UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 10, 2015

OMNICELL, INC.

(Exact name of registrant as specified in its charter)

|

| | | | |

Delaware | | 000-33043 | | 94-3166458 |

(State or other jurisdiction of

incorporation or organization) | | (Commission File Number) | | (IRS Employer Identification Number) |

590 East Middlefield Road

Mountain View, CA 94043

(Address of principal executive offices, including zip code)

(650) 251-6100

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events

On December 10, 2015, Omnicell, Inc. (“Omnicell”) issued a press release to announce the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), with respect to the pending acquisition of Aesynt upon the terms and subject to the conditions set forth in the purchase agreement, dated as of October 29, 2015, by and among Omnicell, Omnicell International, Inc., Aesynt Holding, L.P., Aesynt, Ltd and Aesynt Coöperatief U.A. (the “Securities Purchase Agreement”).

As previously announced on October 29, 2015, Omnicell entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Aesynt Coöperatief U.A., Aesynt Holding, L.P. and Aesynt, Ltd. (together, “Aesynt”). Pursuant to the terms and

conditions of the Securities Purchase Agreement, Omnicell will acquire all of the outstanding interests of Aesynt Coöperatief U.A. on the closing date for total aggregate consideration of $275,000,000, in cash, plus cash on hand at signing minus indebtedness at signing, or approximately $217,300,000. Expiration of the HSR Act waiting period is one of the specific conditions to which the closing of the Securities Purchase Agreement is subject. The Company expects the transaction to close early in the first quarter of 2016, subject to the satisfaction or waiver of the remaining conditions set forth in the Securities Purchase Agreement.

The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

| | |

Number | | Description of Document |

99.1 | | Press release entitled "Omnicell Announces Expiration of Hart-Scott-Rodino Waiting Period," dated December 10, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

| | |

| OMNICELL, INC. |

| | |

Dated: December 10, 2015 | | |

| | /s/ Dan S. Johnston |

| | Dan S. Johnston |

| | Executive Vice President and Chief Legal & Administrative Officer |

EXHIBIT INDEX

|

| | |

Number | | Description of Document |

99.1 | | Press release entitled "Omnicell Announces Expiration of Hart-Scott-Rodino Waiting Period,” dated December 10, 2015

|

Exhibit 99.1

|

| | |

Contact: | | |

Peter Kuipers | | Omnicell, Inc. |

Chief Financial Officer | | 590 East Middlefield Road |

800-850-6664, ext. 6180 | | Mountain View, CA 94043 |

Peter.kuipers@omnicell.com | | |

Omnicell Announces Expiration of Hart-Scott-Rodino Waiting Period

Expiration of the HSR Waiting Period Satisfies one of the Conditions to Close for Aesynt Acquisition

MOUNTAIN VIEW, Calif. -- December 10, 2015 -- Omnicell, Inc. (NASDAQ: OMCL) (“Omnicell”), a leading provider of medication and supply management solutions to healthcare systems, today announced the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended (the “HSR Act”), applicable to its proposed acquisition of all of the outstanding interests of Aesynt Coöperatief U.A. from Aesynt Holding, L.P. and Aesynt, Ltd.

As previously announced on October 29, 2015, Omnicell entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with Aesynt Coöperatief U.A., Aesynt Holding, L.P. and Aesynt, Ltd. (together, “Aesynt”). Pursuant to the terms and conditions of the Securities Purchase Agreement, Omnicell will acquire all of the outstanding interests of Aesynt Coöperatief U.A. on the closing date for total aggregate consideration of $275,000,000, in cash, plus cash on hand at signing minus indebtedness at signing, or approximately $217,300,000. The expiration of the waiting period under the HSR Act satisfies one of the conditions to the closing of the Securities Purchase Agreement. The Company expects the transaction to close early in the first quarter of 2016, subject to the satisfaction or waiver of the remaining conditions set forth in the Securities Purchase Agreement.

Details of this acquisition are included in an investor presentation found in the investor relations section of our website and can be accessed by clicking here.

About Omnicell

Since 1992, Omnicell (NASDAQ: OMCL) has been creating new efficiencies to improve patient care, anywhere it is delivered. Omnicell is a leading supplier of comprehensive automation and business analytics software for patient-centric medication and supply management across the entire health care continuum-from the acute care hospital setting to post-acute skilled nursing and long-term care facilities to the home.

More than 3,200 customers worldwide have utilized Omnicell Automation and Analytics solutions to increase operational efficiency, reduce errors, deliver actionable intelligence and improve patient safety. Omnicell Medication Adherence solutions, including its MTS Medication Technologies brand, provide innovative medication adherence packaging solutions to help reduce costly hospital readmissions. In addition, these solutions enable approximately 7,000 institutional and retail pharmacies worldwide to maintain high accuracy and quality standards in medication dispensing and administration while optimizing productivity and controlling costs.

For more information about Omnicell, Inc. please visit www.omnicell.com.

About Aesynt

Aesynt combines years of healthcare expertise with a comprehensive portfolio of pharmacy automation and information management tools. Aesynt partners with healthcare organizations to fully optimize all medication forms enterprise-wide, driving dramatic cost reductions and improved patient safety. With leading solutions for sterile compounding, enterprise-wide inventory management, and medication dispensing, Aesynt is committed to developing innovative solutions to solve the most pressing challenges for our global healthcare partners. For more information, visit www.aesynt.com or follow Aesynt on Twitter or LinkedIn.

Forward-Looking Statements

This release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to statements relating to the anticipated acquisition of Aesynt and the timing and benefits thereof, the expected combined operations of Omnicell and Aesynt and Omnicell’s financing plans for the Aesynt acquisition. As such, they are subject to the occurrence of many events outside Omnicell’s control and are subject to various risk factors that could cause actual results to differ materially from those expressed or implied in any forward-looking statement. Risks include, without limitation, risks related to Omnicell’s ability to complete the acquisition on the proposed terms and schedule; whether Omnicell or Aesynt will be able to satisfy their respective closing conditions related to the acquisition; whether Omnicell will obtain financing for the transaction on the expected timeline and terms; risks associated with business combination transactions, such as the risk that the businesses will not be integrated successfully, that such integration may be more difficult, time-consuming or costly than expected or that the expected benefits of the acquisition will not occur; risks related to future opportunities and plans for the combined company, including uncertainty of the expected financial performance and results of the combined company following completion of the proposed acquisition; disruption from the proposed acquisition, making it more difficult to conduct business as usual or maintain relationships with customers, employees or suppliers; and the possibility that if the combined company does not achieve the perceived benefits of the proposed acquisition as rapidly or to the extent anticipated by financial analysts or investors, the market price of Omnicell’s shares could decline. Other risks that contribute to the uncertain nature of the forward-looking statements include our ability to take advantage of the growth opportunities in medication management across the spectrum of healthcare settings from long term care to home care, unfavorable general economic and market conditions, risks to growth and acceptance of our products and services, including competitive conversions, and to growth of the clinical automation and workflow automation market generally, the potential of increasing competition, potential regulatory changes, the ability of the company to improve sales productivity to grow product bookings, to develop new products and to acquire and successfully integrate companies. These and other risks and uncertainties are described more fully in Omnicell’s most recent filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on forward-looking statements. All forward-looking statements contained in this press release speak only as of the date on which they were made. Omnicell undertakes no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they were made.

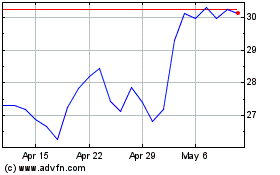

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

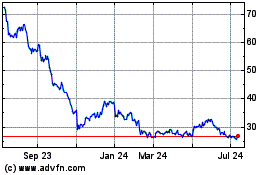

Omnicell (NASDAQ:OMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024