Tech giants are hurriedly snapping up startups in the field of

artificial intelligence, with Intel Corp. the latest to join a

buying spree fueled by one of the hottest trends in the tech

sector.

The chip giant on Tuesday announced plans to pay an undisclosed

amount for Nervana Systems, a 48-employee company working on

semiconductors, software and services to exploit a popular AI

technique called deep learning.

Intel's move follows a deal disclosed Friday by Apple Inc. to

purchase Turi Inc., a Seattle-based specialist in the field. The

two acquisitions add to a string of 31 purchases since 2011 of AI

startups by large companies tallied by venture-capital research

firm CB Insights. The firm lists buyers that include Alphabet

Inc.'s Google, Twitter Inc., Yahoo Inc., International Business

Machines Corp. and Salesforce.com Inc.

Factoring in smaller acquirers, PricewaterhouseCoopers LLP

counts 29 related acquisitions so far this year, suggesting the

total deal count for 2016 will top the 37 deals announced last

year.

"We are on a very swift and increasing pace," said Todson Page,

the accounting and professional service firm's U.S. technology

industry deals leader.

Industry executives link the activity to the quickly widening

applications of AI, a broad term referring to ways to make

computers emulate attributes of the human brain. An initial cycle

of excitement about the technology arose in the 1980s and later

fizzled, but interest boomed in recent years due to breakthroughs

in the field known as machine learning, especially in the specific

area of deep learning.

Instead of programming machines explicitly to, say, recognize a

human face, deep learning allows computers to learn to perform the

task by analyzing vast troves of images of faces. Apple, for

instance, uses deep learning to analyze speech commands issued to

Siri, the software used for a variety of tasks on iPhones. Other

applications include detecting credit-card fraud, interpreting

medical images, studying crop growth, and enabling drones and

self-driving cars to navigate.

"AI is about to transform industry after industry," said Andrew

Ng, a deep-learning pioneer who is chief scientist at Baidu Inc.

and an associate professor at Stanford University.

Dollar figures for the AI acquisition binge are hard to come

by—as are figures for individual AI transactions—because the big

tech companies are swooping in on startups before they have built

market valuations of a size that buyers would be compelled to

disclose.

The buyers need talent more than technology, Mr. Ng said, since

today's AI products quickly will need to be updated. Google, which

led its peers with nine purchases, according to CB Insights, mined

the AI research community in 2013 by buying DNNresearch, a company

helmed by the influential University of Toronto AI researcher

Geoffrey Hinton.

The following year, Google bought DeepMind Technologies Ltd., a

London-based startup founded by Cambridge University graduates that

some publications pegged at a price tag of more than $400 million.

The DeepMind team developed AlphaGo, the AI software that made

headlines earlier this year by defeating a South Korean master of

the game Go.

Apple helped to ignite the recent consumer AI boom following its

2010 purchase of the startup Siri. In buying Turi, the company

stands to benefit from the expertise of Carlos Guestrin, who holds

a University of Washington machine learning professorship endowed

by Amazon.com Inc.

Industry executives say an array of other companies feel a need

counter AI results at younger companies like Google and Facebook

Inc.

"They are arming up," said Matt Ocko, a managing partner at the

venture-capital firm Data Collective, which invested in

Nervana.

The pressures are particularly acute on companies that manage

vast amounts of images or sounds, said Greg Papadopoulos, a venture

partner at New Enterprise Associates, an investor in Turi.

Companies that don't step up activity through acquisitions, he

said, soon will face serious competitive threats.

Intel has special motivations. While its Xeon chips handle most

computing tasks in data centers, rival Nvidia Corp. has popularized

chips known as graphics processing units, or GPUs, to more quickly

handle specialized chores associated with deep learning.

Nervana, which divides its staff between the California cities

of San Diego and Palo Alto, has AI software that exploits GPUs but

also expects to deliver a chip next year it says can complete deep

learning tasks even more quickly.

Jason Waxman, a corporate vice president in Intel's data-center

group, declined to say how it might use Nervana's chips. But Naveen

Rao, Nervana's chief executive and co-founder, said Intel had

unique manufacturing and technical expertise to help propagate the

startup's technology.

"No matter how much money we raised, we would not have access to

the same kind of technology as we will have at Intel," Mr. Rao

said.

Write to Don Clark at don.clark@wsj.com

(END) Dow Jones Newswires

August 09, 2016 16:25 ET (20:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

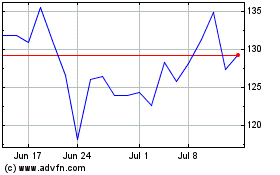

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024