UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

November 5, 2015

DATE OF REPORT

(DATE OF

EARLIEST EVENT REPORTED)

NEWS CORPORATION

(EXACT NAME OF REGISTRANT AS SPECIFIED IN ITS CHARTER)

|

|

|

|

|

| Delaware |

|

001-35769 |

|

46-2950970 |

| (STATE OR OTHER JURISDICTION

OF INCORPORATION) |

|

(COMMISSION

FILE NO.) |

|

(IRS EMPLOYER

IDENTIFICATION NO.) |

1211 Avenue of the Americas, New York, New York 10036

(ADDRESS OF PRINCIPAL EXECUTIVE OFFICES, INCLUDING ZIP CODE)

(212) 416-3400

(REGISTRANT’S TELEPHONE NUMBER, INCLUDING AREA CODE)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02 |

Results of Operations and Financial Condition. |

On November 5, 2015, News Corporation (the

“Company”) released its financial results for the quarter ended September 30, 2015. A copy of the Company’s press release is attached as Exhibit 99.1 to this Form 8-K and incorporated herein by reference.

The information in this report shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release issued by News Corporation, dated November 5, 2015, announcing News Corporation’s financial results for the quarter ended September 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| NEWS CORPORATION

(REGISTRANT) |

|

|

| By: |

|

/s/ Michael L. Bunder |

|

|

Michael L. Bunder |

|

|

Senior Vice President, Deputy General Counsel and Corporate Secretary |

Dated: November 5, 2015

Exhibit Index

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release issued by News Corporation, dated November 5, 2015, announcing News Corporation’s financial results for the quarter ended September 30, 2015. |

Exhibit 99.1

NEWS CORPORATION REPORTS FIRST QUARTER RESULTS FOR FISCAL 2016

FISCAL 2016 FIRST QUARTER KEY FINANCIAL HIGHLIGHTS

| |

• |

|

Revenues of $2.01 billion compared to $2.11 billion in the prior year |

| |

• |

|

Reported Total Segment EBITDA of $165 million compared to $194 million in the prior year |

| |

• |

|

Income from continuing operations was $143 million compared to $109 million in the prior year |

| |

• |

|

Reported EPS from continuing operations were $0.22 compared to $0.15 in the prior year |

| |

• |

|

Results from the Digital Education segment are reflected as discontinued operations |

NEW

YORK, NY – November 5, 2015 – News Corporation (“News Corp” or the “Company”) (NASDAQ: NWS, NWSA; ASX: NWS, NWSLV) today reported financial results for the three months ended September 30, 2015.

Commenting on the results, Chief Executive Robert Thomson said:

“News Corp is on track in its transition to a more digital and global future, having successfully integrated several recent acquisitions and built a

powerful platform for future growth. We are focused on driving sustainable expansion of revenue and profit, and leveraging the potency of our brands, while diligently controlling costs to maximize long-term returns for all investors. Foreign

exchange fluctuations negatively impacted reported results, but this should not obscure the progress at many of our businesses. In fact, News Corp’s revenues, excluding the effect of currency, grew 4% this quarter, underscoring the value of our

shift to higher growth businesses and our prudent reinvestment strategy.

We are particularly pleased with the momentum at realtor.com®, which is significantly ahead of schedule on key metrics. We are now, by some reckoning, the world’s largest digital property listings company and we see a particularly bright future in the

sector, especially in the U.S. where we believe the national real estate market is still returning to health.

Our digital expertise has been

enhanced by the addition of Unruly and Checkout 51, which we expect will have a positive impact across our businesses and around the world. We are already seeing significant new opportunities because of Unruly’s unique skills in measuring the

social and viral penetration of advertising campaigns. We are on the cusp of significant upheaval in the advertising market, which has been distorted by trash traffic, invisible impressions and mockable metrics, to the detriment of advertisers,

large and small.

With recent M&A activity highlighting the rising value of global financial news brands, the progress at Dow Jones and The

Wall Street Journal is noteworthy, with growth in print and digital advertising, and improvements in the professional information business.”

FIRST QUARTER RESULTS FROM CONTINUING OPERATIONS

The

Company reported fiscal 2016 first quarter total revenues of $2.01 billion, a 4% decline as compared to prior year first quarter revenues of $2.11 billion. Adjusted revenues (as defined in Note 1) declined 1% compared to the prior year, as strong

growth in the Digital Real Estate Services segment from REA Group Limited (“REA Group”) was offset by lower advertising revenues at the News and Information Services segment. Fiscal 2016 first quarter reported revenues include $85 million

from the acquisition of Move, Inc. (“Move”) in November 2014,

1

which was more than offset by negative foreign currency fluctuations, which reduced total reported revenues for the first quarter of fiscal 2016 by $188 million as compared to the prior year.

The Company reported first quarter Total Segment EBITDA of $165 million, a 15% decline as compared to $194 million in the prior year. Adjusted Total

Segment EBITDA (as defined in Note 1) declined 7%, or $14 million, compared to the prior year, as continued strength at the Digital Real Estate Services and Cable Network Programming segments, coupled with lower fees and costs related to the U.K.

Newspaper Matters (as defined below), were more than offset by the declines at the News and Information Services segment, including higher legal costs at News America Marketing, and declines at the Book Publishing segment. Negative foreign currency

fluctuations reduced Total Segment EBITDA by $29 million as compared to the prior year.

Income from continuing operations was $143 million as compared to

$109 million in the prior year due to a tax benefit from the release of valuation allowances resulting from the planned disposal of the digital education business, partially offset by lower Total Segment EBITDA, lower Other, net and lower equity

earnings of affiliates.

Earnings per share from continuing operations available to News Corporation stockholders were $0.22 as compared to $0.15 in the

prior year. Adjusted EPS (as defined in Note 3) were $0.05 compared to $0.13 in the prior year.

SEGMENT REVIEW

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

% Change |

|

| |

|

(in millions) |

|

|

Better/(Worse) |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| News and Information Services |

|

$ |

1,290 |

|

|

$ |

1,451 |

|

|

|

(11 |

)% |

| Book Publishing |

|

|

409 |

|

|

|

406 |

|

|

|

1 |

% |

| Digital Real Estate Services |

|

|

191 |

|

|

|

112 |

|

|

|

71 |

% |

| Cable Network Programming |

|

|

124 |

|

|

|

139 |

|

|

|

(11 |

)% |

| Other |

|

|

— |

|

|

|

— |

|

|

|

** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

$ |

2,014 |

|

|

$ |

2,108 |

|

|

|

(4 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

| News and Information Services |

|

$ |

83 |

|

|

$ |

105 |

|

|

|

(21 |

)% |

| Book Publishing |

|

|

42 |

|

|

|

55 |

|

|

|

(24 |

)% |

| Digital Real Estate Services |

|

|

57 |

|

|

|

57 |

|

|

|

— |

% |

| Cable Network Programming |

|

|

28 |

|

|

|

32 |

|

|

|

(13 |

)% |

| Other(a) |

|

|

(45 |

) |

|

|

(55 |

) |

|

|

18 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Segment EBITDA |

|

$ |

165 |

|

|

$ |

194 |

|

|

|

(15 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Other Segment EBITDA includes fees and costs, net of indemnification, related to the U.K. Newspaper Matters of $5 million and $14 million for the three months ended September 30, 2015 and 2014, respectively.

|

2

News and Information Services

Revenues for the first quarter of fiscal 2016 decreased $161 million, or 11%, compared to the prior year. Total segment advertising revenues declined 13%,

primarily due to negative foreign currency fluctuations, weakness in the print advertising market, most notably in Australia, and lower revenues at News America Marketing. Circulation and subscription revenues declined 6%, due to negative foreign

currency fluctuations, partially offset by higher subscription pricing and cover price increases. At Dow Jones, the Company saw growth in both print and digital advertising revenues and higher circulation revenues at The Wall Street Journal

as well as modest growth of professional information business revenues.

Adjusted revenues declined 3% compared to the prior year. Total segment

advertising revenues declined 5% and circulation and subscription revenues increased 2%, excluding the impact of $60 million and $45 million, respectively, from negative foreign currency fluctuations.

Segment EBITDA decreased $22 million in the quarter, or 21%, as compared to the prior year. Adjusted Segment EBITDA decreased 15% compared to the prior year

due to lower advertising revenues and $5 million of higher legal expenses at News America Marketing.

Book Publishing

Revenues in the quarter increased $3 million, or 1%, compared to the prior year, driven by strong sales in General Books resulting from the popularity of Go

Set a Watchman by Harper Lee and the inclusion of the results of Harlequin, acquired in August 2014, partially offset by lower revenues from the Divergent series, lower e-book sales and negative foreign currency fluctuations. Digital

sales represented 20% of consumer revenues for the quarter. Segment EBITDA for the quarter decreased $13 million, or 24%, from the prior year, primarily due to the factors noted above. Adjusted revenues decreased 2% and Adjusted Segment EBITDA

decreased 33% compared to the prior year.

Digital Real Estate Services

Revenues in the quarter increased $79 million, or 71%, compared to the prior year, primarily driven by the inclusion of the results of Move, acquired in

November 2014. At REA Group, increased revenues from greater residential listing depth product penetration and improved listing volumes in Australia were more than offset by negative foreign currency fluctuations. Segment EBITDA in the quarter was

flat compared to the prior year, primarily due to negative foreign currency fluctuations. Adjusted revenues and Adjusted Segment EBITDA increased 21% and 31%, respectively, compared to the prior year.

In the first quarter, Move’s revenues increased 33% on a stand-alone basis to $85 million from $64 million in the prior year. Move saw continued strength

in its Connection for Co-Brokerage product and non-listing Media revenues, coupled with market share gains for its Top Producer software product. Based on Move’s internal data, average monthly unique users of realtor.com®’s web and mobile sites for the quarter grew 43% year-over-year to approximately 46 million, which was driven by 64% growth in mobile users.

3

Cable Network Programming

In the first quarter of fiscal 2016, revenues decreased $15 million, or 11%, compared to the prior year. Adjusted revenues increased 10%, primarily due to

higher affiliate and advertising revenues. Segment EBITDA in the quarter decreased $4 million, or 13%, compared with the prior year. Adjusted Segment EBITDA increased 9%, primarily due to an increase in revenues, as noted above, partially offset by

expected higher programming rights costs related to the Rugby World Cup. Negative foreign currency fluctuations reduced reported revenues for the first quarter of fiscal 2016 by $29 million as compared to the prior year.

Other

Segment EBITDA in the quarter improved by $10

million compared to the prior year, primarily due to lower fees and costs, net of indemnification, related to the claims and investigations arising out of certain conduct at The News of the World (the “U.K. Newspaper Matters”).

The net expense related to the U.K. Newspaper Matters was $5 million for the three months ended September 30, 2015 as compared to $14 million for the

three months ended September 30, 2014.

DISCONTINUED OPERATIONS

During the first quarter of fiscal 2016, management approved a plan to dispose of the Company’s digital education business. As a result of the plan and

the discontinuation of further significant business activities in the Digital Education segment, the assets and liabilities of this segment were classified as held for sale and the results of operations have been reported as discontinued operations

for all periods presented.

In the first quarter of fiscal 2016, Income from discontinued operations, net of tax, was $46 million, which includes a

pre-tax non-cash impairment charge of $76 million reflecting a write down of the digital education business to its fair value less costs to sell and a tax benefit of $151 million recognized as a result of management’s plan to dispose of the

digital education business. On September 30, 2015, the Company sold the Amplify Insight and Amplify Learning businesses for no material gain or loss.

REVIEW OF EQUITY EARNINGS OF AFFILIATES’ RESULTS

Quarterly equity earnings from affiliates were $8 million compared to $25 million in the prior year.

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(in millions) |

|

| Foxtel(a) |

|

$ |

9 |

|

|

$ |

25 |

|

| Other equity affiliates, net |

|

|

(1 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Total equity earnings of affiliates |

|

$ |

8 |

|

|

$ |

25 |

|

|

|

|

|

|

|

|

|

|

4

| (a) |

The Company amortized $12 million related to excess cost over the Company’s proportionate share of its investment’s underlying net assets allocated to finite-lived intangible assets during the three months

ended September 30, 2015 and $16 million in the corresponding period of fiscal 2015. Such amortization is reflected in Equity earnings of affiliates in the Statements of Operations. |

On a U.S. GAAP basis, Foxtel revenues, for the three months ended September 30, 2015, decreased $141 million to $587 million from $728 million in the

prior year period. In local currency, Foxtel revenues increased 3% due to higher subscribers. Total closing subscribers were approximately 2.9 million as of September 30, 2015, with the majority of growth coming from cable and satellite

subscribers, which increased 8% compared to the prior year period. In the quarter, cable and satellite churn improved to 10.1% from 10.9% in the prior year.

Foxtel EBITDA decreased $85 million to $140 million from $225 million. In local currency, Foxtel EBITDA declined 21% due to increased programming costs,

increased costs associated with higher sales volumes, and the public launch of Triple Play.

Foxtel operating income for the three months ended

September 30, 2015 and 2014 was $85 million and $137 million, respectively, after depreciation and amortization of $55 million and $88 million, respectively. Operating income decreased as a result of the factors noted above, partially offset by

lower depreciation expense resulting from Foxtel’s reassessment of the useful lives of cable and satellite installations due to lower subscriber churn. Foxtel’s net income of $42 million decreased from $81 million in the prior year period

as a result of lower operating income as noted above.

FREE CASH FLOW AVAILABLE TO NEWS CORPORATION

Free cash flow available to News Corporation is a non-GAAP financial measure defined as net cash provided by continuing operating activities, less capital

expenditures, and REA Group free cash flow, plus cash dividends received from REA Group.

Free cash flow available to News Corporation excludes cash flows

from discontinued operations.

The Company considers free cash flow available to News Corporation to provide useful information to management and

investors about the amount of cash generated by the business after capital expenditures, which can then be used for strategic opportunities including, among others, investing in the Company’s business, strategic acquisitions, strengthening the

Company’s balance sheet, dividend payouts and repurchasing stock. A limitation of free cash flow available to News Corporation is that it does not represent the total increase or decrease in the cash balance for the period. Management

compensates for the limitation of free cash flow available to News Corporation by also relying on the net change in cash and cash equivalents as presented in the Company’s consolidated statements of cash flows prepared in accordance with GAAP

which incorporates all cash movements during the period.

The following table presents a reconciliation of net cash provided by continuing operating

activities to free cash flow available to News Corporation:

5

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

| |

|

(in millions) |

|

| Net cash provided by continuing operating activities |

|

$ |

141 |

|

|

$ |

220 |

|

| Less: Capital expenditures |

|

|

(63 |

) |

|

|

(94 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

78 |

|

|

|

126 |

|

| Less: REA Group free cash flow |

|

|

(35 |

) |

|

|

(22 |

) |

| Plus: Cash dividends received from REA Group |

|

|

24 |

|

|

|

26 |

|

|

|

|

|

|

|

|

|

|

| Free cash flow available to News Corporation |

|

$ |

67 |

|

|

$ |

130 |

|

|

|

|

|

|

|

|

|

|

Free cash flow available to News Corporation in the three months ended September 30, 2015 was $67 million compared to

$130 million in the prior year period. The decline was primarily due to lower Total Segment EBITDA, the absence of a special dividend received from a cost method investment of $17 million during the three months ended September 30, 2014, as

well as higher restructuring payments of $14 million. Capital expenditures were lower due to the absence of costs associated with the relocation of the Company’s U.K. operations to a new site in London in fiscal 2015. The impact of foreign

currency fluctuations of the U.S. dollar against local currencies resulted in a decrease of free cash flow available to News Corporation of approximately $17 million, or 13% for the three months ended September 30, 2015 as compared to the prior

year.

SUBSEQUENT EVENT

On November 2, 2015,

REA Group announced a proposed transaction to acquire all of the outstanding shares of iProperty Group Limited (ASX: IPP) (“iProperty”) it does not already own for A$4.00 per share in cash or iProperty shareholders can elect to receive

A$1.20 cash and 0.7 shares in a newly-formed company, subject to a maximum 20% indirect equity interest in iProperty. The aggregate consideration for the transaction is expected to be approximately A$500 million (approximately US$350 million) and

will be funded primarily from new debt facilities at REA Group totaling A$480 million, with the remainder from REA Group’s existing cash. The transaction is subject to a number of standard conditions, including iProperty shareholder and court

approval, no material adverse change and no prescribed occurrences, and is expected to be completed during the first quarter of calendar 2016. The acquisition of iProperty extends REA Group’s market leading business in Australia to attractive

markets throughout Southeast Asia.

COMPARISON OF ADJUSTED INFORMATION TO U.S. GAAP INFORMATION

Adjusted revenues, Adjusted Total Segment EBITDA, Total Segment EBITDA, Adjusted net income available to News Corporation stockholders, Adjusted EPS and Free

cash flow available to News Corporation are non-GAAP financial measures contained in this earnings release. This information is provided in order to allow investors to make meaningful comparisons of the Company’s operating performance between

periods and to view the Company’s business from the same perspective as Company management. These non-GAAP measures may be different than similar measures used by other companies and should be considered in addition to, not as a substitute for,

measures of financial performance calculated in accordance with GAAP. Reconciliations for the differences between non-GAAP measures used in this earnings release and comparable financial measures

6

calculated in accordance with U.S. GAAP are included in Notes 1, 2 and 3 and the reconciliation of Net cash provided by continuing operating activities to Free cash flow available to News

Corporation is included above.

Conference call

News

Corporation’s earnings conference call can be heard live at 5:30pm EST on November 5, 2015. To listen to the call, please visit http://investors.newscorp.com.

Cautionary Statement Concerning Forward-Looking Statements

This document contains certain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These

statements are based on management’s views and assumptions regarding future events and business performance as of the time the statements are made. Actual results may differ materially from these expectations due to changes in global economic,

business, competitive market and regulatory factors. More detailed information about these and other factors that could affect future results is contained in our filings with the Securities and Exchange Commission. The “forward-looking

statements” included in this document are made only as of the date of this document and we do not have any obligation to publicly update any “forward-looking statements” to reflect subsequent events or circumstances, except as

required by law.

About News Corporation

News

Corporation (NASDAQ: NWS, NWSA; ASX: NWS, NWSLV) is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content to consumers throughout the world. The company

comprises businesses across a range of media, including: news and information services, book publishing, digital real estate services, cable network programming in Australia, and pay-TV distribution in Australia. Headquartered in New York, the

activities of News Corporation are conducted primarily in the United States, Australia, and the United Kingdom. More information is available at: www.newscorp.com.

Contacts:

Michael Florin

Investor Relations

212-416-3363

mflorin@newscorp.com

Jim Kennedy

Corporate Communications

212-416-4064

jkennedy@newscorp.com

7

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited; in millions, except per share amounts)

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

| Revenues: |

|

|

|

|

|

|

|

|

| Advertising |

|

$ |

880 |

|

|

$ |

920 |

|

| Circulation and Subscription |

|

|

639 |

|

|

|

672 |

|

| Consumer |

|

|

392 |

|

|

|

390 |

|

| Other |

|

|

103 |

|

|

|

126 |

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

|

2,014 |

|

|

|

2,108 |

|

| Operating expenses |

|

|

(1,199 |

) |

|

|

(1,282 |

) |

| Selling, general and administrative |

|

|

(650 |

) |

|

|

(632 |

) |

| Depreciation and amortization |

|

|

(121 |

) |

|

|

(124 |

) |

| Impairment and restructuring charges |

|

|

(17 |

) |

|

|

(4 |

) |

| Equity earnings of affiliates |

|

|

8 |

|

|

|

25 |

|

| Interest, net |

|

|

12 |

|

|

|

17 |

|

| Other, net |

|

|

5 |

|

|

|

48 |

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations before income tax benefit (expense) |

|

|

52 |

|

|

|

156 |

|

| Income tax benefit (expense) |

|

|

91 |

|

|

|

(47 |

) |

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

|

143 |

|

|

|

109 |

|

| Income (loss) from discontinued operations, net of tax |

|

|

46 |

|

|

|

(21 |

) |

|

|

|

|

|

|

|

|

|

| Net income |

|

|

189 |

|

|

|

88 |

|

| Less: Net income attributable to noncontrolling interests |

|

|

(14 |

) |

|

|

(23 |

) |

|

|

|

|

|

|

|

|

|

| Net income attributable to News Corporation stockholders |

|

$ |

175 |

|

|

$ |

65 |

|

| Less: Adjustments to Net income attributable to News Corporation stockholders – Redeemable Preferred Stock Dividends |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net income available to News Corporation stockholders |

|

$ |

175 |

|

|

$ |

65 |

|

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding: |

|

|

|

|

|

|

|

|

| Basic |

|

|

581 |

|

|

|

580 |

|

| Diluted |

|

|

583 |

|

|

|

580 |

|

| Income from continuing operations available to News Corporation stockholders per share—basic and diluted |

|

$ |

0.22 |

|

|

$ |

0.15 |

|

| Income (loss) from discontinued operations available to News Corporation stockholders per share—basic and diluted |

|

$ |

0.08 |

|

|

$ |

(0.04 |

) |

|

|

|

|

|

|

|

|

|

| Net income available to News Corporation stockholders per share—basic and diluted: |

|

$ |

0.30 |

|

|

$ |

0.11 |

|

|

|

|

|

|

|

|

|

|

8

NEWS CORPORATION

CONSOLIDATED BALANCE SHEETS

(in millions)

|

|

|

|

|

|

|

|

|

| |

|

As of September 30,

2015 |

|

|

As of June 30,

2015 |

|

| |

|

(unaudited) |

|

|

(audited) |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

1,898 |

|

|

$ |

1,951 |

|

| Amounts due from 21st Century Fox |

|

|

60 |

|

|

|

63 |

|

| Receivables, net |

|

|

1,301 |

|

|

|

1,283 |

|

| Other current assets |

|

|

630 |

|

|

|

717 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

3,889 |

|

|

|

4,014 |

|

|

|

|

|

|

|

|

|

|

| Non-current assets: |

|

|

|

|

|

|

|

|

| Investments |

|

|

2,196 |

|

|

|

2,379 |

|

| Property, plant and equipment, net |

|

|

2,553 |

|

|

|

2,690 |

|

| Intangible assets, net |

|

|

2,143 |

|

|

|

2,203 |

|

| Goodwill |

|

|

3,012 |

|

|

|

3,063 |

|

| Other non-current assets |

|

|

963 |

|

|

|

686 |

|

|

|

|

|

|

|

|

|

|

| Total assets |

|

$ |

14,756 |

|

|

$ |

15,035 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

272 |

|

|

$ |

238 |

|

| Accrued expenses |

|

|

1,133 |

|

|

|

1,125 |

|

| Deferred revenue |

|

|

354 |

|

|

|

346 |

|

| Other current liabilities |

|

|

407 |

|

|

|

401 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

2,166 |

|

|

|

2,110 |

|

|

|

|

|

|

|

|

|

|

| Non-current liabilities: |

|

|

|

|

|

|

|

|

| Retirement benefit obligations |

|

|

298 |

|

|

|

305 |

|

| Deferred income taxes |

|

|

171 |

|

|

|

166 |

|

| Other non-current liabilities |

|

|

320 |

|

|

|

318 |

|

| Commitments and contingencies |

|

|

|

|

|

|

|

|

| Redeemable preferred stock |

|

|

20 |

|

|

|

20 |

|

| Equity: |

|

|

|

|

|

|

|

|

| Class A common stock |

|

|

4 |

|

|

|

4 |

|

| Class B common stock |

|

|

2 |

|

|

|

2 |

|

| Additional paid-in capital |

|

|

12,431 |

|

|

|

12,433 |

|

| Retained earnings |

|

|

204 |

|

|

|

88 |

|

| Accumulated other comprehensive loss |

|

|

(1,025 |

) |

|

|

(582 |

) |

|

|

|

|

|

|

|

|

|

| Total News Corporation stockholders’ equity |

|

|

11,616 |

|

|

|

11,945 |

|

| Noncontrolling interests |

|

|

165 |

|

|

|

171 |

|

|

|

|

|

|

|

|

|

|

| Total equity |

|

|

11,781 |

|

|

|

12,116 |

|

|

|

|

|

|

|

|

|

|

| Total liabilities and equity |

|

$ |

14,756 |

|

|

$ |

15,035 |

|

|

|

|

|

|

|

|

|

|

9

NEWS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited; in millions)

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

| Operating activities: |

|

|

|

|

|

|

|

|

| Net income |

|

$ |

189 |

|

|

$ |

88 |

|

| Less: Income (loss) from discontinued operations, net of tax |

|

|

46 |

|

|

|

(21 |

) |

|

|

|

|

|

|

|

|

|

| Income from continuing operations: |

|

|

143 |

|

|

|

109 |

|

| Adjustments to reconcile income from continuing operations to cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

121 |

|

|

|

124 |

|

| Equity earnings of affiliates |

|

|

(8 |

) |

|

|

(25 |

) |

| Cash distributions received from affiliates |

|

|

— |

|

|

|

17 |

|

| Other, net |

|

|

(5 |

) |

|

|

(48 |

) |

| Deferred income taxes and taxes payable |

|

|

(109 |

) |

|

|

31 |

|

| Change in operating assets and liabilities, net of acquisitions: |

|

|

|

|

|

|

|

|

| Receivables and other assets |

|

|

(94 |

) |

|

|

17 |

|

| Inventories, net |

|

|

30 |

|

|

|

41 |

|

| Accounts payable and other liabilities |

|

|

74 |

|

|

|

(40 |

) |

| Pension and postretirement benefit plans |

|

|

(11 |

) |

|

|

(6 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities from continuing operations |

|

|

141 |

|

|

|

220 |

|

|

|

|

|

|

|

|

|

|

| Investing activities: |

|

|

|

|

|

|

|

|

| Capital expenditures |

|

|

(63 |

) |

|

|

(94 |

) |

| Acquisitions, net of cash acquired |

|

|

(16 |

) |

|

|

(414 |

) |

| Investments in equity affiliates and other |

|

|

(14 |

) |

|

|

(115 |

) |

| Proceeds from dispositions |

|

|

2 |

|

|

|

114 |

|

| Other |

|

|

5 |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities from continuing operations |

|

|

(86 |

) |

|

|

(509 |

) |

|

|

|

|

|

|

|

|

|

| Financing activities: |

|

|

|

|

|

|

|

|

| Repurchase of shares |

|

|

(15 |

) |

|

|

— |

|

| Dividends paid |

|

|

(16 |

) |

|

|

(17 |

) |

| Other, net |

|

|

(6 |

) |

|

|

(9 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities from continuing operations |

|

|

(37 |

) |

|

|

(26 |

) |

|

|

|

|

|

|

|

|

|

| Net increase (decrease) in cash and cash equivalents from continuing operations |

|

|

18 |

|

|

|

(315 |

) |

| Net decrease in cash and cash equivalents from discontinued operations |

|

|

(35 |

) |

|

|

(57 |

) |

| Cash and cash equivalents, beginning of period |

|

|

1,951 |

|

|

|

3,145 |

|

| Exchange movement on opening cash balance |

|

|

(36 |

) |

|

|

(38 |

) |

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents, end of period |

|

$ |

1,898 |

|

|

$ |

2,735 |

|

|

|

|

|

|

|

|

|

|

10

NOTE 1 – ADJUSTED REVENUES, ADJUSTED TOTAL SEGMENT EBITDA AND ADJUSTED SEGMENT EBITDA

The Company uses revenues, Total Segment EBITDA and Segment EBITDA excluding the impact of acquisitions, divestitures, costs associated with

the U.K. Newspaper Matters and foreign currency fluctuations (“Adjusted Revenues, Adjusted Total Segment EBITDA and Adjusted Segment EBITDA”) to evaluate the performance of the Company’s operations exclusive of certain items that

impact the comparability of results from period to period. The calculation of Adjusted Revenues, Adjusted Total Segment EBITDA and Adjusted Segment EBITDA may not be comparable to similarly titled measures reported by other companies, since

companies and investors may differ as to what type of events warrant adjustment. Adjusted Revenues, Adjusted Total Segment EBITDA and Adjusted Segment EBITDA are not measures of performance under generally accepted accounting principles and should

not be construed as substitutes for amounts determined under GAAP as measures of performance.

However, management uses these measures in comparing the

Company’s historical performance and believes that they provide meaningful and comparable information to investors to assist in their analysis of our performance relative to prior periods and our competitors.

The following table reconciles reported revenues and reported Total Segment EBITDA to Adjusted Revenues and Adjusted Total Segment EBITDA for the three months

ended September 30, 2015 and 2014.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Revenues |

|

|

Total Segment EBITDA |

|

| |

|

For the three months ended

September 30, |

|

|

For the three months ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

Difference |

|

|

2015 |

|

|

2014 |

|

|

Difference |

|

| |

|

(in millions) |

|

|

(in millions) |

|

| As reported |

|

$ |

2,014 |

|

|

$ |

2,108 |

|

|

$ |

(94 |

) |

|

$ |

165 |

|

|

$ |

194 |

|

|

$ |

(29 |

) |

| Impact of acquisitions |

|

|

(111 |

) |

|

|

— |

|

|

|

(111 |

) |

|

|

2 |

|

|

|

7 |

|

|

|

(5 |

) |

| Impact of divestitures |

|

|

— |

|

|

|

(1 |

) |

|

|

1 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Impact of foreign currency fluctuations |

|

|

188 |

|

|

|

— |

|

|

|

188 |

|

|

|

29 |

|

|

|

— |

|

|

|

29 |

|

| Net impact of U.K. Newspaper Matters |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

|

|

14 |

|

|

|

(9 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As adjusted |

|

$ |

2,091 |

|

|

$ |

2,107 |

|

|

$ |

(16 |

) |

|

$ |

201 |

|

|

$ |

215 |

|

|

$ |

(14 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

Adjusted Revenues and Adjusted Segment EBITDA by segment for the three months ended September 30, 2015

and 2014 are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

% Change |

|

| |

|

(in millions) |

|

|

Better/(Worse) |

|

| Adjusted Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

| News and Information Services |

|

$ |

1,405 |

|

|

$ |

1,451 |

|

|

|

(3 |

)% |

| Book Publishing |

|

|

399 |

|

|

|

406 |

|

|

|

(2 |

)% |

| Digital Real Estate Services |

|

|

134 |

|

|

|

111 |

|

|

|

21 |

% |

| Cable Network Programming |

|

|

153 |

|

|

|

139 |

|

|

|

10 |

% |

| Other |

|

|

— |

|

|

|

— |

|

|

|

— |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Adjusted Revenues |

|

$ |

2,091 |

|

|

$ |

2,107 |

|

|

|

(1 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted Segment EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

| News and Information Services |

|

$ |

89 |

|

|

$ |

105 |

|

|

|

(15 |

)% |

| Book Publishing |

|

|

40 |

|

|

|

60 |

|

|

|

(33 |

)% |

| Digital Real Estate Services |

|

|

77 |

|

|

|

59 |

|

|

|

31 |

% |

| Cable Network Programming |

|

|

35 |

|

|

|

32 |

|

|

|

9 |

% |

| Other |

|

|

(40 |

) |

|

|

(41 |

) |

|

|

2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Adjusted Segment EBITDA |

|

$ |

201 |

|

|

$ |

215 |

|

|

|

(7 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

12

The following tables reconcile reported revenues and Segment EBITDA by segment to Adjusted Revenues and

Adjusted Segment EBITDA by segment for the three months ended September 30, 2015 and 2014.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended September 30, 2015 |

|

| |

|

As

Reported |

|

|

Impact of

Acquisitions |

|

|

Impact of

Divestitures |

|

|

Impact of

Foreign

Currency

Fluctuations |

|

|

Net Impact

of U.K.

Newspaper

Matters |

|

|

As

Adjusted |

|

| |

|

(in millions) |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| News and Information Services |

|

$ |

1,290 |

|

|

$ |

(1 |

) |

|

$ |

— |

|

|

$ |

116 |

|

|

$ |

— |

|

|

$ |

1,405 |

|

| Book Publishing |

|

|

409 |

|

|

|

(25 |

) |

|

|

— |

|

|

|

15 |

|

|

|

— |

|

|

|

399 |

|

| Digital Real Estate Services |

|

|

191 |

|

|

|

(85 |

) |

|

|

— |

|

|

|

28 |

|

|

|

— |

|

|

|

134 |

|

| Cable Network Programming |

|

|

124 |

|

|

|

— |

|

|

|

— |

|

|

|

29 |

|

|

|

— |

|

|

|

153 |

|

| Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

$ |

2,014 |

|

|

$ |

(111 |

) |

|

$ |

— |

|

|

$ |

188 |

|

|

$ |

— |

|

|

$ |

2,091 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| News and Information Services |

|

$ |

83 |

|

|

$ |

1 |

|

|

$ |

— |

|

|

$ |

5 |

|

|

$ |

— |

|

|

$ |

89 |

|

| Book Publishing |

|

|

42 |

|

|

|

(3 |

) |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

40 |

|

| Digital Real Estate Services |

|

|

57 |

|

|

|

4 |

|

|

|

— |

|

|

|

16 |

|

|

|

— |

|

|

|

77 |

|

| Cable Network Programming |

|

|

28 |

|

|

|

— |

|

|

|

— |

|

|

|

7 |

|

|

|

— |

|

|

|

35 |

|

| Other |

|

|

(45 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

|

|

(40 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Segment EBITDA |

|

$ |

165 |

|

|

$ |

2 |

|

|

$ |

— |

|

|

$ |

29 |

|

|

$ |

5 |

|

|

$ |

201 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended September 30, 2014 |

|

| |

|

As

Reported |

|

|

Impact of

Acquisitions |

|

|

Impact of

Divestitures |

|

|

Impact of

Foreign

Currency

Fluctuations |

|

|

Net Impact

of U.K.

Newspaper

Matters |

|

|

As

Adjusted |

|

| |

|

(in millions) |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| News and Information Services |

|

$ |

1,451 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

1,451 |

|

| Book Publishing |

|

|

406 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

406 |

|

| Digital Real Estate Services |

|

|

112 |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

|

— |

|

|

|

111 |

|

| Cable Network Programming |

|

|

139 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

139 |

|

| Other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

$ |

2,108 |

|

|

$ |

— |

|

|

$ |

(1 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

2,107 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Segment EBITDA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| News and Information Services |

|

$ |

105 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

105 |

|

| Book Publishing |

|

|

55 |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

60 |

|

| Digital Real Estate Services |

|

|

57 |

|

|

|

2 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

59 |

|

| Cable Network Programming |

|

|

32 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

32 |

|

| Other |

|

|

(55 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

14 |

|

|

|

(41 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Segment EBITDA |

|

$ |

194 |

|

|

$ |

7 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

14 |

|

|

$ |

215 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13

NOTE 2 – TOTAL SEGMENT EBITDA

Segment EBITDA is defined as revenues less operating expenses and selling, general and administrative expenses. Segment EBITDA does not

include: Depreciation and amortization, impairment and restructuring charges, equity earnings of affiliates, interest, net, other, net, and income tax (expense) benefit. Management believes that Segment EBITDA is an appropriate measure for

evaluating the operating performance of the Company’s business segments because it is the primary measure used by the Company’s chief operating decision maker to evaluate the performance of and allocate resources within the Company’s

businesses. Segment EBITDA provides management, investors and equity analysts with a measure to analyze operating performance of each of the Company’s business segments and its enterprise value against historical data and competitors’

data, although historical results may not be indicative of future results (as operating performance is highly contingent on many factors, including customer tastes and preferences).

Total Segment EBITDA is a non-GAAP measure and should be considered in addition to, not as a substitute for, net income, cash flow and other measures of

financial performance reported in accordance with GAAP. In addition, this measure does not reflect cash available to fund requirements and excludes items, such as depreciation and amortization and impairment and restructuring charges, which are

significant components in assessing the Company’s financial performance. The following table reconciles Total Segment EBITDA to income from continuing operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

Change |

|

|

% Change |

|

| |

|

(in millions) |

|

|

|

|

|

Better/(Worse) |

|

| Revenues |

|

$ |

2,014 |

|

|

$ |

2,108 |

|

|

$ |

(94 |

) |

|

|

(4 |

)% |

| Operating expenses |

|

|

(1,199 |

) |

|

|

(1,282 |

) |

|

|

83 |

|

|

|

6 |

% |

| Selling, general and administrative |

|

|

(650 |

) |

|

|

(632 |

) |

|

|

(18 |

) |

|

|

(3 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Segment EBITDA |

|

|

165 |

|

|

|

194 |

|

|

|

(29 |

) |

|

|

(15 |

)% |

| Depreciation and amortization |

|

|

(121 |

) |

|

|

(124 |

) |

|

|

3 |

|

|

|

2 |

% |

| Impairment and restructuring charges |

|

|

(17 |

) |

|

|

(4 |

) |

|

|

(13 |

) |

|

|

** |

|

| Equity earnings of affiliates |

|

|

8 |

|

|

|

25 |

|

|

|

(17 |

) |

|

|

(68 |

)% |

| Interest, net |

|

|

12 |

|

|

|

17 |

|

|

|

(5 |

) |

|

|

(29 |

)% |

| Other, net |

|

|

5 |

|

|

|

48 |

|

|

|

(43 |

) |

|

|

(90 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations before income tax benefit (expense) |

|

|

52 |

|

|

|

156 |

|

|

|

(104 |

) |

|

|

(67 |

)% |

| Income tax benefit (expense) |

|

|

91 |

|

|

|

(47 |

) |

|

|

138 |

|

|

|

** |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations |

|

$ |

143 |

|

|

$ |

109 |

|

|

$ |

34 |

|

|

|

31 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14

NOTE 3 – ADJUSTED NET INCOME FROM CONTINUING OPERATIONS AVAILABLE TO NEWS CORPORATION STOCKHOLDERS AND ADJUSTED EPS

The Company uses net income from continuing operations available to News Corporation stockholders and diluted earnings per share from

continuing operations (“EPS”) excluding expenses related to U.K. Newspaper Matters, Impairment and restructuring charges, and “Other, net”, net of tax (“adjusted net income from continuing operations available to News

Corporation stockholders and adjusted EPS”) to evaluate the performance of the Company’s operations exclusive of certain items that impact the comparability of results from period to period. The calculation of adjusted net income from

continuing operations available to News Corporation stockholders and adjusted EPS may not be comparable to similarly titled measures reported by other companies, since companies and investors may differ as to what type of events warrant adjustment.

Adjusted net income from continuing operations available to News Corporation stockholders and adjusted EPS are not measures of performance under generally accepted accounting principles and should not be construed as substitutes for consolidated net

income available to News Corporation stockholders and net income per share as determined under GAAP as a measure of performance.

However, management uses

these measures in comparing the Company’s historical performance and believes that they provide meaningful and comparable information to investors to assist in their analysis of our performance relative to prior periods and our competitors.

The following tables reconcile reported net income from continuing operations available to News Corporation stockholders and reported diluted EPS to

adjusted net income from continuing operations available to News Corporation stockholders and adjusted EPS for the three months ended September 30, 2015 and 2014.

15

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the three months ended |

|

|

For the three months ended |

|

| |

|

September 30, 2015 |

|

|

September 30, 2014 |

|

| |

|

Net income

available to

stockholders |

|

|

EPS |

|

|

Net income

available to

stockholders |

|

|

EPS |

|

| |

|

(in millions, except per share data) |

|

| Income from continuing operations |

|

$ |

143 |

|

|

|

|

|

|

$ |

109 |

|

|

|

|

|

| Less: Net income attributable to noncontrolling interests |

|

|

(14 |

) |

|

|

|

|

|

|

(23 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income from continuing operations available to News Corporation stockholders |

|

$ |

129 |

|

|

$ |

0.22 |

|

|

$ |

86 |

|

|

$ |

0.15 |

|

| U.K. Newspaper Matters |

|

|

5 |

|

|

|

0.01 |

|

|

|

14 |

|

|

|

0.02 |

|

| Impairment and restructuring charges |

|

|

17 |

|

|

|

0.03 |

|

|

|

4 |

|

|

|

0.01 |

|

| Other, net(a) |

|

|

(5 |

) |

|

|

(0.01 |

) |

|

|

(48 |

) |

|

|

(0.08 |

) |

| Tax impact on items above |

|

|

(8 |

) |

|

|

(0.02 |

) |

|

|

10 |

|

|

|

0.02 |

|

| Tax benefit(b) |

|

|

(106 |

) |

|

|

(0.18 |

) |

|

|

— |

|

|

|

— |

|

| Impact of noncontrolling interest on items included in Other, net above |

|

|

— |

|

|

|

— |

|

|

|

8 |

|

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| As adjusted |

|

$ |

32 |

|

|

$ |

0.05 |

|

|

$ |

74 |

|

|

$ |

0.13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (a) |

Other, net for the three months ended September 30, 2014 primarily includes a gain on the sale of marketable securities and a special dividend received from a cost method investment. |

| (b) |

The Company recognized a tax benefit of approximately $106 million from the release of valuation allowances resulting from the planned disposal of the digital education business. |

16

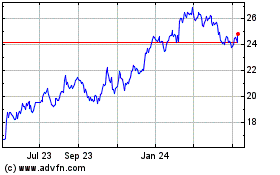

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

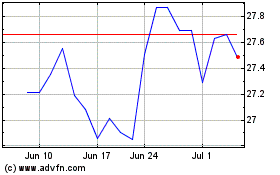

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024