EARNINGS PREVIEW: US Casinos Find Big Money Still In Macau

July 14 2011 - 10:46AM

Dow Jones News

TAKING THE PULSE: Rising visitor numbers, fatter margins and a

series of mostly positive decisions from government regulators are

expected to boost big casino operators' earnings this quarter,

adding momentum to the year's rebound. Those companies with

operations in Asia are seen performing especially well as Chinese

regulators ease some restrictions on visitors to Macau.

Higher revenue from U.S. resorts and casinos depends on a shaky

economic recovery, however, which could spell trouble for some

operators. Susquehanna says Las Vegas' recovery has slowed

dramatically as its busiest convention season ends and the city

becomes more dependent on the leisure market, making holdings

outside the gambling hub all the more important to companies'

results.

COMPANIES TO WATCH:

Wynn Resorts Ltd. (WYNN) - July 18

Wall Street Expectations: Analysts expect earnings of 99 cents a

share on $1.26 billion in revenue. A year earlier, the company

earned 42 cents a share, or 52 cents excluding write-downs, on

revenue of $1.03 billion.

Key Issues: Despite fierce competition, Wynn continues to cash

in on its booming business in Macau, the Chinese gambling Mecca

that reported a 52% jump in June gambling revenue compared with a

year ago. Fitch Ratings last week upgraded the luxury casino resort

operator, citing the Chinese special administrative region as a key

strength. In Las Vegas, Wynn's casino also seems to be pulling

ahead of its major competitors as convention visitors return in

larger numbers.

Penn National Gaming Inc. (PENN) - July 21

Wall Street Expectations: Analysts polled by Thomson Reuters

expect a per-share profit of 47 cents with $687 million in revenue.

A year earlier, the company reported a per-share profit of 9 cents,

or 29 cents excluding items such as asset write-downs, on $598.3

million in revenue.

Key Issues: The operator of casinos and horse racetracks in the

eastern U.S. has seen its revenue improve lately as consumer

spending stabilizes. The company reached an agreement to end

litigation with state authorities in Ohio over one of two planned

casinos there, while analysts have praised a joint venture with

auto racetrack operator International Speedway Corp. (ISCA, ISCB)

in Kansas City. Moody's Investors Service last month raised its

credit outlook for the company to positive, saying it expects Penn

will continue to perform well relative to its competitors.

Las Vegas Sands Corp. (LVS) - Expected July 28

Wall Street Expectations: The consensus calls for 44 cents a

share in earnings and $2.21 billion in revenue. Including the

impact from preferred dividends, Sands posted a penny-per-share

loss a year ago--a profit of 17 cents excluding preopening costs

and other impacts--with revenue minus certain promotional

allowances at $1.59 billion.

Key Issues: Despite its name, the company already generates most

of its revenue in Asia. Sterne Agee says the chain's new casino in

Macau's highly desirable Cotai area "should instantly leverage the

largest existing mass gaming database in Macau" and turn

day-trippers to overnighters with affordable hotel rooms, which are

in short supply there. Results have also benefited from improving

performance at Las Vegas Sands' Marina Bay Sands resort.

Boyd Gaming Corp. (BYD) - Expected Aug. 1

Wall Street Expectations: The Street sees a per-share profit of

2 cents and $579 million in revenue. A year earlier, the company

earned 4 cents a share, or 5 cents excluding items, on $578.5

million in revenue.

Key Issues: Boyd has struggled amid an uneven economic recovery

in the U.S. as revenue remains soft in Las Vegas. One of Sin City's

oldest gambling companies, the geographically diverse casino

operator has benefited in recent quarters from its half stake in

the Borgata in Atlantic City, N.J. A $288 million deal for a

Mississippi resort and spa is expected to further bolster the

company's top line in the long run, but it could add to its already

burdensome costs in its fiscal second quarter.

MGM Resorts International (MGM) - Expected Aug. 3

Wall Street Expectations: Analysts polled by Thomson Reuters

expect a loss of 13 cents a share on $1.59 billion in revenue. The

company posted a year-earlier loss of $2 a share--35 cents

excluding write-downs--and $1.54 billion in revenue.

Key Issues: Earnings will benefit from a recently launched joint

venture in Macau with Pansy Ho, the daughter of local gambling

tycoon Stanley, after an agreement reached earlier this year.

Morgan Stanley also sees the company benefiting from improving

leisure trends at its properties in Las Vegas, but it will take

time for adjusted earnings to return to peak levels.

-By Drew FitzGerald, Dow Jones Newswires; 212-416-2909;

Andrew.FitzGerald@dowjones.com

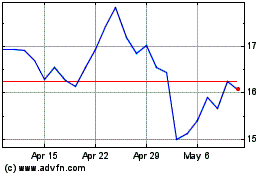

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

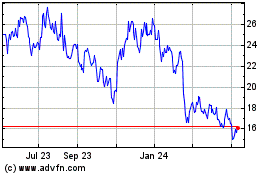

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024