U.S. Pending Home Sales Fell 3.7% in May

June 29 2016 - 10:40AM

Dow Jones News

WASHINGTON—The number of homes going under contract for sale

fell in May, a sign of slowing in the U.S. housing market.

The National Association of Realtors' pending home sales index,

which tracks contract signings for purchases of previously owned

homes, d ecreased a seasonally adjusted 3.7% in May from the prior

month, the trade group said Wednesday. Sales typically close within

a month or two of signing.

Economists surveyed by The Wall Street Journal had expected a

more modest decline of 2.0%.

The index was 110.8 in May compared with a downwardly revised

115.0 in April. The gauge was down 0.2% last month compared with

May 2015, its first annual decline since August 2014.

Lawrence Yun, the NAR's chief economist, pointed to tight

inventory and fast-rising prices as mounting problems for the

housing sector. "Realtors are acknowledging with increasing

frequency lately that buyers continue to be frustrated by the tense

competition and lack of affordable homes for sale in their market,"

he said.

News Corp, owner of The Wall Street Journal, also owns Move

Inc., which operates a website and mobile products for the National

Association of Realtors.

The U.S. housing sector has posted solid gains in recent years,

helping lift overall economic growth. The market's long

postrecession recovery has been supported by historically low

interest rates, which have moved lower so far this year. The

average rate on a 30-year fixed-rate mortgage in May was 3.60%,

down from 3.87% in January, according to Freddie Mac.

Sales of previously owned U.S. homes rose in May at its fastest

pace since February 2007, the Realtors group said last week. Sales

of newly built single-family homes, which are a small fraction of

the overall market, rose 6.4% in the first five months of the year

compared with the same period in 2015, according to Commerce

Department data.

Home-building activity has been rising, too. Housing starts in

the first five months of 2016 were up 10.2% compared with the same

period a year earlier, including a 14.5% increase in the

construction of single-family homes, according to the Commerce

Department.

Still, as Mr. Yun noted Wednesday, the supply of available homes

has remained tight, which is putting upward pressure on prices. At

the end of May, there was a 4.7-month supply of unsold existing

homes and a 5.3-month supply of newly built homes at the current

sales paces.

The Federal Reserve, in its June 15 policy statement, noted that

"the housing sector has continued to improve" since the start of

the year. Fed Chairwoman Janet Yellen told lawmakers last week that

"housing has continued to recover gradually, aided by income gains

and the very low level of mortgage rates."

Pending home sales declined in May across the country, led by a

5.3% drop in the Northeast and a 4.2% decline in the Midwest.

Pending sales were down 3.4% in the West and 3.1% in the South

compared with April. On an annual basis, sales in May were down in

the Midwest, a bit lower in the West, flat in the Northeast and up

slightly in the South.

Write to Ben Leubsdorf at ben.leubsdorf@wsj.com

(END) Dow Jones Newswires

June 29, 2016 10:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

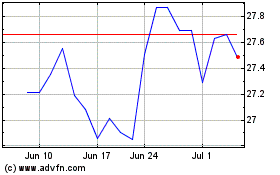

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

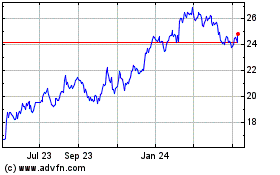

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024