Current Report Filing (8-k)

February 15 2017 - 4:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

February 15, 2017

OMNICELL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Delaware

|

|

000-33043

|

|

94-3166458

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

590 East Middlefield Road

Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 251-6100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.05 Costs Associated with Exit or Disposal Activities

On February 15, 2017, Omnicell, Inc. (the “Company”) announced its intention to create Centers of Excellence (“COE”) for product development, engineering and manufacturing with the Point of Use COE located at the Company’s facilities in California, the Robotics and Central Pharmacy COE located at the Company’s facilities near Pittsburgh, Pennsylvania and the Medication Adherence Consumables COE located at the Company’s facilities in St. Petersburg, Florida.

As part of this initiative, the Company is reducing its workforce by approximately 100 full-time employees, or about 4% of its total headcount, anticipated to be completed in the first quarter of 2017. This reduction in force includes the closure of the Company’s Nashville, Tennessee office, anticipated in the first quarter of 2017, and the Company’s manufacturing facility in Slovenia, anticipated in the third quarter of 2017.

The Company expects to incur approximately $4 million of restructuring expenses in connection with the reduction in force for one-time termination benefits, comprised principally of severance. The Company expects to incur an additional $4 million of restructuring expenses in connection with facility leases, dilapidation, and other one-time facilities related expenses.

The estimates of the charges and costs that the Company expects to incur in connection with the foregoing, and the timing thereof, are subject to a number of assumptions and actual results may differ materially.

This current report on Form 8-K contains forward-looking statements, including, but not limited to, statements related to the expected timing of completion of the consolidation plan, and the expected costs and related charges of the consolidation plan. Words such as "expects," "will," "likely," "anticipates" and similar expressions are intended to identify forward-looking statements. These forward-looking statements are based upon the Company's current plans, assumptions, beliefs, and expectations. Forward-looking statements involve risks and uncertainties. The Company's actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, the risk that the restructuring costs may be greater than anticipated; the risk that the Company's consolidation efforts may have an adverse impact on the Company's internal programs, including engineering, product development, manufacturing and roll-out of new products, its ability to hire and retain key personnel and may be distracting to management; and other risks detailed from time to time in the Company's filings with the Securities and Exchange Commission. The Company expressly disclaims any duty, obligation, or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company's expectations with regard thereto or any change in events, conditions, or circumstances on which any such statements are based.

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

OMNICELL,

INC.

|

|

|

|

|

|

|

|

|

Dated: February 15, 2017

|

By:

|

/s/ Dan S. Johnston

|

|

|

|

Dan S. Johnston

|

|

|

|

Executive Vice President and Chief Legal and Administrative Officer

|

3

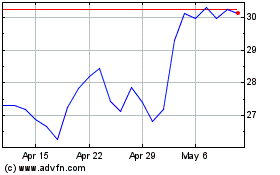

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

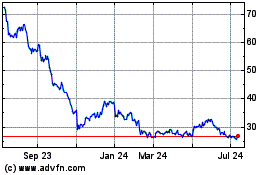

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024