UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

August 28, 2015

Date of report/(Date of earliest event reported)

PATTERSON

COMPANIES, INC.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Minnesota |

|

0-20572 |

|

41-0886515 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1031 Mendota Heights Road

St. Paul, Minnesota 55120

(Address of Principal Executive Offices, including Zip Code)

(651) 686-1600

(Registrant’s Telephone Number, including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.01 |

COMPLETION OF ACQUISITION OR DISPOSITION OF ASSETS |

On August 28, 2015, Patterson Companies, Inc.

(the “Company”) completed the disposition of Patterson Medical Holdings, Inc., a Delaware corporation (“Patterson Medical”), pursuant to the previously announced Stock Purchase Agreement (the “Stock Purchase

Agreement”), dated July 1, 2015, with Lanai Holdings III, Inc. (“Buyer”), a Delaware corporation and affiliate of Madison Dearborn Partners, LLC. Pursuant to the Stock Purchase Agreement, Buyer acquired all of the outstanding

shares of common stock, par value $0.01 per share, of Patterson Medical for a purchase price of approximately $715 million in cash.

The Company also

entered into a transition services agreement with Patterson Medical, dated as of August 28, 2015, pursuant to which Patterson Medical will pay Patterson to provide, among other things, certain information technology, distribution, facilities,

finance, tax and treasury, and human resources services for a limited period of time after closing. A form of the transition services agreement was filed as Exhibit B to the Stock Purchase Agreement.

The above description of the Stock Purchase Agreement and the transactions contemplated thereby does not purport to be complete and is qualified in its

entirety by reference to the full text of the Stock Purchase Agreement, which was previously filed as an exhibit to the Company’s Current Report on Form 8-K dated July 1, 2015 and which is incorporated herein by reference.

| Item 2.04 |

TRIGGERING EVENTS THAT ACCELERATE OR INCREASE A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT. |

The disposition of Patterson Medical on August 28, 2015 triggered the Company’s obligation to prepay certain loans made under the Credit Agreement,

dated as of June 16, 2015, by and among the Company, the Lenders identified therein, The Bank of Tokyo-Mitsubishi UFJ, Ltd., as administrative agent, and Bank of America, N.A., as syndication agent, (the “Credit Agreement”). To

satisfy its prepayment obligation, the Company applied net proceeds of $670 million from the sale of Patterson Medical to prepay certain term loans made under the Credit Agreement.

| Item 5.02 |

DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS. |

(b) As a result of the sale of Patterson Medical, Michael J. Orscheln, who has served as President of Patterson Medical, ceased to be an executive officer of

the Company, effective August 28, 2015.

Disposition of Patterson Medical

On August 28, 2015, Patterson issued a press release announcing that it had completed the disposition of Patterson Medical. A copy of the press release is

attached hereto as Exhibit 99.2.

Equity Award Information

As set forth in our definitive proxy statement filed with the Securities and Exchange Commission on August 7, 2015 (the “2015 Proxy Statement”),

we are asking our shareholders to consider, among other proposals, a proposal to approve our 2015 Omnibus Incentive Plan (the “Omnibus Plan”) at our 2015 annual meeting of shareholders to be held on September 21, 2015 (the “2015

Annual Meeting”). The table below updates, through August 31, 2015, certain equity award information disclosed in our 2015 Proxy Statement and our Annual Report on Form 10-K for the fiscal year ended April 25, 2015, as filed with the

Securities and Exchange Commission on June 24, 2015. The Omnibus Plan remains unchanged and is included as Annex A to our 2015 Proxy Statement. As of August 31, 2015, 103,248,304 shares of our common stock were outstanding.

|

|

|

|

|

|

|

|

|

| |

|

As of

April 25,

2015 |

|

|

As of

August 31,

2015 |

|

| Total Outstanding Awards |

|

|

|

|

|

|

|

|

| Options |

|

|

338,299 |

|

|

|

1,148,164 |

(1) |

| Restricted Stock Awards |

|

|

1,167,093 |

|

|

|

944,839 |

|

| Restricted Unit Awards |

|

|

26,481 |

|

|

|

19,221 |

|

| Performance Units |

|

|

300,280 |

|

|

|

229,172 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

1,832,153 |

|

|

|

2,341,396 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares Available for Future Awards |

|

|

|

|

|

|

|

|

| Amended and Restated Equity Incentive Plan |

|

|

2,882,487 |

|

|

|

0 |

(2) |

| Canadian Plan |

|

|

1,899,346 |

|

|

|

0 |

(3) |

| Employee Stock Purchase Plan |

|

|

1,500,000 |

|

|

|

1,439,048 |

|

| Sharesave Plan |

|

|

200,000 |

|

|

|

200,000 |

|

| Capital Accumulation Plan |

|

|

2,052,812 |

|

|

|

2,052,812 |

|

|

|

|

|

|

|

|

|

|

| Total |

|

|

8,534,645 |

|

|

|

3,691,860 |

|

|

|

|

|

|

|

|

|

|

| (1) |

As of April 25, 2015, the 338,299 options then outstanding had a weighted-average exercise price of $36.22 and a weighted-average remaining contractual life of 5.4 years. As of August 31, 2015, the 1,148,164

options then outstanding had a weighted-average exercise price of $51.01 and a weighted-average remaining contractual life of 8.8 years. |

| (2) |

As of August 31, 2015, 1,057,279 shares remained available for issuance under our Amended and Restated Equity Incentive Plan; however, pursuant to Section 22.1 of the Omnibus Plan, no new awards may be made

under the Amended and Restated Equity Incentive Plan following shareholder approval of the Omnibus Plan. |

| (3) |

As of August 31, 2015, we terminated the Canadian Plan and no shares are available for future issuance thereunder. |

| Item 9.01 |

FINANCIAL STATEMENTS AND EXHIBITS |

(b) Pro forma financial information. The unaudited pro forma

balance sheet of Patterson Companies, Inc., dated as of April 25, 2015, and the unaudited pro forma statements of income of Patterson Companies, Inc. for the years ended April 25, 2015, April 26, 2014 and April 27, 2013 are

filed as Exhibit 99.1 to this Current Report on Form 8-K.

(d) Exhibits

|

|

|

|

|

| 2.1 |

|

Stock Purchase Agreement between Patterson Companies, Inc. and Lanai Holdings III, Inc. dated July 1, 2015 (filed as Exhibit 2.1 to Patterson Companies, Inc.’s Current Report on Form 8-K dated July 1, 2015 and

incorporated herein by reference). |

|

|

| 99.1 |

|

Unaudited pro forma balance sheet of Patterson Companies, Inc., dated as of April 25, 2015, and the unaudited pro forma statements of income of Patterson Companies, Inc. for the years ended April 25, 2015, April 26, 2014 and April

27, 2013. |

|

|

| 99.2 |

|

Press release of Patterson Companies, Inc., dated August 28, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

PATTERSON COMPANIES, INC. |

|

|

|

|

| Date: August 31, 2015 |

|

|

|

By: |

|

/s/ Ann B. Gugino |

|

|

|

|

|

|

Ann B. Gugino |

|

|

|

|

|

|

|

|

|

|

Executive Vice President, Chief Financial Officer and Treasurer |

|

|

|

|

|

|

|

|

|

|

(Principal Financial Officer and Principal Accounting Officer) |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 2.1 |

|

Stock Purchase Agreement between Patterson Companies, Inc. and Lanai Holdings III, Inc. dated July 1, 2015 (filed as Exhibit 2.1 to Patterson Companies, Inc.’s Current Report on Form 8-K dated July 1, 2015 and incorporated

herein by reference). |

|

|

| 99.1 |

|

Unaudited pro forma balance sheet of Patterson Companies, Inc., dated as of April 25, 2015, and the unaudited pro forma statements of income of Patterson Companies, Inc. for the years ended April 25, 2015, April 26, 2014 and April

27, 2013. |

|

|

| 99.2 |

|

Press release of Patterson Companies, Inc., dated August 28, 2015. |

Exhibit 99.1

The following unaudited pro forma consolidated financial statements are based on the consolidated financial statements of Patterson Companies, and are

adjusted to give effect to the event described in the Form 8-K to which this exhibit is attached as if that event occurred at an earlier date. The unaudited pro forma consolidated statements of income for the fiscal years ended April 25, 2015,

April 26, 2014 and April 27, 2013 are adjusted to reflect the sale of Patterson Medical as if it occurred on April 29, 2012. The unaudited pro forma balance sheet is adjusted to reflect the sale of Patterson Medical as if it occurred

on April 25, 2015, the last day of the most recently filed period.

The unaudited pro forma consolidated financial statements are provided for

illustrative purposes only and, therefore, are not necessarily indicative of the operating results or financial position that might have been achieved had the event described in the Form 8-K to which this

exhibit is attached occurred as of an earlier date, nor are they necessarily indicative of future operating results or financial position. The unaudited pro forma consolidated financial statements should be read in conjunction with the historical

consolidated financial statements and notes thereto in the Annual Report on Form 10-K for the fiscal year ended April 25, 2015.

PATTERSON COMPANIES, INC.

PRO FORMA CONSOLIDATED BALANCE SHEET

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

April 25, 2015 |

|

| |

|

Historical

Financial

Statement |

|

|

Pro Forma

Adjustment –

Medical (a) |

|

|

Pro Forma

Financial

Statement |

|

| ASSETS |

|

|

|

|

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

347,260 |

|

|

$ |

(715,000 |

) |

|

$ |

1,062,260 |

|

| Short-term investments |

|

|

53,372 |

|

|

|

— |

|

|

|

53,372 |

|

| Receivables, net of allowance for doubtful accounts |

|

|

644,139 |

|

|

|

57,876 |

|

|

|

586,263 |

|

| Inventory |

|

|

456,687 |

|

|

|

48,265 |

|

|

|

408,422 |

|

| Prepaid expenses and other current assets |

|

|

71,767 |

|

|

|

12,206 |

|

|

|

59,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,573,225 |

|

|

|

(596,653 |

) |

|

|

2,169,878 |

|

| Property and equipment, net |

|

|

226,805 |

|

|

|

22,672 |

|

|

|

204,133 |

|

| Long-term receivables, net |

|

|

71,686 |

|

|

|

— |

|

|

|

71,686 |

|

| Goodwill |

|

|

837,099 |

|

|

|

537,175 |

|

|

|

299,924 |

|

| Identifiable intangibles, net |

|

|

199,829 |

|

|

|

74,804 |

|

|

|

125,025 |

|

| Other |

|

|

39,062 |

|

|

|

1,143 |

|

|

|

37,919 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

2,947,706 |

|

|

$ |

39,141 |

|

|

$ |

2,908,565 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

349,635 |

|

|

$ |

26,341 |

|

|

$ |

323,294 |

|

| Accrued payroll expense |

|

|

79,964 |

|

|

|

7,500 |

|

|

|

72,464 |

|

| Other accrued liabilities |

|

|

148,086 |

|

|

|

(8,127 |

)(b) |

|

|

156,213 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

577,685 |

|

|

|

25,714 |

|

|

|

551,971 |

|

| Long-term debt |

|

|

725,000 |

|

|

|

— |

|

|

|

725,000 |

|

| Deferred income taxes |

|

|

88,264 |

|

|

|

46,851 |

|

|

|

41,413 |

|

| Other |

|

|

42,634 |

|

|

|

2,563 |

|

|

|

40,071 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities |

|

|

1,433,583 |

|

|

|

75,128 |

|

|

|

1,358,455 |

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

| Common stock |

|

|

1,033 |

|

|

|

— |

|

|

|

1,033 |

|

| Additional paid-in capital |

|

|

21,026 |

|

|

|

— |

|

|

|

21,026 |

|

| Accumulated other comprehensive income (loss) |

|

|

(60,346 |

) |

|

|

(13,795 |

) |

|

|

(46,551 |

) |

| Retained earnings |

|

|

1,630,148 |

|

|

|

(22,192 |

)(c) |

|

|

1,652,340 |

|

| Unearned ESOP shares |

|

|

(77,738 |

) |

|

|

— |

|

|

|

(77,738 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

1,514,123 |

|

|

|

(35,987 |

) |

|

|

1,550,110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total liabilities and stockholders’ equity |

|

$ |

2,947,706 |

|

|

$ |

39,141 |

|

|

$ |

2,908,565 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Reflects the elimination of Patterson Medical’s historical assets, liabilities and accumulated comprehensive income amounts, and the receipt of $715,000 of cash proceeds upon sale. |

| (b) |

Reflects historical other accrued liabilities less estimated income taxes payable resulting from the gain on sale of Patterson Medical. |

| (c) |

Reflects the estimated gain on sale of Patterson Medical, less estimated income taxes payable. The actual gain to be recognized will be adjusted by the actual closing adjustments and actual transaction fees incurred.

|

PATTERSON COMPANIES, INC.

PRO FORMA CONSOLIDATED STATEMENT OF INCOME

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal Year Ended April 25, 2015 |

|

| |

|

Historical

Financial

Statement |

|

|

Pro Forma

Adjustment –

Medical |

|

|

Pro Forma

Financial

Statement |

|

| Net sales |

|

$ |

4,375,020 |

|

|

$ |

464,155 |

|

|

$ |

3,910,865 |

|

| Cost of sales |

|

|

3,136,814 |

|

|

|

286,498 |

|

|

|

2,850,316 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

1,238,206 |

|

|

|

177,657 |

|

|

|

1,060,549 |

|

| Operating expenses |

|

|

864,779 |

|

|

|

108,816 |

|

|

|

755,963 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

373,427 |

|

|

|

68,841 |

(a) |

|

|

304,586 |

|

| Other income and expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

2,937 |

|

|

|

(488 |

) |

|

|

3,425 |

|

| Interest expense |

|

|

(33,693 |

) |

|

|

— |

|

|

|

(33,693 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

|

342,671 |

|

|

|

68,353 |

|

|

|

274,318 |

|

| Income taxes |

|

|

119,410 |

|

|

|

25,175 |

(b) |

|

|

94,235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

223,261 |

|

|

$ |

43,178 |

|

|

$ |

180,083 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

2.26 |

|

|

$ |

0.44 |

|

|

$ |

1.82 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

2.24 |

|

|

$ |

0.43 |

|

|

$ |

1.81 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

98,989 |

|

|

|

98,989 |

|

|

|

98,989 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

99,694 |

|

|

|

99,694 |

|

|

|

99,694 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Reflects the elimination of Patterson Medical’s historical segment operating results, adjusted to exclude $2,655 of distribution costs, $1,333 of shared branch expenses, and $827 of compensation expenses consistent

with the accounting requirements of presenting discontinued operations. Also, consistent with discontinued operations accounting requirements, $3,156 of divestiture-related transaction costs incurred by Patterson Medical during the period that were

not included in Patterson Medical’s historical segment results have been included in the Pro Forma Adjustment-Medical results. |

| (b) |

Income taxes have been allocated to Patterson Medical based on the accounting requirements for presenting discontinued operations. |

PATTERSON COMPANIES, INC.

PRO FORMA CONSOLIDATED STATEMENT OF INCOME

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal Year Ended April 26, 2014 |

|

| |

|

Historical

Financial

Statement |

|

|

Pro Forma

Adjustment –

Medical |

|

|

Pro Forma

Financial

Statement |

|

| Net sales |

|

$ |

4,063,715 |

|

|

$ |

478,574 |

|

|

$ |

3,585,141 |

|

| Cost of sales |

|

|

2,865,437 |

|

|

|

298,993 |

|

|

|

2,566,444 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

1,198,278 |

|

|

|

179,581 |

|

|

|

1,018,697 |

|

| Operating expenses |

|

|

852,522 |

|

|

|

127,551 |

|

|

|

724,971 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

345,756 |

|

|

|

52,030 |

(a) |

|

|

293,726 |

|

| Other income and expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

2,869 |

|

|

|

(381 |

) |

|

|

3,250 |

|

| Interest expense |

|

|

(35,713 |

) |

|

|

— |

|

|

|

(35,713 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

|

312,912 |

|

|

|

51,649 |

|

|

|

261,263 |

|

| Income taxes |

|

|

112,300 |

|

|

|

22,369 |

(b) |

|

|

89,931 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

200,612 |

|

|

$ |

29,280 |

|

|

$ |

171,332 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

1.99 |

|

|

$ |

0.29 |

|

|

$ |

1.70 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

1.97 |

|

|

$ |

0.28 |

|

|

$ |

1.69 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

100,727 |

|

|

|

100,727 |

|

|

|

100,727 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

101,643 |

|

|

|

101,643 |

|

|

|

101,643 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Reflects the elimination of Patterson Medical’s historical segment operating results, adjusted to exclude $2,626 of distribution costs, $1,333 of shared branch expenses, and $1,308 of compensation expenses

consistent with the accounting requirements of presenting discontinued operations. |

| (b) |

Income taxes have been allocated to Patterson Medical based on the accounting requirements for presenting discontinued operations. |

PATTERSON COMPANIES, INC.

PRO FORMA CONSOLIDATED STATEMENT OF INCOME

(In thousands, except per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Fiscal Year Ended April 27, 2013 |

|

| |

|

Historical

Financial

Statement |

|

|

Pro Forma

Adjustment –

Medical |

|

|

Pro Forma

Financial

Statement |

|

| Net sales |

|

$ |

3,637,212 |

|

|

$ |

501,997 |

|

|

$ |

3,135,215 |

|

| Cost of sales |

|

|

2,446,443 |

|

|

|

307,975 |

|

|

|

2,138,468 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

1,190,769 |

|

|

|

194,022 |

|

|

|

996,747 |

|

| Operating expenses |

|

|

836,314 |

|

|

|

124,782 |

|

|

|

711,532 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

354,455 |

|

|

|

69,240 |

(a) |

|

|

285,215 |

|

| Other income and expense: |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income, net |

|

|

3,059 |

|

|

|

332 |

|

|

|

2,727 |

|

| Interest expense |

|

|

(36,397 |

) |

|

|

— |

|

|

|

(36,397 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before taxes |

|

|

321,117 |

|

|

|

69,572 |

|

|

|

251,545 |

|

| Income taxes |

|

|

110,845 |

|

|

|

24,216 |

(b) |

|

|

86,629 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

|

$ |

210,272 |

|

|

$ |

45,356 |

|

|

$ |

164,916 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

2.04 |

|

|

$ |

0.44 |

|

|

$ |

1.60 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

2.03 |

|

|

$ |

0.44 |

|

|

$ |

1.59 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average shares: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

103,030 |

|

|

|

103,030 |

|

|

|

103,030 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

103,807 |

|

|

|

103,807 |

|

|

|

103,807 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Reflects the elimination of Patterson Medical’s historical segment operating results, adjusted to exclude $2,233 of distribution costs, $1,346 of shared branch expenses, and $634 of compensation expenses consistent

with the accounting requirements of presenting discontinued operations. |

| (b) |

Income taxes have been allocated to Patterson Medical based on the accounting requirements for presenting discontinued operations. |

Exhibit 99.2

Patterson Companies Completes Sale of Patterson Medical to Madison Dearborn Partners

ST. PAUL, Minn. – Aug. 28, 2015 – Patterson Companies, Inc. (NASDAQ: PDCO) today announced that it has successfully completed the previously

disclosed sale of its medical business to Madison Dearborn Partners (MDP). Under the terms of the agreement, MDP, a Chicago-based private equity firm, is paying Patterson Companies gross proceeds of approximately $715 million in cash.

Scott P. Anderson, chairman and chief executive officer of Patterson Companies, commented, “The sale of the medical business accomplishes a key component

of Patterson’s strategic transformation. We are now well-positioned to focus on developing our highly synergistic dental and animal health businesses, accelerating return on our investments and delivering shareholder value.”

Patterson intends to apply the proceeds from the sale of its medical unit to reduce the debt it incurred to fund the acquisition of Animal Health

International, Inc.

About Patterson Companies, Inc.

Patterson Companies, Inc. is a value-added distributor serving the dental and animal health markets.

Dental Market

Patterson Dental provides a virtually

complete range of consumable dental products, equipment and software, turnkey digital solutions and value-added services to dentists and dental laboratories throughout North America.

Animal Health Market

Patterson Animal Health, formerly

Patterson Veterinary, is a leading, full-line distributor in North America and the U.K. of animal health products, services and technologies to both the production-animal and companion-pet markets.

About Madison Dearborn Partners

Madison Dearborn

Partners (MDP), based in Chicago, is a leading private equity investment firm in the United States. Since MDP’s formation in 1992, the firm has raised six funds with aggregate capital of over US $18 billion and has completed approximately 130

investments. MDP invests in businesses across a broad spectrum of industries, including health care; basic industries; business and government services; consumer; financial and transaction services; and telecom, media and technology services.

Notable health care investments include Option Care, Sage Products, Kaufman Hall, Sirona Dental, Team Health, and VWR International. For more information, please visit www.mdcp.com.

This press release contains certain forward-looking statements, as defined in the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are information of a non-historical nature and are subject to risks and uncertainties that are beyond Patterson’s ability to control. Forward-looking statements generally can be

identified by words such as “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates” or other words or phrases of similar import. Similarly, statements that describe the

proposed benefits of the transaction, including its financial impact, and other statements of management’s beliefs, intentions or goals also are forward-looking statements. It is uncertain whether any of the events anticipated by the

forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition of the combined companies or the price of Patterson stock. These forward-looking statements

involve certain risks and uncertainties that could cause actual results to differ materially from those indicated in such forward-looking statements including, but not limited to, the ability of Patterson to successfully integrate Animal

Health’s operations, product lines and technology; the ability of Patterson to implement its plans, forecasts and other expectations with respect to Animal Health’s business and realize additional opportunities for growth; and the other

risks and important factors contained and identified in Patterson’s filings with the Securities and Exchange Commission, such as its Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K, any of which could cause actual results to

differ materially from the forward-looking statements. Any forward-looking statement in this press release speaks only as of the date on which it is made. Except to the extent required under the federal securities laws, Patterson does not

intend to update or revise the forward-looking statements.

###

For additional information, contact:

Ann B. Gugino

Executive Vice President & CFO

651-686-1600

Source: Patterson Companies, Inc.

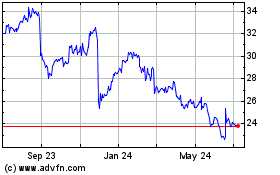

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

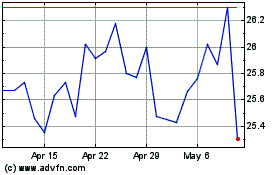

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Apr 2023 to Apr 2024