EARNINGS PREVIEW: Casinos' Growth Still On A Streak

January 26 2012 - 12:31PM

Dow Jones News

TAKING THE PULSE: Most U.S. casino operators have posted

stronger results over the past year as the number of visitors

streaming into Las Vegas gradually improves. Companies with casinos

in the Chinese gambling enclave of Macau are meanwhile seeing a

windfall from highly lucrative VIP visits, which account for nearly

75% of all gambling revenue in the city. Macau gambling revenue

rose 25% last month, capping off a year in which revenue soared

42%. Bears remain wary of those numbers, warning the VIP market's

explosive growth is unsustainable, but for now the island gambling

mecca remains on a tear.

COMPANIES TO WATCH:

Las Vegas Sands Corp. (LVS) - Feb. 1

Wall Street Expectations: Analysts' average estimate calls for a

56-cent per-share profit with $2.46 billion in revenue. Sands last

year posted a profit of 34 cents a share, or 42 cents excluding

certain charges, with revenue minus certain promotional allowances

at $2.02 billion.

Key Issues: Despite its name, Las Vegas Sands has invested

heavily in Asia and now generates most of its revenue there. The

company is poised to benefit from a growing relationship with

Chinese VIP junket operators, who drive a big chunk of Macau's

gambling revenue. Moody's Investors Service also points out a trump

card in Sands' presence in Singapore--the company operates one of

only two casinos in the country--where gambling revenue continues

to surge, helped by limited competition. Yet advisory firm Janney

warned in a note to clients that the company's long-term growth

could be marred by "choppier growth going forward," partly due to

Macau's unpredictable nature.

Penn National Gaming Inc. (PENN) - Feb. 2

Wall Street Expectations: The consensus calls for a 49-cent

per-share profit and $675 million in revenue, according to a survey

by Thomson Reuters. A year earlier, the company reported a $1.97

per-share loss--a 30-cent profit excluding stock-based

compensation, asset write-downs and other items--on $630.2 million

in revenue.

Key Issues: Penn National's regional gambling business remains

vulnerable to weak U.S. employment growth, and its casinos outside

Las Vegas could also face cannibalization from nearby properties.

At the same time, some analysts suggest fourth-quarter gambling

revenue could stage a stealthy comeback. The company will also see

added revenue from its recently acquired M Resort in Las Vegas.

Wynn Resorts Ltd. (WYNN) - Expected Feb. 8

Wall Street Expectations: Analysts expect a $1.28 per-share

profit and $1.36 billion in revenue. A year earlier, the company

earned 91 cents and $1.24 billion, respectively.

Key Issues: Worries about a slowdown in the pace of growth in

Macau pressured Wynn's stock throughout November. An escalating

battle between Chairman and Chief Executive Steve Wynn and business

partner Kazuo Okada, who owns the largest amount of shares at about

20%, has also distracted investors. Wynn's bottom line will still

benefit in the fourth quarter from its exposure to Macau, however,

and the company's high-end Las Vegas properties are generating more

revenue from a rebounding convention business.

MGM Resorts International (MGM) - Expected Feb. 16

Wall Street Expectations: Analysts polled by Thomson Reuters

expect a loss of 18 cents a share on $2.17 billion in revenue. The

company last year posted a loss of 29 cents a share--20 cents

excluding write-downs--with net revenue at $1.47 billion.

Key Issues: Analysts point to encouraging growth trends in MGM's

revenue per available room, a key hotel metric and an indicator

that its Las Vegas casino resorts saw hotel room rates and

occupancy improve following deep falls during the economic

downturn. Charges tied to the company's CityCenter joint venture on

the Strip have weighed down earnings in the past, but Moody's

Investors Service has noted the property delivered

better-than-expected results through the third quarter.

Boyd Gaming Corp. (BYD) - Expected Feb. 28

Wall Street Expectations: Wall Street sees a penny per-share

loss and $593 million in revenue. A year earlier, the company

earned a profit of 8 cents a share, or 5 cents excluding items such

as preopening expenses and debt-retirement impacts, on $551.9

million in revenue.

Key Issues: Some of Boyd's regional casinos could benefit from a

rebound in consumer spending, and the company has expanded its

holdings with a recent acquisition in Biloxi, Miss. At the same

time, Boyd's local Las Vegas casinos have struggled, and its

Borgata property in Atlantic City faces increased competition for a

still-weak share of the regional market. The company in November

terminated an $80 million agreement to sell its Dania Jai-Alai

venue and casino in Florida after buyers were unable to close the

deal within the required period, leaving Boyd burdened with another

drag on its earnings.

-By Drew FitzGerald, Dow Jones Newswires; 212-416-2909;

Andrew.FitzGerald@dowjones.com

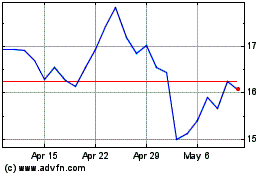

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

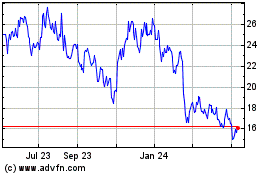

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024