UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D

.

C

.

20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant

þ

Filed by a Party other than the Registrant

¨

Check the appropriate box:

¨

Preliminary Proxy Statement

¨

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ

Definitive Proxy Statement

¨

Definitive Additional Materials

¨

Soliciting Material Pursuant to §240.14a-12

NuVasive, Inc.

(Name of Registrant as Specified in its

Charter)

(Name of Person(s) Filing Proxy

Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

þ

|

|

No fee required.

|

|

|

|

|

¨

|

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

|

|

|

|

|

1)

|

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

|

2)

|

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

|

3)

|

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on

which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

|

4)

|

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

|

5)

|

|

Total fee paid:

|

|

|

|

|

¨

|

|

Fee paid previously with preliminary materials.

|

|

|

|

|

¨

|

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid

previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

1)

|

|

Amount Previously Paid:

|

|

|

|

|

|

|

|

2)

|

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

|

3)

|

|

Filing Party:

|

|

|

|

|

|

|

|

4)

|

|

Date Filed:

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF NUVASIVE, INC.

To Be

Held May 19, 2016

The NuVasive, Inc. 2016 Annual Meeting of Stockholders will be held on May 19, 2016 at 8:00 AM local time at the

Company’s corporate headquarters located at 7475 Lusk Boulevard, San Diego, California 92121 for the following purposes, each as more fully described in the accompanying Proxy Statement:

1. to elect three “Class III” Directors to hold office until the Company’s 2019 Annual Meeting of Stockholders

and until their successors are elected and qualified;

2. to ratify the appointment of Ernst & Young LLP as the

Company’s independent registered public accounting firm for the fiscal year ending December 31, 2016;

3. to

hold a non-binding advisory vote on the compensation of the Company’s named executive officers for the fiscal year ended December 31, 2015; and

4. to transact such other business as may properly come before the meeting or any adjournments or postponements thereof.

Our Board of Directors recommends a vote

“FOR”

each of the Director nominees and

“FOR”

Proposals 2 and 3. Only stockholders of record at the close of business on March 24, 2016 will be entitled to notice of, and to vote at, the Annual Meeting. For ten days prior to the Annual Meeting, a complete list of the stockholders of record

on March 24, 2016, will be available at our corporate headquarters, located at 7475 Lusk Boulevard, San Diego, CA 92121, for examination during ordinary business hours by any stockholder for any purpose relating to the Annual Meeting.

Your vote is important. Whether or not you plan to attend the Annual Meeting in person, we encourage you to vote your

shares. After reading the accompanying Proxy Statement, please make sure to vote your shares: (i) by promptly voting electronically or telephonically as described in the in the accompanying Proxy Statement; (ii) if you received a paper

copy of the proxy card, by completing, dating, signing and returning your proxy card; or (iii) by attending the Annual Meeting in person. Instructions regarding all three methods of voting are provided on the proxy card. If you hold shares

through an account with a brokerage firm, bank or other nominee, please follow the instructions you receive from such firm, bank or other nominee to vote your shares.

I look forward to seeing you at the Annual Meeting.

BY ORDER OF THE BOARD OF DIRECTORS

Gregory T. Lucier

Chairman of the Board and Chief Executive Officer

San Diego, California

April 6, 2016

SOLICITATION OF PROXIES

FOR THE

NUVASIVE, INC.

2016 ANNUAL MEETING OF STOCKHOLDERS

The accompanying proxy is being solicited by the Board of Directors of NuVasive, Inc. (the “Company”) and contains

information related to the Company’s 2016 Annual Meeting of Stockholders. The 2016 Annual Meeting of Stockholders will be held on May 19, 2016 at 8:00 AM local time at the Company’s corporate headquarters located at 7475 Lusk

Boulevard, San Diego, California 92121, or any adjournments or postponements thereof, for the purposes described in the accompanying Notice of Annual Meeting of Stockholders. The Board of Directors has made proxy materials available on the Internet,

or, upon your request, has delivered printed proxy materials to you, in connection with the solicitation of proxies by the Board of Directors for use at the Company’s 2016 Annual Meeting of Stockholders. The Proxy Statement for the

Company’s 2016 Annual Meeting of Stockholders was filed with the U.S. Securities and Exchange Commission on April 6, 2016, which is also the approximate date on which the Proxy Statement and the accompanying proxy were first sent or made

available to stockholders.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE NUVASIVE, INC. 2016 ANNUAL MEETING OF STOCKHOLDERS

The NuVasive, Inc. Proxy Statement and Annual Report for the fiscal year ended December 31, 2015

are available electronically at

www.proxydocs.com/NUVA

YOUR VOTE IS IMPORTANT!

ALL STOCKHOLDERS OF RECORD AT THE CLOSE OF BUSINESS ON MARCH 24, 2016 ARE INVITED TO ATTEND AND VOTE THEIR SHARES AT THE NUVASIVE, INC. 2016

ANNUAL MEETING OF STOCKHOLDERS. WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON, WE ENCOURAGE YOU TO READ THE ACCOMPANYING PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTING INSTRUCTIONS AS SOON AS POSSIBLE TO VOTE YOUR SHARES. FOR

SPECIFIC INSTRUCTIONS ON HOW TO VOTE YOUR SHARES, PLEASE REFER TO THE INSTRUCTIONS ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS YOU RECEIVED IN THE MAIL, THE QUESTION “HOW DO I VOTE?” IN THE ACCOMPANYING PROXY STATEMENT, OR,

IF YOU REQUESTED PRINTED PROXY MATERIALS BY MAIL, YOUR ENCLOSED PROXY CARD. THIS WILL ENSURE THE PRESENCE OF A QUORUM AT THE ANNUAL MEETING. IF YOU ATTEND THE ANNUAL MEETING, YOU MAY VOTE IN PERSON IF YOU WISH TO DO SO, EVEN IF YOU HAVE PREVIOUSLY

SUBMITTED YOUR PROXY OR VOTING INSTRUCTIONS.

|

|

|

|

|

|

|

Page i

|

|

|

|

|

|

|

|

PROXY STATEMENT SUMMARY

2016 ANNUAL MEETING OF STOCKHOLDERS

|

To assist you in reviewing the Proxy Statement for the 2016 Annual Meeting of Stockholders (the “Annual

Meeting”), we call your attention to the following summary information. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting.

|

|

|

|

|

Annual Meeting of Stockholders

|

|

Date and

Time

|

|

May 19, 2016 at 8:00 AM (local time)

|

|

Place

|

|

NuVasive, Inc. Corporate Headquarters 7475 Lusk Boulevard, San Diego,

CA 92121

|

|

Record

Date

|

|

March 24, 2016

|

|

Voting

|

|

Stockholders as of the Record Date are entitled to vote their shares

at the Annual Meeting. Each share of common stock is entitled to one vote for each Director nominee and one vote for each of the other proposals to be voted on at the Annual Meeting.

|

|

|

|

|

|

Proposals and Voting Recommendations

|

|

|

|

Proposal 1 -

Election of three “Class III” Directors to hold office until the Company’s 2019 Annual Meeting of

Stockholders and until their successors are elected and qualified.

For more information, see page 6 of the accompanying Proxy Statement.

|

|

The Board

Recommends a vote

“FOR”

Each Director Nominee

|

|

Proposal 2 -

Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting

firm for the fiscal year ending December 31, 2016.

For more information, see page 22 of the accompanying Proxy Statement.

|

|

The Board

Recommends a vote “FOR”

Proposal 2

|

|

Proposal 3 -

Non-binding advisory vote on the compensation of the Company’s named executive officers for the fiscal year ended

December 31, 2015.

For more information,

see page 25 of the accompanying Proxy Statement.

|

|

The Board

Recommends a vote “FOR”

Proposal 3

|

|

|

|

|

|

Nominees for Election as Directors

|

|

Robert F.

Friel

|

|

Principal Occupation: Chairman, CEO and President,

PerkinElmer, Inc.

Independent Director; Board member since February 2016

Member of NuVasive Compensation Committee

|

|

Donald J.

Rosenberg

|

|

Principal Occupation: EVP and General Counsel,

Qualcomm Incorporated

Independent Director; Board member since February 2016

Member of NuVasive Compensation Committee and Nominating and Corporate Governance Committee

|

|

Daniel J.

Wolterman

|

|

Principal Occupation: President and CEO, Memorial

Hermann Health System

Independent Director; Board member since July 2015

Member of NuVasive Compensation Committee

|

|

|

|

|

|

Page ii

|

|

|

|

|

|

|

|

|

|

PROXY STATEMENT SUMMARY

2016 ANNUAL MEETING OF STOCKHOLDERS

|

|

|

|

|

|

Corporate Governance Highlights

|

|

Size of Board

|

|

Nine

(eight upon the retirement of Mr. Blair following the Annual

Meeting)

|

|

Independent Directors

|

|

Eight of our nine current Directors are independent

|

|

Chairman and CEO

|

|

Combined leadership structure

|

|

Lead Independent Director

|

|

Yes

|

|

Board Self-Evaluation

|

|

Annual

|

|

Retirement Age Policy

|

|

Yes

(72 years of age)

|

|

Voting Standard

|

|

Majority vote

(in uncontested elections)

|

|

Corporate Governance Guidelines

|

|

Yes

|

|

|

|

|

|

|

|

Fiscal 2015 Financial and Business Highlights

|

|

|

|

|

|

Financial Results -

We exceeded our revenue targets by

posting 2015 total revenue of $811.1 million, reflecting an approximately 6.4% increase on a reported basis and 8.2% increase on a constant currency basis over 2014 performance, and exceeded our profitability targets by delivering a 2015 non-GAAP

operating margin of 15.4%.

|

|

|

|

Global

Revenues

$811.1 million

|

|

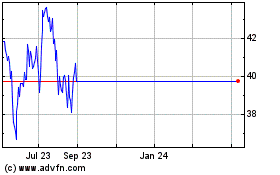

Total Shareholder Return -

We realized total shareholder

return during 2015 of 14.7%, a result only achieved by those in the 78th percentile of the S&P 500. Over a three-year period ending in 2015, we realized total shareholder return of 250%, a result only achieved by those in the 98th percentile of

the S&P 500.

|

|

|

|

Total Shareholder Return

78

th

percentile of

S&P

500

|

|

International Growth -

We increased international revenue by

approximately 15.9% on a constant currency basis compared to 2014 driven by growth across geographies primarily in Japan, Australia, and Italy.

|

|

|

|

15.9% International

Revenue Growth

(constant currency)

|

|

Product Innovation -

We launched over 10 new and enhanced

products in 2015, including our innovative Integrated Global Alignment platform (iGA™), a proprietary, procedurally- integrated, digital platform of specialized products designed to help surgeons achieve more precise spinal column

alignment.

|

|

|

|

10+ New Products,

Including Launch of iGA

|

|

|

|

|

|

Executive Compensation Best Practices

|

|

Clawback Policy

|

|

Yes

(incentive compensation recoverable if material restatement of

financials)

|

|

Tax Gross-Ups

|

|

No tax gross-ups for change-in-control payments

|

|

Compensation Consultant

|

|

Yes

(independent consultant engaged by Compensation

Committee)

|

|

Stock Ownership Guidelines

|

|

Yes

(applies to Directors and senior management)

|

|

Compensation Risk

|

|

Compensation risk assessment conducted annually

|

|

Hedging Activities

|

|

Hedging activities are prohibited under the Company’s Insider

Trading Policy

|

|

|

|

|

|

|

|

Page iii

|

TABLE OF CONTENTS

|

|

|

|

|

Page iv

|

|

|

|

|

|

|

|

|

|

Page v

|

NUVASIVE, INC.

7475 Lusk Boulevard, San Diego, CA 92121

Telephone: (858) 909-1800

PROXY STATEMENT FOR THE 2016 ANNUAL MEETING OF STOCKHOLDERS

May 19, 2016 at 8:00 AM (local time)

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

|

1.

|

Why am I receiving these materials?

|

We have made this proxy statement (the “

Proxy Statement

”) and the accompanying proxy materials

available to you in connection with the solicitation by the Board of Directors (the “

Board

”) of NuVasive, Inc. (the “

Company

” or “

NuVasive

”) of proxies to be voted at the

Company’s 2016 Annual Meeting of Stockholders to be held on May 19, 2016 (the “

Annual Meeting

”), and at any postponements or adjournments of the Annual Meeting.

|

2.

|

What is the purpose of the Annual Meeting?

|

Stockholders are being asked to vote on each of the following items of business at the Annual Meeting: (i) the election of

three “Class III” Directors for terms expiring at the 2019 Annual Meeting of Stockholders; (ii) the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year

ending December 31, 2016; (iii) non-binding advisory approval of the compensation of the Company’s named executive officers (the “

Named Executive Officers

”) for the fiscal year ended December 31, 2015; and

(iv) any other business that may properly come before the Annual Meeting.

|

3

.

|

Why did I receive a notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

|

In accordance with rules adopted by the Securities and Exchange Commission (the

“

SEC

”), we may furnish proxy materials, including this Proxy Statement and our Annual Report on Form 10-K for fiscal year ended December 31, 2015 (the “

2015 Annual Report

”), to our stockholders by

providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not receive printed copies of the proxy materials unless they request them. Instead, the Notice of Internet Availability of Proxy Materials

(the “

Notice

”) (which was mailed to most of our stockholders) will instruct you as to how you may access and review all of the proxy materials on the Internet, as well as how you may submit your proxy on the Internet. All

stockholders will have the ability to access the proxy materials on the website referred to in the Notice or your proxy card and to download printable versions of the proxy materials. If you would like to receive a paper or email copy of our proxy

materials, you should follow the instructions for requesting such materials in the Notice.

|

4

.

|

How do I access electronic copies of the proxy materials?

|

The proxy materials for the Annual Meeting are available electronically at

www.proxydocs.com/NUVA

. If you received a

Notice, the Notice will provide you with instructions regarding how to access electronic copies of our proxy materials and how to vote your shares. The Notice will also indicate how you can elect to receive future proxy materials electronically. We

encourage stockholders to consider choosing to receive future proxy materials electronically, as it will save us the cost of printing and mailing documents to you and will reduce the impact of printing and mailing these materials on the environment.

|

|

|

|

|

|

|

Page 1

|

|

5

.

|

Who is entitled to vote at the Annual Meeting?

|

If you were a holder of shares of the Company’s common stock at the close of business on March 24, 2016 (the

“

Record Date

”), you are entitled to notice of and to vote at the Annual Meeting. At the close of business on the Record Date, there were 49,768,050 shares of our common stock outstanding. Each share of common stock is

entitled to one vote. As summarized below, there are some distinctions between shares owned by “stockholders of record” and shares owned beneficially “in street name.” In accordance with Delaware law, a list of stockholders

entitled to vote at the Annual Meeting will be available at the Annual Meeting and for 10 days prior to the Annual Meeting, Monday through Friday between the hours of 9:00 AM and 4:00 PM local time at our corporate headquarters located at 7475 Lusk

Boulevard, San Diego, CA 92121.

|

6

.

|

What does it mean to be a “stockholder of record”?

|

You are a “stockholder of record” if your shares are registered directly in your name with our transfer agent,

Computershare Trust Company, N.A. As a stockholder of record, you may vote in person at the Annual Meeting (subject to the satisfying the admission criteria) or vote by proxy. If you requested to receive printed proxy materials, we have enclosed or

sent a proxy card for you to use. You may also vote by Internet or telephone, as described in the Notice and below under the heading “How do I vote?”

|

7

.

|

What does it mean to beneficially own shares in “street name”?

|

You are deemed to beneficially own your shares in “street name” if your shares are held in an account at a brokerage

firm, bank, broker-dealer, trust, or other similar organization (we will refer to those organizations collectively as “broker”). If this is the case, the Notice was forwarded to you by your broker. As the beneficial owner, you have the

right to direct your broker on how to vote the shares in your account, and you are invited to attend the Annual Meeting; however, since you are not a stockholder of record, you may not vote your shares in person at the Annual Meeting unless you

request and obtain a valid legal proxy from your broker giving you the right to vote the shares at the meeting.

If you

hold your shares in “street name” and do not provide voting instructions to your broker, your shares will not be voted on any proposals on which your broker does not have discretionary authority to vote (a “broker non-vote”).

Under the rules that govern brokers, brokers have the discretion to vote on routine matters, but not on non-routine matters. The ratification of the appointment of the Company’s independent registered public accounting firm is a matter

considered routine under applicable rules. Non-routine matters include the election of Directors and the advisory vote on the compensation of our Named Executive Officers.

|

8

.

|

How do I vote my shares?

|

If you are a stockholder of record, you may vote your shares by one of the following three methods:

|

|

•

|

|

Vote via the Internet

. Go to the web address

www.proxypush.com/NUVA

and follow the instructions for Internet voting as shown

on the proxy card mailed to you. If you vote via the Internet, you should be aware that there may be incidental costs associated with electronic access, such as your usage charges from your Internet access providers and telephone companies, for

which you will be responsible.

|

|

|

•

|

|

Vote by Telephone

. Dial 1-866-217-7017 and follow the instructions for telephone voting shown on the proxy card mailed to you.

|

|

|

•

|

|

Vote by Proxy Card Mailed to You

. If you do not wish to vote via the Internet or by telephone, please complete, sign, date and mail

the proxy card in the envelope provided. If you vote via the Internet or by telephone, please do not mail your proxy card.

|

The Internet and telephone voting procedures are designed to authenticate your identity and to allow you to vote your shares

for the matters before our stockholders as described in the proxy materials and confirm that your voting instructions have been properly recorded.

|

|

|

|

|

Page 2

|

|

|

If your shares are held through a broker (typically referred to as being held in “street name”), you will receive

separate voting instructions from your broker. In these cases, you may provide your voting instructions by Internet, telephone or mail by submitting a voting instruction form. Your broker may vote your shares on the proposal to ratify our

independent auditors, but will not be permitted to vote your shares with respect to the other proposals before our stockholders as described in this Proxy Statement unless you provide instructions to your broker as to how to vote your shares for

such other proposals.

Votes submitted via the Internet or by telephone for the matters before our stockholders as

described in this Proxy Statement must be received by 11:59 PM Eastern Time on May 18, 2016.

|

9

.

|

How does the Board recommend that I vote my shares?

|

THE BOARD RECOMMENDS THAT YOU VOTE YOUR SHARES “

FOR

” THE ELECTION OF EACH OF THE “CLASS III”

DIRECTOR NOMINEES, “

FOR

” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM, AND “

FOR

” THE NON-BINDING ADVISORY RESOLUTION ON THE

COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS, IN EACH CASE AS FURTEHR DESCRIBED IN THIS PROXY STATEMENT.

|

10

.

|

Can I change my vote after I submit my proxy?

|

Yes. If you are a stockholder of record, you may revoke a proxy at any time before it is voted at the Annual Meeting by

(a) delivering a proxy revocation or another duly executed proxy bearing a later date to the Secretary of the Company at 7475 Lusk Boulevard, San Diego, CA 92121, or (b) attending the Annual Meeting and voting in person. Attendance at the

Annual Meeting will not revoke a proxy unless you actually vote in person at the Annual Meeting. If you beneficially hold shares in street name, you may change your vote by submitting new voting instructions to your broker following the instructions

provided by your broker, or, if you have obtained a legal proxy from your broker or other nominee giving you the right to vote your shares, by attending the Annual Meeting and voting in person.

|

11

.

|

How are the votes counted?

|

The Company’s Restated Bylaws, as amended (the “

Bylaws

”) provide that a majority of all the

outstanding shares of stock entitled to vote constitutes a quorum for the transaction of business at the Annual Meeting. Votes for and against, abstentions, and “broker non-votes” will be counted for purposes of determining the presence or

absence of a quorum. A “broker non-vote” occurs when your broker submits a proxy card for your shares of common stock held in street name, but does not vote on a particular proposal because the broker has not received voting instructions

from you and does not have the authority to vote on that matter without instructions.

In the election of Directors and

for each other proposal to be voted on at the Annual Meeting, you may vote “FOR”, “AGAINST”, or “ABSTAIN”. A vote of “ABSTAIN” with respect to any such matter will not be voted, although it will be counted for

purposes of determining whether there is a quorum. Accordingly, an abstention will have the effect of a negative vote.

If

no instructions are indicated, the shares will be voted as recommended by the Board unless you submit your proxy card through a broker and your broker does not indicate a vote on a particular matter because your broker has not received voting

instructions from you. If the Company receives a proxy card with a broker non-vote, your proxy will be voted “FOR” the ratification of the appointment of Ernst & Young LLP and it will not be included as a vote with respect to the

election of Directors and the approval of the compensation of the Company’s Named Executive Officers.

|

|

|

|

|

|

|

Page 3

|

|

12

.

|

What vote is needed to approve each of the proposals?

|

Under the Bylaws, at any meeting of stockholders for the election of Directors at which a quorum is present, each Director

shall be elected by the vote of a majority of the votes cast with respect to the Director; provided, that in the event of a contested election, Directors shall be elected by a plurality of votes cast by the stockholders entitled to vote at the

election. All other matters shall be determined by a majority of the votes present in person or represented by proxy, unless otherwise required by applicable law, rule or regulation or the Company’s organizational documents.

|

13

.

|

Is cumulative voting permitted for the election of Directors?

|

No. You may not cumulate your votes for the election of Directors.

|

14

.

|

Who will count votes at the Annual Meeting?

|

We have engaged Mediant Communications to serve as the tabulator of votes, and our Board has designated Jason D. Hanson, our

Executive Vice President, Strategy, Corporate Development and General Counsel, to serve as the Inspector of Election.

|

15

.

|

How do I attend the Annual Meeting?

|

Admission to the Annual Meeting is limited to holders of Company common stock on the Record Date and a member of each attending

stockholder’s immediate family or their named representatives. If you are a “stockholder of record” you will need to present identification to be admitted to the Annual Meeting. If you are a stockholder who is an individual, you will

need to present government-issued identification showing your name and photograph (e.g., a driver’s license or passport), or, if you are representing an institutional investor, you will need to present government-issued photo identification and

professional evidence showing your representative capacity for such entity. In each case, we will verify such documentation with our Record Date stockholder list. We reserve the right to limit the number of immediate family members or

representatives who may attend the meeting. For stockholders holding shares “in street name,” in addition to providing identification as outlined for record holders above, you will need a valid proxy from your broker or a recent brokerage

statement or letter from your broker reflecting your stock ownership as of the Record Date.

All purses, briefcases,

bags, etc. that are brought into the facility may be subject to inspection. The use of mobile phones, pagers, recording or photographic equipment, tablets and/or computers is not permitted in the meeting room during the Annual Meeting.

|

16

.

|

Who pays the costs of the proxy solicitation?

|

The Company will pay all of the costs of soliciting proxies. In addition to solicitation by mail, officers, Directors and

shareowners of the Company may solicit proxies personally, or by telephone, without receiving additional compensation. The Company, if requested, will also pay brokers and other fiduciaries that hold shares of common stock for beneficial owners for

their reasonable out-of-pocket expenses of forwarding these materials to stockholders. The Company has retained Morrow & Co., LLC, (with offices at 470 West Ave., Stamford, CT 06902) to assist in the solicitation of proxies in connection

with the Annual Meeting. The Company will pay such firm customary fees, expected to be no more than $10,000, plus expenses.

|

17

.

|

Could other matters be decided in the Annual Meeting?

|

As of the date of this Proxy Statement, the Company is not aware of any matters to be voted upon at the Annual Meeting other

than those stated in this Proxy Statement. If any other matters are properly brought before the Annual Meeting, the persons named by the Board as proxy holders will have the discretionary authority to

|

|

|

|

|

Page 4

|

|

|

vote the shares represented by proxy on those matters. The Board has named Quentin S. Blackford (Executive Vice President and Chief Financial Officer), Jason D. Hanson (Executive Vice President,

Strategy, Corporate Development and General Counsel), and Carol A. Cox (Executive Vice President, External Affairs and Corporate Marketing) as proxy holders. If, for any reason, any of the nominees are not available as a candidate for Director, the

persons named as proxy holders will vote your proxy for such other candidate or candidates as may be nominated by the Board.

|

18

.

|

Is it possible that the Annual Meeting may be postponed?

|

The Annual Meeting may be adjourned or postponed, if needed, as provided by the Bylaws and pursuant to Delaware law. Unless a

new record date is fixed, your proxy will still be valid and may be voted at any adjourned or postponed meeting. You will still be able to change or revoke your proxy until it is voted at the reconvened or rescheduled meeting.

|

19

.

|

Where can I find the voting results of the Annual Meeting?

|

We intend to announce preliminary voting results at the Annual Meeting and publish the final results by filing a Current Report

on Form 8-K with the SEC.

|

|

|

|

|

|

|

Page 5

|

PROPOSAL 1—ELECTION OF DIRECTORS

At the Annual Meeting, we are asking our stockholders to elect three individuals nominated for election as “Class

III” Directors. Our Board currently consists of nine Directors and is divided into three classes. Our current Class III Directors are Jack R. Blair, Robert F. Friel, Donald J. Rosenberg and Daniel J. Wolterman, and each of their terms as a

Director will expire at the Annual Meeting. Our Board, upon recommendation of our Nominating and Corporate Governance Committee, nominated Messrs. Friel, Rosenberg and Wolterman for re-election as Class III Directors at the Annual Meeting. In

accordance with our retirement age policy for Directors, Mr. Blair will not be standing for re-election and will retire as a Director immediately following the Annual Meeting. Effective upon Mr. Blair’s retirement, the Board has

approved a reduction in the size of the Board from nine to eight Directors.

If elected at the Annual Meeting, each of

Messrs. Friel, Rosenberg and Wolterman will serve as Class III Directors until the 2019 Annual Meeting of Stockholders, and in each case until their respective successors are duly elected and qualified. Information regarding the experience of each

of Messrs. Friel, Rosenberg and Wolterman, including the qualifications, attributes and skills that led our Board to nominate each as a Director, can be found below under the caption “—Nominees for Election of Directors and Directors

Continuing in Office.”

Each of Messrs. Friel, Rosenberg and Wolterman has indicated that he is willing and able to

serve as a Director. If any of the Board’s nominees for Director declines to serve or becomes unavailable for any reason, or in the event of a Board vacancy, the Nominating and Corporate Governance Committee may seek out other potential

Director candidates, and one or more of such candidates may be elected as a Director in accordance with the Company’s organizational documents.

As each of the nominees is an incumbent Director, if a nominee fails to receive “FOR” votes representing a majority

of votes cast, the director shall promptly tender his or her resignation to the Board, subject to acceptance by the Board. The Nominating and Corporate Governance Committee of the Board would then be charged with making a recommendation to the Board

as to whether to accept or reject the tendered resignation, or whether other action should be taken. The Board will act on the tendered resignation, taking into account the recommendation of the Nominating and Corporate Governance Committee, and

publicly disclose its decision regarding the tendered resignation and the rationale behind the decision. If the Board determines not to accept the resignation of the incumbent Director, the incumbent Director will continue to serve until the next

annual meeting and until his or her successor is duly elected, or his or her earlier resignation or removal.

Vote Required and Board Recommendation

Directors are elected by a majority of the votes cast at the Annual Meeting. A majority of votes cast means that the

number of shares voted “FOR” a nominee exceeds the number of votes cast “AGAINST” that nominee. Votes to “ABSTAIN” and broker non-votes are not counted as votes cast with respect to that Director, and will have no

direct effect on the outcome of the election of Directors.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTE

“

FOR

”

THE ELECTION OF EACH OF ROBERT F. FRIEL, DONALD J. ROSENBERG AND

DANIEL J. WOLTERMAN AS A “CLASS III” DIRECTOR.

|

|

|

|

|

Page 6

|

|

|

Board of Directors

The table below lists the name, age and certain other information of each member of the Board, as of March 24, 2016 (the

Record Date for our Annual Meeting):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Age

|

|

Committee Membership

|

|

|

|

Director

Class

|

|

|

|

Audit

Committee

|

|

Compensation

Committee

|

|

Nominating and

Corporate Governance

Committee

|

|

Term

Expires

(1)

|

|

|

Gregory T.

Lucier

|

|

51

|

|

—

|

|

—

|

|

—

|

|

2017

|

|

I

|

|

Jack R. Blair

(2)

|

|

73

|

|

—

|

|

Chair

|

|

—

|

|

2016

|

|

III

|

|

Vickie L.

Capps

|

|

54

|

|

X

|

|

—

|

|

X

|

|

2018

|

|

II

|

|

Peter C.

Farrell, Ph.D., AM

|

|

73

|

|

—

|

|

X

|

|

Chair

|

|

2018

|

|

II

|

|

Robert F.

Friel

|

|

60

|

|

—

|

|

X

|

|

—

|

|

2016

|

|

III

|

|

Lesley H.

Howe

|

|

71

|

|

Chair

|

|

—

|

|

—

|

|

2018

|

|

II

|

|

Leslie V.

Norwalk, Esq.

|

|

50

|

|

X

|

|

—

|

|

X

|

|

2017

|

|

I

|

|

Donald J.

Rosenberg, Esq.

|

|

65

|

|

—

|

|

X

|

|

X

|

|

2016

|

|

III

|

|

Daniel J.

Wolterman

|

|

59

|

|

—

|

|

X

|

|

—

|

|

2016

|

|

III

|

|

(1)

|

Term expires at Annual Meeting of Stockholders in year indicated.

|

|

(2)

|

In accordance with the Company’s retirement age policy for Directors, Mr. Blair will not be standing for re-election and is retiring as a

Director immediately following the Annual Meeting. The Compensation Committee has indicated that it intends to appoint Mr. Wolterman as Chair of the Compensation Committee to succeed Mr. Blair.

|

Nominees for Election of Directors and Directors Continuing in Office

The following sets forth information as of March 24, 2016, regarding the members of our Board, including the Director

nominees for election at the Annual Meeting, related to his or her business experience and service on other boards of directors. In addition, we discuss below the qualifications, attributes and skills that led our Board to the conclusion that each

of our Directors should serve as a Director of NuVasive. We believe that our Board includes individuals with a strong background in executive leadership and management, accounting and finance, and Company and industry knowledge. We also believe that

our Directors’ diversity of backgrounds and experiences results in different perspectives, ideas, and viewpoints, which make our Board more effective in carrying out its duties. We believe that our Directors hold themselves to the highest

standards of integrity and that they are committed to representing the long-term interests of our stockholders.

Class III

Directors—Nominees for Election at the 2016 Annual Meeting of Stockholders

Robert F. Friel.

Robert F.

Friel has served as a member of our Board since February 2016. Mr. Friel currently serves as Chairman, Chief Executive Officer and President of PerkinElmer, Inc., a global leader focused on improving the health and safety of people and the

environment. Prior to being appointed PerkinElmer’s President and Chief Executive Officer in February 2008 and Chairman in April 2009, Mr. Friel had served as President and Chief Operating Officer since August 2007, and as Vice Chairman

and President of PerkinElmer’s Life and Analytical Sciences unit since January 2006. Mr. Friel was previously Executive Vice President and Chief Financial Officer of PerkinElmer, with responsibility for business development and information

technology in addition to his oversight of finance functions, from October 2004 until January 2006. Mr. Friel joined PerkinElmer in February 1999 as Senior Vice President and Chief Financial Officer. Prior to joining PerkinElmer, he held

several senior management positions with AlliedSignal, Inc., now Honeywell International. Mr. Friel received a Bachelor of Arts degree in economics from Lafayette College and a Master of

|

|

|

|

|

|

|

Page 7

|

Science degree in taxation from Fairleigh Dickinson University. Mr. Friel currently services as a member of the board of directors of Xylem, Inc. and previously served on the board of

directors of CareFusion Corporation prior to its acquisition by Becton, Dickinson and Company in March 2015. Mr. Friel’s experience as the Chief Executive Officer and President of PerkinElmer, as well as his experience as a former chief

financial officer, provide valuable leadership and financial experience to our Board.

Donald J. Rosenberg.

Donald

J. Rosenberg, Esq. has served as a member of our Board of Directors since February 2016. Since October 2007, Mr. Rosenberg has served as Executive Vice President, General Counsel and Corporate Secretary of Qualcomm Incorporated, a world leader

in 3G, 4G and next-generation wireless technologies. Prior to joining Qualcomm, Mr. Rosenberg served as Senior Vice President, General Counsel and Corporate Secretary of Apple Inc. from December 2006 until October 2007. From May 1975 to

November 2006, Mr. Rosenberg held numerous positions at IBM Corporation, including Senior Vice President and General Counsel. Mr. Rosenberg has served as an adjunct professor of law at New York’s Pace University School of Law, where

he taught courses in intellectual property and antitrust law. He is the immediate past National Co-Chairman of the Board of the Lawyers’ Committee for Civil Rights Under Law. He received a Bachelor of Science degree in mathematics from the

State University of New York at Stony Brook and his Juris Doctor from St. John’s University School of Law. Mr. Rosenberg brings significant experience in legal and compliance matters, as well as global leadership experience, to our Board.

Daniel J. Wolterman.

Daniel J. Wolterman has served as a member of our Board of Directors since July 2015. Since

2002, Mr. Wolterman has served as President and CEO of Memorial Hermann Health System, the largest not-for-profit health system in Southeast Texas. He has more than 30 years of experience in the healthcare industry and a long history of

community involvement. He serves on the Joint Commission’s Center for Transforming Healthcare Leadership Advisory Council, the board of directors of the Greater Houston Partnership and the board of directors of Voluntary Hospitals of America.

He previously served on the board of directors of Volcano Corporation prior to its acquisition by Royal Philips in February 2015. Mr. Wolterman is also an Adjunct Professor at The University of Texas School of Public Health. Mr. Wolterman

earned a B.S. degree in business administration and a M.B.A. in finance from the University of Cincinnati and a Master’s Degree in healthcare administration from Xavier University. Mr. Wolterman’s extensive knowledge of the healthcare

industry and his executive leadership experience as President and CEO of Memorial Hermann Health System provide valuable perspective and guidance to the Board.

Class II Directors Continuing in Office—Terms Expiring at the 2018 Annual Meeting of Stockholders

Vickie L. Capps.

Vickie L. Capps has served as a member of our Board since June 2015. From July 2002 to December 2013,

Ms. Capps served as the Chief Financial Officer of DJO Global, Inc., a leading global provider of medical device solutions for musculoskeletal health, vascular health and pain management. Prior to joining DJO Global, Ms. Capps served as

the Chief Financial Officer of several other public and private companies. Earlier in her career, she served as a senior audit and accounting professional at Ernst & Young LLP. Ms. Capps is a member of the Senior Advisory Board of

Consonance Capital Partners, a healthcare investment firm, and serves on the board of its portfolio company, Enclara Pharmacia. Ms. Capps also serves on the board of directors and as chair of the Audit Committees of Otonomy, Inc. and Connecture

Inc. She previously served on the board of directors of RF Surgical Systems, Inc. prior to its acquisition by Medtronic in August 2015 and the board of directors of SenoRx, Inc. prior to its acquisition by C.R. Bard, Inc. in July 2010. In addition,

Ms. Capps serves on the board of directors of the San Diego State University Research Foundation. Ms. Capps is a California Certified Public Accountant and was recognized as CFO of the Year by the San Diego Business Journal in 2009 and

2010. Ms. Capps earned a bachelor’s degree in business administration/accounting from San Diego State University. Ms. Capps’ extensive financial expertise and executive leadership experience as a former chief financial officer

provide valuable financial and accounting experience to our Board.

|

|

|

|

|

Page 8

|

|

|

Peter C

.

Farrell, Ph

.

D

.

, AM.

Peter C. Farrell, Ph.D., AM, has served as a member of our Board since

January 2005. Dr. Farrell is founding Chairman of ResMed, Inc., a leading developer and manufacturer of medical equipment for the diagnosis and treatment of sleep-disordered breathing, and has been a director and chairman of the board since its

inception in June 1989. He served as Chief Executive Officer of ResMed from 1990 to 2007 and again from February 2011 until March 2013. From March 2013 through December 2013, Dr. Farrell served as executive chairman of ResMed, and, in January

2014, he became non-executive chairman. Dr. Farrell also serves on the board of directors of Mikroscan Technologies, Inc. In addition, Dr. Farrell is a member of the National Academy of Engineering. Dr. Farrell holds bachelor’s

and master’s degrees in chemical engineering from the University of Sydney and the Massachusetts Institute of Technology, a Ph.D. in bioengineering from the University of Washington, Seattle and a Doctor of Science from the University of New

South Wales for research related to dialysis and renal medicine. Dr. Farrell’s broad management experience and responsibilities, through his experience as a founding executive of ResMed, provide relevant experience to our Board in a number

of strategic and operational areas.

Lesley H

.

Howe.

Lesley H. Howe has served as a member of our Board

since February 2004. Mr. Howe has over 40 years of experience in accounting, finance and business management within a variety of industries. Mr. Howe had a 30-year career with KPMG Peat Marwick LLP, an international accounting and auditing

firm, in which he was an audit partner for 23 years and an area managing partner/managing partner of the Los Angeles office of KPMG from 1994 to 1997. He most recently served as Chief Executive Officer of Consumer Networks LLC, a San Diego-based

internet marketing and promotions company from 2001 until its sale in 2007. Mr. Howe currently serves on the board of directors of Jamba, Inc., the leading retailer of quality blended fruit beverages, where he served as Lead Director from May

2010 to March 2015. He previously served on the board of directors and was chair of the Audit Committee of DJ Orthopedics Inc. from 2002 through 2008, and he served on the board of directors and was chair of the Audit Committee of P.F. Chang’s

China Bistro until the company was acquired and taken private in 2012. Mr. Howe also served on the board of directors of Volcano Corporation prior to its acquisition by Royal Philips in February 2015. Mr. Howe received a B.S. in business

administration from the University of Arkansas. Mr. Howe’s extensive public accounting, financial and executive management background provide valuable financial and accounting experience and expertise to our Board.

Class I Directors Continuing in Office—Terms Expiring at the 2017 Annual Meeting of Stockholders

Gregory T

.

Lucier.

Gregory T. Lucier has served as our Chairman of the Board and Chief Executive Officer since

May 2015. He has served as a member of our Board since December 2013. Mr. Lucier has over 25 years of executive management experience and served as Chairman of the Board and Chief Executive Officer of Life Technologies Corporation, a global

biotechnology company, from May 2003 until their acquisition by Thermo Fisher Scientific Inc. in February 2014. Prior to joining Life Technologies, Mr. Lucier served as Chief Executive Officer and President at GE Medical Systems Information

Technologies, Vice President for Global Services at GE Medical Systems and served as a corporate officer of the General Electric Corporation. He currently serves on the board of Catalent Corporation and Invuity, Inc. Mr. Lucier previously

served on the board of directors of CareFusion Corporation prior to its acquisition by Becton, Dickinson and Company in March 2015. Mr. Lucier received a Bachelor of Science Degree with high distinction in industrial engineering from

Pennsylvania State University and a Master of Business Administration degree from Harvard Graduate School of Business Administration. Mr. Lucier’s executive experience in the biotechnology industry provides strategic and practical

knowledge to our Board related to strategy, finance, regulatory, clinical research and other operational areas in our industry.

Leslie V. Norwalk.

Leslie V. Norwalk, Esq., has served as a member of our Board since May 2014. Since 2007,

Ms. Norwalk has served as a Strategic Advisor and Strategic Counsel to Epstein Becker & Green, P.C., a law firm, and two consulting agencies: EBG Advisors, Inc., and National Health Advisors. Since 2008, Ms. Norwalk has been an

Operating Partner at Enhanced Equity Fund, L.P. She also serves as an Advisor to

|

|

|

|

|

|

|

Page 9

|

Warburg Pincus LLC. Previously, Ms. Norwalk served the Bush Administration as the Acting Administrator for the Centers for Medicare & Medicaid Services, where she managed the

day-to-day operations of Medicare,

Medicaid, State Child Health Insurance Programs, Survey and Certification of health care facilities and other federal health care initiatives. For four years prior to that, she was the agency’s Deputy

Administrator, responsible for the implementation of the changes made under the Medicare Modernization Act, including the Medicare Prescription Drug Benefit. Prior to serving the Bush Administration, Ms. Norwalk practiced law in the Washington,

D.C. office of Epstein Becker & Green, P.C. where she advised clients on a variety of health policy matters. She also served in the first Bush administration in the White House Office of Presidential Personnel, and the Office of the U.S.

Trade Representative. In addition to NuVasive, Ms. Norwalk serves as a member of the board of directors of the following organizations: Providence Service Corporation, Starus, Inc., HPOne, Inc., Endologix, Inc., Press Ganey Associates, and

Abode Healthcare, and served on the board of directors of Volcano Corporation prior to its acquisition by Royal Philips in February 2015. Ms. Norwalk also serves as Member of International Advisory Council at APCO Worldwide Inc. She earned a

J.D. degree from the George Mason University School of Law and a bachelor’s degree, cum laude, in economics and international relations from Wellesley College. Ms. Norwalk’s deep knowledge of, and experience with, the healthcare

industry and government regulations provides valuable guidance and insight to our Board.

There are no family

relationships among any of the Company’s Directors or executive officers.

|

|

|

|

|

Page 10

|

|

|

CORPORATE GOVERNANCE

Overview

We are committed to maintaining the highest standards of corporate governance. Our Corporate Governance Guidelines and

Code of Ethical Business Conduct, together with our restated certificate of incorporation, Bylaws, and the charters of our Board Committees, form the basis for our corporate governance framework. As discussed below under “—Board and

Committee Membership and Structure,” our Board has established three standing committees to assist in fulfilling its responsibilities to the Company and its stockholders: the Audit Committee, the Compensation Committee and the Nominating and

Corporate Governance Committee (the “

Nominating Committee

”).

Our Corporate

Governance Guidelines (which include our categorical standards of director independence), our Code of Ethical Business Conduct (which includes our policies on ethics and compliance), our Board Committee charters and other corporate governance

information can be accessed in the “Investors” section of our website at

www.nuvasive.com

, by clicking the “Governance” link and then the “Highlights” tab. Any stockholder also may request copies of these

materials in print, without charge, by contacting our Investor Relations Department at 858-909-1812.

Corporate Governance

Guidelines

Our Corporate Governance Guidelines are designed to address effective corporate governance of our Company.

Our Corporate Governance Guidelines cover topics including, but not limited to, Director qualification criteria, Director responsibilities, Director compensation, Board evaluation, Committee matters, succession planning and stock ownership

guidelines for Directors and management. Our Corporate Governance Guidelines are reviewed regularly by the Nominating Committee and revised when appropriate. During the year ended December 31, 2015, after consideration of corporate governance

best practices and based on the recommendation of the Nominating Committee, the Board amended the Corporate Governance Guidelines to establish a Director retirement age policy. The Company’s retirement age policy, as codified in the Corporate

Governance Guidelines, now provides that a Director may not stand for re-election after age 72, but need not resign until the end of his or her term. As a result of the retirement age policy, Mr. Blair will not be standing for re-election and

is retiring as a Director immediately following the Annual Meeting.

The full text of our Corporate Governance Guidelines

can be accessed in the “Investors” section of our website at

www.nuvasive.com

, by clicking the “Governance” link and then the “Highlights” tab. A printed copy may also be obtained by any stockholder upon request

to our Investor Relations Department.

Code of Ethical Business Conduct

We have adopted a Code of Ethical Business Conduct (the “

Code

”), which includes our code of ethics for

our senior financial officers. The Code applies to all of our officers, employees and Directors and establishes policies pertaining to, among other things, employee conduct in the workplace, workplace safety, confidentiality, conflicts of interest,

accuracy of books, records and financial statements, securities trading, anti-corruption, competition laws, interactions with health care professionals and political and charitable activities. The full text of the Code can be accessed in the

“Investors” section of our website at

www.nuvasive.com

, by clicking the “Corporate Governance” link and then the “Highlights” tab. A printed copy may also be obtained by any stockholder upon request to our

Investor Relations Department.

The Audit Committee is responsible for oversight of the Company’s Global Business

Ethics and Compliance program, including related policies and training and education programs. The Audit Committee reviews and approves all waivers of the Code for executive officers or Directors and provides for prompt

|

|

|

|

|

|

|

Page 11

|

disclosure of all waivers required to be disclosed under applicable law. We will disclose future amendments to the Code, or waivers required to be disclosed under applicable law from the Code for

our principal executive officer, principal financial officer, principal accounting officer or controller, and our other executive officers and our Directors, on our website,

www.nuvasive.com

, within four business days following the date of

the amendment or waiver.

In addition, we maintain an Integrity Hotline by which employees and third parties may report

violations of the Code or seek guidance on business conduct matters. The Integrity Hotline is a third-party hosted service and has multi-lingual representatives available to take calls 24 hours a day, seven days a week.

Identification and Evaluation of Director Nominees

The Nominating Committee believes the Company is well served by its current Directors. In the ordinary course, absent special

circumstances or a material change in the criteria for Board membership, the Nominating Committee will re-nominate incumbent Directors who continue to be qualified for Board service and are willing to continue as Directors. From time to time, the

Nominating Committee may also consider and evaluate potential new Director candidates who meet the criteria for selection as a Board nominee and have specific qualities or skills identified by the Board, and one or more of such candidates may be

appointed as Directors as appropriate and in accordance with the Company’s organizational documents. Director candidates will be selected based on input from members of the Board, senior management of the Company and, if the Nominating

Committee deems appropriate, a third-party search firm. The Nominating Committee will evaluate each candidate’s qualifications and check relevant references; in addition, such candidates will be interviewed by members of the Nominating

Committee. Candidates meriting serious consideration will also meet other members of the Board. Based on this input, the Nominating Committee will evaluate which of the prospective candidates is qualified to serve as a Director and whether the

Nominating Committee should recommend to the Board that this candidate be appointed to fill a vacancy on the Board, or presented for approval of the stockholders, as appropriate.

In identifying and evaluating Director candidates for appointment or re-election to the Board, the Nominating Committee

considers the appropriate balance of experience, skills and characteristics required of the Board, seeks to ensure that at least a majority of the Directors are independent under the rules of the NASDAQ Stock Market

(“

NASDAQ

”), and that members of the Audit Committee meet the financial literacy and sophistication requirements under NASDAQ rules (including that at least one of them qualifies as an “audit committee financial

expert” under the rules of the SEC). Nominees for Director are selected on the basis of their depth and breadth of experience, integrity, ability to make independent analytical inquiries, understanding of the Company’s business

environment, and willingness to devote adequate time to Board duties. Additionally, the Nominating Committee will consider diversity in personal and professional backgrounds and seeks diverse individuals, such as women and individuals from minority

groups, to include in the pool of candidates for Board nomination; however, there is no formal policy with respect to diversity considerations in identifying Director nominees.

Over the course of the last year, our Board identified and recruited four new Directors to bring additional skills and

experience to the Board. In connection with the Board’s regular self-assessment process, the Board determined that it would it be beneficial to increase the size of the Board and recruit new Directors. The Nominating Committee developed

profiles for preferred skills and experience for potential Director candidates and oversaw the Director search process. The Nominating Committee helped identify and consider potential Director candidates with a focus on candidates with one or more

of the following attributes: healthcare industry experience; financial expertise; international experience; and experience with technology and intellectual property. Upon the recommendation of the Nominating Committee, the Board approved the

election of Vickie L. Capps (elected in June 2015), Daniel J. Wolterman (elected in July 2015), Robert F. Friel (elected in February 2016) and Donald J. Rosenberg (elected in February 2016). Ms. Capps was elected to the Board at the 2015

|

|

|

|

|

Page 12

|

|

|

Annual Meeting to serve as a “Class II” Director until the 2018 Annual Meeting. Each of Messrs. Wolterman, Friel and Rosenberg have been nominated for re-election to the Board at the

Annual Meeting to serve as a “Class III” Director until the 2019 Annual Meeting. The Nominating Committee and the Board believe that each of the Director nominees for election at the Annual Meeting brings a strong and unique set of

qualifications, attributes and skills and provides the Board as a whole with an optimal balance of experience, leadership and competencies in areas of importance to our Company. Under “Proposal 1—Election of Directors,” we provide an

overview of each Director nominee’s principal occupation, business experience and other directorships, together with other key attributes that we believe provide value to the Board, the Company and its stockholders.

Stockholder Recommendations for Director Nominees

In nominating candidates for election as a Director, the Nominating Committee will consider written proposals from stockholders

for Director nominees. Any such nominations should be submitted to the Nominating Committee, care of the Secretary of the Company, and should include the following information: (a) all information relating to such nominee that is required to be

disclosed pursuant to Regulation 14A under the Securities Exchange Act of 1934 (including such person’s written consent to being named in the Proxy Statement as a nominee and to serving as a Director if elected), and (b) all information

required by the Company’s Bylaws (including the names and addresses of the stockholders making the nomination and the appropriate biographical information and a statement as to the qualification of the nominee). For more information, see the

discussion under the caption “Additional Information.”

The Company has never received a proposal from a

stockholder to nominate a Director. Although the Nominating Committee has not adopted a formal policy with respect to stockholder nominees, the Nominating Committee expects that the evaluation process for a stockholder nominee would be similar to

the process outlined above.

Director Independence

Under our Corporate Governance Guidelines and NASDAQ rules, our Board is required to be comprised of a majority of independent

directors. The Nominating Committee evaluates our Directors’ compliance with NASDAQ rules regarding independence, as well as other factors, in making a recommendation to the Board as to whether Directors can be considered independent. Under

applicable SEC and NASDAQ rules, the existence of certain “related party” transactions between a Director and the Company with dollar amounts above certain thresholds are required to be disclosed and preclude a finding by the Board that

the Director is independent. In addition to transactions required to be disclosed under SEC and NASDAQ rules, the Board considered certain other relationships in making its independence determinations, and determined, in each case, that such other

relationships did not impair the Director’s ability to exercise independent judgment on behalf of the Company. Based on the recommendation of the Nominating Committee, the Board has determined that the following directors, comprising all of our

non-employee directors, are independent under the NASDAQ rules and our Corporate Governance Guidelines: Jack R. Blair, Vickie L. Capps, Peter C. Farrell, Robert F. Friel, Lesley H. Howe, Leslie V. Norwalk, Donald J. Rosenberg, and Daniel J.

Wolterman.

Board Leadership Structure

Mr. Lucier serves as our Chief Executive Officer and Chairman of the Board. The Board determined that

Mr. Lucier’s service as Chief Executive Officer and Chairman of the Board is in the best interest of the Company and its stockholders. Mr. Lucier possesses detailed and in-depth knowledge of the issues, opportunities and challenges

facing the Company and its businesses and is thus best positioned to develop agendas that ensure that the Board’s time and attention are focused on the most critical matters. Although the Company believes that the combination of the Chairman

and CEO roles is appropriate at this time based upon the current circumstances, the Company’s Corporate Governance Guidelines do not establish this approach as a policy. This combined role

|

|

|

|

|

|

|

Page 13

|

enables decisive leadership, ensures clear accountability, and enhances the Company’s ability to communicate its message and strategy clearly and consistently to the Company’s

employees, investors, customers and suppliers, particularly during times of turbulent economic and industry conditions. This previously has been and should continue to be beneficial in driving a unified approach to core operating processes across a

global organization that has experienced significant growth from year-to-year.

Our Board leadership structure also

includes a Lead Independent Director. The Lead Independent Director is elected by a majority of the independent Directors for a renewable term of two years and presides at meetings of the non-employee and independent directors, presides at all

meetings of the Board at which the Chairman is not present and performs such other functions as the Board may direct, including advising the Chairman with respect to Board meeting agendas. The Lead Independent Director also has other authority and

responsibilities that are described in the charter of the Lead Independent Director. The full text of the charter for the Lead Independent Director can be accessed in the “Investors” section of our website at

www.nuvasive.com

, by

clicking the “Governance” link and then the “Highlights” tab. Mr. Blair currently serves as the Lead Independent Director. In accordance with our retirement age policy for Directors, Mr. Blair will not be standing for

re-election and will retire as a Director immediately following the Annual Meeting. The Board has indicated that it intends to appoint Mr. Howe as the Lead Independent Director to succeed Mr. Blair.

Each of the Directors other than Mr. Lucier is independent, and the Board believes that the independent Directors provide

effective oversight of management. Moreover, in addition to feedback provided during the course of Board meetings, the independent Directors have regular executive sessions. Following an executive session of independent Directors, the independent

Directors communicate with the Chairman directly regarding any specific feedback or issues, provide the Chairman with input regarding agenda items for Board and Committee meetings, and coordinate with the Chairman regarding information to be

provided to the independent Directors in performing their duties. The Board believes that this approach appropriately and effectively complements the combined Chairman and Chief Executive Officer structure.

Role of Board in Risk Oversight Process

The responsibility for the day-to-day management of risk lies with the Company’s management, while the Board is

responsible for overseeing the risk management process to ensure that it is properly designed, well-functioning and consistent with the Company’s overall corporate strategy. Each year, the Company’s management identifies what it believes

are the top individual risks facing the Company. These risks are then discussed and analyzed with the Board. This enables the Board to coordinate the risk oversight role, particularly with respect to risk interrelationships. However, in addition to

the Board, the Committees of the Board consider the risks within their areas of responsibility. The Audit Committee oversees the risks associated with the Company’s financial reporting and internal controls, as well as the Company’s

corporate compliance policies (for example, policies addressing relationships with health care professionals and compliance with anti-kickback laws). The Nominating Committee oversees the risks associated with the Company’s overall governance,

as well as the Company’s global risk assessment process. The Compensation Committee oversees the risks associated with the succession planning process to understand that the Company has a slate of future candidates that are qualified for key

management positions. In addition, the Compensation Committee determines whether any compensation practices create risk-taking incentives that are reasonably likely to have a material adverse effect on the Company.

The Board’s risk oversight function complements the Company’s leadership structure. The Company’s Chairman of

the Board and Chief Executive Officer is able to promote open communication between management and Directors relating to risk as well as combine the operational focus of management with the risk oversight capabilities of the Board.

|

|

|

|

|

Page 14

|

|

|

Executive Sessions

Executive sessions of independent non-employee directors are held in connection with each regularly scheduled Board meeting and

at other times as necessary, and are chaired by the Lead Independent Director. The Board’s policy is to hold executive sessions without the presence of management, including the Chief Executive Officer and other non-independent directors, if

any. The Committees of our Board also generally meet in executive session at the end of each Committee meeting.

Board and

Committee Effectiveness

On an annual basis, the Board and each of its Committees performs an annual self-assessment to

evaluate their effectiveness in fulfilling their obligations. The Nominating Committee also oversees individual evaluations of Directors, the results of which are shared with such individual Director. The Board, Committee and individual director

evaluations cover a wide range of topics, including, among others, the fulfillment of the Board and Committee responsibilities identified in the Corporate Governance Guidelines and charters for each Committee.

Director Attendance at Annual Meeting of Stockholders

The Company does not have a formal policy regarding Director attendance at annual meetings of stockholders, however, we

encourage all of our Directors to attend each annual meeting. All of the Directors serving on our Board at the 2015 Annual Meeting of Stockholders attended the meeting.

Board and Committee Membership and Structure

Our Board has three standing Committees, comprised of the Audit Committee, the Compensation Committee and the Nominating

Committee. Each Committee acts pursuant to a written charter, each of which can be accessed in the “Investors” section of our website at

www.nuvasive.com

, by clicking the “Governance” link and then the

“Highlights” tab. Each Committee reviews its charter on an annual basis. In addition to the three standing Committees, the Board may approve from time to time the creation of special or ad hoc committees to assist the Board in carrying out

its duties.

During the year ended December 31, 2015, the Board met 12 times, and each member of the Board attended

75% or more of the Board meetings during the year that were held during the period for which he or she was a Director. During the year ended December 31, 2015, the Audit Committee and the Compensation Committee each met seven times, and the

Nominating Committee met four times. Each Director who served on the Audit, Compensation or Nominating Committees attended at least 75% of the respective committee meetings during the year ended December 31, 2015 that were held during the

period for which they he or she was a committee member.

Audit Committee.

The Audit Committee currently

consists of Lesley H. Howe (Chair), Vickie L. Capps, and Leslie V. Norwalk. The Board has determined that all members of the Audit Committee are independent Directors under NASDAQ rules and each of them is able to read and fundamentally understand

financial statements. The Board has determined that Lesley H. Howe and Vickie L. Capps each qualify as an “audit committee financial expert” as defined by the rules of the SEC. During the fiscal year ended December 31, 2015, Eileen

More also served on the Audit Committee, until her retirement as a Director immediately following the 2015 Annual Meeting of Stockholders. The purpose of the Audit Committee is to oversee both the accounting and financial reporting processes of the

Company as well as audits of its financial statements. The responsibilities of the Audit Committee include appointing and approving the compensation of the independent registered public accounting firm selected to conduct the annual audit of our

accounts, reviewing the scope and results of the independent audit, reviewing and evaluating internal accounting policies, and approving all professional services to be provided to the Company by its independent registered public accounting firm.

The Audit Committee is governed by a written charter approved by the Board. The Audit Committee report is included in this Proxy Statement under the caption “Report of the Audit Committee.”

|

|

|

|

|

|

|

Page 15

|

Compensation Committee.

The Compensation Committee currently consists of Jack R. Blair (Chair), Peter C. Farrell,

Robert F. Friel, Donald J. Rosenberg and Daniel J. Wolterman. Messrs. Friel and Rosenberg joined the Compensation Committee in February 2016 at the time of their election to the Board. In accordance with our retirement age policy for Directors,

Mr. Blair will not be standing for re-election and will retire as a Director immediately following the Annual Meeting. The Compensation Committee has indicated that it intends to appoint Mr. Wolterman as Chair of the Compensation Committee

to succeed Mr. Blair. During the fiscal year ended December 31, 2015, Peter M. Leddy, Ph.D. and Gregory T. Lucier also served as members of the Compensation Committee. Mr. Lucier stepped down as a member of the Compensation Committee

in connection with his March 2015 appointment as Interim Chief Executive Officer, and Dr. Leddy stepped down as a member of the Compensation Committee and the Board in connection with his July 2015 appointment as Executive Vice President,

Corporate Integrity and Global Human Resources.

The Board has determined that all members of the Compensation Committee

are independent Directors under NASDAQ rules. The Compensation Committee administers the Company’s benefit and stock plans, reviews and administers all compensation arrangements for senior executive officers, and establishes and reviews general

policies relating to the compensation and benefits of our executive officers and shareowners. The Compensation Committee meets several times a year and consults with independent compensation consultants, as it deems appropriate, to review, analyze

and set compensation packages for our executive officers, including our Chief Executive Officer. In addition, the Compensation Committee determines whether any compensation policies create risk-taking incentives that are reasonably likely to have a