UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. )

|

| |

Filed by the Registrant [X] |

Filed by a Party other than the Registrant [ ] |

| |

Check the appropriate box: |

[ ] | Preliminary Proxy Statement |

[ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

[X] | Definitive Proxy Statement |

[ ] | Definitive Additional Materials |

[ ] | Soliciting Material Pursuant to §240.14a-12 |

| |

National Western Life Insurance Company |

| |

Payment of Filing Fee (Check the appropriate box): |

[X] | No fee required. |

[ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

1) | Title of each class of securities to which transaction applies: |

| |

| |

2) | Aggregate number of securities to which transaction applies: |

| |

| |

3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

| |

4) | Proposed maximum aggregate value of transaction: |

| |

| |

5) | Total fee paid: |

| |

| |

[ ] | Fee paid previously with preliminary materials. |

[ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

1) | Amount Previously Paid: |

| |

| |

2) | Form, Schedule or Registration Statement No: |

| |

| |

3) | Filing Party: |

| |

| |

4) | Date Filed: |

| |

National Western Life Insurance Company

PROXY STATEMENT/PROSPECTUS

A REORGANIZATION IS PROPOSED-YOUR VOTE IS VERY IMPORTANT

April 30, 2015

To Our Shareholders:

We cordially invite you to attend the 2015 Annual Meeting of Shareholders of National Western Life Insurance Company (“we,” “us,” “our” or “NWLIC”) to be held on June 19, 2015 at 9 a.m., local time, at the Moody Gardens Hotel at Seven Hope Boulevard, Galveston, Texas 77554.

At the annual meeting, in addition to electing directors and ratifying the appointment of our independent registered public accounting firm, you will be asked to consider and vote on a proposal to reorganize our company into a holding company pursuant to which our present company will become a subsidiary of a newly formed Delaware corporation named National Western Life Group, Inc., which we refer to in this proxy statement/prospectus as “Newco,” and you will become a shareholder of Newco. We refer to this proposal in the proxy statement/prospectus as the “Reorganization Proposal.” You will also be asked to approve two additional proposals. The first is to elect 10 members to our board of directors. The second is to ratify the appointment of BKD, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015.

Upon completion of the reorganization described above, Newco will, in effect, replace NWLIC as the publicly held corporation. Newco and its subsidiaries will conduct all of the operations we currently conduct. Implementing the holding company structure will provide us with strategic, operational and financing flexibility, and incorporating the new holding company in Delaware will allow us to take advantage of the flexibility, predictability and responsiveness that Delaware corporate law provides.

In the reorganization, your existing shares of our Class A and Class B common stock will be converted automatically into shares of Newco Class A and Class B common stock, respectively. You will own the same number of shares of Newco Class A and Class B common stock as you now own of our common stock, and your shares will represent the same ownership percentage of Newco as you have of us. In addition, the reorganization generally will be tax-free for our shareholders. Your rights as a shareholder of Newco will be substantially the same as your rights as a shareholder of NWLIC, subject to certain differences described herein.

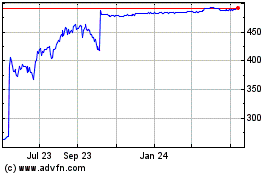

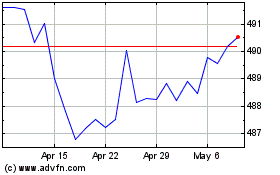

We expect the shares of Newco Class A common stock to trade under the ticker symbol “NWLI” on the NASDAQ Stock Market (“NASDAQ”), the same ticker symbol currently used for the trading of NWLIC’s Class A common stock on NASDAQ. On April 2, 2015, the last trading day before the announcement of the Reorganization Proposal, the closing price per share of NWLIC’s Class A common stock was $256.10. On April 22, 2015, the most recent trading day for which prices were available, the closing price per share of NWLIC’s Class A common stock was $246.80. There is no established public trading market for the NWLIC’s Class B common stock, and we do not expect there to be an established trading market for Newco’s Class B common stock.

In order to implement the Reorganization Proposal, we need shareholders to adopt and approve the related Agreement and Plan of Merger (the “Reorganization Agreement”). Our Board of Directors has carefully considered the Reorganization Agreement, which provides for the merger of NWLIC and a subsidiary of Newco called NWLIC MergerCo, Inc., and the related transactions described in this proxy statement/prospectus, and the Board of Directors believes that they are advisable, fair to, and in the best interest of our shareholders, and recommends that you vote “FOR” the Reorganization Proposal and “FOR” the other proposals described in this proxy statement/prospectus. Because adoption of the Reorganization Proposal requires the affirmative vote of holders of at least two-thirds of the outstanding shares of each of the Class A Stock and Class B Stock at the annual meeting, your vote is important, no matter how many or how few shares you may own. Whether or not you plan to attend the annual meeting, please take the time to vote by completing, signing and mailing the enclosed proxy card in the postage-paid envelope provided or by voting by telephone or over the Internet.

Our Board of Directors and management look forward to greeting those of you who are able to attend the annual meeting. For additional information about NWLIC, please see the enclosed annual report on Form 10-K for the fiscal year ended December 31, 2014. The accompanying notice of meeting and this proxy statement/prospectus provide specific information about the annual meeting and explain the various proposals. Please read these materials carefully. In particular, you should consider the discussion of risk factors beginning on page 8 before voting on the Reorganization Proposal.

Thank you for your continued support of and interest in our company.

|

| | |

| | Sincerely, |

| | |

| | /S/ Robert L. Moody |

| | Robert L. Moody |

| | Chairman of the Board |

| | and Chief Executive Officer |

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of the securities to be issued under this proxy statement/prospectus or determined if this proxy statement/prospectus is accurate or adequate. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated April 30, 2015 and is being first sent to NWLIC shareholders on or about May 4, 2015.

National Western Life Insurance Company

850 East Anderson Lane

Austin, Texas 78752-1602

(512) 836-1010

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To the Shareholders of National Western Life Insurance Company:

The 2015 Annual Meeting of Shareholders (“Annual Meeting”) of National Western Life Insurance Company (the “Company” or “NWLIC”) will be held on Friday, June 19, 2015 at the Moody Gardens Hotel at Seven Hope Boulevard, Galveston, Texas 77554 at 9:00 a.m. local time for the following purposes:

1.To consider and vote upon a proposal, which we refer to as the “Reorganization Proposal,” approving the Agreement and Plan of Merger, dated as of April 6, 2015, by and among National Western Life Insurance Company, National Western Life Group, Inc. and NWLIC MergerCo, Inc., which agreement is included in the accompanying proxy statement/prospectus as Annex I;

2. To elect four designees of holders of Class A Stock and six designees of holders of Class B Stock, for a total of 10 members to the board of directors of NWLIC, who shall hold office until the next annual shareholders’ meeting or until their respective successors have been elected or appointed;

3. To ratify the appointment of the firm of BKD, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2015;

4. To transact other business that may properly come before the Annual Meeting, or any adjournment or adjournments thereof.

These items are fully described in the proxy statement, which is part of this notice. The Company has not received notice of other matters that may be properly presented at the Annual Meeting.

Pursuant to the rules of the Securities and Exchange Commission, NWLIC has elected to provide access to our proxy materials over the Internet. Accordingly, we will mail, beginning on or about May 4, 2015, a Notice of Internet Availability of Proxy Materials to our shareholders of record and beneficial owners as of the record date of April 20, 2015. All shareholders and beneficial owners will have the ability to access all of the proxy materials on a website referenced in the Notice of Internet Availability of Proxy Materials as of the date of mailing of the Notice of Internet Availability of Proxy Materials.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS: Copies of the proxy statement and the Annual Report on Form 10-K for the year ended December 31, 2014, are available at http://www.cstproxy.com/nationalwesternlife/2015.

The Board of Directors of the Company has fixed the close of business on April 20, 2015 as the record date for the determination of the shareholders entitled to notice of and to vote at the Annual Meeting or any adjournment or adjournments thereof. A complete list of shareholders will be open to examination by any shareholder for any purpose germane to the Annual Meeting between the hours of 9:00 a.m. and 5:00 p.m., local time, at the offices of the Company at 850 East Anderson Lane, Austin, Texas 78752-1602 for ten days prior to the Annual Meeting. If you would like to view the shareholder list, please call the Company Secretary at (512) 836-1010 to schedule an appointment. The list will also be available at the Annual Meeting and may be inspected by any shareholder who is present.

Regardless of the number of shares of National Western Life Insurance Company common stock you hold, as a shareholder your vote is important and the Board of Directors of the Company strongly encourages you to exercise your right to vote. To ensure your vote is recorded promptly, please vote as soon as possible, even if you plan to attend the Annual Meeting.

|

| | |

| | By Order of the Board of Directors |

| | |

April 30, 2015 | | /S/ Rey Perez |

| | Rey Perez |

| | Senior Vice President - Chief Legal Officer and Secretary |

IMPORTANT

SHAREHOLDERS WHO DO NOT EXPECT TO ATTEND IN PERSON ARE URGED TO VOTE VIA THE INTERNET OR BY PHONE, OR REQUEST PAPER COPIES OF THE PROXY MATERIALS AND COMPLETE, SIGN, DATE, AND RETURN A PROXY CARD AS PROMPTLY AS POSSIBLE TO ENSURE ITS ARRIVAL IN TIME FOR THE ANNUAL MEETING.

ADDITIONAL INFORMATION

National Western Life Group, Inc. (“Newco”) has filed a registration statement on Form S-4 to register with the SEC the shares of Class A and Class B common stock of Newco into which each outstanding share of Class A and Class B common stock, respectively, of NWLIC will be converted automatically in the reorganization described herein. This proxy statement/prospectus is part of that registration statement and constitutes a prospectus of Newco in addition to being a proxy statement of NWLIC for the annual meeting.

The SEC allows us to “incorporate by reference” information into this proxy statement/prospectus, which means that we can disclose important information to you by referring you to another document filed separately by NWLIC with the SEC. This proxy statement/prospectus incorporates important business and financial information about NWLIC from its annual report on Form 10-K for the year ended December 31, 2014 and from other documents that are not included in or being delivered with this proxy statement/prospectus. The information incorporated by reference is deemed to be part of this proxy statement/prospectus except for any information superseded by information in this proxy statement/prospectus or in any document subsequently filed with the SEC that is also incorporated by reference. See “Documents Incorporated by Reference” under “Where You Can Find More Information.”

The incorporated information that is not included in or being delivered with this proxy statement/ prospectus is available to you without charge upon your written or oral request. You can obtain any document that is incorporated by reference in this proxy statement/prospectus, excluding all exhibits that have not been specifically incorporated by reference, by requesting it in writing or by telephone from us at the following address or telephone number:

National Western Life Insurance Company

850 East Anderson Lane

Austin, Texas 78752-1602

(512) 836-1010

or by visiting our website at www.nationalwesternlife.com. Information on NWLIC’s website is not incorporated by reference into this proxy statement/prospectus or made a part hereof for any purpose.

You may read and copy any of the information on file with the SEC at the SEC’s public reference room, located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for further information about the public reference room. NWLIC’s SEC filings are also available on the SEC’s website located at http://www.sec.gov.

You should rely only on the information contained in this proxy statement/prospectus or that to which we have referred you. We have not authorized anyone to provide you with any additional information. This proxy statement/prospectus is dated as of the date listed on the cover page. You should not assume that the information contained in this proxy statement/prospectus is accurate as of any date other than such date and neither the mailing of this proxy statement/prospectus to shareholders, nor the issuance of shares of Newco Class A and Class B common stock in the reorganization, shall create any implication to the contrary.

TABLE OF CONTENTS

PURPOSES OF THE ANNUAL MEETING 1

QUORUM AND VOTING 1

REVOCABILITY OF PROXY 3

SOLICITATION 3

QUESTIONS AND ANSWERS ABOUT THE HOLDING COMPANY REORGANIZATION 4

What is the Reorganization Proposal? 4

Why are you forming a holding company? 4

What will happen to my stock? 4

How will being a Newco stockholder be different from being a NWLIC shareholder? 4

Will the management or the business of the company change as a result of the Reorganization? 4

What will the name of the public company be following the Reorganization? 4

Will the company’s CUSIP number change as a result of the Reorganization? 4

Will I have to turn in my stock certificates? 5

What are the material U.S. federal income tax consequences as a result of the Reorganization? 5

How will the Reorganization be treated for accounting purposes? 5

If the shareholders approve the Reorganization, when will it occur? 5

Do I have dissenters’ (or appraisal) rights? 5

What is the authorized capital of NWLIC and Newco? 5

Whom do I contact if I have questions about the Reorganization Proposal? 5

SUMMARY OF THE REORGANIZATION PROPOSAL 6

The Principal Parties 6

What You Will Receive in the Reorganization (Page 12) 6

Conditions to Completion of the Reorganization (Page 13) 7

Termination of the Reorganization Agreement (Page 14) 7

Board of Directors and Executive Officers of Newco Following the Reorganization (Page 16) 7

Markets and Market Prices 7

Certain Financial Information 7

RISK FACTORS 8

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS 10

PROPOSAL 1: REORGANIZATION 11

Reasons for the Reorganization; Recommendation of our Board of Directors 11

Reorganization Procedure 12

What NWLIC Shareholders Will Receive in the Reorganization 12

NWLIC Stock Options and Other Rights to Receive NWLIC Stock 13

Corporate Name Following the Reorganization 13

No Exchange of Stock Certificates 13

Conditions to Reorganization 13

Effectiveness of Reorganization 13

Amendment of Reorganization Agreement 14

Material U.S. Federal Income Tax Consequences 14

No Compensation Related to the Reorganization 15

Anticipated Accounting Treatment 15

Authorized Capital Stock 15

Listing of Newco Class A Common Stock on the NASDAQ Global Market; De-listing

and De-registration of NWLIC Class A Stock 15

Board of Directors and Executive Officers of Newco Following the Reorganization 16

Independent Registered Public Accounting Firm of Newco 16

Issuances of Newco Class A Common Stock Under the NWLIC Plans 16

Newco Restated Certificate of Incorporation 16

Restrictions on the Sale of Newco Shares 16

| |

Description of Newco Capital Stock | 16 |

General 16

Class A Common Stock 17

Class B Common Stock 17

Anti-Takeover Effects of Certain Provisions of Newco’s Certificate of Incorporation, Bylaws

and Delaware Law 17

Authorized but Unissued Shares of Common Stock and Preferred Stock 18

Advance Notice Requirements for Stockholders Proposals and Director Nominations 18

Amendment to the Restated Certificate of Incorporation and Bylaws 18

Limitation of Director Liability and Indemnification 19

Description of NWLIC Capital Stock 19

General 20

Class A Common Stock 20

Class B Common Stock 20

Limitation of Director Liability and Indemnification 21

PROPOSAL 2: ELECTION OF DIRECTORS 31

Nominees for the Board of Directors 31

EXECUTIVE OFFICERS 34

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS 35

Relationships among Directors and Executive Officers 35

Transactions with Related Persons, Promoters, and Certain Control Persons 36

Review, Approval, and Ratification of Transactions with Related Persons 37

INFORMATION RELATING TO OUR BOARD OF DIRECTORS 37

The Board of Directors 37

Meetings of the Board of Directors 37

Attendance at Annual Meetings of Shareholders 37

Board Leadership / Affirmative Determinations Regarding Director Independence 37

Risk Management 38

Committees of the Board of Directors 38

DIRECTOR NOMINATIONS 39

DIRECTOR QUALIFICATIONS 39

NWLIC Director Nominees 39

COMMUNICATIONS WITH THE BOARD OF DIRECTORS 40

CODE OF ETHICS 40

COMPENSATION AND STOCK OPTION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION 40

COMPENSATION DISCUSSION AND ANALYSIS 41

Compensation Committee Report 49

Summary Compensation Table 50

All Other Compensation 51

Grants of Plan-Based Awards 52

Outstanding Equity Awards at December 31, 2014 54

Option Exercises and Stock Vested 56

Pension Benefits 57

Non-Qualified Deferred Compensation 59

Potential Payments Upon Termination or Change in Control 60

Director Compensation 61

PROPOSAL 3: RATIFICATION OF INDEPENDENT REGISTERED 62

Audit Fees 62

AUDIT COMMITTEE REPORT 64

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT 65

Owners of More Than 5% of Our Common Stock 65

Directors and Executive Officers 65

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE 67

OTHER INFORMATION 67

Annual Report to Shareholders 67

Deadlines for Submitting Shareholder Nominations and Proposals 67

VALIDITY OF SHARES 68

EXPERTS 68

WHERE YOU CAN FIND MORE INFORMATION 68

Registration Statement 68

Other SEC Filings 68

Documents Incorporated by Reference 68

Documents Available Without Charge 69

ANNEX I - AGREEMENT AND PLAN OF MERGER

ANNEX II - RESTATED CERTIFICATION OF INCORPORATION

ANNEX III - BYLAWS

National Western Life Insurance Company

850 East Anderson Lane

Austin, Texas 78752-1602

(512) 836-1010

PROXY STATEMENT/PROSPECTUS

2015 ANNUAL MEETING OF SHAREHOLDERS

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS: Copies of this Proxy Statement and the Annual Report on Form 10-K for the year ended December 31, 2014 are available at http://www.cstproxy.com/nationalwesternlife/2015.

This proxy statement/prospectus and the accompanying proxy are being made available to shareholders on or about May 4, 2015 in connection with the solicitation by the Board of Directors (the “Board of Directors”) of National Western Life Insurance Company of proxies to be used at the 2015 Annual Meeting of Shareholders (the “Annual Meeting”) of National Western Life Insurance Company to be held on Friday, June 19, 2015 at the Moody Gardens Hotel at Seven Hope Boulevard, Galveston, Texas 77554 at 9:00 a.m. local time. Our principal executive offices are located at 850 East Anderson Lane, Austin, Texas 78752-1602. Unless the context requires otherwise, references in this proxy statement/prospectus to “NWLIC,” “the Company,” “we,” “us,” or “our” refer to National Western Life Insurance Company.

PURPOSES OF THE ANNUAL MEETING

The purposes of the annual meeting are to:

| |

1. | Consider and vote upon a proposal, which we refer to as the “Reorganization Proposal,” approving the Agreement and Plan of Merger, dated as of April 6, 2015, among National Western Life Insurance Company, National Western Life Group, Inc. and NWLIC MergerCo, Inc., which agreement is attached to this proxy statement/prospectus as Annex I (Proposal 1); |

| |

2. | Elect four designees of holders of Class A Stock and six designees of holders of Class B Stock, for a total of 10 members to the board of directors of NWLIC, who shall hold office until the next annual shareholders’ meeting or until their respective successors have been elected or appointed (Proposal 2); |

| |

3. | Ratify the appointment of the firm of BKD, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015 (Proposal 3); and |

| |

4. | Transact such other business as may properly come before the meeting or any adjournment thereof. |

QUORUM AND VOTING

Holders of record of our Class A common stock, par value $1.00 per share (the “Class A Stock”), and our Class B common stock, par value $1.00 per share (the “Class B Stock” and, together with the Class A Stock, the “Common Stock”), at the close of business on April 20, 2015, will be entitled to notice of and to vote at the Annual Meeting or any adjournment or adjournments thereof. As of April 20, 2015, there were 3,436,166 shares of Class A Stock outstanding, held by 3,525 holders of record and 200,000 shares of Class B Stock outstanding, held by two holders of record. The number of holders of record does not include any beneficial owners for whom shares of Common Stock may be held in “nominee” or “street” name.

Shareholders of record at the close of business on April 20, 2015 will be entitled to vote at the Annual Meeting. Each shareholder is entitled to one vote per share held by such holder on all matters coming before the Annual Meeting, except as otherwise described below.

The presence, in person or by proxy, of the holders of one-half (1/2) of the total of each of the Class A Stock and the Class B Stock will constitute a quorum at the Annual Meeting. If a quorum is not present or represented at the Annual Meeting, the shareholders entitled to vote thereat, present in person or represented by proxy, have the power to adjourn the Annual Meeting from time to time without further notice, other than announcement at the Annual Meeting, until a quorum is present. At such reconvened Annual Meeting at which a quorum is present, any business may be transacted as originally noticed. Abstentions and broker non-votes

(shares held by a broker or nominee that does not have the authority to vote on a matter, and has not received instructions from the beneficial owner) are counted as present in determining whether the quorum requirement is met.

Approval of the Reorganization Proposal. The adoption of the Reorganization Proposal requires the affirmative vote of holders of at least two-thirds of the outstanding shares of each of the Class A Stock and Class B Stock at the annual meeting. Abstentions and broker-non votes will have the same effect as a vote against the Reorganization Proposal.

Election of Directors. Article 4 of our restated articles of incorporation, as amended (as so amended, the "restated articles of incorporation"), provides that the Class A shareholders have the exclusive right to elect one-third (1/3) of the members of our Board of Directors, plus one director for any remaining fraction, and that the Class B shareholders have the exclusive right to elect the remaining members of our Board of Directors. Our Bylaws provide that directors are elected by a plurality vote of each class of stock voting separately. Abstentions and broker non-votes will not have any impact on the result of the vote on this item.

In view of Robert L. Moody’s ("Mr. Moody") ownership, as of April 20, 2015, of more than 99% of the Class B Stock outstanding, as well as Mr. Moody’s ownership of 33.9% of the Class A Stock outstanding (see Stock Ownership table below), Mr. Moody holds the voting power to elect a majority of our Board of Directors. We are considered to be a controlled company, and Mr. Moody is the controlling shareholder.

Ratification of Independent Registered Public Accounting Firm. The affirmative vote of a majority of the shares of the Class A and Class B Common Stock, voting together as the same class, cast at the annual meeting, in person or by proxy, is required to ratify the appointment of BKD, LLP to serve as our independent registered public accounting firm. Abstentions will not have any impact on the result of the vote on this item.

The Inspector of Elections for the Annual Meeting will be Rey Perez, our Senior Vice President - Chief Legal Officer and Secretary, and he will tabulate the votes. We will announce preliminary voting results at the Annual Meeting. The final official voting results from the Annual Meeting will be disclosed in a Current Report on Form 8-K to be filed within four business days after the Annual Meeting.

You may vote your proxy by Internet, telephone, or mail, as explained below. Votes submitted electronically over the Internet or by telephone must be received by 7:00 p.m., Eastern Daylight Time, on June 18, 2015. Voting your proxy does not limit your right to vote in person should you decide to attend the Annual Meeting. The law of Colorado, under which NWLIC is incorporated, specifically permits electronically transmitted proxies, provided that each such proxy contains or is submitted with information from which the Inspector of Elections of the Annual Meeting can determine that such electronically transmitted proxy was authorized by the shareholder. If your shares are held in the name of a broker, bank, or other holder of record, you will be provided voting instructions from the holder of record. If you vote by Internet or telephone, please do not mail in a proxy card as it will revoke your Internet or telephone proxy.

| |

• | Internet. Access the Internet voting site at http://www.cstproxy.com/nationalwesternlife/2015. Follow the on-screen instructions and be sure to have the control number listed on your proxy card available when you access the Internet voting site. Please note that shareholders that vote through the Internet must bear all costs associated with electronic access, including Internet access fees. |

| |

• | Telephone. Dial the toll free number found on your proxy card. Follow the voice prompts and be sure to have the control number listed on your proxy card available when you call. |

| |

• | Mail. If you requested printed copies of the proxy materials, you may vote by mail by simply marking, signing, dating, and returning the proxy card in the postage-prepaid envelope provided for your convenience. |

If a shareholder properly uses the Internet voting procedures described on the proxy card, or calls the toll-free telephone number, or completes, signs, dates, and returns the proxy card, by 7:00 p.m., Eastern Daylight Time, on June 18, 2015, his, her, or its shares will be voted at the Annual Meeting in accordance with his, her, or its instructions. If a shareholder returns a proxy card unsigned or undated, his, her, or its vote cannot be counted. If a shareholder signs and dates a proxy card, but does not fill out the voting instructions on the proxy card, the shares represented by the proxy will be voted in accordance with the Board of Directors’ recommendations, as follows:

| |

• | FOR the Reorganization Proposal; |

| |

• | FOR the election of each of the nominees to the Board of Directors to hold office until the next annual shareholders’ meeting or until their respective successors have been elected or appointed; |

| |

• | FOR the ratification of the appointment of the firm of BKD, LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2015; and |

| |

• | In addition, if any other matters properly come before the Annual Meeting, Ross R. Moody, our President and Chief Operating Officer, and Rey Perez, our Senior Vice President - Chief Legal Officer and Secretary, the named proxies, have discretionary authority to vote on those matters in accordance with their best judgment. The Board of Directors is not currently aware of any other matters that may come before the Annual Meeting. |

REVOCABILITY OF PROXY

The proxy is for use at the Annual Meeting if a shareholder will be unable to attend in person. The proxy (whether submitted by mail, telephone, or Internet) may be revoked by a shareholder at any time before it is exercised on the date of the Annual Meeting by:

| |

• | executing and delivering a written notice of revocation to the Secretary of NWLIC at our principal executive offices; |

| |

• | submitting a later-dated proxy by Internet in the manner specified above, by telephone in the manner specified above, or in writing to the Secretary of NWLIC at our principal executive offices; or |

| |

• | attending and voting in person at the Annual Meeting. |

Attendance at the Annual Meeting will not revoke a proxy unless a shareholder provides written notice of revocation to the Secretary of NWLIC before the proxy is exercised or unless the shareholder votes his or her shares in person at the Annual Meeting. Street name holders that vote by proxy may revoke their voting instructions in accordance with their broker's, bank's, or other nominee's procedures.

SOLICITATION

This solicitation is made on behalf of our Board of Directors. The cost of preparing, assembling, printing, and mailing the Notice of Internet Availability of Proxy Materials, Notice of Annual Meeting of Shareholders, this proxy statement/prospectus, the proxy card, and any additional materials, as well as the cost of soliciting the proxies will be borne by us, including reimbursement paid to brokerage firms and other custodians, nominees, and fiduciaries for reasonable costs incurred in forwarding the proxy materials to, and solicitation of proxies from, the beneficial owners of shares held by such persons. In addition, our officers, directors and other regular employees, without additional compensation, may solicit proxies by mail, email, personal interview, telephone or other electronic transmission.

QUESTIONS AND ANSWERS

ABOUT THE HOLDING COMPANY REORGANIZATION

What is the Reorganization Proposal?

We are asking you to approve an Agreement and Plan of Merger (the “Reorganization Agreement”) that would result in our reorganization into a Delaware holding company. Prior to entering into the Reorganization Agreement, National Western Life Group, Inc. (“Newco”) was incorporated in the State of Delaware as a wholly-owned subsidiary of National Western Life Insurance Company, a Colorado corporation (“NWLIC”), and NWLIC MergerCo, Inc. was incorporated in the State of Colorado as a wholly-owned subsidiary of Newco. Under the Reorganization Agreement, NWLIC will merge with NWLIC MergerCo, Inc., with NWLIC surviving the merger as a wholly-owned subsidiary of Newco (the “Reorganization”).

Upon completion of the Reorganization, Newco will, in effect, replace NWLIC as the publicly held corporation. Newco and its subsidiaries will conduct all of the operations we currently conduct. As a result of the Reorganization, the current shareholders of NWLIC will become stockholders of Newco with the same number and percentage of shares of Newco as they held of NWLIC prior to the Reorganization. The Reorganization Agreement, which sets forth the plan of merger and is the primary legal document that governs the Reorganization, is attached as Annex I to this proxy statement/prospectus. You are encouraged to read the Reorganization Agreement carefully.

Why are you forming a holding company?

We are forming a holding company in Delaware to:

•better align our corporate structure with our business operations;

| |

• | provide us with greater strategic, business and administrative flexibility, which may allow us to acquire or form other businesses, if and when appropriate and feasible, that may be owned and operated by us, but which could be separate from our current businesses; and |

•take advantage of the benefits of Delaware corporate law.

What will happen to my stock?

In the Reorganization, your shares of NWLIC Class A common stock ("Class A Stock") will automatically be converted into the same number of shares of Newco Class A common stock and your shares of NWLIC Class B common stock ("Class B Stock") will automatically be converted into the same number of shares of Newco Class B common stock. As a result, you will become a stockholder of Newco and will own the same number and percentage of shares of Newco common stock that you now own of NWLIC common stock. We expect that Newco Class A common stock will be listed on the NASDAQ under the symbol “NWLI”, the same ticker symbol currently used by NWLIC. There is no established public trading market for the NWLIC’s Class B common stock and we do not expect there to be an established trading market for Newco’s Class B common stock.

How will being a Newco stockholder be different from being a NWLIC shareholder?

After the Reorganization, you will own the same number and percentage of the same class of shares of Newco common stock that you owned of such class of NWLIC common stock immediately prior to the Reorganization. You will own shares of a Delaware holding company that owns our operating businesses. In addition, as a stockholder of Newco, your rights will be governed by Delaware corporate law and the certificate of incorporation and bylaws of the Delaware corporation. Your rights as a stockholder of Newco will be substantially the same as your rights as a shareholder of NWLIC.

Will the management or the business of the company change as a result of the Reorganization?

No. The management and business of our company will remain the same after the Reorganization.

What will the name of the public company be following the Reorganization?

The name of the public company following the Reorganization will be “National Western Life Group, Inc.”

Will the company’s CUSIP number change as a result of the Reorganization?

Yes. Following the Reorganization, the CUSIP number for the Newco common stock will be 638517102.

Will I have to turn in my stock certificates?

No. Do not turn in your stock certificates. We will not require you to exchange your stock certificates as a result of the Reorganization. After the Reorganization, your NWLIC common stock certificates will represent the same number of the same class of shares of Newco common stock.

What are the material U.S. federal income tax consequences as a result of the Reorganization?

The proposed Reorganization is intended to be a tax-free transaction under U.S. federal income tax laws. We expect that you will not recognize any gain or loss for U.S. federal income tax purposes upon your receipt of Newco common stock in exchange for your shares of NWLIC common stock in the Reorganization; however, the tax consequences to you will depend on your own situation. You should consult your own tax advisors concerning the specific tax consequences of the Reorganization to you, including any state, local or foreign tax consequences of the Reorganization.

How will the Reorganization be treated for accounting purposes?

For accounting purposes, the Reorganization into a holding company structure will be treated as a merger of entities under common control. The accounting treatment for such events is similar to the former “pooling of interests method.” Accordingly, the consolidated financial position and results of operations of NWLIC will be included in the consolidated financial statements of Newco on the same basis as currently presented.

What vote is required to approve the Reorganization Proposal?

The required vote is the affirmative vote of holders of at least two-thirds of the outstanding shares of each of the Class A Stock and Class B Stock at the annual meeting.

What percentage of the outstanding shares do directors and executive officers hold?

As of April 20, 2015, directors, executive officers, and their affiliates beneficially owned approximately 34.9% of our outstanding shares of Class A Stock and 99.8% of our outstanding shares of Class B Stock.

If the shareholders approve the Reorganization, when will it occur?

Unless the Board of Directors determines otherwise, we expect to complete the Reorganization in the latter part of 2015, provided that our shareholders approve the Reorganization and all other conditions to completion of the Reorganization are satisfied.

Do I have dissenters’ (or appraisal) rights?

No. Holders of NWLIC common stock do not have dissenters’ or appraisal rights under Colorado law as a result of the Reorganization.

What is the authorized capital of NWLIC and Newco?

NWLIC’s restated articles of incorporation currently authorize the issuance of 7,500,000 shares of Class A Stock and 200,000 shares of Class B Stock. Newco’s restated certificate of incorporation, which will govern the rights of our stockholders after the Reorganization, currently authorizes the issuance of 7,500,000 shares of Class A common stock and 200,000 shares of Class B common stock. Upon completion of the Reorganization, the number of shares of Newco Class A and Class B common stock that will be outstanding will be equal to the number of shares of NWLIC Class A Stock and Class B Stock outstanding immediately prior to the Reorganization.

Whom do I contact if I have questions about the Reorganization Proposal?

You may contact us at:

National Western Life Insurance Company

Attn: Rey Perez

850 East Anderson Lane

Austin, Texas 78752-1602

(512) 836-1010

SUMMARY OF THE REORGANIZATION PROPOSAL

This section highlights key aspects of the Reorganization Proposal, including the Reorganization Agreement, that are described in greater detail elsewhere in this proxy statement/prospectus. It does not contain all of the information that may be important to you. To better understand the Reorganization Proposal, and for a more complete description of the legal terms of the Reorganization Agreement, you should read this entire document carefully, including the Annexes, and the additional documents to which we refer you. You can find information with respect to these additional documents in “Where You Can Find More Information.”

The Principal Parties

National Western Life Insurance Company (Colorado corporation)

850 East Anderson Lane

Austin, Texas 78752-1602

(512) 836-1010

National Western Life Insurance Company, a Colorado corporation (“NWLIC”) is a stock life insurance company, chartered in the State of Colorado in 1956, and doing business in forty-nine states, the District of Columbia, and four U.S. territories or possessions.

In connection with the Reorganization, NWLIC will merge with NWLIC MergerCo, Inc., a wholly-owned subsidiary of Newco, with NWLIC surviving the merger as a wholly-owned subsidiary of Newco. After the Reorganization, NWLIC will continue to engage in the business currently conducted by NWLIC, and all of NWLIC’s contractual, employment and other business relationships will generally continue unaffected by the Reorganization, except that immediately following the merger, most of NWLIC’s executive management team and certain corporate-level employees will become employees of Newco.

NWLIC’s headquarters is located at 850 East Anderson Lane, Austin, Texas 78752-1602, and the telephone number at this location is (512) 836-1010. Information about NWLIC is available on its website at www.nationalwesternlife.com. The information on NWLIC’s website is not incorporated by reference herein and is not deemed to be part of this proxy statement/prospectus.

National Western Life Group, Inc. (Delaware corporation)

850 East Anderson Lane

Austin, Texas 78752-1602

(512) 836-1010

National Western Life Group, Inc., a Delaware corporation (“Newco”), was formed as a wholly-owned subsidiary of NWLIC in order to effect the Reorganization. Prior to the Reorganization, Newco will have no assets or operations other than those incident to its formation.

NWLIC MergerCo, Inc.

850 East Anderson Lane

Austin, Texas 78752-1602

(512) 836-1010

NWLIC MergerCo, Inc. (“MergerCo”) is a Colorado corporation and was formed as a wholly-owned subsidiary of Newco in order to effect the Reorganization. Prior to the Reorganization, MergerCo will have no assets or operations other than those incident to its formation.

What You Will Receive in the Reorganization (Page 12)

In the Reorganization, each outstanding share of NWLIC’s Class A Stock will be converted automatically into one share of Newco Class A common stock and each share of NWLIC’s Class B Stock will be converted automatically into one share of Newco Class B common stock. In addition, each outstanding option to purchase shares of NWLIC Class A Stock, if not exercised before the completion of the Reorganization, will become an option to acquire, at the same exercise price, an identical number of shares of Newco Class A common stock. Each outstanding stock appreciation right ("SAR") relating to NWLIC's Class A Stock will be converted automatically into a SAR representing one share of Newco Class A common stock.

On the Record Date, there were outstanding 3,436,166 and 200,000 shares of NWLIC Class A Stock and Class B Stock, as well as options representing an aggregate of 21,768 shares of NWLIC Class A Stock, and 99,411 SARs.

Conditions to Completion of the Reorganization (Page 13)

The completion of the Reorganization depends on the satisfaction or waiver of a number of conditions, including, but not limited to, the following:

| |

• | absence of any stop order suspending the effectiveness of the registration statement, of which this proxy statement/prospectus forms a part, relating to the shares of Newco Class A and Class B common stock to be issued in the Reorganization; |

| |

• | receipt by NWLIC of permits, authorizations, consents, approvals, or terminations or expirations of waiting periods as are required under applicable corporate and insurance laws; |

•approval and adoption of the Reorganization Agreement by NWLIC’s shareholders;

•receipt of approval for listing on the NASDAQ of shares of Newco Class A common stock to be issued in the Reorganization;

•absence of any order or proceeding that would prohibit or make illegal completion of the Reorganization; and

| |

• | receipt by NWLIC and Newco of a legal opinion of Sutherland Asbill & Brennan LLP with respect to the material U.S. federal income tax consequences of the Reorganization. |

Termination of the Reorganization Agreement (Page 14)

We may terminate the Reorganization Agreement, even after adoption by our shareholders, if our Board of Directors determines that for any reason the completion of the Reorganization is inadvisable or not in the best interest of NWLIC or its shareholders.

Board of Directors and Executive Officers of Newco Following the Reorganization (Page 16)

The Board of Directors of Newco presently consists of the same persons comprising the Board of Directors of NWLIC and it is expected that the Newco Board of Directors will remain the same following the Reorganization. Newco expects that its senior management following the Reorganization will be substantially the same as that of NWLIC immediately prior to the Reorganization.

Markets and Market Prices

Newco Class A common stock is not currently traded on any stock exchange. NWLIC Class A Stock is traded under the symbol “NWLI” on the NASDAQ, and we expect Newco Class A common stock to also trade on the NASDAQ under the symbol “NWLI” following the Reorganization. On April 2, 2015, the last trading day before the announcement of the Reorganization Proposal, the closing price per share of NWLIC Class A Stock as quoted on the NASDAQ was $256.10. On April 22, 2015, the most recent trading day for which prices were available, the closing price per share of NWLIC Class A Stock as quoted on the NASDAQ was $246.80. There is no established public trading market for the NWLIC’s Class B common stock and we do not expect there to be an established trading market for Newco’s Class B common stock.

Certain Financial Information

We have not included pro forma financial comparative per share information concerning NWLIC that gives effect to the Reorganization because, immediately after the completion of the Reorganization, the consolidated financial statements of Newco will be the same as NWLIC’s consolidated financial statements immediately prior to the Reorganization, and the Reorganization will result in the conversion of each share of NWLIC Class A Stock and Class B Stock into one share of Newco Class A and Class B common stock, respectively. In addition, we have not provided financial statements of Newco because, prior to the Reorganization, it will have no assets, liabilities, or operations other than incident to its formation.

RISK FACTORS

In considering whether to vote in favor of the Reorganization Proposal, you should consider all of the information we have included in this proxy statement/prospectus, including its Annexes, and all of the information included in the documents we have incorporated by reference, including our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and the risk factors described in the other documents incorporated by reference. In addition, you should pay particular attention to the risks described below.

Our Board of Directors may choose to defer or abandon the Reorganization.

Completion of the Reorganization may be deferred or abandoned, at any time, by action of our Board of Directors, whether before or after the annual meeting. While we currently expect the Reorganization to take place in the latter part of 2015, assuming that the proposal to approve and adopt the Reorganization Agreement is approved at the annual meeting, our Board of Directors may defer completion or may abandon the Reorganization because of any determination by our Board of Directors that the Reorganization would be inadvisable or not in the best interest of NWLIC or its shareholders.

We may not obtain the expected benefits of our Reorganization into a holding company.

We believe our reorganization into a holding company will provide us with benefits in the future. These expected benefits may not be obtained if market conditions or other circumstances prevent us from taking advantage of the strategic, business, and financing flexibility that it affords us. As a result, we may incur the costs of creating the holding company without realizing the possible benefits.

As a holding company, Newco will depend in large part on dividends from its operating subsidiaries to satisfy its obligations. The amount of dividends that Newco can receive from its life insurance subsidiary, NWLIC, is limited by law.

After the completion of the Reorganization, Newco will be a holding company with no business operations of its own. Its only significant assets will be the outstanding capital stock of its subsidiaries, which will include NWLIC. As a result, it will rely on funds from its current subsidiaries and any subsidiaries that it may form or acquire in the future to meet its obligations.

The amount of dividends that Newco’s life insurance company subsidiary, NWLIC, can pay is restricted under applicable insurance law and regulations. These restrictions are based, in part, on the prior year’s statutory income and surplus. In general, dividends up to specified levels are considered ordinary and may be paid without prior regulatory approval. Dividends in larger amounts, or extraordinary dividends, are subject to approval by the insurance commissioner of the relevant state of domicile. Under Colorado insurance law, an extraordinary dividend or distribution is defined as a dividend or distribution that, together with other dividends and distributions made within the preceding twelve months, exceeds the lesser of (1) 10% of the insurer’s policyholder surplus as of the preceding December 31 or (2) the insurer’s net gain from operations for the twelve-month period ended the preceding December 31, in each case determined in accordance with statutory accounting principles.

From time to time, the National Association of Insurance Commissioners, a national association of state insurance regulators that sets guidelines for statutory policies, procedures and reporting for insurers, have considered, and may in the future consider, proposals to further limit dividend payments that an insurance company may make without regulatory approval. No assurance is given that more stringent restrictions will not be adopted from time to time by the State of Colorado, which is the state in which NWLIC is domiciled, and such restrictions could have the effect, under certain circumstances, of significantly reducing dividends or other amounts payable to Newco by NWLIC without prior approval by regulatory authorities.

The market for Newco shares may differ from the market for NWLIC shares.

Although it is anticipated that the Newco Class A common stock will be authorized for listing on the NASDAQ, the market prices, trading volume, and volatility of the Newco Class A common stock could be different from those of the NWLIC Class A Stock.

The proposed reorganization into a holding company may result in substantial direct and indirect costs whether or not completed.

The Reorganization may result in substantial direct costs. These costs and expenses are expected to consist primarily of attorneys’ fees, accountants’ fees, filing fees, and financial printing expenses and will be substantially incurred prior to the vote of our shareholders. The Reorganization may also result in certain indirect costs by diverting the attention of our management and employees from our business and by increasing our administrative costs and expenses. These administrative costs and expenses will include keeping separate records and in some cases making separate regulatory filings for each of Newco and each of its subsidiaries. The Reorganization may also result in certain state sales taxes and other transfer taxes.

Anti-takeover provisions in Newco’s restated certificate of incorporation and bylaws and under Delaware law may delay or prevent a third party acquisition of Newco, which could decrease the value of Newco’s Class A and Class B common stock.

The restated certificate of incorporation and bylaws of Newco, as well as Delaware law, contain provisions that could make it more difficult for a third party to acquire it without the consent of its Board of Directors. For example:

| |

• | Newco’s bylaws limit the business at special meetings of the stockholders to the purpose stated in the notice of the meeting; provided that Newco’s board of directors has the authority to submit additional matters to the stockholders and to cause other business to be transacted; |

| |

• | Newco’s bylaws establish advance notice requirements for submitting nominations for election to the board of directors and for proposing matters that can be acted upon by stockholders at a meeting, including requirements as to the content and timely provision of such a notice; |

| |

• | Newco’s bylaws limit the ability of Newco’s stockholders to request a special meeting of the stockholders, requiring a requesting stockholder to be a record holder of at least 25% of the outstanding shares of common stock of Newco, to have held such required percentage continuously for two years prior to the date of delivery of such notice, and to have complied in full with additional requirements in Newco’s bylaws; |

| |

• | Newco’s restated certificate of incorporation grants the holders of Class A common stock the exclusive right to elect one-third (1/3) of the members of our board of directors (plus one director for any remaining fraction) and the holders of Class B common stock the exclusive right to elect the remaining members of Newco’s board of directors; |

| |

• | Newco’s restated certificate of incorporation and bylaws limit the removal of any director elected by the holders of the Class A common stock or the Class B common stock voting as a separate class or otherwise designated as a Class A or Class B director to removal, with or without cause, solely by the affirmative vote of a majority of the holders of the Class A common stock or Class B common stock, as applicable, voting as a separate class and then entitled to vote at an election of such designated directors; |

| |

• | Newco’s restated certificate of incorporation and bylaws limit the filling of director vacancies to the vote of the majority of the remaining directors, even if less than a quorum, who were elected or designated by the same class of stockholders who elected or designated the director whose position is being filled, even if less than a quorum, or, if there are no such remaining directors, then by the holders of the same class of stock who elected the director whose position is being filled; |

| |

• | Newco’s restated certificate of incorporation requires that any action taken by stockholders only be taken at an annual or special meeting of the stockholders and prohibits any stockholder action from being taken by written consent without a meeting; and |

| |

• | Section 203 of the General Corporation Law of the State of Delaware ("DGCL") prohibits Newco from engaging in any “business combination” with any “interested stockholder” for a period of three years following the time that the stockholder became an interested stockholder, unless certain approvals are obtained by the board of directors and/or stockholders, as applicable, or certain other requirements are satisfied, as provided in Section 203 of the DGCL. |

Although we believe all of these provisions will make a higher third-party bid more likely by requiring potential acquirers to negotiate with the board of directors, these provisions will apply even if an initial offer may be considered beneficial by some stockholders and therefore could delay and/or prevent a deemed beneficial offer from being considered.

As a stockholder of a Delaware corporation, and based on Newco’s restated certificate of incorporation and bylaws, your rights after the Reorganization will be different from, and may be less favorable than, your current rights as a shareholder of a Colorado corporation and based on NWLIC’s restated articles of incorporation and bylaws.

After the completion of the Reorganization, you will become a stockholder of a public company incorporated in Delaware instead of Colorado and will be subject to the terms of Newco’s restated certificate of incorporation and bylaws instead of NWLIC’s restated articles of incorporation and bylaws. As a result, your rights as a stockholder will be governed by Delaware corporate law as opposed to Colorado corporate law, and by the terms of the organizational documents of Newco as opposed to the organizational documents of NWLIC. Because they are separate bodies of law and separate organizational documents, Delaware corporate law will be different from Colorado corporate law and Newco’s organizational documents will be different from NWLIC’s organizational documents. Although many of these differences will not have a significant impact on the rights of stockholders, some of these differences may be less favorable to stockholders. Some of the differences between Delaware and Colorado corporate

law, and Newco’s and NWLIC’s organizational documents, that may be less favorable to stockholders after the completion of the Reorganization are the following:

| |

• | under Newco’s bylaws, only record holders of at least 25% of the outstanding shares of common stock of Newco who have held such required percentage continuously for two years prior to the date of delivery of a written request for such a meeting and who have complied in full with additional requirements in Newco’s bylaws will have the right to request a special meeting of the stockholders, as opposed to Colorado corporate law, which gives holders of 10% of the voting shares the right to call a special meeting; |

| |

• | under Newco’s bylaws, advance notice is required for stockholders to submit nominations for election to the board of directors and to propose matters that can be acted upon by stockholders at a meeting, including requirements as to the content and timely provision of such a notice, as opposed to Colorado corporate law and NWLIC’s organizational documents, which do not impose such advance notice requirements on stockholders; |

| |

• | under Newco’s restated certificate of incorporation, any action taken by stockholders must be taken at an annual or special meeting of the stockholders and may not be taken by stockholders by written consent without a meeting, as opposed to Colorado corporate law and NWLIC’s organizational documents, which, taken together, permit stockholders of NWLIC to take action by written consent in lieu of a meeting so long as consent to such action is unanimous; |

| |

• | under Newco’s bylaws, a vote of the holders of at least 66 2/3% of the shares of Newco’s capital stock is required to amend, alter, or repeal the bylaws, as opposed to NWLIC’s bylaws, which permit stockholders of NWLIC to amend, alter, or repeal the bylaws by the affirmative vote of the holders of a majority of the shares present or represented at a meeting and entitled to vote; and |

| |

• | under Delaware corporate law, fewer corporate transactions give rise to dissenters’ rights than under Colorado corporate law. |

These differences may limit the significance of your rights as a stockholder in these contexts. For a discussion of these and other differences between Delaware and Colorado corporate law, and certain provisions of the organizational documents of Newco and NWLIC, see “Description of Newco Capital Stock,” “Description of NWLIC Capital Stock” and “Comparative Rights of Holders of Newco Capital Stock and NWLIC Capital Stock” below.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Statements in this proxy statement/prospectus and in documents incorporated by reference in this proxy statement/prospectus contain various forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), which represent our management’s beliefs and assumptions concerning future events. When used in this proxy statement/prospectus and in documents incorporated herein by reference, forward-looking statements include, without limitation, statements regarding financial forecasts or projections, and our expectations, beliefs, intentions or future strategies that are signified by the words “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “predicts,” “potential,” “may,” “will,” “should” or the negative of these terms or other comparable terminology. These forward-looking statements are subject to risks, uncertainties, and assumptions that could cause our actual results and the timing of certain events to differ materially from those expressed in the forward-looking statements.

You should understand that many important factors, in addition to those discussed or incorporated by reference in this proxy statement/prospectus, could cause our results to differ materially from those expressed in the forward-looking statements. Potential factors that could affect our results include those described in this proxy statement/prospectus under “Risk Factors” above, and those identified in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and in the other documents incorporated by reference. In light of these risks and uncertainties, the forward-looking results discussed or incorporated by reference in this proxy statement/prospectus might not occur. Except as required by law, we are not obligated to release publicly any revisions to these forward-looking statements that might reflect events or circumstances occurring after the date of this proxy statement/prospectus or those that might reflect the occurrence of unanticipated events.

PROPOSAL 1: REORGANIZATION

This section of the proxy statement/prospectus describes the Reorganization Proposal. Although we believe that the description in this section covers the material terms of the Reorganization Proposal, this summary may not contain all of the information that is important to you. The summary of the material provisions of the Reorganization Agreement provided below is qualified in its entirety by reference to the Reorganization Agreement, which we have attached as Annex I to this proxy statement/prospectus and which we incorporate by reference into this proxy statement/prospectus. You should carefully read the entire proxy statement/prospectus and the Reorganization Agreement for a more complete understanding of the Reorganization Proposal. Your approval of the Reorganization Proposal will constitute your approval and adoption of the Reorganization Agreement, the Reorganization, the restated certificate of incorporation of National Western Life Group, Inc., and the bylaws of National Western Life Group, Inc.

Reasons for the Reorganization; Recommendation of our Board of Directors

Our Board of Directors concluded that the Reorganization is advisable, determined that the terms of the Reorganization Agreement are fair to and in the best interest of NWLIC and its shareholders, and adopted and approved the Reorganization Agreement.

During the course of its deliberations, our Board of Directors consulted with management and outside legal counsel and considered a number of positive factors, including the following:

| |

• | Possible Future Strategic and Business Flexibility of the Holding Company Structure. We believe the holding company structure could facilitate future expansion of our business by providing a more flexible structure for acquiring other businesses or entering into joint ventures while continuing to keep the operations and risks of our other businesses separate. Although we have no present plans or any arrangements, understandings, or agreements to make any acquisitions or enter into any joint ventures, we may do so in the future. Furthermore, implementing the holding company structure may reduce the risk that liabilities of our core businesses and other businesses, if any, that may be operated in the future by separate subsidiaries would be attributed to each other. |

| |

• | Possible Future Financing Flexibility of the Holding Company Structure. We believe that a holding company structure may be beneficial to shareholders in the future because it would permit the use of financing techniques that are not available to NWLIC because NWLIC is a life insurance company. |

| |

• | Possible Future Flexibility because Newco is not an Insurance Company. Because Newco would not be an insurance company, it will not be subject to the insurance laws, rules, and regulations of the various states in which we now operate. |

| |

• | Predictability, Flexibility, and Responsiveness of Delaware Law to Corporate Needs. For many years, Delaware has followed a policy of encouraging incorporation in that state and has adopted comprehensive, modern, and flexible corporate laws, which are updated regularly to meet changing business needs. As a result of this deliberate policy to provide a hospitable climate for corporate development, many major public corporations have chosen Delaware for their domicile. In addition, the Delaware courts have developed considerable expertise in dealing with corporate issues relating to public companies. Thus, a substantial body of case law has developed construing Delaware corporate law and establishing legal principles and policies regarding publicly held Delaware corporations. We believe that, for these reasons, Delaware law will provide greater legal predictability with respect to our corporate legal matters than we have under Colorado law. We further believe that Delaware law will provide greater efficiency, predictability, and flexibility in our public legal affairs than is presently available under Colorado law. |

| |

• | Attractiveness of Delaware Law to Directors and Officers. We believe that organizing under Delaware law will enhance our ability to attract and retain qualified directors and officers. The corporate law of Delaware, including its extensive body of case law, offers directors and officers of public companies more certainty and stability. Under Delaware law, the parameters of director and officer liability are more clearly defined and better understood than under Colorado law. To date, we have not experienced difficulty in retaining directors or officers, but directors of public companies are exposed to significant potential liability. We therefore believe that providing the benefits afforded directors by Delaware law will enable us to compete more effectively with other public companies in the recruitment of talented and experienced directors and officers. At the same time, we believe that Delaware law regarding corporate fiduciary duties provides appropriate protection for our stockholders from possible abuses by directors and officers. In addition, under Delaware law, directors’ personal liability cannot be eliminated for: |

◦any breach of the director’s duty of loyalty to the corporation or its stockholders,

◦acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law,

◦unlawful payment of dividends or unlawful repurchases or redemptions of stock, or

◦any transactions from which the director derived an improper personal benefit.

In addition to the positive factors described above, our Board of Directors also considered the following potential negative factor associated with the Reorganization Proposal:

| |

• | Increased Costs and Expenses Associated with Implementing the Reorganization Proposal and Administering a Holding Company Structure. The Reorganization may result in substantial direct costs. These costs and expenses are expected to consist primarily of attorneys’ fees, accountants’ fees, filing fees, and financial printing expenses and will be substantially incurred prior to the vote of our shareholders. The Reorganization may also result in certain indirect costs by diverting the attention of our management and employees from our business and increasing our administrative costs and expenses. These administrative costs and expenses will include keeping separate records and in some cases making separate regulatory filings for each of Newco and its current and future subsidiaries. The Reorganization may also result in certain state sales taxes and other transfer taxes. |

After careful consideration, our Board of Directors has determined that creation of a holding company offers a net benefit to our shareholders. Our Board of Directors has approved the Reorganization Proposal, determined that the terms of the Reorganization Agreement and the Reorganization are advisable and in the best interest of our shareholders, and has adopted and approved the Reorganization Agreement. Our Board Directors recommends that our shareholders vote “FOR” adoption and approval of the Reorganization Agreement at the annual meeting.

Reorganization Procedure

NWLIC currently owns all of the issued and outstanding common stock of Newco, Newco currently owns all of the issued and outstanding common stock of MergerCo, the subsidiary formed for purposes of completing the proposed Reorganization, and NWLIC owns all of the issued and outstanding equity interests of The Westcap Corporation (of Delaware), NWL Investments, Inc., NWL Financial, Inc., NWL Services, Inc., NWLSM, Inc., and Regent Care San Marcos Holdings, LLC. Following the approval of the Reorganization Agreement by the NWLIC shareholders and the satisfaction or waiver of the other conditions specified in the Reorganization Agreement (which are described below), NWLIC will merge with MergerCo, the subsidiary of Newco. As a result of this merger:

| |

• | NWLIC will be the surviving corporation and the separate corporate existence of MergerCo will cease. |

| |

• | Each outstanding share of NWLIC Class A Stock and Class B Stock will automatically convert into one share of Newco Class A or Class B common stock, as described below, and the current shareholders of NWLIC will become the stockholders of Newco. |

| |

• | Newco will own all of NWLIC’s common stock and each share of Newco common stock now held by NWLIC will be canceled. |

The result of the Reorganization will be that your current company, NWLIC, will be merged with MergerCo and NWLIC will become a subsidiary of Newco. Newco’s restated certificate of incorporation is included as Annex II to this proxy statement/prospectus and a copy of Newco’s bylaws is included as Annex III to this proxy statement/prospectus. For more information regarding your rights as a shareholder before and after the Reorganization, see “Description of Newco Capital Stock,” “Description of NWLIC Capital Stock,” and “Comparative Rights of Newco Capital Stock and NWLIC Capital Stock.”

Immediately following the merger, as part of the Reorganization, NWLIC will distribute the stock of its subsidiaries, NWL Investments, Inc. and NWL Services, Inc. to Newco. As a result, NWLIC, NWL Investments, Inc., and NWL Services, Inc., will all be direct subsidiaries of Newco.

In all other respects, your company will remain the same. The current directors of NWLIC will continue as directors of Newco, and senior management will be substantially similar. In addition, our current business and operations will remain the same.

What NWLIC Shareholders Will Receive in the Reorganization

Each share of NWLIC Class A Stock and Class B Stock will convert into one share of Newco Class A or Class B common stock, as appropriate. After the completion of the Reorganization, you will own the same type, number, and percentage of shares of Newco capital stock as you currently own of NWLIC capital stock.

NWLIC Stock Options and Other Rights to Receive NWLIC Stock

Each of the outstanding options to acquire, or SARs relating to, shares of NWLIC Class A Stock in the aggregate will become options to acquire, or SARs relating to, on the same terms and conditions as before the Reorganization, an identical number of shares of Newco Class A common stock. On the Record Date, there were outstanding options representing the right to purchase an aggregate of 21,768 shares of NWLIC Class A Stock and SARs relating to 99,411 shares of NWLIC Class A Stock under NWLIC’s existing stock-based compensation plans, which include the NWLIC 1995 Stock and Incentive Plan and the NWLIC 2008 Incentive Plan (collectively the “NWLIC Plans”). Following the Reorganization, NWLIC plan participants will be entitled to receive shares of Newco Class A common stock rather than shares of NWLIC Class A Stock, on the same terms and conditions otherwise provided for in the respective plans.

Corporate Name Following the Reorganization

The name of the public company following the Reorganization will be “National Western Life Group, Inc.”

No Exchange of Stock Certificates

In the Reorganization, your shares of NWLIC Class A Stock and Class B Stock will be converted automatically into shares of Newco Class A or Class B common stock, respectively. Your certificates of NWLIC capital stock, if any, will represent, from and after the Reorganization, an equal number of shares of Newco capital stock, and no action with regard to stock certificates will be required on your part. We expect to send you a notice after the Reorganization is completed specifying this and other relevant information.

Conditions to Reorganization

We will complete the Reorganization only if each of the following conditions is satisfied or waived:

| |

• | The registration statement of Newco shall have been deemed or declared effective by the SEC under the Securities Act and no stop order suspending the effectiveness of the registration statement shall have been issued by the SEC and no proceeding for that purpose shall have been initiated or, to the knowledge of Newco or NWLIC, threatened by the SEC and not concluded or withdrawn. No similar proceeding with respect to the proxy statement shall have been initiated or, to the knowledge of Newco or NWLIC, threatened by the SEC and not concluded or withdrawn. |

| |

• | The Reorganization Agreement shall have been approved by the requisite vote of the shareholders of NWLIC in accordance with the Colorado Business Corporation Act (“CBCA”) and the restated articles of incorporation of NWLIC. |

| |

• | The Newco Class A common stock to be issued pursuant to the Reorganization shall have been approved for listing on the NASDAQ by The NASDAQ Stock Market, LLC. |

| |

• | NWLIC shall have made such filings and obtained such permits, authorizations, consents, approvals or terminations or expirations of waiting periods as are required by the corporate and insurance laws and regulations of all applicable jurisdictions. |

| |

• | No order, statute, rule, regulation, executive order, injunction, stay, decree, judgment or restraining order that is in effect shall have been enacted, entered, promulgated or enforced by any court or governmental or regulatory authority or instrumentality that prohibits or makes illegal the consummation of the Reorganization or the transactions contemplated by the Reorganization Agreement. |

| |

• | The Boards of Directors of NWLIC and Newco shall have received the legal opinion of Sutherland Asbill & Brennan LLP in form and substance reasonably satisfactory to them indicating that holders of Newco capital stock will not recognize gain or loss for United States federal income tax purposes as a result of the transactions contemplated by the Reorganization Agreement. |

Effectiveness of Reorganization

The Reorganization will become effective on the date we file a statement of merger with the Secretary of State of the State of Colorado or a later date that we specify therein. We will file the statement when the conditions to the Reorganization described above have been satisfied or waived. We expect that we will specify in the statement that the Reorganization will be effective in the latter part of 2015.

Termination of Reorganization Agreement

The Reorganization Agreement may be terminated at any time prior to the completion of the reorganization (even after adoption by our shareholders) by action of our Board of Directors if it determines that for any reason the completion of the transactions provided for therein would be inadvisable or not in the best interest of our company or our shareholders.

Amendment of Reorganization Agreement

The Reorganization Agreement may, to the extent permitted by the CBCA, be supplemented, amended, or modified at any time prior to the completion of the Reorganization (even after adoption by our shareholders) by the mutual consent of the parties thereto.

Material U.S. Federal Income Tax Consequences