EARNINGS PREVIEW: Improved Results Seen At Large US Casinos

April 29 2010 - 1:54PM

Dow Jones News

TAKING THE PULSE: Some casino companies are expecting improved

first-quarter results compared with a year earlier, when most

posted losses during the depths of the recession, which sharply

reduced tourism and consumer spending. With recent openings of two

big resorts in Macau and Singapore by Wynn Resorts Ltd. (WYNN) and

Las Vegas Sands Corp. (LVS), respectively, both companies now rely

on Asia for most of their revenue.

Las Vegas remains weak though convention bookings have picked

up, but prospects are bright in Macau, China's gambling enclave and

the world's largest casino market by revenue. Meanwhile, five

casinos are for sale in Atlantic City, N.J., which has been hurt by

the recession and competition from gambling in nearby

Pennsylvania.

Penn National Gaming Inc. (PENN) last week reported an 11%

decline in first-quarter profit as revenue slid 3.3% on the

continuing downturn in U.S. gambling. The company, which operates

19 casino and horse-racing facilities in 14 states and Ontario but

not in Las Vegas, also said bad weather hurt results at some

locations.

COMPANIES TO WATCH:

Wynn Resorts Ltd. (WYNN) - reports Thursday

Wall Street Expectations: Analysts anticipate earnings of 14

cents a share on revenue of $850 million, according to analysts

polled by Thomson Reuters. A year earlier, Wynn had a loss of 30

cents on $740 million in revenue.

Key Issues: Wynn, which has a stronger balance sheet than most

of its rivals, is opening its new hotel and casino, Encore at Wynn

Macau, and plans to start construction of a major new casino in

Macau's Cotai area next year. Asia has become so core to the

company's operations that Steve Wynn said he will consider moving

the firm's headquarters to Macau from Las Vegas.

Boyd Gaming Corp. (BYD) - reports May 4

Wall Street Expectations: Analysts anticipate earnings of 7

cents on revenue of $410 million, compared with a prior-year loss

of 16 cents on revenue of $435 million.

Key Issues: One of the oldest Las Vegas gambling companies, Boyd

attracts many locals, who are struggling with declining home values

and job losses. The company has been trying to buy rival bankrupt

Station Casinos Inc., but a series of insider deals that Station

recently struck with lenders and members of its founding family

make it unlikely that Boyd will win its bid.

MGM Mirage (MGM) - reports May 6

Wall Street Expectations: Analysts predict a loss of 27 cents on

revenue of $1.41 billion. A year earlier, the casino giant reported

earnings of 38 cents, including a 44-cent gain from selling Las

Vegas' Treasure Island, on revenue of $1.66 billion.

Key Issues: MGM Mirage this month warned that its loss would be

larger than Wall Street expected and would include a $255 million

operating loss for its $8.5 billion CityCenter, which opened in Las

Vegas in December. The debt-laden company last month said it would

leave Atlantic City, where it co-owns the Borgata with Boyd Gaming,

in response to regulatory concerns.

Las Vegas Sands Corp. (LVS) - no reporting date set

Wall Street Expectations: The largest publicly traded U.S.

casino company by market capitalization, is seen posting a 2-cent

profit on revenue of $1.3 billion. A year earlier, its loss was 14

cents on revenue of $1.08 billion.

Key Issues: The casino giant, best known for the Venetian

resorts in Las Vegas and Macau, just opened the world's most

expensive casino, the $5.5 billion Marina Bay Sands, on Singapore's

main waterfront. When the new resort is fully operational in June,

the company will get as much as 85% of its earnings from Asia.

(The Thomson Reuters estimate and year-ago figures may not be

comparable due to one-time items and other adjustments.)

-By Kathy Shwiff, Dow Jones Newswires; 212-416-2357;

Kathy.Shwiff@dowjones.com

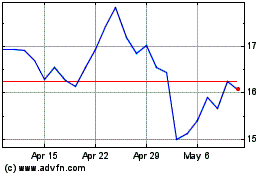

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Mar 2024 to Apr 2024

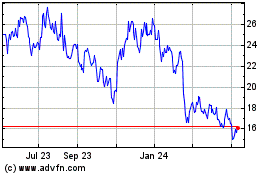

PENN Entertainment (NASDAQ:PENN)

Historical Stock Chart

From Apr 2023 to Apr 2024