Current Report Filing (8-k)

June 13 2016 - 4:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

June 7, 2016

OMNICELL, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

000-33043

|

|

94-3166458

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification Number)

|

590 East Middlefield Road

Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 251-6100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

On June 7, 2016, at a meeting of the Compensation Committee (the “Committee”) of the Board of Directors of Omnicell, Inc. (the “Company”), the Committee approved a long-term performance cash incentive pursuant to the Company’s 2009 Equity Incentive Plan that will pay a cash bonus to select executive officers upon the Company’s achievement of certain revenue goals (subject to a threshold operating margin) for the fiscal year ending December 31, 2017. For Randall A. Lipps, Peter J. Kuipers, Robin G. Seim, J. Christopher Drew, Dan S. Johnston and Jorge Taborga, the long-term cash incentive is weighted up to 75% of the total available to be earned on the achievement of specified levels of revenue generated from all product lines excluding those brought into the Company through acquisition during 2016 and 2017 (“organic revenue growth”) and up to 25% on the achievement of a specified level of revenue run rate generated from acquisitions of other companies or technologies through December 31, 2017 (“inorganic revenue run rate”). For Nhat H. Ngo, the long-term cash incentive is weighted up to 50% of the total available to be earned on the achievement of the inorganic revenue run rate, and up to 50% on the achievement of the organic revenue growth. The inorganic revenue run rate is calculated by summing the quotients derived by dividing the actual 2017 revenue generated from each acquisition completed during the 2016 and 2017 years by the number of days that the Company owned the acquired entity in 2017 and multiplying that sum by 365. The actual amount of cash incentive that may be paid may be from 0% to 100% of the maximum payout numbers reflected below, depending upon the Company’s performance. Performance below thresholds would result in no payouts and performance above the maximum would result in no additional payout. To be eligible for a payment under the long-term cash incentive, our executive officers must also be employed continuously through December 31, 2017.

|

Name

|

|

Title

|

|

Maximum

Payout of

Long Term

Cash

Incentive

(performance

based)

|

|

|

Randall A. Lipps

|

|

Chairman, President and Chief Executive Officer

|

|

$

|

1,200,000

|

|

|

Peter J. Kuipers

|

|

Executive Vice President, Chief Financial Officer

|

|

$

|

500,000

|

|

|

Robin G. Seim

|

|

President, Global Automation and Medication Adherence

|

|

$

|

750,000

|

|

|

J. Christopher Drew

|

|

President, North American Automation and Analytics

|

|

$

|

750,000

|

|

|

Dan S. Johnston

|

|

Executive Vice President and Chief Legal & Administrative Officer

|

|

$

|

400,000

|

|

|

Nhat Ngo

|

|

Executive Vice President, Strategy and Business Development

|

|

$

|

450,000

|

|

|

Jorge Taborga

|

|

Executive Vice President, Engineering

|

|

$

|

400,000

|

|

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

OMNICELL, INC.

|

|

|

|

|

|

|

|

Dated: June 13, 2016

|

By:

|

/s/ Dan S. Johnston

|

|

|

|

Dan S. Johnston,

Executive Vice President

and Chief Legal and Administrative Officer

|

3

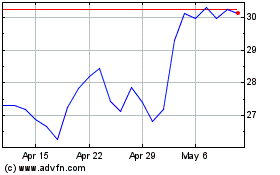

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

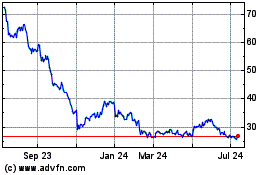

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024