By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

J.C. Penney, Nordstrom tumble on weak earnings

U.S. stock futures pared their losses Friday, following news

that sales at U.S. retailers jumped 1.3% in April to mark the

biggest gain in a year.

After briefly flirting with positive territory, stock futures

remained in the red ahead of the opening bell, as a fresh drop in

oil prices curbed investors' risk appetite.

Dow Jones Industrial Average futures fell 49 points, or 0.2%, to

17,624, while futures for the S&P 500 were down 4 points, or

0.2%, to 2,055. Nasdaq-100 futures lost 4 points, or 0.1%, to

4,330.

Auto dealers, gas stations and online vendors spearheaded the

increase in retail sales, which exceeded economists' expectations

of an 1% rise.

(http://www.marketwatch.com/story/retail-sales-leap-13-in-april-2016-05-13)

Meanwhile U.S. producer prices rose 0.2% in April

(http://www.marketwatch.com/story/us-producer-prices-climb-02-in-april-2016-05-13)

after two straight declines, but inflation at the wholesale level

remained largely absent in the broader economy.

Investors welcomed the strong retail-sales reading after a

flurry of disappointing news in that sector this week, due to which

on Friday ahead of the opening bell the consumer-discretionary

sector, which mainly includes retailers, was the only S&P 500

sector on track for a weekly loss.

The dollar and U.S. stocks took a hit on Wednesday after U.S.

retailers such as Macy's Inc.(M) and Kohl's Corp.(KSS) delivered

weaker earnings reports and downgraded 2016 forecasts. But on

Friday, the dollar

(http://www.marketwatch.com/story/dollar-slips-as-market-looks-ahead-to-next-weeks-g-7-2016-05-13)

gained against the yen and the euro following the strong data.

"We have quite the contradiction between what many U.S.

retailers said this week about the macro landscape and today's

April retail sales figure," said Peter Boockvar, chief market

analyst at The Lindsey Group, in emailed comments.

According to Boockvar, the discrepancy points to a story of

"shifting channels" rather than slowing sales, as the numbers

showed "quite a difference between online and department stores"

which the core rate of sales improved year-over-year to its best

reading since July.

Also weighing on risk appetite was the fact that crude oil

prices

(http://www.marketwatch.com/story/oil-price-rally-fades-as-oversupply-fears-crop-up-again-2016-05-13)

moved lower, with West Texas Intermediate down 1.5%, after comments

from Russian Energy Minister Alexander Novak drew attention. He

told reporters on Thursday he doesn't see the oil market balancing

out until the first half of 2017, Reuters reported.

Oil prices rallied Thursday after an International Energy Agency

report said declines in global production will ease a crude supply

glut. A reading on North America's oil-rig count is expected Friday

afternoon.

Overall, this week has been muted for stocks. With one session

left to go, the Dow industrials are down 0.1%, and the S&P 500

is up just 0.3%. The Nasdaq Composite is flat.

The Dow industrials barely eked out a gain on Thursday

(http://www.marketwatch.com/story/us-stocks-look-set-to-recover-from-corporate-bruising-2016-05-12),

and the S&P 500 finished flat. Equities were prevented from

making gains largely due to a steep slide in Apple Inc.(AAPL) and

other technology shares. A biotech selloff also weighed on the

Nasdaq Composite .

"The lack of catalysts this week have left investors without any

direction. I don't think this is helped by a number of assets

currently being at elevated levels, oil and U.S. equities to name

just a couple," said Craig Erlam, senior market analyst at Oanda,

in emailed comments.

Economic data: The University of Michigan's consumer sentiment

index for May, due for release at 10 a.m. Eastern, alongside

business inventories for March.

Fed speak: Comments from Fed Chairwoman Janet Yellen could draw

some attention. In a letter to Rep. Brad Sherman (D., Calif.)

(http://www.marketwatch.com/story/feds-yellen-says-negative-rates-would-need-careful-consideration-2016-05-13)

released by his office on Thursday, she said the central bank

wouldn't rule out using negative interest rates, but such a move

would require careful consideration.

San Francisco Fed President John Williams will speak to the

Sacramento Economic Forum in Sacramento, Calif., at 6:25 p.m.

Eastern Time.

Stocks to watch:J.C. Penney Co. Inc.(JCP) tumbled 9.3% before

the bell after the company missed quarterly sales estimates

(http://www.marketwatch.com/story/jc-penney-shares-tumble-after-weak-sales-fall-short-of-estimates-2016-05-13)

as same-store sales fell way below expectations.

Nordstrom Inc.(JWN) shares plunged 14.5% after the retailer

reported lower-than-expected first-quarter sales

(http://www.marketwatch.com/story/nordstrom-shares-plunge-after-revenue-eps-miss-2016-05-12)

and earnings.

Nvidia Corp shares climbed 10.2% after the company's profit rose

46% in the latest quarter as the chip maker saw strong growth

(https://www.google.com/url?sa=t&rct=j&q=&esrc=s&source=web&cd=8&cad=rja&uact=8&ved=0ahUKEwj_q-v3gtfMAhWC4yYKHd2RA3oQqQIIMTAH&url=http%3A%2F%2Fwww.marketwatch.com%2Fstory%2Fnvidia-shares-rally-5-after-earnings-outlook-top-street-view-2016-05-12&usg=AFQjCNHU-3P5jnI19CcJkml2qm_KcG_TpQ&bvm=bv.122129774,d.eWE)

in gaming products as well as newer sectors like automotive

"infotainment."

Shake Shack Inc.(SHAK) shares gained 6% premarket after the

company swung to a better-than-expected profit for its first

quarter, boosted by strong same-store sales

(http://www.marketwatch.com/story/shake-shacks-strong-same-store-sales-boost-profit-2016-05-12)

and new location openings, leading the chain to raise its annual

guidance.

Apple will invest $1 billion in Didi Chuxing Technology Co.,

China's homegrown competitor to Uber Technologies Inc., the iPhone

maker announced late Thursday

(http://www.marketwatch.com/story/apple-puts-1-billion-into-chinas-uber-rival-didi-2016-05-13).

U.S.-listed shares of Royal Dutch Shell PLC(RDSB.LN) (RDSB.LN)

(RDSB.LN) (RDSB.LN) could be active. Shares fell in London after an

estimated 2,100 barrels of crude leaked from a Royal Dutch Shell

facility in the Gulf of Mexico Thursday

(http://www.marketwatch.com/story/shell-shuts-well-after-leak-into-gulf-of-mexico-2016-05-12).

Other markets: Asian markets

(http://www.marketwatch.com/story/oil-volatility-unsettles-asian-markets-nikkei-set-for-around-2-weekly-gain-2016-05-13)

finished Friday lower, with markets rattled by oil-price

volatility. The Nikkei 225 index dropped 1.4%, though it finished

the week nearly 2% higher. The Shanghai Composite Index lost 0.3%

on the day, but posted a nearly 3% drop for the week.

European stocks were mixed

(http://www.marketwatch.com/story/european-shares-push-lower-heading-for-third-straight-weekly-drop-2016-05-13)

after a rough week on the earnings front. Gold prices fell 0.4% to

$1,265.8 an ounce.

Read: Investors' appetite for gold is soaring, and there is

little sign of a slowdown

(http://www.marketwatch.com/story/investor-appetite-for-gold-is-soaring-and-theres-little-sign-of-a-slowdown-2016-05-12)

(END) Dow Jones Newswires

May 13, 2016 09:13 ET (13:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

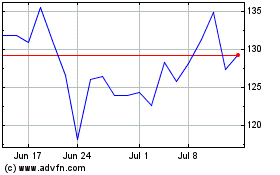

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024