A.M. Best Affirms Ratings of National Western Life Insurance Company

June 11 2015 - 12:19PM

Business Wire

A.M. Best has affirmed the financial strength rating of A

(Excellent) and the issuer credit rating of “a” of National

Western Life Insurance Company (NWL) (Denver, CO)

[NASDAQ:NWLI]. The outlook for both ratings is stable.

The affirmation of the ratings reflects NWL's consistently

favorable operating results, which have led to increases in

statutory capital, consolidated stockholders' equity and

risk-adjusted capitalization. NWL maintains a relatively diverse

business profile, offering primarily equity-indexed annuities

within the United States and equity-indexed universal life

domestically and to residents of international countries.

International sales are generated from applications submitted by

residents of Central and South America, the Caribbean, Eastern

Europe, Asia and the Pacific Rim. A.M. Best notes that NWL

mitigates the added risk of international exposure by accepting

applications to its Texas office from foreign nationals in upper

socioeconomic classes and by denominating policies in the U.S.

dollar. Furthermore, A.M. Best views the company’s risk management

procedures favorably, proactively mitigating and hedging its

primary risk exposures, including changes to interest rates and

duration mismatches, equity market volatility, currency

fluctuations and sovereign risks.

Partially offsetting these positive rating factors is NWL's

large exposure to interest sensitive liabilities, due to growth in

annuities and equity-indexed life products. NWL mitigates the risk

of spread compression through a well-matched fixed income portfolio

and active management of crediting rates. However, a continued low

interest rate environment could negatively impact the company's

operating results. Furthermore, the domestic life market has been

challenged to maintain sales growth and has recorded large

statutory losses and just modest GAAP earnings, partially

offsetting the profitability provided by other lines of business.

A.M. Best notes that the company could be challenged to sustain its

historical operating performance due to competition from larger

companies with substantial financial resources and marketing depth,

as well as increased expense strains associated with premium

growth.

A.M. Best believes positive rating actions are unlikely in the

near term to medium term. NWL's ratings may face downward pressure

following increased concentration of revenue or earnings in

individual product segments, unfavorable consolidated operating

trends, or material declines in risk-adjusted capitalization.

The methodology used in determining these ratings is Best’s

Credit Rating Methodology, which provides a comprehensive

explanation of A.M. Best’s rating process and contains the

different rating criteria employed in the rating process. Best’s

Credit Rating Methodology can be found at

www.ambest.com/ratings/methodology.

Key insurance criteria reports utilized:

- A.M. Best's Liquidity Model for U.S.

Life Insurers

- Evaluating Country Risk

- Risk Management and the Rating Process

for Insurance Companies

- Understanding BCAR for U.S. and

Canadian Life/Health Insurers

This press release relates to rating(s) that have been

published on A.M. Best's website. For all rating information

relating to the release and pertinent disclosures, including

details of the office responsible for issuing each of the

individual ratings referenced in this release, please visit A.M.

Best’s Ratings & Criteria Center.

A.M. Best Company is the world's oldest and most

authoritative insurance rating and information source. For more

information, visit www.ambest.com.

Copyright © 2015 by A.M. Best Company,

Inc. ALL RIGHTS RESERVED.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150611006011/en/

A.M. BestKeith BehrmannFinancial

Analyst908-439-2200, ext.

5733keith.behrmann@ambest.comorThomas

RosendaleAssistant Vice President908-439-2200, ext.

5201thomas.rosendale@ambest.comorChristopher

SharkeyManager, Public Relations908-439-2200, ext.

5159christopher.sharkey@ambest.comorJim

PeavyAssistant Vice President, Public

Relations908-439-2200, ext.

5644james.peavy@ambest.com

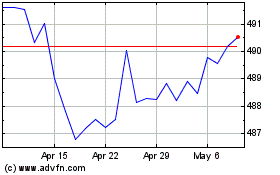

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Mar 2024 to Apr 2024

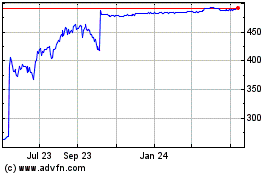

National Western Life (NASDAQ:NWLI)

Historical Stock Chart

From Apr 2023 to Apr 2024