By Sara Sjolin, MarketWatch

Hewlett Packard Enterprise shares drop premarket

Wall Street stocks looked set for a lower open on Friday,

setting the Dow up to end its 10-strong streak of record closes, as

investors hunted for cues that could push the markets higher.

Futures for the Dow Jones Industrial Average slipped 23 points,

or 0.1%, to 20,773. The Dow's gain on Thursday was its 10th in a

row as well as its 10th straight record closing high

(http://www.marketwatch.com/story/dow-eyes-10th-day-of-gains-as-us-stock-futures-rise-on-back-of-oil-rally-2017-02-23)

-- the longest such streak since 1987.

"Fresh record highs in the U.S. stock markets are no longer

surprising. [On the] contrary, they gradually increase the anxiety

in the market. Nobody knows when and how the reflation story [will]

end," said Ipek Ozkardeskaya, senior market analyst at London

Capital Group, in a note.

As for the other major indexes, futures for the S&P 500 fell

3.80 points, or 0.2%, to 2,359.25 on Friday, while those for the

Nasdaq-100 lost 11.25 points, or 0.2%, to 5,320.75.

In Thursday's action, the S&P 500 managed to eke out a 0.99

point gain, while the Nasdaq Composite ended 0.4% lower, pressured

by Nvidia Corp. (NVDA) and Tesla Inc. (TSLA) .

For the week, both the Dow and S&P were set for gains as of

Thursday's close, while the Nasdaq was eyeing a weekly loss.

"Biding their time": Premarket trading was muted with little in

the way of top-tier earnings reports or economic releases ahead on

Friday.

"It is conceivable that market participants are biding their

time at this point, waiting for next week's Fed speeches from Fed

Chairwoman Yellen and FOMC member Fischer, while President Trump's

joint session before Congress on Tuesday is also highly important,"

said Konstantinos Anthis, markets researcher at ADS Securities, in

a note.

(http://projects.marketwatch.com/2017/trump-today-signup/)

Investors will be listening to hear whether President Donald

Trump will keep up his "highly optimistic tone" on his proposed

reforms, or whether he will try to manage expectations, as Treasury

Secretary Steven Mnuchin appears to be doing, Anthis said.

Read:Mnuchin in no rush to label China a currency manipulator

(http://www.marketwatch.com/story/mnuchin-in-no-rush-to-label-china-a-currency-manipulator-2017-02-23)

And see:Doubts persist about tax timing as Trump meets with CEOs

(http://www.marketwatch.com/story/doubts-persist-about-tax-timing-as-trump-meets-with-ceos-2017-02-23)

"If we don't get further detail by the time President Trump

addresses a joint sitting of Congress on Tuesday, 28th February,

then the rally that we've seen in the past three months could

become susceptible to some profit taking," said Michael Hewson,

chief market analyst at CMC Markets UK..

Trump is expected to provide details on his highly anticipated

tax reform proposals in his Congress appearance Tuesday. Federal

Reserve chief Janet Yellen and Fed Vice Chairman Stanley Fischer

are slated to speak on Friday next week.

Read:Doubts persist about tax timing as Trump meets with CEOs

(http://www.marketwatch.com/story/doubts-persist-about-tax-timing-as-trump-meets-with-ceos-2017-02-23)

Economic news: Readings on new-home sales for January and

consumer sentiment for February are both due to come out at 10 a.m.

Eastern Time.

In the afternoon, the weekly U.S. oil rig count from Baker

Hughes Inc. (BHI) is scheduled for release. Last week, the closely

watched report showed the tally has risen

(http://www.marketwatch.com/story/why-oil-experts-think-opecs-us-headache-wont-go-away-this-year-2017-02-20)

for five straight weeks, leaving the count at the highest level

since October 2015.

Read: Why oil experts think OPEC's U.S. headache won't go away

this year

(http://www.marketwatch.com/story/why-oil-experts-think-opecs-us-headache-wont-go-away-this-year-2017-02-20)

(http://www.marketwatch.com/story/why-oil-experts-think-opecs-us-headache-wont-go-away-this-year-2017-02-20)Crude

oil was down 0.7% at $54.07 on Friday, while Brent traded 0.7%

lower at $56.40. The U.S. oil benchmark on Thursday closed at its

highest level since July 2015

(http://www.marketwatch.com/story/oil-prices-regain-momentum-us-supply-data-ahead-2017-02-23),

boosted by a smaller-than-expected rise in crude inventories.

Stock movers: Shares of Hewlett Packard Enterprise Co.(HPE)

slumped 6.7% in premarket action after the IT company late Thursday

reported lower sales than expected

(http://www.marketwatch.com/story/hewlett-packard-enterprise-falls-after-revenue-miss-slashed-earnings-forecast-2017-02-23)

and slashed its earnings projections for the fiscal year.

Shares of RH(RH) , the company formerly known as Restoration

Hardware, jumped 13% premarket. The high-end home furnishings

retailer late Thursday forecast higher-than-expected quarterly

results

(http://www.marketwatch.com/story/rh-shares-rally-on-higher-than-expected-forecast-2017-02-23).

J.C. Penney Co. Inc.(JCP) and Foot Locker Inc.(FL) are slated to

report earnings ahead of the bell.

Other markets:Asian stock markets

(http://www.marketwatch.com/story/asian-markets-dip-as-investors-cash-out-after-dovish-fed-minutes-2017-02-23)

closed mostly lower, with Europe following the same trend in the

early going.

Metals rose across the board, with silver on track for a ninth

straight weeks of gains.

The ICE Dollar index was down 0.1% at 100.96.

(END) Dow Jones Newswires

February 24, 2017 05:38 ET (10:38 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

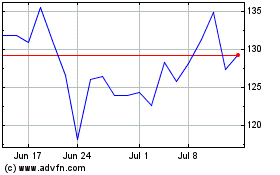

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024