Pending Home Sales Highest in Decade

May 26 2016 - 1:40PM

Dow Jones News

The number of homes that in April went under contract to be sold

climbed to the highest level in over a decade, a sign the housing

market is gaining traction and supported by steady job creation and

historically low interest rates.

Pending sales of previously owned homes, reflecting contract

signings, rose 5.1% last month from March, the National Association

of Realtors said Thursday, handily exceeding the 0.7% rise expected

by economists surveyed by The Wall Street Journal.

The sales index climbed to 116.3, the highest level since

February 2006. An index of 100 is equal to the average level of

contract activity during 2001, which the NAR considers a "normal,"

or balanced, market for the current U.S. population.

"U.S. housing-market activity continues to improve, and all

indications thus far point to a strong spring selling season," said

Barclays economist Jesse Hurwitz.

Steady demand for housing has tightened supply and pushed up

prices in many markets, especially those where many jobs are being

created.

But that doesn't seem to be deterring buyers.

Thursday's figures showed the highest jumps in the West and

South, two regions with swiftly appreciating home prices. The

Midwest showed a slight slowdown, despite being the most affordable

region. That could be a reflection of a slight cooling off as

existing-home sales in the Midwest rose sharply in April.

Nationwide, April existing-home sales rose for the second straight

month, the NAR said Friday, leaving 4.7 months' supply of existing

homes on the market.

Some economists are concerned that scarce inventory could cap

further improvement in the market.

Housing-industry watchers are looking to builders to add more

houses to the market. But inventory of new homes for sale sank at

the end of April to 4.7 months' supply, its lowest level in more

than a year, the Commerce Department said Tuesday.

"Housing appears to have had a really good early spring market

but this could be due to the fact that the winter was mild and

spring set in early," said Steven Ricchiuto, chief economist at

Mizuho Securities USA. "I expect this will prove to be a

short-lived development."

Pending sales in April rose 4.6% compared with a year earlier,

marking the 20th consecutive month of year-over-year gains. Pending

sales provide a more up-to-date assessment of the housing market

than other measures because they are based on contract signings,

the earliest stage of the sales process. It can take weeks and even

months for sales to become final, or to "close." Contracts can be

canceled for a variety of reasons.

Pantheon Macroeconomics chief economist Ian Shepherdson called

April's pending home sales "spectacular" but said he expects "no

further significant gains in the next few months" based on patterns

in mortgage applications and seasonal issues that potentially

overstate April's pending sales figure.

New-home sales picked up in April, the Commerce Department said

Tuesday. But the tightening in the new-construction market has

pushed up prices 9.7% from a year earlier: April's median sales

price of $321,100 was the highest price on record.

It is unclear whether potential home buyers can keep up with

such rapid price gains, since wages haven't been rising at nearly

that pace. Soaring prices may shift buying appetites to more

affordable regions, such as the Midwest.

News Corp., owner of The Wall Street Journal, also owns Move

Inc., which operates a website and mobile products for the National

Association of Realtors.

Write to Anna Louie Sussman at anna.sussman@wsj.com

(END) Dow Jones Newswires

May 26, 2016 13:25 ET (17:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

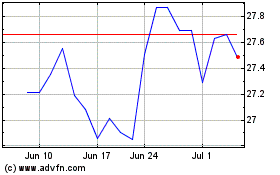

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

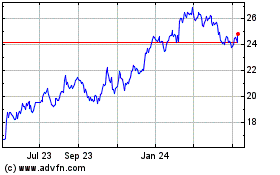

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024