UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported) August 6, 2015 (August 6, 2015)

NATIONAL WESTERN LIFE INSURANCE COMPANY

(Exact Name of Registrant as Specified in Charter)

|

| | | | |

Colorado | | 2-17039 | | 84-0467208 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

850 East Anderson Lane Austin, Texas | | 78752-1602 |

(Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code (512) 836-1010

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results of Operations and Financial Condition

On August 6, 2015, National Western Life Insurance Company ("Company") announced via press release the Company's financial results for the quarter and six months ended June 30, 2015. A copy of the Company's press release is attached hereto as Exhibit 99.1. This Form 8-K and the attached exhibit are provided under Item 9.01 of Form 8-K and are furnished to, but not filed with, the Securities and Exchange Commission.

The press release is available at the Company's website, www.nationalwesternlife.com.

|

| | | |

Item 9.01 Financial Statements and Exhibits |

|

( d ) Exhibits |

|

Exhibit No. | Description |

| |

99.1 | Press Release dated August 6, 2015 |

|

|

|

|

| | | |

SIGNATURE |

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

|

| NATIONAL WESTERN LIFE INSURANCE COMPANY |

|

Date: August 6, 2015 | /S/Brian M. Pribyl |

| Brian M. Pribyl |

| Senior Vice President, |

| Chief Financial Officer |

| and Treasurer |

|

|

|

| | | |

EXHIBIT INDEX |

|

Exhibit | | Description |

| | |

99.1 | | Press Release of National Western Life Insurance Company issued August 6, 2015 reporting financial results for the quarter and six months ended June 30, 2015.

|

EXHIBIT 99.1

National Western Life Announces 2015 Second Quarter Earnings

Austin, Texas, August 6, 2015 ‑ Ross R. Moody, President and Interim Chief Executive Officer of National Western Life Insurance Company (Nasdaq: NWLI), announced today second quarter 2015 consolidated net earnings of $28.9 million, or $8.16 per diluted Class A common share, compared with consolidated net earnings of $29.2 million, or $8.25 per diluted Class A common share, for the second quarter of 2014. For the six months ended June 30, 2015, the Company reported consolidated net earnings of $50.2 million, or $14.19 per diluted Class A common stock, compared with $49.0 million, or $13.86 per diluted Class A common shares a year ago. The Company's book value per share increased to $437.86 as of June 30, 2015 from $436.35 at March 31, 2015.

The Company reported earnings from operations, excluding net realized gains and losses on investments, of $26.1 million for the three months ended June 30, 2015, or $7.38 per diluted Class A common share, compared to $27.2 million, or $7.69 per diluted Class A common share, in the same period for 2014. Mr. Moody commented on the earnings results saying, "Operating results were very solid for the quarter. We continue to maintain expense control discipline in keeping costs down and our policy benefits returned to expected levels after running higher than normal in the first quarter." Earnings from operations for the six months ended June 30, 2015 of $46.8 million, or $13.23 per diluted Class A common share, were slightly higher than the $46.0 million, or $13.02 per diluted Class A common share, recorded during the same period in 2014. Mr. Moody observed, "We are in a very competitive market and in the midst of exceptionally low interest rates. Given that the majority of our products are interest-sensitive, being able to maintain our profitability levels in this environment is very gratifying."

Revenues for the quarter ended June 30, 2015, excluding realized and unrealized gains and losses on index options and investments, increased to $159.7 million from $158.5 million in the second quarter of 2014 principally due to gains in universal life contract revenues and net investment income. Mr. Moody noted, "Our focus is on building a growing block of profitable life insurance business. Domestic life insurance sales have lead the way so far this year with placed policies up 20% in the first six months over last year. Investment of premium payments into a highly diversified portfolio of investment grade fixed income securities is producing consistent investment income growth."

Founded in 1956, National Western Life is a stock life insurance company offering a broad portfolio of individual universal life, whole life and term insurance plans, annuity products, and investment contracts meeting the financial needs of its customers in 49 states as well as residents of various countries in Central and South America, the Caribbean, Eastern Europe, Asia, and the Pacific Rim. The Company has 268 employees and approximately 22,240 contracted independent agents, brokers, and consultants, and at June 30, 2015, maintained total assets of $11.5 billion, stockholders' equity of $1.6 billion, and life insurance in force of $22.9 billion.

Caution Regarding Forward-Looking Statements:

This press release contains statements which are or may be viewed as forward-looking within the meaning of The Private Securities Litigation Reform Act of 2005. Forward-looking statements relate to future operations, strategies, financial results or other developments, and are subject to assumptions, risks, and uncertainties. Factors that may cause actual results to differ materially from those contemplated in these forward-looking statements can be found in the Company's Form 10-K filed with the Securities and Exchange Commission. Forward-looking statements speak only as of the date the statement was made and the Company undertakes no obligation to update such forward-looking statements. There can be no assurance that other factors not currently anticipated by the Company will not materially and adversely affect our results of operations. Investors are cautioned not to place undue reliance on any forward-looking statements made by us or on our behalf.

National Western Life Insurance Company

News Release - Page 2

Summary of Consolidated Operating Results (Unaudited)

(In thousands except per share data)

|

| | | | | | | | | | | |

| Three Months Ended | | Six Months Ended |

| June 30, | | June 30, |

| 2015 | | 2014 | | 2015 | | 2014 |

Revenues: | | | | | | | |

Revenues, excluding investment and index option gains (losses) | 159,742 |

| | 158,525 |

| | 314,941 |

| | 314,467 |

|

Realized and unrealized gains (losses) on index options | (8,782 | ) | | 45,251 |

| | (17,069 | ) | | 45,799 |

|

Realized gains on investments | 4,258 |

| | 3,065 |

| | 5,236 |

| | 4,578 |

|

Total revenues | 155,218 |

| | 206,841 |

| | 303,108 |

| | 364,844 |

|

| | | | | | | |

Earnings: | | | | | | | |

Earnings from operations | 26,091 |

| | 27,191 |

| | 46,781 |

| | 46,033 |

|

Net realized gains on investments | 2,767 |

| | 1,992 |

| | 3,403 |

| | 2,976 |

|

Net earnings | 28,858 |

| | 29,183 |

| | 50,184 |

| | 49,009 |

|

| | | | | | | |

Net earnings attributable to Class A shares | 28,042 |

| | 28,358 |

| | 48,765 |

| | 47,623 |

|

| | | | | | | |

Basic Earnings Per Class A Share: | | | | | | | |

Earnings from operations | 7.38 |

| | 7.70 |

| | 13.23 |

| | 13.02 |

|

Net realized gains on investments | 0.78 |

| | 0.56 |

| | 0.96 |

| | 0.84 |

|

Net earnings | 8.16 |

| | 8.26 |

| | 14.19 |

| | 13.86 |

|

| | | | | | | |

Basic Weighted Average Class A Shares | 3,436 |

| | 3,435 |

| | 3,436 |

| | 3,435 |

|

| | | | | | | |

Diluted Earnings Per Class A Share: | | | | | | | |

Earnings from operations | 7.38 |

| | 7.69 |

| | 13.23 |

| | 13.02 |

|

Net realized gains on investments | 0.78 |

| | 0.56 |

| | 0.96 |

| | 0.84 |

|

Net earnings | 8.16 |

| | 8.25 |

| | 14.19 |

| | 13.86 |

|

| | | | | | | |

Diluted Weighted Average Class A Shares | 3,437 |

| | 3,437 |

| | 3,437 |

| | 3,437 |

|

Investor Relations Contact:

Brian M. Pribyl - Senior Vice President, Chief Financial Officer and Treasurer

(512) 836-1010

bpribyl@nationalwesternlife.com

www.nationalwesternlife.com

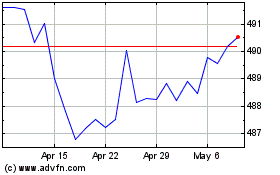

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

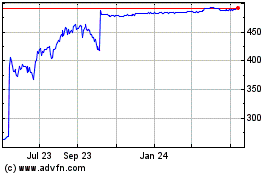

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Apr 2023 to Apr 2024