U.S. Pending Home Sales Edged Higher in June

July 27 2016 - 10:40AM

Dow Jones News

WASHINGTON—A measure of homes under contract for sale rose

slightly in June, as ongoing job growth and low interest rates

continued to support the U.S. housing market going into the second

half of the year.

The National Association of Realtors' pending home sales index,

which tracks contract signings for purchases of previously owned

homes, rose a seasonally adjusted 0.2% in June from the prior

month, the trade group said Wednesday. Sales then typically close

within a month or two of the signing.

Economists surveyed by The Wall Street Journal had expected a

larger rise of 1.8%, following May's drop of 3.7%.

The index stood at 111.0 in June, from May's reading of 110.8.

Compared with June 2015, the index has risen 1.0%.

June's reading was still the second-highest in the past 12

months, and a notch above the 2015 average of 108.9. But it was

noticeably lower than 2016's high of 115.0, reached in April. And

in May, the measure posted its first year-over-year decline since

August 2014.

Lawrence Yun, NAR's chief economist, said the weak June gain

reflected a "slight, early summer cool-down after a very active

spring."

News Corp., owner of The Wall Street Journal, also owns Move

Inc., which operates a website and mobile products for the National

Association of Realtors.

Pending sales were mixed in June across the country. A 3.2%

monthly rise in the Northeast gave the overall index a boost,

helped by a smaller rise in the Midwest. The index fell in June in

the West and the South from the prior month. On an annual basis,

pending sales in June were 1.6% to 1.8% higher than in June 2015 in

every region except the West, where they were down by a similar

magnitude.

The U.S. housing market has been posting steady gains in recent

years, helping boost overall economic growth. But the ongoing

strength of home sales has some industry observers worried that

shrinking inventory and rising prices will weigh on further gains

going forward.

In June, sales of existing homes rose to their strongest pace in

nearly a decade, NAR said last week. At that pace of sales, there

were 4.6 months' worth of existing homes on the market last month,

down from five months' worth in June of 2015, according to NAR. New

home sales, which account for about 10% of the market, were up

about 10% in the first six months of 2016 over the same period a

year ago, the Commerce Department said Tuesday.

Job growth has been slowing in 2016 compared with the prior

year, another potential headwind for the housing market, although

wage growth is starting to pick up. But interest rates, another key

factor supporting home purchases, continue to hover near

historically low levels. The average rate on a 30-year fixed-rate

mortgage in June was 3.57%, down from 3.87% in January, according

to Freddie Mac.

In June testimony to Congress, Federal Reserve Chairwoman Janet

Yellen noted that "housing has continued to recover gradually,

aided by income gains and the very low level of mortgage

rates."

On Wednesday afternoon, Fed officials will conclude a two-day

meeting in which they are discussing the state of the economy and

monetary policy.

Write to Anna Louie Sussman at anna.sussman@wsj.com

(END) Dow Jones Newswires

July 27, 2016 10:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

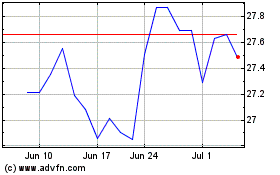

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

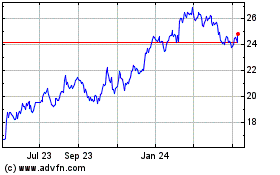

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024