UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of

Report: July 29, 2015

INSIGHT ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-25092 |

|

86-0766246 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 6820 South Harl Avenue, Tempe, Arizona |

|

85283 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (480) 333-3000

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy

the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

On July 29, 2015, Insight Enterprises, Inc.

announced by press release its results of operations for the second quarter ended June 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1 and incorporated by reference herein. The information disclosed under this

Item 2.02, including Exhibit 99.1 hereto, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under

the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

Press release dated July 29, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Insight Enterprises, Inc. |

|

|

|

|

| Date: July 29, 2015 |

|

|

|

By: |

|

/s/ Glynis A. Bryan |

|

|

|

|

|

|

Glynis A. Bryan |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

|

|

|

| FOR IMMEDIATE RELEASE |

|

NASDAQ: NSIT |

INSIGHT ENTERPRISES, INC. REPORTS SECOND QUARTER 2015 RESULTS

TEMPE, AZ – July 29, 2015 – Insight Enterprises, Inc. (NASDAQ: NSIT) (the “Company”) today reported results of

operations for the quarter ended June 30, 2015.

| |

• |

|

Consolidated net sales of $1.42 billion for the second quarter of 2015 were consistent with net sales reported in the second quarter of 2014, but increased 7% year over year excluding the effects of foreign currency

movements. |

| |

• |

|

Net sales in North America of $978.7 million increased 10%; |

| |

• |

|

Net sales in EMEA of $380.6 million decreased 15%, but increased 1% excluding the effects of foreign currency movements; and |

| |

• |

|

Net sales in APAC of $64.8 million decreased 21%, down 8% excluding the effects of foreign currency movements. |

| |

• |

|

Consolidated gross profit of $191.4 million decreased 2% compared to the second quarter of 2014, but increased 4% year over year excluding the effects of foreign currency movements. Consolidated gross margin decreased

approximately 30 basis points to 13.4% of net sales. |

| |

• |

|

Gross profit in North America of $128.2 million (13.1% gross margin) increased 3% year over year; |

| |

• |

|

Gross profit in EMEA of $52.8 million (13.9% gross margin) was down 6% year to year, but increased 10% year over year excluding the effects of foreign currency movements; and |

| |

• |

|

Gross profit in APAC of $10.4 million (16.0% gross margin) was down 23% year to year, down 10% excluding the effects of foreign currency movements. |

| |

• |

|

Consolidated earnings from operations decreased 7% compared to the second quarter of 2014 to $43.0 million, or 3.0% of net sales. Excluding the effects of foreign currency movements, the decrease in consolidated

earnings from operations was 1% year to year. |

| |

• |

|

Earnings from operations in North America decreased 4% year to year to $29.3 million, or 3.0% of net sales; |

| |

• |

|

Earnings from operations in EMEA decreased 3% year to year to $9.5 million, or 2.5% of net sales, but increased 17% year over year excluding the effects of foreign currency movements; and |

| |

• |

|

Earnings from operations in APAC decreased 32% year to year to $4.2 million, or 6.4% of net sales. Excluding the effects of foreign currency movements, the decrease in APAC’s earnings from operations was 21% year

to year. |

| |

• |

|

Non-GAAP consolidated earnings from operations for the second quarter of 2015, which exclude severance and restructuring expenses in both periods and

the non-cash impairment and |

- MORE -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

|

|

|

| Insight Q2 2015 Results, Page

2

|

|

July 29, 2015 |

| |

accelerated depreciation charges related to the Company’s Illinois real estate assets in the prior year period, decreased 16% year to year to $43.4 million, or 3.0% of net sales.*

|

| |

• |

|

Consolidated net earnings and diluted earnings per share for the second quarter of 2015 were $25.5 million and $0.67 respectively, at an effective tax rate of 38.1%. |

| |

• |

|

Non-GAAP consolidated net earnings and diluted earnings per share for the second quarter of 2015, which exclude severance and restructuring expenses and the tax effect of these charges, were $25.9 million and $0.68,

respectively.* |

| |

• |

|

During the three months ended June 30, 2015, the Company repurchased approximately 1.6 million shares of its common stock for $47.4 million. |

“In the second quarter, we continued to execute our sales investment plans while delivering on a seasonally important quarter for our business. 2015

is turning out to be a year of diverse product and services opportunity with our largest clients, and we are garnering our share of that growth, albeit at lower margins, while at the same time we are growing our share with U.S. Federal government

clients,” stated Ken Lamneck, President and Chief Executive Officer.

“We are also excited about our brand refresh announced during the second

quarter and the recent launch of our new Insight.com website. We see the marketplace moving from traditional IT products to Intelligent Technology, business solutions that help our clients not only run their business more efficiently, but

smarter. I am very proud of our team for coming together to reshape the way we represent Insight to our many stakeholders,” added Lamneck.

The

Company refers to changes in net sales and gross profit on a consolidated basis and in EMEA and APAC excluding the effects of foreign currency movements. In computing these changes and percentages, the Company compares the current year amount as

translated into U.S. dollars under the applicable accounting standards to the prior year amount in local currency translated into U.S. dollars utilizing the weighted average translation rate for the current period.

Net of tax amounts referenced herein were computed using the statutory tax rate for the taxing jurisdictions in the operating segment in which the related

expenses were recorded, adjusted for the effects of valuation allowances on net operating losses in certain jurisdictions.

* A tabular reconciliation of

financial measures prepared in accordance with United States generally accepted accounting principles (“GAAP”) to non-GAAP financial measures is included at the end of this press release.

- MORE -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

|

|

|

| Insight Q2 2015 Results, Page

3

|

|

July 29, 2015 |

GUIDANCE

For the full year of 2015, the Company continues to expect top line growth in the low single digits, in U.S. dollars, and gross margins similar to those

reported in the first half of 2015. As a result, the Company now expects diluted earnings per share for the full year 2015 of $2.05 to $2.15.

This

outlook reflects:

| |

• |

|

an average U.S. dollar to Euro currency exchange rate of $1.10 and an average U.S. dollar to British Pound currency exchange rate of $1.52; |

| |

• |

|

the adverse effect on gross profit of previously announced partner program changes in the software category, which the Company expects to be between $5 and $10 million for the full year 2015; |

| |

• |

|

an effective tax rate of 37% to 39%; |

| |

• |

|

an average outstanding share count of approximately 38.3 million shares for the year; and |

| |

• |

|

capital expenditures of $10 to $15 million. |

This outlook excludes severance and restructuring expenses

incurred during the year.

CONFERENCE CALL AND WEBCAST

The Company will host a conference call and live web cast today at 5:00 p.m. ET to discuss second quarter 2015 results of operations. A live web cast of the

conference call (in listen-only mode) will be available on the Company’s web site at http://nsit.client.shareholder.com/events.cfm, and a replay of the web cast will be available on the Company’s web site for a limited time

following the call. To listen to the live web cast by telephone, call 1-877-402-8904 if located in the U.S., 678-809-1029 for international callers, and enter the access code 83541143.

USE OF NON-GAAP FINANCIAL MEASURES

The

non-GAAP financial measures exclude severance and restructuring expenses in 2015 and 2014, non-cash impairment and accelerated depreciation charges related to our Illinois real estate assets in the second quarter of 2014 and the tax effect of these

charges. The Company excludes these charges when internally evaluating earnings from operations, tax expense, net earnings and diluted earnings per share for the Company and earnings from operations for each of the Company’s operating segments.

These non-GAAP measures are used to evaluate financial performance against budgeted amounts, to calculate incentive compensation, to assist in forecasting future performance and to compare the Company’s results to those of the Company’s

competitors. The Company believes that these non-GAAP financial measures are useful to investors because they allow for greater transparency, facilitate comparisons to prior periods and the Company’s competitors’ results and assist in

forecasting performance for future periods. These non-GAAP financial measures are not prepared in accordance with GAAP and may be different from non-GAAP financial measures presented by other companies. Non-GAAP financial measures should not be

considered as a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP.

- MORE -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

|

|

|

| Insight Q2 2015 Results, Page

4

|

|

July 29, 2015 |

FINANCIAL SUMMARY TABLE

(DOLLARS IN THOUSANDS, EXCEPT PER SHARE

DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

change |

|

|

2015 |

|

|

2014 |

|

|

change |

|

| Insight Enterprises, Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

1,424,031 |

|

|

$ |

1,417,897 |

|

|

|

— |

|

|

$ |

2,643,710 |

|

|

$ |

2,632,427 |

|

|

|

— |

|

| Gross profit |

|

$ |

191,415 |

|

|

$ |

194,599 |

|

|

|

(2 |

%) |

|

$ |

353,228 |

|

|

$ |

358,344 |

|

|

|

(1 |

%) |

| Gross margin |

|

|

13.4 |

% |

|

|

13.7 |

% |

|

|

(30 |

bps) |

|

|

13.4 |

% |

|

|

13.6 |

% |

|

|

(20 |

bps) |

| Selling and administrative expenses |

|

$ |

148,004 |

|

|

$ |

147,810 |

|

|

|

— |

|

|

$ |

288,800 |

|

|

$ |

290,239 |

|

|

|

— |

|

| Severance and restructuring expenses |

|

$ |

372 |

|

|

$ |

310 |

|

|

|

20 |

% |

|

$ |

1,095 |

|

|

$ |

647 |

|

|

|

69 |

% |

| Earnings from operations |

|

$ |

43,039 |

|

|

$ |

46,479 |

|

|

|

(7 |

%) |

|

$ |

63,333 |

|

|

$ |

67,458 |

|

|

|

(6 |

%) |

| Net earnings |

|

$ |

25,499 |

|

|

$ |

27,249 |

|

|

|

(6 |

%) |

|

$ |

36,450 |

|

|

$ |

38,799 |

|

|

|

(6 |

%) |

| Diluted earnings per share |

|

$ |

0.67 |

|

|

$ |

0.66 |

|

|

|

2 |

% |

|

$ |

0.93 |

|

|

$ |

0.93 |

|

|

|

— |

|

| North America |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

978,650 |

|

|

$ |

889,252 |

|

|

|

10 |

% |

|

$ |

1,801,359 |

|

|

$ |

1,669,934 |

|

|

|

8 |

% |

| Gross profit |

|

$ |

128,216 |

|

|

$ |

125,038 |

|

|

|

3 |

% |

|

$ |

239,732 |

|

|

$ |

232,451 |

|

|

|

3 |

% |

| Gross margin |

|

|

13.1 |

% |

|

|

14.1 |

% |

|

|

(100 |

bps) |

|

|

13.3 |

% |

|

|

13.9 |

% |

|

|

(60 |

bps) |

| Selling and administrative expenses |

|

$ |

99,033 |

|

|

$ |

94,558 |

|

|

|

5 |

% |

|

$ |

191,435 |

|

|

$ |

183,739 |

|

|

|

4 |

% |

| Severance and restructuring expenses |

|

$ |

(150 |

) |

|

$ |

(14 |

) |

|

|

|

** |

|

$ |

255 |

|

|

$ |

63 |

|

|

|

305 |

% |

| Earnings from operations |

|

$ |

29,333 |

|

|

$ |

30,494 |

|

|

|

(4 |

%) |

|

$ |

48,042 |

|

|

$ |

48,649 |

|

|

|

(1 |

%) |

| EMEA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

380,626 |

|

|

$ |

446,857 |

|

|

|

(15 |

%) |

|

$ |

735,468 |

|

|

$ |

834,800 |

|

|

|

(12 |

%) |

| Gross profit |

|

$ |

52,815 |

|

|

$ |

56,086 |

|

|

|

(6 |

%) |

|

$ |

97,626 |

|

|

$ |

105,407 |

|

|

|

(7 |

%) |

| Gross margin |

|

|

13.9 |

% |

|

|

12.6 |

% |

|

|

130 |

bps |

|

|

13.3 |

% |

|

|

12.6 |

% |

|

|

70 |

bps |

| Selling and administrative expenses |

|

$ |

42,754 |

|

|

$ |

46,030 |

|

|

|

(7 |

%) |

|

$ |

85,511 |

|

|

$ |

93,135 |

|

|

|

(8 |

%) |

| Severance and restructuring expenses |

|

$ |

522 |

|

|

$ |

215 |

|

|

|

143 |

% |

|

$ |

840 |

|

|

$ |

475 |

|

|

|

77 |

% |

| Earnings from operations |

|

$ |

9,539 |

|

|

$ |

9,841 |

|

|

|

(3 |

%) |

|

$ |

11,275 |

|

|

$ |

11,797 |

|

|

|

(4 |

%) |

| APAC |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

64,755 |

|

|

$ |

81,788 |

|

|

|

(21 |

%) |

|

$ |

106,883 |

|

|

$ |

127,693 |

|

|

|

(16 |

%) |

| Gross profit |

|

$ |

10,384 |

|

|

$ |

13,475 |

|

|

|

(23 |

%) |

|

$ |

15,870 |

|

|

$ |

20,486 |

|

|

|

(23 |

%) |

| Gross margin |

|

|

16.0 |

% |

|

|

16.5 |

% |

|

|

(50 |

bps) |

|

|

14.8 |

% |

|

|

16.0 |

% |

|

|

(120 |

bps) |

| Selling and administrative expenses |

|

$ |

6,217 |

|

|

$ |

7,222 |

|

|

|

(14 |

%) |

|

$ |

11,854 |

|

|

$ |

13,365 |

|

|

|

(11 |

%) |

| Severance and restructuring expenses |

|

$ |

— |

|

|

$ |

109 |

|

|

|

(100 |

%) |

|

$ |

— |

|

|

$ |

109 |

|

|

|

(100 |

%) |

| Earnings from operations |

|

$ |

4,167 |

|

|

$ |

6,144 |

|

|

|

(32 |

%) |

|

$ |

4,016 |

|

|

$ |

7,012 |

|

|

|

(43 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

North America |

|

|

EMEA |

|

|

APAC |

|

| |

|

Three Months Ended

June 30, |

|

|

Three Months Ended

June 30, |

|

|

Three Months Ended

June 30, |

|

| Sales Mix |

|

2015 |

|

|

2014 |

|

|

% change* |

|

|

2015 |

|

|

2014 |

|

|

% change* |

|

|

2015 |

|

|

2014 |

|

|

% change* |

|

| Hardware |

|

|

60 |

% |

|

|

59 |

% |

|

|

11 |

% |

|

|

32 |

% |

|

|

31 |

% |

|

|

(13 |

%) |

|

|

5 |

% |

|

|

5 |

% |

|

|

(10 |

%) |

| Software |

|

|

33 |

% |

|

|

35 |

% |

|

|

5 |

% |

|

|

66 |

% |

|

|

67 |

% |

|

|

(16 |

%) |

|

|

92 |

% |

|

|

92 |

% |

|

|

(21 |

%) |

| Services |

|

|

7 |

% |

|

|

6 |

% |

|

|

27 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

(12 |

%) |

|

|

3 |

% |

|

|

3 |

% |

|

|

(38 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

100 |

% |

|

|

100 |

% |

|

|

10 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

(15 |

%) |

|

|

100 |

% |

|

|

100 |

% |

|

|

(21 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * |

Represents growth/decline in category net sales on a U.S. dollar basis. |

| ** |

Percentage change not considered meaningful. |

- MORE -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

|

|

|

| Insight Q2 2015 Results, Page

5

|

|

July 29, 2015 |

FORWARD-LOOKING INFORMATION

Certain statements in this release and the related conference call and web cast are “forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements, including the Company’s expected 2015 financial results, including diluted earnings per share, and the assumptions relating thereto, including top line growth rates, gross

margin performance, foreign currency exchange rates, the effect on gross profit of partner program changes, the Company’s effective tax rate, capital expenditures, the expected average outstanding share counts for 2015 and trends and

opportunities relating to the IT industry, are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified. Future events and actual results could differ materially from those set forth in, contemplated by, or

underlying the forward-looking statements. There can be no assurances that the results discussed by the forward-looking statements will be achieved, and actual results may differ materially from those set forth in the forward-looking statements.

Some of the important factors that could cause the Company’s actual results to differ materially from those projected in any forward-looking statements, include, but are not limited to, the following, which are discussed in “Risk

Factors” in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2014:

| |

• |

|

the Company’s reliance on partners for product availability and competitive products to sell as well as the Company’s competition with its partners; |

| |

• |

|

the Company’s reliance on partners for marketing funds and purchasing incentives; |

| |

• |

|

changes in the IT industry and/or rapid changes in technology; |

| |

• |

|

actions of the Company’s competitors, including manufacturers and publishers of products the Company sells; |

| |

• |

|

failure to comply with the terms and conditions of the Company’s commercial and public sector contracts; |

| |

• |

|

disruptions in the Company’s IT systems and voice and data networks; |

| |

• |

|

the security of the Company’s electronic and other confidential information; |

| |

• |

|

general economic conditions; |

| |

• |

|

the Company’s reliance on commercial delivery services; |

| |

• |

|

the Company’s dependence on certain personnel; |

| |

• |

|

the variability of the Company’s net sales and gross profit; |

| |

• |

|

the risks associated with the Company’s international operations; |

| |

• |

|

exposure to changes in, interpretations of, or enforcement trends related to tax rules and regulations; and |

| |

• |

|

intellectual property infringement claims and challenges to the Company’s registered trademarks and trade names. |

Additionally, there may be other risks that are otherwise described from time to time in the reports that the Company files with the Securities and Exchange

Commission. Any forward-looking statements in this release should be considered in light of various important factors, including the risks and uncertainties listed above, as well as others. The Company assumes no obligation to update, and, except as

may be required by law, does not intend to update, any forward-looking statements. The Company does not endorse any projections regarding future performance that may be made by third parties.

|

|

|

|

|

| CONTACTS: |

|

GLYNIS BRYAN |

|

HELEN JOHNSON |

|

|

CHIEF FINANCIAL OFFICER |

|

SENIOR VP, FINANCE |

|

|

TEL. 480.333.3390 |

|

TEL. 480.333.3234 |

|

|

EMAIL glynis.bryan@insight.com |

|

EMAIL helen.johnson@insight.com |

- MORE -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

|

|

|

| Insight Q2 2015 Results, Page

6

|

|

July 29, 2015 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(IN THOUSANDS, EXCEPT PER SHARE DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Net sales |

|

$ |

1,424,031 |

|

|

$ |

1,417,897 |

|

|

$ |

2,643,710 |

|

|

$ |

2,632,427 |

|

| Costs of goods sold |

|

|

1,232,616 |

|

|

|

1,223,298 |

|

|

|

2,290,482 |

|

|

|

2,274,083 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit |

|

|

191,415 |

|

|

|

194,599 |

|

|

|

353,228 |

|

|

|

358,344 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling and administrative expenses |

|

|

148,004 |

|

|

|

147,810 |

|

|

|

288,800 |

|

|

|

290,239 |

|

| Severance and restructuring expenses |

|

|

372 |

|

|

|

310 |

|

|

|

1,095 |

|

|

|

647 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings from operations |

|

|

43,039 |

|

|

|

46,479 |

|

|

|

63,333 |

|

|

|

67,458 |

|

| Non-operating (income) expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

(192 |

) |

|

|

(333 |

) |

|

|

(346 |

) |

|

|

(582 |

) |

| Interest expense |

|

|

1,718 |

|

|

|

1,501 |

|

|

|

3,456 |

|

|

|

2,959 |

|

| Net foreign currency exchange loss |

|

|

20 |

|

|

|

461 |

|

|

|

633 |

|

|

|

957 |

|

| Other expense, net |

|

|

281 |

|

|

|

443 |

|

|

|

612 |

|

|

|

692 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings before income taxes |

|

|

41,212 |

|

|

|

44,407 |

|

|

|

58,978 |

|

|

|

63,432 |

|

| Income tax expense |

|

|

15,713 |

|

|

|

17,158 |

|

|

|

22,528 |

|

|

|

24,633 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

25,499 |

|

|

$ |

27,249 |

|

|

$ |

36,450 |

|

|

$ |

38,799 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

$ |

0.67 |

|

|

$ |

0.67 |

|

|

$ |

0.94 |

|

|

$ |

0.94 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

$ |

0.67 |

|

|

$ |

0.66 |

|

|

$ |

0.93 |

|

|

$ |

0.93 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in per share calculations: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

|

38,067 |

|

|

|

40,951 |

|

|

|

38,870 |

|

|

|

41,292 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

|

|

38,326 |

|

|

|

41,228 |

|

|

|

39,160 |

|

|

|

41,573 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- MORE -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

|

|

|

| Insight Q2 2015 Results, Page 7 |

|

July 29, 2015 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(IN THOUSANDS)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

| |

|

June 30,

2015 |

|

|

December 31,

2014 |

|

| ASSETS |

|

|

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

175,508 |

|

|

$ |

164,524 |

|

| Accounts receivable, net |

|

|

1,459,277 |

|

|

|

1,309,209 |

|

| Inventories |

|

|

170,298 |

|

|

|

122,573 |

|

| Inventories not available for sale |

|

|

44,351 |

|

|

|

45,261 |

|

| Deferred income taxes |

|

|

13,748 |

|

|

|

13,385 |

|

| Other current assets |

|

|

71,643 |

|

|

|

62,920 |

|

|

|

|

|

|

|

|

|

|

| Total current assets |

|

|

1,934,825 |

|

|

|

1,717,872 |

|

| Property and equipment, net |

|

|

96,361 |

|

|

|

104,181 |

|

| Goodwill |

|

|

26,257 |

|

|

|

26,257 |

|

| Intangible assets, net |

|

|

17,863 |

|

|

|

23,567 |

|

| Deferred income taxes |

|

|

57,956 |

|

|

|

58,620 |

|

| Other assets |

|

|

19,333 |

|

|

|

17,626 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2,152,595 |

|

|

$ |

1,948,123 |

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

| Accounts payable – trade |

|

$ |

1,069,354 |

|

|

$ |

819,916 |

|

| Accounts payable – inventory financing facility |

|

|

150,952 |

|

|

|

122,781 |

|

| Accrued expenses and other current liabilities |

|

|

138,336 |

|

|

|

144,561 |

|

| Current portion of long-term debt |

|

|

1,400 |

|

|

|

766 |

|

| Deferred revenue |

|

|

50,473 |

|

|

|

50,904 |

|

|

|

|

|

|

|

|

|

|

| Total current liabilities |

|

|

1,410,515 |

|

|

|

1,138,928 |

|

| Long-term debt |

|

|

51,291 |

|

|

|

62,535 |

|

| Deferred income taxes |

|

|

702 |

|

|

|

940 |

|

| Other liabilities |

|

|

24,712 |

|

|

|

24,489 |

|

|

|

|

|

|

|

|

|

|

|

|

|

1,487,220 |

|

|

|

1,226,892 |

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

| Preferred stock |

|

|

— |

|

|

|

— |

|

| Common stock |

|

|

373 |

|

|

|

401 |

|

| Additional paid-in capital |

|

|

314,126 |

|

|

|

337,167 |

|

| Retained earnings |

|

|

373,578 |

|

|

|

396,992 |

|

| Accumulated other comprehensive loss – foreign currency translation adjustments |

|

|

(22,702 |

) |

|

|

(13,329 |

) |

|

|

|

|

|

|

|

|

|

| Total stockholders’ equity |

|

|

665,375 |

|

|

|

721,231 |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

2,152,595 |

|

|

$ |

1,948,123 |

|

|

|

|

|

|

|

|

|

|

- MORE -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

|

|

|

| Insight Q2 2015 Results, Page 8 |

|

July 29, 2015 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(IN THOUSANDS)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

| |

|

Six Months Ended June 30, |

|

| |

|

2015 |

|

|

2014 |

|

| Cash flows from operating activities: |

|

|

|

|

|

|

|

|

| Net earnings |

|

$ |

36,450 |

|

|

$ |

38,799 |

|

| Adjustments to reconcile net earnings to net cash provided by operating activities: |

|

|

|

|

|

|

|

|

| Depreciation and amortization |

|

|

19,001 |

|

|

|

20,781 |

|

| Non-cash real estate impairment |

|

|

— |

|

|

|

4,558 |

|

| Provision for losses on accounts receivable |

|

|

1,962 |

|

|

|

2,344 |

|

| Write-downs of inventories |

|

|

1,473 |

|

|

|

845 |

|

| Write-off of property and equipment |

|

|

— |

|

|

|

487 |

|

| Non-cash stock-based compensation |

|

|

4,627 |

|

|

|

3,684 |

|

| Excess tax benefit from employee gains on stock-based compensation |

|

|

(543 |

) |

|

|

(423 |

) |

| Deferred income taxes |

|

|

94 |

|

|

|

(422 |

) |

| Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

| Increase in accounts receivable |

|

|

(167,600 |

) |

|

|

(61,142 |

) |

| Increase in inventories |

|

|

(48,376 |

) |

|

|

(34,696 |

) |

| Increase in other current assets |

|

|

(9,447 |

) |

|

|

(7,884 |

) |

| (Increase) decrease in other assets |

|

|

(2,095 |

) |

|

|

6,987 |

|

| Increase in accounts payable |

|

|

263,120 |

|

|

|

133,294 |

|

| (Decrease) increase in deferred revenue |

|

|

(438 |

) |

|

|

9,883 |

|

| Decrease in accrued expenses and other liabilities |

|

|

(1,904 |

) |

|

|

(13,380 |

) |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

|

|

96,324 |

|

|

|

103,715 |

|

|

|

|

|

|

|

|

|

|

| Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| Purchases of property and equipment |

|

|

(6,552 |

) |

|

|

(5,342 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

|

|

(6,552 |

) |

|

|

(5,342 |

) |

|

|

|

|

|

|

|

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| Borrowings on senior revolving credit facility |

|

|

243,910 |

|

|

|

218,492 |

|

| Repayments on senior revolving credit facility |

|

|

(227,410 |

) |

|

|

(234,992 |

) |

| Borrowings on accounts receivable securitization financing facility |

|

|

781,100 |

|

|

|

392,000 |

|

| Repayments on accounts receivable securitization financing facility |

|

|

(808,100 |

) |

|

|

(417,000 |

) |

| Borrowings under other financing agreements |

|

|

— |

|

|

|

2,002 |

|

| Payments on capital lease obligation |

|

|

(110 |

) |

|

|

(108 |

) |

| Net borrowings (repayments) under inventory financing facility |

|

|

28,171 |

|

|

|

(6,557 |

) |

| Payment of deferred financing fees |

|

|

— |

|

|

|

(200 |

) |

| Excess tax benefit from employee gains on stock-based compensation |

|

|

543 |

|

|

|

423 |

|

| Payment of payroll taxes on stock-based compensation through shares withheld |

|

|

(2,117 |

) |

|

|

(1,624 |

) |

| Repurchases of common stock |

|

|

(85,951 |

) |

|

|

(29,652 |

) |

|

|

|

|

|

|

|

|

|

| Net cash used in financing activities |

|

|

(69,964 |

) |

|

|

(77,216 |

) |

|

|

|

|

|

|

|

|

|

| Foreign currency exchange effect on cash and cash equivalent balances |

|

|

(8,824 |

) |

|

|

1,953 |

|

|

|

|

|

|

|

|

|

|

| Increase in cash and cash equivalents |

|

|

10,984 |

|

|

|

23,110 |

|

| Cash and cash equivalents at beginning of period |

|

|

164,524 |

|

|

|

126,817 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents at end of period |

|

$ |

175,508 |

|

|

$ |

149,927 |

|

|

|

|

|

|

|

|

|

|

- MORE -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

|

|

|

| Insight Q2 2015 Results, Page 9 |

|

July 29, 2015 |

INSIGHT ENTERPRISES, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES

(IN THOUSANDS, EXCEPT PER SHARE

DATA)

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

June 30, |

|

|

Six Months Ended

June 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Consolidated Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

43,039 |

|

|

$ |

46,479 |

|

|

$ |

63,333 |

|

|

$ |

67,458 |

|

| Non-cash real estate impairment and accelerated depreciation |

|

|

— |

|

|

|

5,178 |

|

|

|

— |

|

|

|

5,178 |

|

| Severance and restructuring expenses |

|

|

372 |

|

|

|

310 |

|

|

|

1,095 |

|

|

|

647 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP |

|

$ |

43,411 |

|

|

$ |

51,967 |

|

|

$ |

64,428 |

|

|

$ |

73,283 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Net Earnings: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

25,499 |

|

|

$ |

27,249 |

|

|

$ |

36,450 |

|

|

$ |

38,799 |

|

| Non-cash real estate impairment and accelerated depreciation, net of tax |

|

|

— |

|

|

|

3,174 |

|

|

|

— |

|

|

|

3,174 |

|

| Severance and restructuring expenses, net of tax |

|

|

408 |

|

|

|

179 |

|

|

|

964 |

|

|

|

403 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP |

|

$ |

25,907 |

|

|

$ |

30,602 |

|

|

$ |

37,414 |

|

|

$ |

42,376 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated Diluted EPS: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

0.67 |

|

|

$ |

0.66 |

|

|

$ |

0.93 |

|

|

$ |

0.93 |

|

| Non-cash real estate impairment and accelerated depreciation, net of tax |

|

|

— |

|

|

|

0.08 |

|

|

|

— |

|

|

|

0.08 |

|

| Severance and restructuring expenses, net of tax |

|

|

0.01 |

|

|

|

— |

|

|

|

0.03 |

|

|

|

0.01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP |

|

$ |

0.68 |

|

|

$ |

0.74 |

|

|

$ |

0.96 |

|

|

$ |

1.02 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| North America Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

29,333 |

|

|

$ |

30,494 |

|

|

$ |

48,042 |

|

|

$ |

48,649 |

|

| Non-cash real estate impairment and accelerated depreciation |

|

|

— |

|

|

|

5,178 |

|

|

|

— |

|

|

|

5,178 |

|

| Severance and restructuring expenses (income) |

|

|

(150 |

) |

|

|

(14 |

) |

|

|

255 |

|

|

|

63 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP |

|

$ |

29,183 |

|

|

$ |

35,658 |

|

|

$ |

48,297 |

|

|

$ |

53,890 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EMEA Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

9,539 |

|

|

$ |

9,841 |

|

|

$ |

11,275 |

|

|

$ |

11,797 |

|

| Severance and restructuring expenses |

|

|

522 |

|

|

|

215 |

|

|

|

840 |

|

|

|

475 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP |

|

$ |

10,061 |

|

|

$ |

10,056 |

|

|

$ |

12,115 |

|

|

$ |

12,272 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| APAC Earnings from Operations: |

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP |

|

$ |

4,167 |

|

|

$ |

6,144 |

|

|

$ |

4,016 |

|

|

$ |

7,012 |

|

| Severance and restructuring expenses |

|

|

— |

|

|

|

109 |

|

|

|

— |

|

|

|

109 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP |

|

$ |

4,167 |

|

|

$ |

6,253 |

|

|

$ |

4,016 |

|

|

$ |

7,121 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- ### -

Insight Enterprises, Inc. 6820 South Harl Avenue

Tempe, Arizona 85283 800.467.4448 FAX 480.760.8958

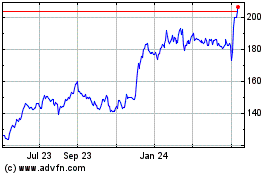

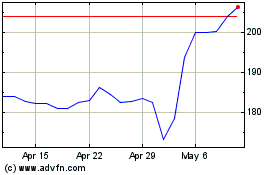

Insight Enterprises (NASDAQ:NSIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Insight Enterprises (NASDAQ:NSIT)

Historical Stock Chart

From Apr 2023 to Apr 2024