- Sales totaled $1.1 billion, up 6.7

percent on constant currency basis, with adjusted earnings per

diluted share of $0.68

- Dental sales expanded by 10.3

percent on a constant currency basis, reflecting strong equipment

sales

- Full fiscal-year sales rose 8.7

percent on a constant currency basis, with adjusted earnings per

share of $2.27

- Company provides adjusted earnings

guidance range for fiscal year 2016

Patterson Companies, Inc. (Nasdaq: PDCO) today reported that

consolidated sales totaled $1.1 billion (see attached Sales Summary

for further details) in its fiscal fourth quarter ended April 25,

2015; 4.2 percent higher than fiscal 2014. Reported net income

totaled $64.5 million, or $0.65 per diluted share, compared to

$55.7 million, or $0.55 per diluted share during the same period

last fiscal year. After adjusting for one-time transaction costs

related to the pending acquisition of Animal Health International

and the potential sale of Patterson Medical, fourth quarter fiscal

2015 earnings per diluted share were $0.68.

“Executing on our strategic plan and focusing on operational

discipline enabled Patterson to close fiscal 2015 with healthy

contributions from all three of our businesses,” said Scott

Anderson, chairman and chief executive officer. “We are encouraged

by the momentum we are seeing in all of our business units. As we

work to complete the acquisition of Animal Health International and

the potential sale of our Medical unit, we are confident that the

transformation we are pursuing for Patterson will lead to long-term

growth and success.”

Patterson DentalSales for Patterson Dental, which

accounts for approximately 59 percent of total sales, increased to

$679.1 million, up 10.3 percent on a constant currency basis, from

the year-earlier period. Also, on a constant currency basis, sales

by category versus the prior-year quarter were as follows:

- Dental equipment and software improved

23.3 percent led by strong CEREC CAD/CAM and digital technology

sales;

- Consumable dental supplies increased

3.3 percent; and

- Other services and products, consisting

primarily of technical service, parts and labor, software support

services and artificial teeth, climbed 6.0 percent.

Commented Anderson, “We are pleased with the growth and share

gains in technology-oriented sales, driven by Patterson’s

industry-leading sales, technical service and after-sales support.

We believe that dentists’ willingness to invest in technology

affirms the trend toward dental-office digitization. Our technology

and expanding core dental equipment offerings, complemented by

Patterson’s high-touch service, position us well to capitalize on

stable-to-steadily improving market dynamics.”

Patterson VeterinarySales for Patterson Veterinary, the

company’s second largest business, increased to $356.0 million, or

up 2.7 percent on a constant currency basis. For veterinary sales

by category, again on a constant currency basis, versus the

year-ago quarter:

- Consumable sales rose 1.7 percent;

- Equipment sales increased 31.8 percent;

and

- Sales of other services and products,

consisting primarily of technical service, parts and labor, and

software support services, were up 2.5 percent.

Anderson continued, “Patterson Veterinary, which represented

about one-third of our total sales, reported growth in the fiscal

fourth quarter as we continue to transition to a new diagnostic

manufacturer relationship. We believe our recently announced

agreement to acquire Animal Health International will strengthen

the scale and market position of Patterson Veterinary, expanding

our presence in production and companion animal markets.”

On May 4, 2015, Patterson Companies announced a definitive

agreement to acquire Animal Health International, Inc., a leading

production animal health distribution company in the United States.

This acquisition will more than double the size of Patterson's

veterinary business. The combined unit will offer a range of

products and services to customers in the United States, Canada and

the United Kingdom.

Patterson MedicalSales for Patterson Medical, the

company’s rehabilitation supply and equipment business, totaled

$113.8 million in the fiscal 2015 fourth quarter, up 3.7 percent,

excluding currency and prior-year divestiture impacts. Consolidated

sales of Patterson Medical currently represent approximately 10

percent of total company sales.

Anderson said, “Earlier this month, we announced the potential

sale of our Medical unit. Our initiatives to improve the

performance of Patterson Medical were again demonstrated as we

posted sales gains for the fourth consecutive quarter. We believe

that Patterson Medical will flourish under a new owner that can

focus on driving growth in the rehabilitation space.”

Share Repurchases and DividendsFor the fiscal 2015 year,

Patterson repurchased approximately 1.2 million shares of its

outstanding common stock, with a value of $47.5 million, leaving

approximately 21 million shares for repurchase under the current

authorization. The company also increased its dividend in the

fiscal fourth quarter by 10 percent to $0.22 per share and paid

$21.5 million in cash dividends to shareholders in the period.

The company paid $81.8 million in dividend payments for fiscal year

2015.

Full-Year ResultsConsolidated sales for the full fiscal

2015 year totaled $4.4 billion, up 8.7 percent on a constant

currency basis from $4.1 billion in fiscal 2014. Adjusted net

income was $226.2 million, or $2.27 per diluted share (adjusted for

$0.03 per diluted share of one-time transaction costs related to

the acquisition of Animal Health International and the potential

sale of Patterson Medical), compared to adjusted net income of

$213.9 million, or $2.10 per diluted share, in fiscal 2014

(adjusted for $0.13 per share of costs for the Patterson Medical

restructuring).

Business OutlookAnderson concluded, “We begin fiscal 2016

with optimism and momentum. Our previously announced agreement to

acquire Animal Health International, along with the potential

divestiture of our Medical unit, have the potential to transform

Patterson Companies and our growth profile. As we move into the new

fiscal year, we are encouraged by the stable-to-strengthening

demand across all of our businesses. We are establishing our

adjusted fiscal 2016 earnings guidance in the range of $2.40-$2.50

per diluted share.”

The fiscal 2016 annual financial outlook and adjusted earnings

guidance:

- Assumes stable North American and

international markets – conditions similar to fiscal 2015

- Includes the impact of an extra week in

fiscal 2016 compared to the previous year

- Excludes the following:

- Approximately $0.05 of one-time

training costs related to the company’s enterprise resource

planning implementation

- The impact from additional share

repurchases that may occur

- The impact of the Animal Health

International acquisition and potential Medical divestiture

Fourth Quarter and Full Fiscal Year ReconciliationThe

following non-GAAP table is provided to adjust reported net income

for the impact of the costs associated with restructuring the

medical segment and one-time transaction costs related to the

pending acquisition of Animal Health International and the

potential sale of Patterson Medical. Management believes that the

adjusted income amounts provide a helpful representation of the

company’s current quarter performance.

(Dollars in

thousands, except EPS)

Three Months Ended Twelve Months

Ended April 25, 2015 April 26, 2014

April 25, 2015 April 26, 2014 Net

Income - reported $ 64,518 $ 55,670 $ 223,261 $ 200,612

Restructuring costs - 5,701 - 13,267 One-time transaction costs

2,894 - 2,894 - Net Income - adjusted $

67,412 $ 61,371 $ 226,155 $ 213,879 Diluted Earnings Per

Share - reported $ 0.65 $ 0.55 $ 2.24 $ 1.97 Restructuring costs -

0.06 - 0.13 One-time transaction costs 0.03 -

0.03 - Diluted Earnings Per Share - adjusted $ 0.68 $ 0.61 $

2.27 $ 2.10

Fourth Quarter Conference Call and ReplayPatterson’s

fourth quarter earnings conference call will start at 10 a.m.

Eastern today. Investors can listen to a live webcast of the

conference call at www.pattersoncompanies.com. The conference call

will be archived on Patterson’s website. A replay of the fourth

quarter conference call can be heard for one week at 888-203-1112

and by providing the Conference ID 1982881, when prompted.

About Patterson Companies, Inc.Patterson Companies, Inc.

is a value-added distributor serving the dental, companion-pet

veterinarian and rehabilitation supply markets.Dental MarketAs Patterson’s largest business,

Patterson Dental provides a virtually complete range of consumable

dental products, equipment and software, turnkey digital solutions

and value-added services to dentists and dental laboratories

throughout North America.Veterinary

MarketPatterson Veterinary is a leading distributor in the

U.S. and U.K. of consumable veterinary supplies, equipment and

software, diagnostic products, vaccines and pharmaceuticals

predominantly to companion-pet veterinary clinics.Rehabilitation MarketPatterson Medical is the

world’s leading distributor of rehabilitation supplies and

non-wheelchair assistive patient products to the physical and

occupational therapy markets. The unit’s global customer base

includes hospitals, long-term care facilities, clinics and

dealers.

This release contains forward-looking statements as defined in

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are information of a non-historical

nature and are subject to risks and uncertainties that are beyond

the Company’s ability to control. Any statements made in this press

release about the Company’s future financial conditions, results of

operations, expectations, plans, or prospects, including the

information under the heading “Business Outlook”, constitute

forward-looking statements. Forward-looking statements also include

those preceded or followed by the words "anticipates," "believes,"

"could," "estimates," "expects," "intends," "may," "plans,"

“projects,” “should,” "targets" and/or similar expressions. These

forward-looking statements are based on the Company’s current

estimates and assumptions and, as such, involve uncertainty and

risk. Forward-looking statements are not guarantees of future

performance, and actual results may differ materially from those

contemplated by the forward-looking statements because of a number

of factors, including the factors described in Item 1A of the

Company’s most recent Annual Report on Form 10-K, which factors are

incorporated herein by reference. Any forward-looking statement in

this release speaks only as of the date in which it is made. Except

to the extent required under the federal securities laws, the

Company does not intend to update or revise the forward-looking

statements.

PATTERSON COMPANIES, INC. CONDENSED CONSOLIDATED

STATEMENTS OF INCOME (In thousands, except per share

amounts) (Unaudited)

Three Months Ended Twelve Months

Ended April 25, April 26, April 25,

April 26, 2015 2014 2015 2014

Net sales $ 1,148,854 $ 1,102,077 $ 4,375,020 $ 4,063,715

Gross profit 333,600 315,868 1,238,206 1,198,278

Operating expenses 226,904 223,267

864,779 852,522 Operating income

106,696 92,601 373,427 345,756 Other expense, net

(7,511 ) (7,479 ) (30,756 ) (32,844 )

Income before taxes 99,185 85,122 342,671 312,912 Income

taxes 34,667 29,452 119,410

112,300 Net income $ 64,518 $

55,670 $ 223,261 $ 200,612 Earnings per

share: Basic $ 0.65 $ 0.56 $ 2.26 $ 1.99 Diluted $ 0.65 $ 0.55 $

2.24 $ 1.97 Shares: Basic 98,981 99,707 98,989 100,727

Diluted 99,677 100,684 99,694 101,643 Dividends declared per

common share $ 0.22 $ 0.20 $ 0.82 $ 0.68 Gross margin -

adjusted 29.0 % 28.7 % 32.2 % 32.2 % NVS - - (3.9 ) (2.6 ) Medical

restructuring - - -

(0.1 ) Gross margin - reported 29.0 % 28.7 % 28.3 % 29.5 %

Operating expenses as a % of net sales - adjusted 19.3 %

19.7 % 22.5 % 22.6 % NVS - - (2.8 ) (1.9 ) One-time transaction

costs 0.4 - 0.1 - Medical restructuring - 0.6

- 0.3 Operating expenses as a %

of net sales - reported 19.7 % 20.3 % 19.8 % 21.0 %

Operating income as a % of net sales - adjusted 9.7 % 9.0 % 9.7 %

9.6 % NVS - - (1.1 ) (0.7 ) One-time transaction costs (0.4 ) -

(0.1 ) - Medical restructuring - (0.6 )

- (0.4 ) Operating income as a % of net sales -

reported 9.3 % 8.4 % 8.5 % 8.5 % Effective tax rate -

adjusted 35.1 % 33.7 % 35.2 % 35.2 % NVS - - (0.4 ) (0.3 ) One-time

transaction costs (0.1 ) - - - Medical restructuring -

0.9 - 1.0

Effective tax rate - reported 35.0 % 34.6 % 34.8 % 35.9 %

PATTERSON COMPANIES, INC. CONDENSED CONSOLIDATED

BALANCE SHEETS (In thousands)

April 25, April 26, 2015 2014

(Unaudited) ASSETS Current assets: Cash and

short-term investments $ 400,632 $ 305,683 Receivables 644,139

607,580 Inventory 456,687 436,463 Prepaid expenses and other

current assets 71,767 65,991 Total current assets

1,573,225 1,415,717 Property and equipment, net 226,805 204,939

Goodwill and other intangible assets 1,036,928 1,067,583

Investments and other 110,748 176,438 Total assets $

2,947,706 $ 2,864,677

LIABILITIES AND STOCKHOLDERS'

EQUITY Current liabilities: Accounts payable $ 349,635 $

342,056 Other accrued liabilities 228,050 201,407

Total current liabilities 577,685 543,463 Long-term debt 725,000

725,000 Other non-current liabilities 130,898 124,550

Total liabilities 1,433,583 1,393,013 Stockholders' equity

1,514,123 1,471,664 Total liabilities and stockholders'

equity $ 2,947,706 $ 2,864,677

PATTERSON

COMPANIES, INC. SALES SUMMARY (Dollars in

thousands) (Unaudited)

Total

Foreign Constant April 25, April 26,

Sales Exchange Currency 2015

2014 Growth Impact Growth

Three Months

Ended

Consolidated net sales Consumable and printed products1 $

770,282 $ 774,286 (0.5 ) % (2.8 ) % 2.3 % Equipment and software1

292,414 244,367 19.7 (1.8 ) 21.5 Other 86,158 83,424

3.3 (1.4 ) 4.7 Total $ 1,148,854 $ 1,102,077 4.2

% (2.5 ) % 6.7 % Dental supply Consumable and

printed products1 $ 353,597 $ 345,932 2.2 % (1.1 ) % 3.3 %

Equipment and software1 252,859 207,750 21.7 (1.6 ) 23.3 Other

72,624 69,166 5.0 (1.0 ) 6.0 Total $

679,080 $ 622,848 9.0 % (1.3 ) % 10.3 %

Veterinary supply Consumable and printed products $ 332,915 $

342,294 (2.7 ) % (4.4 ) % 1.7 % Equipment and software 15,504

11,777 31.6 (0.2 ) 31.8 Other 7,562 7,768 (2.7 ) (5.2

) 2.5 Total $ 355,981 $ 361,839 (1.6 ) % (4.3 ) % 2.7

% Rehabilitation supply Consumable and printed products $

83,769 $ 86,060 (2.7 ) % (3.1 ) % 0.4 % Equipment and software

24,052 24,840 (3.2 ) (4.0 ) 0.8 Other 5,972 6,490

(8.0 ) (1.6 ) (6.4 ) Total $ 113,793 $ 117,390 (3.1 ) % (3.2 ) %

0.1 %

Twelve Months

Ended

Consolidated net sales Consumable and printed products1 $

3,083,113 $ 2,810,491 9.7 % (1.1 ) % 10.8 % Equipment and software1

958,067 940,088 1.9 (0.9 ) 2.8 Other 333,840 313,136

6.6 (0.7 ) 7.3 Total $ 4,375,020 $ 4,063,715 7.7

% (1.0 ) % 8.7 % Dental supply Consumable and

printed products1 $ 1,355,982 $ 1,323,378 2.5 % (0.8 ) % 3.3 %

Equipment and software1 818,342 795,132 2.9 (0.9 ) 3.8 Other

279,971 263,586 6.2 (0.7 ) 6.9 Total $

2,454,295 $ 2,382,096 3.0 % (0.8 ) % 3.8 %

Veterinary supply Consumable and printed products $ 1,380,427 $

1,134,932 21.6 % (1.6 ) % 23.2 % Equipment and software 46,671

44,020 6.0 (0.1 ) 6.1 Other 29,472 24,093 22.3

(1.9 ) 24.2 Total $ 1,456,570 $ 1,203,045 21.1 % (1.5

) % 22.6 % Rehabilitation supply Consumable and

printed products $ 346,704 $ 352,181 (1.6 ) % (0.5 ) % (1.1 ) %

Equipment and software 93,054 100,936 (7.8 ) (1.3 ) (6.5 ) Other

24,397 25,457 (4.2 ) (0.4 ) (3.8 ) Total $ 464,155 $

478,574 (3.0 ) % (0.7 ) % (2.3 ) %

1 Certain products were reclassed from

equipment to consumables in current and prior periods

PATTERSON COMPANIES, INC.

SUPPLEMENTARY FINANCIAL DATA

(In thousands)

(Unaudited)

Three Months Ended Twelve

Months Ended April 25, April 26,

April 25, April 26, 2015

2014 2015 2014 Operating income Dental

supply $ 70,637 $ 67,292 $ 249,575 $ 249,138 Veterinary supply

16,483 16,680 56,670 49,855 Rehabilitation supply 19,576

8,629 67,182 46,763

$ 106,696 $ 92,601 $ 373,427 $ 345,756

Other (expense) income, net Interest income $ 952 $

1,090 $ 4,864 $ 4,982 Interest expense (7,868 ) (9,132 ) (33,693 )

(35,713 ) Other (595 ) 563 (1,927 )

(2,113 ) $ (7,511 ) $ (7,479 ) $ (30,756 ) $ (32,844 )

PATTERSON COMPANIES, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands)

(Unaudited) Twelve Months

Ended April 25, April 26, 2015 2014

Operating activities: Net income $ 223,261 $ 200,612

Depreciation & amortization 51,330 49,986 Non-cash employee

based compensation 26,485 20,018 Change in assets and liabilities,

net of acquired (38,385 ) (74,780 ) Net cash provided

by operating activities 262,691 195,836 Investing

activities: Additions to property and equipment, net of disposals

(62,945 ) (40,387 ) Acquisitions and equity investments (10,515 )

(145,815 ) Proceeds from sale 46,369 6,546 Purchase of investments

(543 ) (99,672 ) Other investing activity 18,035

(4,436 ) Net cash used in investing activities (9,599 )

(283,764 ) Financing activities: Dividends paid (81,760 )

(85,657 ) Share repurchases (47,539 ) (96,486 ) Payment on revolver

(130,000 ) (135,000 ) Draw on revolver 130,000 135,000 Settlement

of swap (29,003 ) - Retirement of long-term debt (250,000 ) -

Proceeds from issuance of long-term debt 250,000 - Other financing

activities 7,367 21,942 Net cash used

in financing activities (150,935 ) (160,201 ) Effect of

exchange rate changes on cash (19,805 ) 7,809

Net increase (decrease) in cash and cash equivalents $

82,352 $ (240,320 )

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150521005353/en/

Patterson Companies, Inc.Ann B. Gugino, 651-686-1600Vice

President & CFO

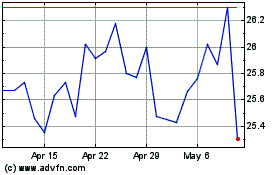

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

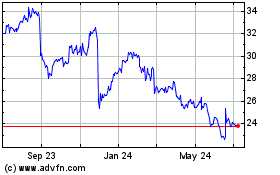

Patterson Companies (NASDAQ:PDCO)

Historical Stock Chart

From Apr 2023 to Apr 2024