc. ("GLPI"), through a tax free spin-off (the "Spin-Off"). In connection with the Spin-Off, each shareholder of the Company received one share

of common stock of GLPI for each share of common stock of the Company held by such shareholder. From the announcement of the Spin-Off on November 15, 2012 until its completion on

November 1, 2013, the Company's share price increased by 56.8%, which exceeded the performance of leading stock indices over this time period, including the Dow Jones Industrial Average, the

S&P 500 and the Russell 3000 index. Notably, the Spin-Off created the first real estate investment trust in the gaming industry and resulted in significant shareholder value, all in the face of

ongoing challenges in the regional gaming industry, including a slow consumer recovery and saturation in certain regions. Furthermore, the Spin-Off has served as a catalyst for the entire gaming

industry, with many of our peers, including Caesars Entertainment Corporation, MGM Resorts International, Boyd Gaming Corporation and Pinnacle Entertainment, Inc. linked to proposals or

discussions to complete their own real estate spin-off transactions.

In

presiding over and approving the Spin-Off, the Board determined that the complex and novel transaction was likely to bring meaningful benefits to the Company's stakeholders by

unlocking the value of the Company's real estate assets, creating a vehicle for efficiently returning capital to shareholders, gaining access to capital at lower blended costs and creating two well

capitalized company platforms poised for sustained long-term growth in distinct industries led by disciplined, market tested management teams. We believe that this assessment (and ultimate

implementation) by the Board and senior management has proven to be accurate. For example, GLPI made total dividend payments to its shareholders of $14.32 per share over the course of 2014, including

a one-time cash and stock dividend of $11.84 related to its Earnings and Profits purge made in connection with its election to be taxed as a real estate investment trust (the "Purge").

At

the same time, throughout 2014 the Company has strengthened its standing as a top regional gaming operator following the Spin-Off, by its active pursuit of development projects and

acquisitions and by its operational performance. For instance, the Company (without any involvement by GLPI) was

awarded the Category 2 (slots) license in Plainville, Massachusetts in February 2014 following a competitive bidding process. Soon thereafter, the Massachusetts Supreme Judicial Court issued a

decision permitting a state-wide referendum in November that would have repealed the 2011 legislation authorizing gaming in Massachusetts. Notwithstanding this serious obstacle, the Company and the

Board took a judicious risk by proceeding with construction on the gaming facility during the pending

6

Table of Contents

referendum,

while engaging in a vigorous voter education campaign to defend its investment in Massachusetts. The Company's measured approach to risk was rewarded when voters overwhelmingly voted to

retain the 2011 gaming legislation. Consequently, the facility is slated to open in June 2015, and we expect it to operate as the sole gaming facility in the entire Commonwealth of Massachusetts for

several years.

During

2014, the Company also completed the successful relocation and construction of two new racetrack and video lottery terminal ("VLT") facilities, in Austintown and Dayton, Ohio,

both of which were completed on time and on budget. These two opportunities in Ohio were a consequence of the Company's diligent involvement in the state since 2006 and, more specifically, the

initiative to amend the Ohio Constitution (adopted on November 3, 2009), which led to the development and opening of two new casinos in Toledo and Columbus in 2012. That constitutional

amendment also led to the legalization of VLTs at all of the racing facilities in the state, and the Company spent well over a year negotiating with the State of Ohio regarding the location and

economics of its two additional gaming facilities. The Company also completed its hotel construction project at Zia Park in New Mexico during 2014. In addition, the Company continued to develop its

planned Hollywood Casino-branded facility on the Jamul Indian Village's land in trust (near San Diego, California), which the Company is currently financing and will manage, and brand upon opening.

That opening is expected to occur in mid-2016. We expect these projects to be meaningful value creators for our shareholders. One of the key benefits of the Spin-Off is that, although the Company's

earnings are lower as a result of its rent obligations, development projects such as those in Massachusetts and California (which are not subject to the master lease with GLPI) are expected to have a

positive impact to the Company, as evidenced by the 17.5% increase in our stock price since the Spin-Off (as of March 31, 2015). In 2014, the Company also began to lay the groundwork for its

internet gaming initiative, anticipating that the Company's strong brand and national footprint will prove valuable in this relatively new space.

Looking

back over time, the Board and the Company have consistently been open to concepts that tangibly enhance shareholder value. In 2007, for instance, the Company entered into an

agreement to sell the Company to several private equity investment firms that, if consummated as planned, would have resulted in the payment of a significant premium to shareholders. In 2008, in

connection with the termination of that agreement due to the credit crisis, the Company obtained a settlement resulting in over $1.4 billion of capital that the Company utilized for future

investment (such as its developments in Ohio and Kansas). Further, since that time, the Company has repurchased over 13.4 million shares of its common stock and common share equivalents. This

series of transactions reflects both the Company's intense focus on maximizing shareholder value, as well as its ability to respond nimbly and creatively to changes in the market and new

opportunities.

The

Board believes that its structure and composition have been important elements of the Company's development activity, growth and success in regional gaming markets over the years.

The Board is comprised of individuals who each bring unique talents and perspectives to their service on the Board and, as a group, strike a balance between those who have a proven track record of

effectively working together to responsibly oversee management's operation of the Company and those who bring fresh perspective and insight to the Board. In fact, over the last two years, the Company

has added three talented new directors and looks forward to the long term benefits of their diversity of experience and views.

In

furtherance of the Company's objective to maximize shareholder value, the Board strives to maintain a governance environment where (i) entrepreneurship and appropriate risk

taking are encouraged, with a focus on both long- and short-term value creation, (ii) shareholder perspectives are understood and long term relationships with shareholders are fostered through

frequent, candid and comprehensive disclosure to the Company's shareholders and the investment community, (iii) integrity and accountability are integrated into the Company's operations and

(iv) the Company is able to continuously attract, develop and retain the best possible executive talent to manage the Company's

7

Table of Contents

operations.

The Board continuously evaluates the governance environment to enable the Company to respond appropriately to changes, practices and market conditions, as well as suggestions from our

shareholders and other stakeholders, in a manner that we believe will protect and promote the Company's long-term record of growing shareholder value.

Composition and Independence

The Company's Board of Directors currently consists of eight members: Peter M. Carlino, Harold Cramer, David A. Handler, John M.

Jacquemin, Ronald J. Naples, Barbara Shattuck Kohn, Jane Scaccetti and Timothy J. Wilmott. Mr. Wilmott was appointed to the Board on September 16, 2014, after the Board made the

determination that his insight into the day-to-day operational and strategic initiatives of the Company would be valuable to its decision making process. Ms. Scaccetti was appointed to the

Board on April 13, 2015, following a determination by the Board that her strong business and accounting background would be ideally suited for service on the Board and, in particular, on the

Audit Committee. The Board believes it is appropriately sized to carry out its responsibilities. With eight directors, the Board is small enough to stimulate individual engagement and involvement and

to allow each of its members to communicate frequently with management and each other. In addition, this size remains small enough to permit meetings to be conducted on short notice,

to better facilitate the Company's timely consideration of potential opportunities and challenges as they arise. This is especially critical to support the Company's efforts to strategically acquire

or develop new gaming and racing properties and to unlock shareholder value through innovative transactions, all of which may involve complex and unforeseen issues that arise on short notice and

require collaboration and prompt decision making. At the same time, the Board believes that it is large enough to encourage diverse viewpoints and better collaborative decision making. The collective

membership of the Board has a strong background in capital markets, accounting, legal and governmental affairs, as well as long-term experience with the Company's operations in a highly regulated

industry. The Board believes that its composition is optimized to support and oversee the Company's business and strategy.

The

Board has determined that all of the directors, other than Mr. Carlino and Mr. Wilmott, are independent under the current Listing Rules of the NASDAQ Stock Market (the

"NASDAQ Rules"). Mr. Carlino does not currently meet these independence requirements, in part, due to his previous role as Chief Executive Officer of the Company, a position he relinquished in

2013 in connection with the Spin-Off.

Board Leadership

Since the time of the Company's initial public offering in 1994 until the Spin-Off in 2013, Mr. Carlino served as both the

Company's Chief Executive Officer and Chairman of the Board. In connection with the Spin-Off, Mr. Wilmott became Chief Executive Officer of the Company (and subsequently joined the Board on

September 16, 2014), and Mr. Carlino retained his position as the Company's Chairman of the Board and became Chairman of the Board and Chief Executive Officer of GLPI. David A. Handler

also joined the board of directors of GLPI in connection with the Spin-Off, while retaining his position on the Board. The Board believes there are appropriate policies and procedures in place to

address any actual or perceived conflicts of interest relating to the two "overlapping" directors and that those procedures have worked well in the year and a half since the Spin-Off.

The

Board believes that Mr. Carlino is best suited to serve as Chairman of the Board because of his proven track record of generating shareholder value for the Company. This

impressive record has been based on his vision for the Company and his talent for successfully identifying and capitalizing on opportunities in the gaming and racing industry, as well as his

significant role in recruiting and developing talented executives to manage the Company. Moreover, the Board believes that

8

Table of Contents

Mr. Carlino's

substantial beneficial ownership of the Company's equity strongly aligns his interests with the interests of shareholders.

The

roles of the Chairman of the Board and Chief Executive Officer were split at the time of the Spin-Off. Our Chief Executive Officer is responsible for the general management and

operation of the business, providing guidance and oversight of senior management and setting the strategic direction of the Company. The Chairman of our Board monitors the content, quality and

timeliness of information sent to our Board and is available for consultation with our Board regarding oversight of our business affairs. The Board believes that the decision to separate the roles of

Chairman of the Board and Chief Executive Officer has been beneficial, both with regards to corporate governance and operational execution.

The

Board also believes that it has meaningful structural mechanisms for effective independent oversight of management's accountability. Six of the eight members of the Board are

independent directors and only independent directors serve on each of the Board's committees (as well as two non-director members of the Compliance Committee, as described below). The independent

directors typically meet several times per year in executive session. Both the Audit Committee and the Compliance Committee have ample internal staff and outside resources to assist them in carrying

out their responsibilities. The Company maintains a 36 person internal audit staff overseen by the Company's Vice President, Internal Audit, who provides reports to the Audit Committee, and a 34

person compliance staff overseen by the Company's Vice President of Regulatory Affairs and Chief Compliance Officer (the "Chief Compliance Officer"), who provides frequent reports to the Compliance

Committee. Additionally, the Company retained two non-director members to serve on its Compliance Committee: Steve DuCharme, a former Chairman of the Nevada State Gaming Control Board with over

30 years of experience in law enforcement and gaming regulation, serves as the Chairman of the Compliance Committee, and Thomas N. Auriemma, the Company's former Vice President, Chief

Compliance Officer and former Director of the Division of Gaming Enforcement in New Jersey, with over 30 years of experience as a gaming regulator in the State of New Jersey, serves as a

non-director member.

Risk Oversight

The Board of Directors does not view risk in isolation and recognizes that a prudent level of risk-taking is an essential element of

the Company's operating and growth strategy. As such, the Board takes an active role in the oversight of risks that potentially impact the Company (ranging from cyber security, economic, political and

a host of others) and the management team is charged with managing those risks. In fact, the Company is currently in the process of completing a comprehensive internal enterprise risk management

study. The purpose of this study is to help the

Board and the Company better understand, quantify, mitigate and manage the various risks the Company faces across the enterprise that could obstruct the Company from executing its corporate strategy

and achieving its goals. In addition, members of management attend all meetings of the Board, and the Board and management work closely to ensure that awareness of salient risks are integrated into

the Company's operations. In fulfilling its objective, many of the direct oversight functions of the Board are performed by the Board's committees with support from both ample internal resources as

well as independent outside advisors. For example, the Audit Committee receives frequent reports directly from the Company's Vice President, Internal Audit, the Chief Financial Officer, the General

Counsel, the Chief Operating Officer and the Chief Compliance Officer. The Audit Committee also has express authority to direct the Company's internal audit staff. Additionally, the Company's

independent registered public accounting firm, Ernst & Young LLP, provides support through its annual audit and quarterly reviews of the Company's financial statements. The Compliance

Committee is structured in the same manner relative to the Chief Compliance Officer and the Company's compliance staff and also has regular

9

Table of Contents

access

to the Company's senior management team. A discussion of the risk assessment process undertaken by the Compensation Committee is described on page 33 of this Proxy Statement.

Further,

the Board has adopted a Code of Business Conduct (the "Code of Conduct") reflecting a variety of best practices, which is applicable to all directors and employees of the

Company, including the Company's principal executive officer, principal financial officer and principal accounting officer. The Code of Conduct, which is updated periodically, is designed to, among

other things, deter wrongdoing, address potential conflicts of interest and promote ethical conduct, full and accurate reporting in the Company's filings with the SEC and compliance with applicable

laws. The Code of Conduct also provides a 24-hour hotline that any employee, customer or third party can use to report, anonymously if they so choose, any suspected fraud, financial impropriety or

other alleged wrongdoing. These reports are promptly investigated and receive the highest level of management attention, with particular focus from the Chief Compliance Officer and the Vice President,

Internal Audit, as appropriate. Subsequently, senior management provides investigation summaries to the Compliance Committee and the Audit Committee. A copy of the current Code of Conduct is available

on the Company's website at www.pngaming.com/About.

The

Board has also adopted Corporate Governance Guidelines (the "Corporate Governance Guidelines") that set forth the Company's policies and procedures relating to corporate governance.

These Corporate Governance Guidelines are intended to provide a structure within which our Board and management can effectively pursue the Company's objectives for the benefit of its shareholders and

other constituencies. The Corporate Governance Guidelines include policies and procedures relating to, among other items, the role, structure and composition of the Board, Board procedures and

leadership, risk oversight, use of outside consultants and conflicts of interest, including actual or perceived conflicts of interest arising from the two members of the Board who also serve on the

board of directors of GLPI. A copy of the current Corporate Governance Guidelines is available on the Company's website at www.pngaming.com/About.

In

addition to the above, the Company has adopted numerous other policies and procedures addressing the Company's operations and corporate governance, including stock ownership

guidelines, an executive compensation clawback policy, a corporate signature authority policy and a compliance and reporting plan. The Board regularly reviews the Company's corporate governance

policies and practices to evaluate their effectiveness in identifying, assessing and managing risks and to achieve compliance with the requirements of Pennsylvania law (the state in which the Company

is incorporated), the NASDAQ Rules and the SEC rules and regulations, all in the context of increasing shareholder value.

2014 Board and Committee Meetings

Each member of the Company's Board contributes a substantial amount of time and effort in connection with his or her service as Board

and committee members. The Board held six formal meetings during the fiscal year ended December 31, 2014. During that same period, the Audit Committee held eight formal meetings, the

Compensation Committee held three formal meetings, the Nominating and Corporate Governance Committee held two formal meetings and the Compliance Committee held five formal meetings. Further, Board

members are encouraged to, and regularly do. engage in informal discussions with members of management and they are provided daily industry clips and property results as well as frequent management

reports and updates.

During

the year ended December 31, 2014, each of the Company's directors attended at least 75% of the meetings of the Board and committees of the Board of which he or she was a

member. The Company encourages directors to attend shareholder meetings. Each of the Company's directors attended the 2014 Annual Meeting of Shareholders held on June 12, 2014.

10

Table of Contents

Committees of the Board

The Board maintains four standing committees—the Audit Committee, the Compensation Committee, the Compliance Committee and

the Nominating and

Corporate Governance Committee—to assist the Board in achieving its objectives. The specific duties and operation of each committee are described in more detail below. The Board has

determined that each director serving on one or more Board committees is independent under the NASDAQ Rules and the applicable rules and regulations of the SEC. As of December 31, 2014, the

committee structure and membership was:

|

|

|

|

|

|

|

|

|

Name

|

|

Audit

Committee |

|

Compensation

Committee |

|

Nominating

and Corporate

Governance

Committee |

|

Compliance

Committee |

Peter M. Carlino |

|

— |

|

— |

|

— |

|

— |

Harold Cramer |

|

Member |

|

Chair |

|

Chair |

|

Member |

David A. Handler |

|

— |

|

Member |

|

Member |

|

— |

John M. Jacquemin |

|

Chair(1) |

|

— |

|

— |

|

— |

Barbara Shattuck Kohn |

|

Member |

|

Member |

|

Member |

|

— |

Ronald J. Naples |

|

— |

|

— |

|

— |

|

Member |

Timothy J. Wilmott |

|

— |

|

— |

|

— |

|

— |

- (1)

- Ms. Scaccetti

succeeded John M. Jacquemin as Chair of the Audit Committee following her appointment to the Board on April 13, 2015.

Audit Committee

Jane Scaccetti (Chair), John M. Jacquemin, Harold Cramer, Barbara Shattuck Kohn are the members of the Audit Committee. Each member of

the Audit Committee satisfies the criteria for independence under the NASDAQ Rules and the rules and regulations of the SEC. The Board has determined that each of the members of the Audit Committee

meets the financial literacy requirements under the NASDAQ Rules and that both Ms. Scaccetti, the Chairman of the Audit Committee and Mr. Jacquemin, the former Chairman of the Audit

Committee, are "audit committee financial experts" within the meaning of the rules and regulations of the SEC. The Audit Committee operates under a written charter adopted by the Board of Directors

that is reviewed annually and complies with the NASDAQ Rules and is available at www.pngaming.com/About.

The

principal functions of the Audit Committee are to:

- •

- serve as an independent and objective party to monitor the integrity of the Company's financial reporting process and internal control

system;

- •

- review and appraise the audit efforts of the Company's independent registered public accounting firm and internal auditors and monitor

their independence; and

- •

- maintain free and open communication with and among the independent registered public accounting firm, the internal auditors, the

Company's finance department, senior management and the Board of Directors.

The

Audit Committee is also responsible for reviewing and pre-approving all conflicts of interest and related party transactions involving the Board or the Company's named executive

officers, including any actual or perceived conflicts of interest arising from the two members of the Board who also serve on the board of directors of GLPI. The Audit Committee will only approve

related party transactions that are not inconsistent with the best interests of the Company and its shareholders based on a review of (i) the benefits to the Company of the transaction and

(ii) the terms of the transaction and the terms available to or from unrelated third parties, as applicable. In discharging its oversight

11

Table of Contents

role,

the Audit Committee is empowered to investigate any matter brought to its attention and any other matters that the Audit Committee believes should be investigated. The Audit Committee may at any

time engage, at the expense of the Company, independent counsel or other advisors, as it deems necessary to carry out its duties.

Compensation Committee

Harold Cramer (Chairman), David A. Handler and Barbara Shattuck Kohn are the members of the Compensation Committee. Each member of the

Compensation Committee satisfies the criteria for independence under the NASDAQ Rules and the rules and regulations of the SEC. Each member of the Compensation Committee is also a non-employee

director, as defined under Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and an outside director, as defined under Section 162(m) of the Internal

Revenue Code of 1986, as amended. The Compensation Committee operates under a written charter adopted by the Board of Directors that is reviewed annually and complies with the NASDAQ Rules and the SEC

rules and is available at www.pngaming.com/About.

The

Compensation Committee evaluates the annual performance of the Chief Executive Officer (the "CEO") and other executive officers and sets their annual compensation, which authority

and responsibility includes:

- •

- setting salary, annual short-term incentive opportunities, long-term equity based incentives and other benefits;

- •

- monitoring industry trends and best practices with regard to executive compensation;

- •

- reviewing and approving, consistent with the compensation philosophy adopted by the Compensation Committee, any annual short-term

incentive compensation plan for the CEO and other executive officers, and the related review and approval of the performance criteria, goals and objectives provided for in such plan;

- •

- reviewing executive compensation programs annually to determine whether they are properly coordinated and achieving their intended

purposes;

- •

- periodically reviewing the policies for administration of the Company's executive compensation programs;

- •

- assessing the Company's management and leadership succession planning;

- •

- approving the number of incentive awards that the CEO may grant to employees other than executive officers;

- •

- recommending director compensation to the Board; and

- •

- administering and interpreting the Company's 2003 Long Term Incentive Compensation Plan and 2008 Long Term Incentive Compensation

Plan, as amended (the "2008 Plan").

The

Chairman of the Compensation Committee is responsible for leadership of the Compensation Committee. The Compensation Committee may form subcommittees and delegate authority to them,

as it deems appropriate. The CEO and other senior officers of the Company may attend Compensation Committee meetings at the invitation of the Compensation Committee, but they are not present for

executive sessions and do not participate in any discussion of their own compensation.

The

CEO provides the Compensation Committee performance assessments and compensation recommendations for each executive officer of the Company (other than himself). The Compensation

Committee considers the CEO's recommendations with the assistance of the Consultant (as defined below) and sets the compensation of those executive officers based on such deliberations. The

12

Table of Contents

Compensation

Committee holds executive sessions without management to facilitate candid discussion regarding executive performance and compensation, including establishing the CEO's compensation.

Pursuant

to the Compensation Committee's charter, the Compensation Committee is authorized to retain the services of compensation consultants or advisors to provide such advice and

assistance as it deems appropriate in its sole discretion. The Compensation Committee has the sole responsibility to oversee the work of any advisors. The Compensation Committee can terminate the

services of such compensation consultants and advisors and approves their fees and retention terms, which are funded by the Company. The Compensation Committee engaged an independent third party

executive compensation consultant in 2014, Exequity LLP (the "Consultant"), who also served as the Company's consultant the previous two years, to provide advice and assistance to the

Compensation Committee in carrying out its duties and responsibilities with respect to the Company's executive compensation programs and non-employee director compensation. Prior to engaging the

Consultant, and at least annually during the engagement, the Compensation Committee evaluates the independence of the Consultant. This review includes receiving information regarding other services,

if any, provided by the Consultant to the Company, the Board of Directors or other committees of the Board of Directors, and periodically reviewing the fees incurred as a result of such other

activities. In 2014, the Compensation Committee determined that the Consultant was independent of the Company and that the retention of the Consultant by the Compensation Committee did not give rise

to any conflicts of interest.

As

part of its ongoing services to the Compensation Committee, the Consultant frequently attends the Compensation Committee meetings and supports the Compensation Committee in carrying

out its duties and responsibilities with respect to the Company's executive compensation programs by providing information related to metrics and trends in the Company's industry as well as among

public companies generally. The Consultant also accumulates and summarizes market data at the request of the Compensation Committee regarding compensation of the Company's executives in comparison to

its peer group and others, as appropriate. The Consultant gathers data and provides advice regarding the Company's performance relative to its peer group, the structure of annual short-term and

long-term incentive compensation, the appropriateness of financial and other performance measures and the design of equity incentive plans. The Consultant reports directly to the Compensation

Committee and has been authorized by it to work with certain executive officers of the Company as well as other employees in the Company's human resources, legal, and finance departments in connection

with the Consultant's work for the Compensation Committee. In addition, the Consultant is encouraged to and does engage individually with each of the Compensation Committee members.

Nominating and Corporate Governance Committee

Harold Cramer (Chairman), David A. Handler and Barbara Shattuck Kohn are the members of the Nominating and Corporate Governance

Committee. Each member of the Nominating and Corporate Governance Committee satisfies the criteria for independence under the NASDAQ Rules and the rules and regulations of the SEC. The Nominating and

Corporate Governance Committee operates under a written charter adopted by the Board of Directors that is reviewed annually and complies with the NASDAQ Rules and is available at

www.pngaming.com/About.

The

Nominating and Corporate Governance Committee is responsible for:

- •

- reviewing and making recommendations on the eligibility criteria for individual Board and committee membership, including the range of

skills and expertise, diversity, and independence that should be represented on the Board and its committees;

- •

- reviewing and recommending the appropriate structure, composition and size of the Board and its committees;

13

Table of Contents

- •

- identifying and recommending, for the Board's selection, nominees for election to the Board; and

- •

- overseeing the Company's Corporate Governance Guidelines and other corporate governance practices, including reviewing and

recommending to the Board for approval any new or revised guidelines, documents or policies that comprise the Company's corporate governance framework.

The

Nominating and Corporate Governance Committee has a long-standing practice of including on the Board a complementary mix of individuals with diverse backgrounds and skills reflective

of the varied challenges facing the Company's management as it strives to continue to generate increased shareholder value. Over the last two years, the Nominating and Corporate Governance Committee

has recommended, and the Board has approved, the addition of three talented new directors who are expected to bring valuable diversity of experience and views to the Board.

Compliance Committee

Ronald J. Naples and Harold Cramer are the Board members of the Compliance Committee and Steve DuCharme and Thomas N. Auriemma are the

non-director members of the Compliance Committee. The members of the Compliance Committee are individuals who, by virtue of their familiarity with law enforcement, regulated businesses, the business

activities of the Company or gaming control, are sensitive to the concerns of the gaming regulation authorities and are capable of determining the existence or likelihood of a violation of a law,

rule, regulation, policy or procedure applicable to the Company. Steve DuCharme, Chairman of the Committee, is a former Chairman of the Nevada State Gaming Control Board with over 30 years of

experience in law enforcement and gaming regulation. Thomas N. Auriemma is the Company's former Vice President, Chief Compliance Officer and former Director of the Division of Gaming Enforcement in

New Jersey, with over 30 years of experience as a gaming regulator in the State of New Jersey. The Compliance Committee operates under a written charter adopted by the Board of Directors. The

Chief Compliance Officer reports to the Compliance Committee, and other executives of the Company (including the General Counsel, the Chief Operating Officer and the Vice President, Internal Audit)

regularly attend meetings of the Compliance Committee, at the committee's invitation, in order to ensure the Committee has ready access to first-hand knowledge and to encourage pervasive compliance

culture throughout the Company.

The

Compliance Committee was established to foster, through self-regulatory policies and procedures, compliance with applicable laws relating to the Company's gaming and racing

businesses and to prevent, to the fullest extent possible, any involvement by the Company in any activities that could pose a threat to the reputation and integrity of the Company's gaming and racing

operations.

The

Compliance Committee is responsible for:

- •

- reviewing and assessing the adequacy of the Company's compliance policies and procedures;

- •

- reviewing and assessing the effectiveness of the Company's compliance efforts, particularly the training on and implementation of

procedures;

- •

- monitoring audits and investigations conducted or overseen by the Company's compliance personnel;

- •

- monitoring administrative investigations of and disciplinary actions against the Company; and

- •

- reporting to the Board any matters of concern regarding the Company's compliance with various laws and regulations.

14

Table of Contents

In

discharging its oversight role, the Compliance Committee is empowered to investigate any matter brought to its attention and may engage, at the expense of the Company, independent

counsel or other advisors as it deems necessary to carry out its duties.

Director Selection Process

The Nominating and Corporate Governance Committee considers candidates for Board membership suggested by, among others, its members,

other Board members and management. The committee will also consider recommendations of nominees for directors by shareholders (for information relating to the nominations of directors by our

shareholders, please see "Director Nominations by Shareholders" below). In addition, the committee has authority to engage a search firm to assist in the identification of director candidates, to

approve the search firm fees (which are paid by the Company) and other retention terms, and to obtain advice and assistance from internal and external legal, accounting or other advisors.

In

selecting nominees for director, the committee considers a number of factors, including, but not limited to:

- •

- whether a candidate has demonstrated business and industry experience that is relevant to the Company, including recent experience at

the senior management level (preferably as chief executive officer or a similar position) of a company as large or larger than the Company;

- •

- a candidate's ability to meet the suitability standards set forth in the Company's bylaws, as well as the rigorous suitability and

filing requirements of the relevant regulatory agencies in each of the jurisdictions where the Company operates;

- •

- a candidate's ability to effectively represent the interests of the shareholders;

- •

- a candidate's diversity of experience and independence from management and freedom from potential conflicts of interest with the

Company;

- •

- a candidate's financial literacy, including whether the candidate can meet the audit committee membership standards set forth in the

NASDAQ and SEC rules;

- •

- whether a candidate is recognized for his or her reputation, integrity, judgment, skill, leadership ability, honesty and moral values;

- •

- a candidate's ability to work constructively with the Company's management and other directors; and

- •

- a candidate's willingness, taking into consideration the number of other boards on which the candidate serves, to dedicate sufficient

time and energy to his or her board and committee duties.

During

the process of considering a potential nominee, the Nominating and Corporate Governance Committee and their Company delegates generally request extensive additional information

about, and conduct interviews with, the potential nominee. The information expected to be provided includes detailed financial and personal history customarily required by the Company's gaming and

racing regulators. In addition, the committee will also request that the candidate submit to an investigation overseen by the Chief Compliance Officer to evaluate whether the candidate is suitable to

serve on the Board of a publicly traded, multi-jurisdictional, highly regulated gaming and racing company.

Director Nominations by Shareholders

Shareholders who have beneficially owned at least 1% of the Company's common stock for a continuous period of not less than

12 months before making such recommendation may submit director nominations to the Nominating and Corporate Governance Committee for consideration. To be timely,

15

Table of Contents

a

shareholder's notice to the Secretary must be hand-delivered to or mailed (certified or registered mail, return receipt requested) and received at the principal executive offices of the Company not

less than 120 nor more than 150 days prior to the anniversary date of the immediately preceding annual meeting of shareholders.

To

be in proper written form, a shareholder's notice must contain with respect to each nominee: (i) all information relating to such person that is required to be disclosed in a

proxy statement or other filing required to be made in connection with solicitations of proxies for election of directors in a contested election, or otherwise required by Section 14 of the

Exchange Act and the rules and regulations promulgated thereunder; (ii) a description of all direct and indirect compensation, economic interests and other material monetary agreements,

arrangements and understandings during the past three years between or among such shareholder and beneficial owner, if any, and their respective affiliates and associates; (iii) a description

of all relationships, agreements, arrangements and understandings between the proposed nominee and the recommending shareholder and the beneficial owner, if any; (iv) a description of all

relationships between the recommended nominee and any of the Company's competitors, customers, suppliers, labor unions or other related parties; and (v) a completed and signed questionnaire,

representations, consent and agreement as required by the Company's bylaws.

A

shareholder's notice must also contain certain other information regarding the shareholder giving the notice and the beneficial owner, if any, on whose behalf the recommendation for

nomination or proposal is made, including: (i) the name, address and telephone number of such shareholder and the name, address and telephone number of such beneficial owner, if any;

(ii) the class or series and number of shares and any other securities of the Company which are owned of record by such shareholder and beneficially by such beneficial owner, and the time

period such shares have been held; (iii) any material pending or threatened legal proceeding in which such shareholder or beneficial owner is a party or material participant involving the

Company or any of its officers or directors, or any affiliate of the Company, and any direct or indirect material interest in any material contract or agreement of such shareholder or beneficial owner

with the Company, any affiliate of the Company or any principal competitor of the Company; (iv) a representation that such shareholder and beneficial owner, if any, intend to be present in

person at the meeting; (v) a representation that such shareholder and such beneficial owner, if any, intend to continue to hold the reported securities through the date of the Company's next

annual meeting of shareholders; and (vi) a completed and signed questionnaire, representations, consent and agreement as required by Company's bylaws.

The

notice shall be accompanied by a written consent of each recommended nominee to provide (i) all information necessary to enable the Company to respond fully to any suitability

inquiry conducted under the executive, administrative, judicial and/or legislative rules, regulations, laws and orders of any jurisdiction to which the Company is then subject; (ii) a

multijurisdictional personal disclosure form in the form customarily submitted by officers and directors of the Company; (iii) such additional information concerning the recommended nominee as

may reasonably be required by the Nominating and Corporate Governance Committee and/or Board to determine the eligibility of such recommended nominee to serve as an independent director of the

Company, that could be material to a reasonable shareholder's understanding of the independence, or lack thereof, of such proposed nominee, and to evaluate whether the recommended nominee is an

unsuitable person; and (iv) a background check to confirm the qualifications and character of the recommended nominee, to evaluate whether the nominee is an unsuitable person, and to make such

other determinations as the Nominating and Corporate Governance Committee or the Board may deem appropriate or necessary.

The

foregoing is a brief summary of the requirements to properly nominate an individual for election to the Board. For further information regarding director nominations by shareholders,

please see Article VII of the Company's bylaws.

16

Table of Contents

Compensation of Directors

The Company pays director fees to each director who is not an employee of the Company. During the year ended December 31, 2014,

each non-employee director received an annual cash fee of $50,000, plus an additional $10,000 for service on each of the Audit Committee and the Compensation Committee, as applicable. On

March 13, 2014, each director on such date also received an annual award of phantom stock units equal to 17,446 shares, other than Mr. Carlino, who received an annual award of phantom

stock units equal to 26,169 shares in recognition of his service as Chairman of the Board. The number of phantom stock units awarded to the directors was determined based on the closing price of the

Company's stock on December 31, 2013 ($14.33) in order to approximate a value of $250,000 per director (or $375,000 in the case of Mr. Carlino). Each award vests in four equal annual

installments from the date of grant.

2014 Director Compensation Table

The following table sets forth information with respect to all compensation awarded to the Company's non-employee directors during the

last completed fiscal year.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Year Compensation |

|

Outstanding |

|

Name

|

|

Fees Earned

or Paid in

Cash ($) |

|

Stock Awards

($)(1) |

|

Total ($) |

|

Stock

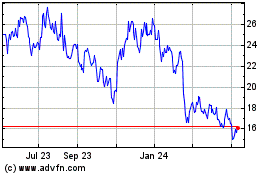

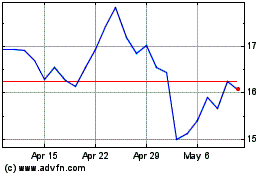

Ticker |

|

Stock

Awards(2) |

|

Peter M. Carlino |

|

|

50,000 |

|

|

339,412 |

|

|

389,412 |

|

PENN |

|

|

852,251 |

|

|

|

|

|

|

|

|

|

|

|

|

GLPI |

|

|

4,771,419 |

|

Harold Cramer |

|

|

70,000 |

|

|

226,275 |

|

|

296,275 |

|

PENN |

|

|

29,104 |

|

|

|

|

|

|

|

|

|

|

|

|

GLPI |

|

|

8,928 |

|

David A. Handler |

|

|

60,000 |

|

|

226,275 |

|

|

286,275 |

|

PENN |

|

|

29,104 |

|

|

|

|

|

|

|

|

|

|

|

|

GLPI |

|

|

13,054 |

|

John M. Jacquemin |

|

|

60,000 |

|

|

226,275 |

|

|

286,275 |

|

PENN |

|

|

29,104 |

|

|

|

|

|

|

|

|

|

|

|

|

GLPI |

|

|

8,928 |

|

Barbara Shattuck Kohn |

|

|

70,000 |

|

|

226,275 |

|

|

296,275 |

|

PENN |

|

|

29,104 |

|

|

|

|

|

|

|

|

|

|

|

|

GLPI |

|

|

8,928 |

|

Ronald J. Naples |

|

|

50,000 |

|

|

226,275 |

|

|

276,275 |

|

PENN |

|

|

19,983 |

|

|

|

|

|

|

|

|

|

|

|

|

GLPI |

|

|

2,392 |

|

- (1)

- The

amounts listed above are calculated based on the closing price on the day prior to grant date. In 2014, each non-employee director was granted an award

of phantom stock units equal to 17,446 shares, which for financial statement reporting purposes are deemed to have a grant date fair value of $226,275, other than Mr. Carlino (the Chairman),

who was granted an award of phantom stock units equal to 26,169 shares, which for financial statement reporting purposes are deemed to have a fair value of $339,412.

- (2)

- Stock

awards represent phantom stock unit awards outstanding as of December 31, 2014, as well as outstanding phantom stock unit awards in GLPI

received on a one-time basis as part of the Spin-Off, as more particularly described on page 28 of this Proxy Statement. Mr. Carlino's outstanding stock awards include 105,997 phantom

stock units and 746,254 options in the Company and 164,641 restricted stock awards, 320,364 phantom stock units and 4,286,414 options in GLPI (which represent compensation he received as Chief

Executive Officer and Chairman of the Board). Mr. Handler's outstanding stock awards include 8,928 phantom stock units and 4,126 restricted stock awards in GLPI.

17

Table of Contents

Stock Ownership Guidelines

The Board of Directors has established stock ownership guidelines for non-employee directors of the Company. Each non-employee director

is expected to own and hold shares of common stock, including restricted stock and phantom stock units, equal in value to at least five times the annual cash retainer (exclusive of separate committee

retainers) for non-employee directors in the applicable year. New non-employee directors have a period of three years from the date of initial election to achieve this ownership guideline. As of

December 31, 2014, all non-employee directors who have served on the Board for at least three years were in compliance with these guidelines.

The

Compensation Committee also established stock ownership guidelines for senior officers as follows:

|

|

|

| Chief Executive Officer |

|

Three times base salary |

Chief Operating Officer |

|

Two times base salary |

Chief Financial Officer |

|

Two times base salary |

All other senior officers |

|

One times base salary |

As

with the director stock ownership guidelines, the value of a senior officer's stock ownership at any time will be based on the aggregate value of common stock, restricted stock and

phantom stock units held by such senior officer. Senior officers as of the date of the Spin-Off will have three years from the date of the Spin-Off to comply with these guidelines, and newly hired

senior officers will have five years from their date of hire to comply with these guidelines. As of December 31, 2014, all Named Executive Officers (as defined on page 44 of this Proxy

Statement) were in compliance with this policy.

Shareholder Access Policy

Shareholders who wish to communicate with directors should do so by writing to Penn National Gaming, Inc., 825 Berkshire

Boulevard, Suite 200, Wyomissing, PA 19610, Attention: Secretary. The Secretary of the Company reviews all such correspondence and forwards to the Board a summary of all such correspondence and

copies of all correspondence that, in the opinion of the Secretary, deals with the functions of the Board or Board committees or that he otherwise determines requires their attention. Directors may at

any time review a log of all correspondence received by the Company that is addressed to members of the Board and request copies of any such correspondence. Concerns relating to accounting, internal

controls or auditing matters will be brought to the attention of the Audit Committee.

18

Table of Contents

PROPOSAL NO. 1

ELECTION OF CLASS I DIRECTORS

Information about Nominees and Other Directors

The Board of Directors currently consists of eight members: Peter M. Carlino (Chairman), Harold Cramer, David A. Handler, John M.

Jacquemin, Barbara Shattuck Kohn, Jane Scaccetti, Ronald J. Naples and Timothy J. Wilmott. The directors are organized into three classes, with each class elected to serve a three year term. Two

Class I directors will be elected at the Annual Meeting to hold office, subject to the provisions of the Company's bylaws, until the annual meeting of shareholders of the Company to be held in

2018 and until their respective successors are duly elected and qualified.

Change in Board composition

Timothy J. Wilmott was appointed to the Company's Board of Directors on September 16, 2014, and Jane Scaccetti was appointed to

the Board on April 13, 2015.

Class I Nominees

The following table sets forth the name, age, principal occupation and respective service dates of each person who has been nominated

to be a director of the Company. Each nominee has consented to be named as a nominee and, to the knowledge of the Company, is willing to serve as a director, if elected. Should either of the nominees

not remain a nominee at the end of the meeting (a situation which is not anticipated), solicited proxies may be voted by the holders of the proxies for a substitute nominee (unless a proxy contains

instructions to the contrary).

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Nominee

|

|

Age |

|

Principal Occupation |

|

Director

Since |

|

Term

Expires

(if elected) |

|

David A. Handler |

|

|

50 |

|

Partner, Centerview Partners |

|

|

1994 |

|

|

2018 |

|

John M. Jacquemin |

|

|

68 |

|

President, Mooring Financial Corporation |

|

|

1995 |

|

|

2018 |

|

The

Board has determined that each of the director nominees is independent under the NASDAQ Rules.

Nominee Qualifications

David A. Handler. Mr. Handler has been a director since 1994. In August 2008, Mr. Handler joined Centerview Partners as a

Partner.

Centerview Partners is a boutique financial advisory and private equity firm. From April 2006 to August 2008, he was a Managing Director at UBS Investment Bank. From April 2000 until April 2006, he

was a Senior Managing Director at Bear Stearns & Co., Inc. From July 1995 to April 2000, Mr. Handler was employed by Jefferies & Company, Inc. where he became a

Managing Director in March 1998. In November 2013, Mr. Handler became a director of Gaming and Leisure Properties, Inc.

The

Nominating and Corporate Governance Committee recommended the nomination of Mr. Handler, and the Board supports and approves such nomination, because of his experience in

investment banking and capital markets that has included a focus on mergers and acquisitions and other significant transactions, which compliments his long term exposure to the gaming industry.

Mr. Handler's background has been an invaluable asset to the Company over the years, particularly in connection with evaluating potential acquisition and financing opportunities (including the

preferred equity investment in the Company by Fortress Investment Group, LLC in 2008 and the Spin-Off).

19

Table of Contents

John M. Jacquemin. Mr. Jacquemin has been a director since 1995. Mr. Jacquemin is President of Mooring Financial Corporation,

a group

of financial services companies founded by Mr. Jacquemin in 1982 that specializes in the purchase and administration of commercial loan portfolios.

The

Nominating and Corporate Governance Committee recommended the nomination of Mr. Jacquemin, and the Board supports and approves such nomination because of his experience with

private equity funds specializing in restructurings, workouts and the valuation of distressed debt. The nature of these investments requires an intimate and sophisticated understanding of financial

statements to enable the identification of growth opportunities in troubled companies, as well as valuation expertise. This experience brings unique perspective to the Board and is enhanced by

Mr. Jacquemin's financial sophistication and financial statement expertise and long term exposure to the gaming industry.

In

addition to the qualifications of each nominee for director described above, David A. Handler and John M. Jacquemin are standing for re-election based upon the judgment, financial

acumen and skill they have previously demonstrated as Board members, as well as their demonstrated commitment to serve on the Board.

Continuing Directors