UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

______________

FORM 8-K

______________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 7, 2015

|

|

NVIDIA CORPORATION (Exact name of registrant as specified in its charter) |

|

| | |

Delaware | 0-23985 | 94-3177549 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

|

| |

2701 San Tomas Expressway, Santa Clara, CA (Address of principal executive offices) | 95050 (Zip Code) |

Registrant’s telephone number, including area code: (408) 486-2000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Adoption of Fiscal Year 2016 Variable Compensation Plan

On April 7, 2015, the Compensation Committee of our Board of Directors adopted the Fiscal Year 2016 Variable Compensation Plan, or the 2016 Plan, which provides eligible executive officers the opportunity to earn a cash bonus award based on the level of achievement by us of certain corporate objectives, or the Corporate Targets, during our fiscal year 2016. We operate on a fiscal year ending on the last Sunday in January. We designate our fiscal year by the year in which that fiscal year ends (e.g., fiscal year 2016 refers to our fiscal year ending January 31, 2016).

An eligible participant’s target variable cash compensation under the 2016 Plan will be based on the achievement by NVIDIA of the Corporate Targets, such amount referred to as the Target Variable Cash Compensation.

The Compensation Committee has set the Corporate Targets for fiscal year 2016 based upon the achievement of specified fiscal year 2016 revenue and has established a threshold and a maximum.

Unless otherwise determined by the Compensation Committee, a participant must remain an employee through the payment date under the 2016 Plan to be eligible to earn an award.

The following table sets forth the Target Variable Cash Compensation for our named executive officers under the 2016 Plan:

|

| | |

Named Executive Officer | Target Variable Cash Compensation |

Target Variable Cash Compensation as a % of Fiscal Year 2016 Base Salary |

Jen-Hsun Huang President and Chief Executive Officer | $1,000,000 | 100% |

Colette M. Kress Executive Vice President and Chief Financial Officer | $275,000 | 35% |

Ajay K. Puri Executive Vice President, Worldwide Field Operations | $475,000 | 54% |

David M. Shannon Executive Vice President, Chief Administrative Officer and Secretary | $200,000 | 25% |

Debora Shoquist Executive Vice President, Operations | $150,000 | 21% |

The 2016 Plan is filed with this report as Exhibit 10.1 and is incorporated herein by reference. The foregoing description is subject to, and qualified in its entirety by, the 2016 Plan.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

|

| | |

Exhibit Number | | Description |

10.1 | | Fiscal Year 2016 Variable Compensation Plan of NVIDIA Corporation. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| |

| NVIDIA Corporation |

Date: April 9, 2015 | By: /s/ Rebecca Peters |

| Rebecca Peters |

| Vice President, Corporate Affairs and Assistant Secretary |

EXHIBIT INDEX

|

| | |

Exhibit Number | | Description |

10.1 | | Fiscal Year 2016 Variable Compensation Plan of NVIDIA Corporation. |

NVIDIA CORPORATION

FISCAL YEAR 2016 VARIABLE COMPENSATION PLAN

Overview

The compensation philosophy of NVIDIA Corporation (the “Company”) is to attract, motivate, retain and reward its management through a combination of base salary and performance based compensation. Certain Senior Officers, as defined below (collectively, the “Participants”), who are employed at the Company during fiscal year 2016 and, unless otherwise determined by the Compensation Committee (the “Committee”), are employees of the Company through the date that any amounts earned hereunder are paid (each, a “Variable Cash Payment”), will be eligible to earn compensation under the Fiscal Year 2016 Variable Compensation Plan (the “Plan”). The Plan is designed to award a Variable Cash Payment for performance in fiscal year 2016 to a Participant if the Company achieves certain corporate performance targets (the “Corporate Targets”). Payments earned based on the achievement of Corporate Targets shall be referred to herein as a “Corporate Variable Cash Payment.”

For purposes of the Plan, only the Company’s chief executive officer, chief financial officer and other named executive officers shall be considered “Senior Officers.” The Committee shall determine the persons to be specified as Senior Officers for purposes of this Plan and the Senior Officers who may be Participants hereunder.

Determination of Fiscal Year 2016 Variable Cash Payments

Certain Senior Officers are eligible to earn a Variable Cash Payment at a specified target amount (the “Variable Cash Payment Target Amount”) if the Company achieves its Corporate Targets. A Participant’s Variable Cash Payment Target Amount is based on the difficulty and responsibility of each position. For fiscal year 2016, each Participant’s Variable Cash Payment Target Amount will be entirely allocated to the achievement of the Corporate Targets (the “Corporate Variable Cash Target Amount”). A Participant may be eligible to earn more or less than his or her Corporate Variable Cash Target Amount as described more fully below.

The Committee has set the Corporate Targets for the Participants based on achievement of specified target fiscal year 2016 revenue. For purposes of the Plan, revenue, or “Actual Result”, is defined as revenue, as reported in the Company’s annual earnings release for fiscal year 2016.

The Committee has also set threshold and maximum Actual Result targets for fiscal year 2016 for Participants for the award of a portion or all of the Corporate Variable Cash Payment (the “Threshold” and “Maximum,” respectively). The actual Corporate Variable Cash Payments that may be earned for fiscal year 2016 (the “Actual Corporate Variable Cash Payments”) shall be made pursuant to the following:

| |

• | If the Actual Result is less than the Threshold, a Participant will not earn any portion of his or her Corporate Variable Cash Target Amount. |

| |

• | If the Actual Result equals the Threshold, each Participant may earn an Actual Corporate Variable Cash Payment equal to 25% of his or her Corporate Variable Cash Target Amount. |

| |

• | If the Actual Result exceeds the Threshold but is less than the Corporate Target, each Participant may earn an Actual Corporate Variable Cash Payment pursuant to the formula set forth below: |

Actual Corporate Variable Cash Payment = [(((Actual Result - Threshold) / (Corporate Target - Threshold))*75%) + 25%] * Corporate Variable Cash Target Amount

| |

• | If the Actual Result equals the Corporate Target, each Participant may earn an Actual Corporate Variable Cash Payment equal to 100% of his or her Corporate Variable Cash Target Amount. |

| |

• | If the Actual Result exceeds the Corporate Target but is less than the Maximum, each Participant may earn an Actual Corporate Variable Cash Payment pursuant to the formula set forth below: |

Actual Corporate Variable Cash Payment = [((Actual Result - Corporate Target) / (Maximum - Corporate Target)) + 1] * Corporate Variable Cash Target Amount

| |

• | If the Actual Result equals or exceeds the Maximum, each Participant may earn an Actual Corporate Variable Cash Payment equal to two (2) times his or her Corporate Variable Cash Target Amount. In no event may any Participant earn an Actual Corporate Variable Cash Payment in excess of two (2) times his or her Corporate Variable Cash Target Amount. |

Miscellaneous Provisions

Payments under this Plan shall be made following the end of fiscal year 2016, on such schedule as may be approved by the Committee in its discretion, but in all cases in compliance with the short-term deferral exemption from Section 409A of the Internal Revenue Code of 1986, as amended.

Participation in the Plan shall not alter in any way the at will nature of the Company’s employment of a Participant, and such employment may be terminated at any time for any reason, with or without cause and with or without prior notice.

Notwithstanding whether this Plan is referenced in another agreement, policy, arrangement or other document, only the Board of Directors or the Committee may amend or terminate this Plan at any time.

Any Variable Cash Payments or other benefits paid under this Plan shall be subject to the Company’s Clawback Policy. By accepting any payment hereunder, the Participant agrees to be subject to the Clawback Policy.

This Plan shall be governed by and construed in accordance with the laws of the State of California, without regard to its principles of conflicts of laws.

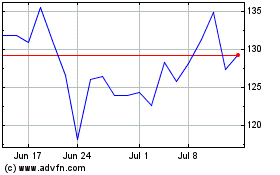

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Mar 2024 to Apr 2024

NVIDIA (NASDAQ:NVDA)

Historical Stock Chart

From Apr 2023 to Apr 2024