Use these links to rapidly review the document

TABLE OF CONTENTS

TABLE OF CONTENTS

Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-177118

PROSPECTUS SUPPLEMENT

(to the prospectus dated October 18, 2011)

7,692,308 Shares of Common Stock

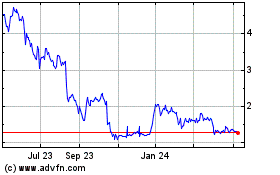

We are selling 7,692,308 shares of our common stock. Our common stock is listed on the NASDAQ Global Market under the symbol "NLST." On

February 17, 2015, the last reported sales price of our common stock on the NASDAQ Global Market was $1.68 per share. Based on 41,501,334 shares of outstanding common stock as of

February 17, 2015, of which 35,771,641 were held by non-affiliates, and a per share price of $1.68, the aggregate market value of our outstanding common stock held by non-affiliates was

approximately $60,096,357.

Investing in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should review

carefully the risks and uncertainties described under the heading "Risk Factors" on page S-6 of this prospectus supplement. This prospectus supplement should be read in conjunction with and may not be

delivered or utilized without the prospectus dated October 18, 2011.

|

|

|

|

|

|

|

|

|

|

| |

|

|

Per Share

|

|

Total

|

| |

Public offering price |

|

$1.30 |

|

$10,000,000.40 |

| |

Underwriting discounts (1) |

|

$0.091 |

|

$ 700,000.03 |

| |

Proceeds to Netlist (before expenses) |

|

$1.209 |

|

$ 9,300,000.37 |

|

- (1)

- In

addition to the underwriting discount, we have agreed to pay up to $75,000 of the fees and expenses of the underwriter in connection with this offering

and granted the underwriter a right to serve as exclusive placement agent or sole underwriter in securities offerings we or our stockholders might undertake in the 6 months following the

closing of this offering. See "Underwriting" for additional information.

We

have granted the underwriter a 30 day option to purchase up to an additional 1,153,846 shares of common stock from us at the public offering price, less the underwriting

discount, to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this

prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Craig-Hallum Capital Group

The date of this prospectus supplement is February 19, 2015.

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

No

dealer, salesperson or other person is authorized to give any information or to represent anything not contained in this prospectus supplement or the accompanying prospectus. You must

not rely on any unauthorized information or representations. This prospectus supplement and the accompanying prospectus are an offer to sell only the securities offered hereby, but only under

circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus supplement and the accompanying prospectus is current only as of their respective dates.

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying base prospectus is part of a registration statement that we filed with the Securities

and Exchange Commission, or SEC, utilizing a "shelf" registration process. Each time we sell securities under the accompanying base prospectus we will provide a prospectus supplement that will contain

specific information about the terms of that offering, including the price, the amount of securities being offered and the plan of distribution. The shelf registration statement was filed with the SEC

on September 30, 2011, and was declared effective by the SEC on October 18, 2011. This prospectus supplement describes the specific details regarding this offering and may add, update or

change information contained in the accompanying prospectus. The accompanying base prospectus provides general information about us, some of which, such as the section entitled "Plan of Distribution,"

may not apply to this offering.

If

information in this prospectus supplement is inconsistent with the accompanying base prospectus or the information incorporated by reference, you should rely on this prospectus

supplement. This prospectus supplement, together with the base prospectus and the documents incorporated by reference into this prospectus supplement and the base prospectus, includes all material

information relating to this offering. We have not authorized anyone to provide you with different or additional information. You should assume that the information appearing in this prospectus

supplement, the accompanying

prospectus, and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus is accurate only as of the respective dates of those documents. Our business,

financial condition, results of operations and prospects may have changed since those dates. You should carefully read this prospectus supplement, the base prospectus, the

information and documents incorporated herein by reference and the additional information under the heading "Where You Can Find More Information" before making an investment

decision.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into the

accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should

not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

otherwise mentioned or unless the context requires otherwise, all references in this prospectus to "Netlist," "the Company," "we," "us" and "our" refer to Netlist, Inc., a

Delaware corporation, and its subsidiaries on a consolidated basis.

S-1

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus, the documents we have filed with the SEC that are incorporated herein by

reference includes and incorporates by reference "forward-looking statements." We intend these forward-looking statements to be covered by the safe harbor provisions for forward-looking statements

contained in the Private Securities Litigation Reform Act of 1995. Words such as "anticipate," "estimate," "expect," "project," "intend," "may," "plan," "predict," "believe," "should" and similar

words or expressions are intended to identify forward-looking statements. Investors should not place undue reliance on forward-looking statements. All forward-looking statements reflect the present

expectation of future events of our management and are subject to known and unknown risks, uncertainties and assumptions that could cause actual results to differ materially from those described in

any forward-looking statements. These risks and uncertainties include, but are not limited to risks associated with: the uncertainty of our future capital requirements and the likelihood that we will

need to raise additional funds; the amount and terms of our indebtedness; the launch and commercial success of our products, programs and technologies; the success of our product partnerships; our

reliance on suppliers of critical components and vendors in the

supply chain; continuing to develop, qualify and produce adequate volumes of EXPRESSvault™, NVvault™, HyperCloud® and VLP Planar-X RDIMM; the impact on us of

substantially diminished sales to Dell; our ability to leverage our NVvault™ technology in a more diverse customer base; the rapidly-changing nature of technology; risks associated with

intellectual property, including the costs and unpredictability of litigation and reexamination proceedings before the USPTO; volatility in the pricing of DRAM ICs and NAND; changes in and uncertainty

of customer acceptance of, and demand for, our existing products and products under development, including uncertainty of and/or delays in product orders and product qualifications; delays in our and

our customers' product releases and development; introductions of new products by competitors; changes in end-user demand for technology solutions; our ability to attract and retain skilled personnel;

fluctuations in the market price of critical components; evolving industry standards; and the political and regulatory environment in the PRC; our ability to maintain our NASDAQ listing; and other

important factors that we discuss in greater detail under the heading "Risk Factors" contained in the applicable prospectus supplement and any related free writing prospectus, and in our most recent

annual report on Form 10-K and in our most recent quarterly report on Form 10-Q, as well as any amendments thereto reflected in subsequent filings with the SEC. Given these risks,

uncertainties and other important factors, you should not place undue reliance on these forward-looking statements. You should carefully read both this prospectus, the applicable prospectus supplement

and any related free writing prospectus, together with the information incorporated herein by reference as described under the heading "Where You Can Find More Information," completely and with the

understanding that our actual future results may be materially different from what we expect.

These forward-looking statements represent our estimates and assumptions only as of the date made. We undertake no duty to update these forward-looking statements

after the date of this prospectus, except as required by law, even though our situation may change in the future. We qualify all of our forward-looking statements by these cautionary

statements.

S-2

Table of Contents

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus supplement, the accompanying base

prospectus and the documents incorporated by reference. This summary does not contain all of the information that you should consider before deciding to invest in our securities. You should read this

entire prospectus supplement and the accompanying base prospectus carefully,

including the section entitled "Risk Factors" beginning on page S-6 and our consolidated financial statements and the related notes and the other information incorporated by reference into this

prospectus supplement and the accompanying prospectus before making an investment decision.

Overview

We design, manufacture and sell a wide variety of high performance, logic-based memory subsystems for the global datacenter, storage

and high-performance computing markets. Our memory subsystems consist of combinations of dynamic random access memory integrated circuits ("DRAM ICs" or "DRAM"), NAND flash memory ("NAND"),

application-specific integrated circuits ("ASICs") and other components assembled on printed circuit boards ("PCBs"). We primarily market and sell our products to leading original equipment

manufacturer ("OEM") customers, hyperscale datacenter operators and storage vendors. Our solutions are targeted at applications where memory plays a key role in meeting system performance

requirements. We leverage a portfolio of proprietary technologies and design techniques, including combining discrete semiconductor technologies from third parties such as DRAM and NAND flash to

function as one, efficient planar design, and alternative packaging techniques to deliver memory subsystems with persistence, high density, small form factor, high signal integrity, attractive thermal

characteristics, reduced power consumption and low cost per bit. Our NVvault™ product is the first to offer both DRAM and NAND in a standard form factor memory subsystem as a persistent

dual-in line memory module ("DIMM") in mission critical applications. Our HyperCloud® technology incorporates our patented rank multiplication and load reduction technologies.

Intellectual Property and Licensing

Our high performance memory subsystems are developed in part using our proprietary technologies, and we believe that the strength of

our intellectual property rights will be important to the success of our business. We utilize patent and trade secret protection, confidentiality agreements with customers and partners, disclosure and

invention assignment agreements with employees and consultants and other contractual provisions to protect our intellectual property and other proprietary information. We plan to license specific,

custom designs to our customers, charging royalties at a fixed amount per product or a percentage of sales. More generally, we intend to vigorously defend and monetize our intellectual property

through licensing arrangements and, where necessary, enforcement actions against those entities using our patented solutions in their products. Royalties resulting from these patent monetization

efforts can be structured in a variety of ways, including but not limited to one-time paid up licenses or on-going royalty arrangements. However, our efforts may not result in significant revenues

from these licensing agreements.

As

of September 27, 2014, we had 49 U.S. patents issued, 2 foreign patents granted and over 30 pending applications worldwide. Assuming that they are properly maintained, our

patents will expire at various dates between 2022 and 2029. Our issued patents and patent applications relate to the use of custom logic in high performance memory subsystems, including

DIMMs employing DRAM and combinations of DRAM and NAND flash, PCB design, layout and packaging techniques. We intend to actively pursue the filing of additional patent applications related to

our technology advancements. While we believe that our patent and other intellectual property rights are important to our success, our technical expertise and ability to introduce new products in a

timely manner are also important factors in developing and maintaining our competitive position. Accordingly, we believe that our

S-3

Table of Contents

business

is not materially dependent upon any one claim in any of our existing patents or pending patent applications.

Recent Developments

In connection with our trade secret misappropriation and breach of contract action pending in the United States District Court of the

Northern District of California, we announced on January 13, 2015, that Judge Yvonne Gonzalez Rogers granted our Motion for Preliminary Injunction against Diablo Technologies, Inc., for

controller chips used by SanDisk Corporation in its high-speed ULLtraDIMM SSD product line. Under the Court's order, Diablo and SanDisk are prohibited from manufacturing and selling the controller

chipset used by SanDisk in the ULLtraDIMM and as a result, from further sale or distribution of the ULLtraDIMM itself. On appeal to the U.S. Court of Appeals for the Federal Circuit, the Federal

Circuit denied Diablo's request to stay the injunction but granted SanDisk's narrower request to stay the injunction as to SanDisk's existing inventory of the now-enjoined controller chips. Both

parties' appeals remain pending before the Federal Circuit. The jury trial is set to begin March 9, 2015.

We

recently completed our 2014 fiscal year. Based on information that we have to date, we estimate that our revenues for the quarter ended December 27, 2014 will be approximately

$2.5 million and that our net losses for the quarter ended December 27, 2014 will be between $5.0 million and $6.0 million. These expected results are preliminary, are

subject to the completion of an audit of our December 27, 2014 consolidated financial statements, and are not necessarily indicative of the results to be expected for future periods.

Corporate Information

We commenced operations in September 2000. Our principal executive offices are located at 175 Technology Drive,

Suite 150, Irvine, California 92618 and our telephone number at that address is (949) 435-0025. Our website address is http://www.netlist.com. The information contained on our

website is not incorporated by reference into, and does not form any part of, this prospectus supplement. We have included our website address as a factual reference and do not intend it to be an

active link to our website.

Risk Factors

Our business is subject to substantial risk. Please carefully consider the "Risk Factors" beginning on page S-6 of this

prospectus supplement and other information included and incorporated by reference in this prospectus supplement, for a discussion of the factors you should consider carefully before deciding to

purchase the securities offered by this prospectus supplement. Additional risks and uncertainties not presently known to us or that we currently deem immaterial may also impair our business

operations. You should be able to bear a complete loss of your investment.

S-4

Table of Contents

THE OFFERING

The following is a brief summary of some of the terms of the offering and is qualified in its entirety by

reference to the more detailed information appearing elsewhere in this prospectus supplement and the accompanying prospectus. For a more complete description of the terms of our common stock, see the

"Description of Our Capital Stock" section in the accompanying prospectus.

|

|

|

Securities offered by us in this offering |

|

7,692,308 shares of our common stock, par value $0.001 per share. |

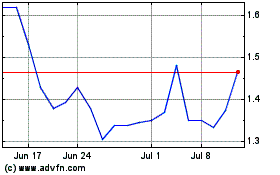

Offering Price |

|

$1.30 per share of common stock. |

Common Stock Outstanding before this offering |

|

41,501,334 shares. |

Over-allotment option |

|

We have granted to the underwriter an option, which is exercisable within 30 days from the date of this prospectus, to

purchase up to 1,153,846 additional shares of our common stock to cover over-allotments, if any. |

Use of proceeds |

|

For general corporate purposes. See "Use of Proceeds" on page S-30. |

Risk Factors |

|

See "Risk Factors" on page S-6 and other information included in this prospectus supplement, or incorporated herein by

reference, for a discussion of factors you should carefully consider before deciding to invest in our common stock. |

NASDAQ Global Market Symbol |

|

NLST |

The

number of shares of our common stock outstanding immediately before this offering is as of February 17, 2015 and excludes:

- •

- 7,879,868 shares of common stock issuable upon exercise of options outstanding as of February 17, 2015, of which approximately

4,308,604 shares are exercisable;

- •

- 750,636 shares of common stock available for future grants under our stock option plans as of February 17, 2015, which amount

is subject to annual increases pursuant to the terms of our Amended and Restated 2006 Equity Incentive Plan;

- •

- 4,272,535 shares of common stock issuable upon exercise of warrants outstanding as of February 17, 2015, 1,525,282 of which are

exercisable at $0.89 per share and 2,747,253 of which are exercisable at $1.00 per share (of which 4,272,535 are currently exercisable); and

- •

- 1,153,846 shares of common stock issuable if the underwriter exercises its option to purchase additional shares of common stock in

full.

S-5

Table of Contents

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before purchasing our common stock, you should

carefully consider the following risk factors as well as all other information contained in this prospectus supplement and the accompanying prospectus and the documents incorporated by reference,

including our consolidated financial statements and the related notes. Each of these risk factors, either alone or taken together, could adversely affect our business, operating results and financial

condition, as well as adversely affect the value of an investment in our common stock. There may be additional risks that we do not presently know of or that we currently believe are immaterial which

could also impair our business and financial position. If any of the events described below were to occur, our financial condition, our ability to access capital resources, our results of operations

and/or our future growth prospects could be materially and adversely affected and the market price of our common stock could decline. As a result, you could lose some or all of any investment you may

have made or may make in our common stock.

RISKS RELATED TO THIS OFFERING AND OUR COMMON STOCK

You will experience immediate dilution in the book value per share of the common stock you purchase.

Because the price per share of our common stock being offered is substantially higher than the book value per share of our common

stock, you will suffer substantial dilution in the net tangible book value of the common stock you purchase in this offering. If you purchase shares of common stock in this offering, you will suffer

immediate and substantial dilution of $0.91 per share in the net tangible book value of the common stock. See the section entitled "Dilution" below for a more detailed discussion of the dilution you

will incur if you purchase common stock in this offering.

Our management will have broad discretion over the use of the net proceeds from this offering.

We currently anticipate using the net proceeds from this offering for general corporate purposes, including working capital and other

general and administrative purposes. We have not reserved or allocated specific amounts for these purposes and we cannot specify with certainty how we will use the net proceeds. Accordingly, our

management will have considerable discretion in the application of the net proceeds and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are being

used appropriately. The net proceeds may be used for corporate purposes that do not increase our operating results or market value. Until the net proceeds are used, they may be placed in investments

that do not produce income or that lose value.

Our principal stockholders have significant voting power and may take actions that may not be in the

best interest of our other stockholders.

As of October 31, 2014, approximately 13.9% of our outstanding common stock was held by affiliates, including 13.8% held by Chun

K. Hong, our chief executive officer and chairman of our board of directors. As a result, Mr. Hong has the ability to exert substantial influence

over all matters requiring approval by our stockholders, including the election and removal of directors and any proposed merger, consolidation or sale of all or substantially all of our assets and

other corporate transactions. This concentration of control could be disadvantageous to other stockholders with interests different from those of Mr. Hong.

Anti-takeover provisions under our charter documents and Delaware law could delay or prevent a

change of control and could also limit the market price of our stock.

Our certificate of incorporation and bylaws contain provisions that could delay or prevent a change of control of our company or

changes in our board of directors that our stockholders might consider favorable. In addition, these provisions could limit the price that investors would be willing to pay in

S-6

Table of Contents

the

future for shares of our common stock. The following are examples of provisions which are included in our certificate of incorporation and bylaws, each as

amended:

- •

- our board of directors is authorized, without prior stockholder approval, to designate and issue preferred stock, commonly referred to

as "blank check" preferred stock, with rights senior to those of our common stock;

- •

- stockholder action by written consent is prohibited;

- •

- nominations for election to our board of directors and the submission of matters to be acted upon by stockholders at a meeting are

subject to advance notice requirements; and

- •

- our board of directors is expressly authorized to make, alter or repeal our bylaws.

In

addition, we are governed by the provisions of Section 203 of the Delaware General Corporation Law, which may prohibit certain business combinations with stockholders owning

15% or more of our outstanding voting stock. These and other provisions in our certificate of incorporation and bylaws, and of Delaware law, could make it more difficult for stockholders or potential

acquirers to obtain control of our board of directors or initiate actions that are opposed by the then-current board of directors, including delaying or impeding a merger, tender offer, or proxy

contest or other change of control transaction involving our company. Any delay or prevention of a change of control transaction or changes in our board of directors could prevent the consummation of

a transaction in which our stockholders could receive a substantial premium over the then-current market price for their shares.

The price of and volume in trading of our common stock has and may continue to fluctuate

significantly.

Our common stock has been publicly traded since November 2006. The price of our common stock and the trading volume of our shares are

volatile and have in the past fluctuated significantly. There can be no assurance as to the prices at which our common stock will trade in the future or that an active trading market in our common

stock will be sustained in the future. The market price at which our common stock trades may be influenced by many factors, including but not limited to, the

following:

- •

- our operating and financial performance and prospects, including our ability to achieve and sustain profitability in the future;

- •

- investor perception of us and the industry in which we operate;

- •

- the availability and level of research coverage of and market making in our common stock;

- •

- changes in earnings estimates or buy/sell recommendations by analysts;

- •

- sales of our newly issued common stock or other securities associated with our shelf registration statement declared effective by the

SEC on October 18, 2011 and our new registration statement on Form S-3 (Registration No. 333-199446) which we have filed but which has not yet been declared effective by the SEC,

or the perception that such sales may occur;

- •

- general financial and other market conditions; and

- •

- changing and recently volatile domestic and international economic conditions.

In

addition, shares of our common stock and the public stock markets in general, have experienced, and may continue to experience, extreme price and trading volume volatility. These

fluctuations may adversely affect the market price of our common stock and a stockholder's ability to sell their shares into the market at the desired time or at the desired price.

S-7

Table of Contents

In

2007, following a drop in the market price of our common stock, securities litigation was initiated against us. Given the historic volatility of our industry, we may become engaged in

this type of litigation in the future. Securities litigation is expensive and time-consuming.

We do not currently intend to pay dividends on our common stock, and any return to investors is

expected to come, if at all, only from potential increases in the price of our common stock.

At the present time, we intend to use available funds to finance our operations. Accordingly, while payment of dividends rests within

the discretion of our board of directors, no cash dividends on our common shares have been declared or paid by us and we have no intention of paying any such dividends in the foreseeable future. Any

return to investors is expected to come, if at all, only from potential increases in the price of our common stock.

RISKS RELATED TO OUR BUSINESS

We expect a number of factors to cause our operating results to fluctuate on a quarterly and annual

basis, which may make it difficult to predict our future performance.

Our operating results have varied significantly in the past and will continue to fluctuate from quarter-to-quarter or year-to-year in

the future due to a variety of factors, many of which are beyond our control. Factors relating to our business that may contribute to these quarterly and annual fluctuations include the following

factors, as well as other factors described elsewhere in this prospectus supplement:

- •

- adverse developments in litigation we are pursuing for infringement of our intellectual property;

- •

- disputes regarding intellectual property rights and the possibility of our patents being reexamined by the USPTO;

- •

- the costs and management attention diversion associated with litigation;

- •

- general economic conditions, including the possibility of a prolonged period of limited economic growth in the U.S. and Europe;

disruptions to the credit and financial markets in the U.S., Europe and elsewhere;

- •

- our inability to develop new or enhanced products that achieve customer or market acceptance in a timely manner, including our

HyperCloud® memory module, our NVvaultTM and Hypervault family of products and our flash-based memory products;

- •

- our failure to maintain the qualification of our products with our current customers or to qualify current and future products with

our current or prospective customers in a timely manner or at all;

- •

- the timing of actual or anticipated introductions of competing products or technologies by us or our competitors, customers or

suppliers;

- •

- our ability to procure an adequate supply of key components, particularly DRAM ICs and NAND Flash;

- •

- the loss of, or a significant reduction in sales to, a key customer;

- •

- the cyclical nature of the industry in which we operate;

- •

- a reduction in the demand for our high performance memory subsystems or the systems into which they are incorporated;

- •

- our customers' failure to pay us on a timely basis;

S-8

Table of Contents

- •

- costs, inefficiencies and supply risks associated with outsourcing portions of the design and the manufacture of integrated circuits;

- •

- our ability to absorb manufacturing overhead if our revenues decline or vary from our projections;

- •

- delays in fulfilling orders for our products or a failure to fulfill orders;

- •

- dependence on large suppliers who are also competitors and whose manufacturing priorities may not support our production schedules;

- •

- changes in the prices of our products or in the cost of the materials that we use to build our products, including fluctuations in the

market price of DRAM ICs and NAND;

- •

- our ability to effectively operate our manufacturing facility in the PRC;

- •

- manufacturing inefficiencies associated with the start-up of new manufacturing operations, new products and initiation of volume

production or disruption due to power outages, natural disasters or other factors;

- •

- our failure to produce products that meet the quality requirements of our customers;

- •

- the loss of any of our key personnel;

- •

- changes in regulatory policies or accounting principles;

- •

- our ability to adequately manage or finance internal growth or growth through acquisitions;

- •

- the effect of our investments and financing arrangements on our liquidity; and

- •

- the other factors described in this "Risk Factors" section and elsewhere in this prospectus supplement.

Due

to the various factors mentioned above, and others, the results of any prior quarterly or annual periods should not be relied upon as an indication of our future operating

performance. In one or more future periods, our results of operations may fall below the expectations of securities analysts and investors. In that event, the market price of our common stock would

likely decline. In addition, the market price of our common stock may fluctuate or decline regardless of our operating performance.

We have historically incurred losses and may continue to incur losses.

Since the inception of our business in 2000, we have only experienced one fiscal year (2006) with profitable results. In order to

regain profitability, or to achieve and sustain positive cash flows from operations in the future, we must further reduce operating expenses and/or increase our revenues and gross margins. Although we

have in the past engaged in a series of cost reduction actions, and believe that we could reduce our current level of expenses through elimination or reduction of strategic initiatives, such expense

reductions alone may not make us profitable or allow us to sustain profitability if it is achieved. Our ability to achieve profitability will depend on increased revenue growth from, among other

things, our ability to monetize our intellectual property, increased demand for our memory subsystems and related product offerings, as well as our ability to expand into new and emerging markets. We

may not be successful in achieving the necessary revenue growth or the expected expense reductions. Moreover, we may be unable to sustain past or expected future expense reductions in subsequent

periods. We may not achieve profitability or sustain such profitability, if achieved, on a quarterly or annual basis in the future.

Any

failure to achieve profitability could result in increased capital requirements and pressure on our liquidity position. We believe our future capital requirements will depend on many

factors,

S-9

Table of Contents

including

our levels of net sales, the timing and extent of expenditures to support sales, marketing, research and development activities, the expansion of manufacturing capacity both domestically and

internationally and the continued market acceptance of our products. Our capital requirements could result in our having to, or otherwise choosing to, seek additional funding through public or private

equity offerings or debt financings. Such funding may not be available on terms acceptable to us, or at all, either of which could result in our inability to meet certain of our financial obligations

and other related commitments.

Our future capital needs are uncertain, and we may need to raise additional funds, which may not be

available on acceptable terms or at all.

We believe our existing cash balances, borrowing availability under our bank credit facility with Silicon Valley Bank ("SVB"),

borrowing availability under our loan agreement with Fortress Credit Opportunities I LP ("Fortress"), an affiliate of Fortress Investment Group LLC and successor to DBD Credit

Funding LLC, and the cash expected to be generated from operations, will be sufficient to meet our anticipated cash needs for at least the next 12 months. However, we may need

significant additional capital, which we may seek to raise through, among other things, public and private equity offerings and debt financings. Our future capital requirements will depend on many

factors, including our levels of net sales, the timing and extent of expenditures to support research and development activities and patent infringement litigation, the expansion of manufacturing

capacity both domestically and internationally and the continued market acceptance of our products. Additional funds may not be available on terms acceptable to us, or at all. Furthermore, if we issue

equity or convertible debt securities to raise additional funds, our existing stockholders may experience dilution, and the new equity or debt securities may have rights, preferences, and privileges

senior to those of our existing stockholders. If we incur additional debt, it may increase our leverage relative to our earnings or to our equity capitalization.

If

adequate working capital is not available when needed, we may be required to significantly modify our business model and operations to reduce spending to a sustainable level. It could

cause us to be unable to execute our business plan, take advantage of future opportunities, or respond to competitive pressures or customer requirements. It may also cause us to delay, scale back or

eliminate some or all of our research and development programs, or to reduce or cease operations.

We have incurred a material amount of indebtedness to fund our operations, the terms of which

required that we pledge substantially all of our assets as security and that we agree to share certain patent monetization revenues that may accrue in the future. Our level of indebtedness and the

terms of such indebtedness, could adversely affect our operations and liquidity.

We have incurred debt secured by all of our assets under our credit facilities and term loans with Fortress and SVB. Our credit

facility with Fortress is secured by a first-priority security interest in our intellectual property assets (other than certain patents and related assets relating to the NVvault™ product

line) and a second priority security interest in substantially all of our other assets. Our credit facility with SVB is secured by a first priority security interest in all of our assets other than

our intellectual property assets, to which SVB has a second priority security interest. The credit facility with Fortress contains customary representations, warranties and indemnification provisions,

as well as affirmative and negative covenants that, among other things restrict our ability to:

- •

- incur additional indebtedness or guarantees;

- •

- incur liens;

- •

- make investments, loans and acquisitions;

- •

- consolidate or merge

S-10

Table of Contents

- •

- sell or exclusively license assets, including capital stock of subsidiaries;

- •

- alter our business;

- •

- engage in transactions with affiliates; and

- •

- pay dividends or make distributions.

The

credit facilities also include events of default, including, among other things, payment defaults, breaches of representations, warranties or covenants, certain bankruptcy events,

and certain material adverse changes. If we were to default under either credit facility and were unable to obtain a waiver for such a default, interest on the obligations would accrue at an increased

rate. In the case of a default, the lenders could accelerate our obligations under the credit agreements and exercise their rights to foreclose on their security interests, which would cause

substantial harm to our business and prospects.

- •

- Incurrence and maintenance of this debt could have material consequences, such as:

- •

- requiring us to dedicate a portion of our cash flow from operations and other capital resources to debt service, thereby reducing our

ability to fund working capital, capital expenditures, and other cash requirements;

- •

- increasing our vulnerability to adverse economic and industry conditions;

- •

- limiting our flexibility in planning for, or reacting to, changes and opportunities in, our business and industry, which may place us

at a competitive disadvantage; and

- •

- limiting our ability to incur additional debt on acceptable terms, if at all.

Concurrently

with the execution of the credit facility with Fortress, we entered into a Patent Monetization Side Letter Agreement which provides, among other things, that an affiliate of

Fortress may be entitled to share in certain monetization revenues that we may derive in the future related to our patent portfolio (excluding certain patents relating to the NVvault™

product line).

Monetization revenues subject to this arrangement include revenues recognized during the seven year term of the Letter Agreement from net amounts actually paid to us or our subsidiaries in connection

with any assertion of, agreement not to assert, or license of, our patent portfolio. Monetization revenues subject to the arrangement also include the value attributable to our patent portfolio in any

sale of the Company during the seven year term, subject to a maximum amount. The Letter Agreement also requires that we use commercially reasonable efforts to pursue opportunities to monetize our

patent portfolio during the term of the Letter Agreement, provided that we are under no obligation to pursue any such opportunities that we do not deem to be in our best interest in our reasonable

business judgment. Notwithstanding the foregoing, there can be no assurance that we will be successful in these efforts, and we may expend resources in pursuit of monetization revenues that may not

result in any benefit to us. Moreover, the revenue sharing obligation will reduce the benefit we receive from any monetization transactions, which could adversely affect our operating results and

would reduce the amounts payable to our stockholders in the event of a sale transaction.

We are involved in and expect to continue to be involved in costly legal and administrative

proceedings to defend against claims that we infringe the intellectual property rights of others or to enforce or protect our intellectual property rights.

As is common to the semiconductor industry, we have experienced substantial litigation regarding patent and other intellectual property

rights. Lawsuits claiming that we are infringing others' intellectual property rights have been and may in the future be brought against us, and we are currently defending against claims of invalidity

in the USPTO.

S-11

Table of Contents

The

process of obtaining and protecting patents is inherently uncertain. In addition to the patent issuance process established by law and the procedures of the USPTO, we must comply

with JEDEC administrative procedures in protecting our intellectual property within its industry standard setting process. These procedures evolve over time, are subject to variability in their

application, and may be inconsistent with each other. Failure to comply with JEDEC's administrative procedures could jeopardize our ability to claim that our patents have been infringed.

By

making use of new technologies and entering new markets there is an increased likelihood that others might allege that our products infringe on their intellectual property rights.

Litigation is inherently uncertain, and an adverse outcome in existing or any future litigation could subject us to significant liability for damages or invalidate our proprietary rights. An adverse

outcome also could force us to take specific actions, including causing us to:

- •

- cease manufacturing and/or selling products, or using certain processes, that are claimed to be infringing a third party's

intellectual property;

- •

- pay damages (which in some instances may be three times actual damages), including royalties on past or future sales;

- •

- seek a license from the third party intellectual property owner to use their technology in our products, which license may not be

available on reasonable terms, or at all; or

- •

- redesign those products that are claimed to be infringing a third party's intellectual property.

If

any adverse ruling in any such matter occurs, any resulting limitations in our ability to market our products, or delays and costs associated with redesigning our products or payments

of license fees to third parties, or any failure by us to develop or license a substitute technology on commercially reasonable terms could have a material adverse effect on our business, financial

condition and results of operations.

There

is a limited pool of experienced technical personnel that we can draw upon to meet our hiring needs. As a result, a number of our existing employees have worked for our existing or

potential competitors at some point during their careers, and we anticipate that a number of our future employees will have similar work histories. In the past, some of these competitors have claimed

that our employees misappropriated their trade secrets or violated non-competition or non-solicitation agreements. Some of our competitors may threaten or bring legal action involving similar claims

against us or our existing employees or make such claims in the future to prevent us from hiring qualified candidates. Lawsuits of this type may be brought, even if there is no merit to the claim,

simply as a strategy to drain our financial resources and divert management's attention away from our business.

Our

business strategy also includes litigating claims against others, including our competitors, customers and former employees, to enforce our intellectual property, contractual and

commercial rights

including, in particular, our trade secrets, as well as to challenge the validity and scope of the proprietary rights of others. We could become subject to counterclaims or countersuits against us as

a result of this litigation. Moreover, any legal disputes with customers could cause them to cease buying or using our products or delay their purchase of our products and could substantially damage

our relationship with them.

Any

litigation, regardless of its outcome, would be time consuming and costly to resolve, divert our management's time and attention and negatively impact our results of operations. We

cannot assure you that current or future infringement claims by or against third parties or claims for indemnification by customers or end users of our products resulting from infringement claims will

not be asserted in the future or that such assertions or claims will not materially adversely affect our business, financial condition or results of operations.

S-12

Table of Contents

Notwithstanding

the issuance of the preliminary injunction issued against Diablo Technologies, Inc., for controller chips used by SanDisk Corporation in its high-speed ULLtraDIMM

SSD product line, there can be no assurance that we will prevail at trial in the case or obtain a settlement favorable to us or that we will be able to effectively enforce the terms of the preliminary

injunction to prevent the sale or marketing of the affected products or future generations of such products. Moreover, regardless of the outcome, we expect that we will be required to expend

significant resources to pursue the case, which may not be resolved in a timely manner. If we do not prevail, the expenses associated with the matter, including the bond that would be subject to

forfeiture if we do not prevail, would materially adversely affect our financial condition and operating results.

Our revenues and results of operations have been substantially dependent on NVvault™ and

we may be unable to replace revenue lost from the rapid decline in prior generation NVvault™ sales to Dell.

For the nine months ended September 27, 2014 and September 28, 2013, our NVvault™ non-volatile RDIMM used in

cache-protection and data logging applications, including our NVvault™ battery-free, the flash-based cache system, accounted for approximately 48% and 32% of total net sales, respectively.

Following Intel's launch of its Romley platform in the first quarter of 2012, we have experienced a rapid decline in NVvault™ sales to Dell, and we recognized no NVvault™ sales

to Dell in the nine months ended September 27, 2014, as compared to $2.1 million in the nine months ended September 28, 2013. We expect no demand from Dell for our DDR2

NVvault™. In order to leverage our NVvault™ technology and diversify our customer base, and to secure one or more new key customers other than Dell, we continue to pursue

additional qualifications of

NVvault™ with other OEMs and to target customer applications such as online transaction processing (OLTP), virtualization, big data analytics, high speed transaction processing,

high performance database, and in-memory database applications. We also introduced EXPRESSvault™ in March 2011, and we continue to pursue qualification of next generation DDR3

NVvault™ with customers. Our future operating results will depend on our ability to commercialize these NVvault™ product extensions, as well as other products such as

HyperCloud® and HyperVault and other high-density and high-performance solutions. HyperVault is still under development and may require substantial additional investment. We may not be

successful in expanding our qualifications or in marketing any new or enhanced products.

We are subject to risks relating to our focus on developing our HyperCloud® and

NVvault™ products and lack of market diversification.

We have historically derived a substantial portion of our net sales from sales of our high performance memory subsystems for use in the

server market. We expect these memory subsystems to continue to account for a portion of our net sales in the near term, although we may be unable to meet customer demand for our

HyperCloud® or NVvault™ products in future periods if we experience disruptions in the supply of raw materials. We believe that continued market acceptance of these products or

derivative products that incorporate our core memory subsystem technology for use in servers is critical to our success.

We

have invested a significant portion of our research and development budget into the design of ASIC and hybrid devices, including the HyperCloud® memory subsystem,

introduced in November 2009, as well as our NVvault family of products. These designs and the products they are incorporated into are subject to increased risks as compared to our legacy products. For

example:

- •

- we are dependent on a limited number of suppliers for both the DRAM ICs and the ASIC devices that are essential to the functionality

of the HyperCloud® memory subsystem, and we have experienced supply chain disruptions and shortages of DRAM and Flash required to create our HyperCloud®, NVvault and Planar X

VLP products as a result of business issues that are specific to our suppliers or the industry as a whole;

S-13

Table of Contents

- •

- we may be unable to achieve new qualifications or customer or market acceptance of the HyperCloud® memory subsystem or

other new products, or achieve such acceptance in a timely manner;

- •

- the HyperCloud® memory subsystem or other new products may contain currently undiscovered flaws, the correction of which

would result in increased costs and time to market; and

- •

- we are required to demonstrate the quality and reliability of the HyperCloud® memory subsystem or other new products to

our customers, and are required to qualify these new products with our customers, which requires a significant investment of time and resources prior to the receipt of any revenue from such customers.

We

experienced a longer qualification cycle than anticipated with our HyperCloud® memory subsystems, and as a result, we have not generated significant

HyperCloud® product revenues to date relative to our investment in the product. We entered into collaborative agreements with both IBM and HP pursuant to which these OEMs qualified

the 16GB and 32GB versions of HyperCloud® for use with their products. While we and each of the OEMs committed financial and other resources toward the collaboration, the efforts

undertaken with each of these collaborative agreements have not resulted in significant product margins for us to date relative to our investment in developing and marketing these products. We must

secure an adequate supply of DRAM in order to continue to sell our HyperCloud® product in future periods and, even assuming we are successful in maintaining an adequate supply, we cannot

provide any assurances that we will achieve sufficient revenues or margins from our HyperCloud® products.

Additionally,

if the demand for servers deteriorates or if the demand for our products to be incorporated in servers declines, our operating results would be adversely affected, and we

would be forced to diversify our product portfolio and our target markets. We may not be able to achieve this diversification, and our inability to do so may adversely affect our business.

We use a small number of custom ASIC, DRAM ICs and NAND suppliers and are subject to risks of

disruption in the supply of custom ASIC, DRAM ICs and NAND.

Our ability to fulfill customer orders or produce qualification samples is dependent on a sufficient supply of DRAM ICs and NAND, which

are essential components of our memory subsystems. We are also dependent on a sufficient supply of custom ASIC devices to produce our HyperCloud® memory modules. There are a relatively

small number of suppliers of DRAM ICs and NAND, and we purchase from only a subset of these suppliers. We have no long-term DRAM or NAND supply contracts.

From

time to time, shortages in DRAM ICs and NAND have required some suppliers to limit the supply of their DRAM ICs and NAND. We have experienced supply chain disruptions and shortages

of DRAM and Flash required to create our HyperCloud®, NVvault and Planar X VLP products, and we are continually working to secure adequate supplies of DRAM and Flash necessary to fill

customers' orders for our products in a timely manner. If we are unable to obtain a sufficient supply of DRAM ICs or NAND Flash to meet our customers' requirements, these customers may reduce future

orders for our products or not purchase our products at all, which would cause our net sales to decline and harm our operating results. In addition, our reputation could be harmed and, even assuming

we are successful in resolving supply chain disruptions, we may not be able to replace any lost business with new customers, and we may lose market share to our competitors.

Additionally,

we could face obstacles in moving production of our ASIC components away from our current design and production partners. Our dependence on a small number of suppliers and

the lack of any guaranteed sources of ASIC components, DRAM and NAND supply expose us to several risks, including the inability to obtain an adequate supply of these important components, price

increases, delivery delays and poor quality.

S-14

Table of Contents

Historical

declines in customer demand and our revenues caused us to reduce our purchases of DRAM ICs and NAND. Such fluctuations could occur in the future. Should we not maintain

sufficient purchase levels with some suppliers, our ability to obtain supplies of raw materials may be impaired due to the practice of some suppliers to allocate their products to customers with the

highest regular demand.

Our

customers qualify the ASIC components, DRAM ICs and NAND of our suppliers for use in their systems. If one of our suppliers should experience quality control problems, it may be

disqualified by one or more of our customers. This would disrupt our supplies of ASIC components, DRAM ICs and NAND and reduce the number of suppliers available to us, and may require that we qualify

a new supplier. If our suppliers are unable to produce qualification samples on a timely basis or at all, we could experience delays in the qualification process, which could have a significant impact

on our ability to sell that product.

We may lose our competitive position if we are unable to timely and cost-effectively develop new or

enhanced products that meet our customers' requirements and achieve market acceptance.

Our industry is characterized by intense competition, rapid technological change, evolving industry standards and rapid product

obsolescence. Evolving industry standards and technological change or new, competitive technologies could render our existing products obsolete. Accordingly, our ability to compete in the future will

depend in large part on our ability to identify and develop new or enhanced products on a timely and cost-effective basis, and to respond to changing customer requirements. In order to develop and

introduce new or enhanced products, we need to:

- •

- identify and adjust to the changing requirements of our current and potential customers;

- •

- identify and adapt to emerging technological trends and evolving industry standards in our markets;

- •

- design and introduce cost-effective, innovative and performance- enhancing features that differentiate our products from those of our

competitors;

- •

- develop relationships with potential suppliers of components required for these new or enhanced products;

- •

- qualify these products for use in our customers' products; and

- •

- develop and maintain effective marketing strategies.

Our

product development efforts are costly and inherently risky. It is difficult to foresee changes or developments in technology or anticipate the adoption of new standards. Moreover,

once these things are identified, if at all, we will need to hire the appropriate technical personnel or retain third party designers, develop the product, identify and eliminate design flaws, and

manufacture the product in production quantities either in-house or through third-party manufacturers. As a result, we may not be able to successfully develop new or enhanced products or we may

experience delays in the development and introduction of new or enhanced products. Delays in product development and introduction could result in the loss of, or delays in generating, net sales and

the loss of market share, as well as damage to our reputation. Even if we develop new or enhanced products, they may not meet our customers' requirements or gain market acceptance.

Our customers require that our products undergo a lengthy and expensive qualification process

without any assurance of net sales.

Our prospective customers generally make a significant commitment of resources to test and evaluate our memory subsystems prior to

purchasing our products and integrating them into their systems. This extensive qualification process involves rigorous reliability testing and evaluation of our

S-15

Table of Contents

products,

which may continue for nine months or longer and is often subject to delays. In addition to qualification of specific products, some of our customers may also require us to undergo a

technology qualification if our product designs incorporate innovative technologies that the customer has not previously encountered. Such technology qualifications often take substantially longer

than product qualifications and can take over a year to complete. Qualification by a prospective customer does not ensure any sales to that prospective customer. Even after successful qualification

and sales of our

products to a customer, changes in our products, our manufacturing facilities, our production processes or our component suppliers may require a new qualification process, which may result in

additional delays.

In

addition, because the qualification process is both product specific and platform specific, our existing customers sometimes require us to re-qualify our products, or to qualify our

new products, for use in new platforms or applications. For example, as our OEM customers transition from prior generation architectures to current generation architectures, we must design and qualify

new products for use by those customers. In the past, the process of design and qualification has taken up to nine months to complete, during which time our net sales to those customers declined

significantly. After our products are qualified, it can take several months before the customer begins production and we begin to generate net sales from such customer.

Likewise,

when our memory component vendors discontinue production of components, it may be necessary for us to design and qualify new products for our customers. Such customers may

require of us or we may decide to purchase an estimated quantity of discontinued memory components necessary to ensure a steady supply of existing products until products with new components can be

qualified. Purchases of this nature may affect our liquidity. Additionally, our estimation of quantities required during the transition may be incorrect, which could adversely impact our results of

operations through lost revenue opportunities or charges related to excess and obsolete inventory.

We

must devote substantial resources, including design, engineering, sales, marketing and management efforts, to qualify our products with prospective customers in anticipation of sales.

Significant delays in the qualification process, such as those experienced with our HyperCloud® product, could result in an inability to keep up with rapid technology change or new,

competitive technologies. If we delay or do not succeed in qualifying a product with an existing or prospective customer, we will not be able to sell that product to that customer, which may result in

our holding excess and obsolete inventory and harm our operating results and business.

Sales to a limited number of customers represent a significant portion of our net sales and the loss

of, or a significant reduction in sales to, any one of these customers could materially harm our business.

Sales to certain of our OEM customers have historically represented a substantial majority of our net sales. Approximately 18%, 15% and

21% of our net sales in the nine months ended September 27, 2014 were to three of our customers. Approximately 39% and 17% of our net sales in the nine months ended September 28, 2013

were to two of our customers. The composition of major customers and their respective contributions to our net sales have varied and will likely continue to vary from period to period as our

OEMs progress through the life cycle of the products they produce and sell. We do not have long-term agreements with our OEM customers, or with any other customer. Any one of these customers

could decide at any time to discontinue, decrease or delay their purchase of our products. In addition, the prices that these customers pay for our products could

change at any time. The loss of any of our OEM customers, or a significant reduction in sales to any of them, could significantly reduce our net sales and adversely affect our operating results.

S-16

Table of Contents

Our ability to maintain or increase our net sales to our key customers depends on a variety of factors, many of which are beyond our control. These factors

include our customers' continued sales of servers and other computing systems that incorporate our memory subsystems and our customers' continued incorporation of our products into their systems.

Because of these and other factors, net sales to these customers may not continue and the amount of such net sales may not reach or exceed historical levels in any future period. Because these

customers account for a substantial portion of our net sales, the failure of any one of these customers to pay on a timely basis would negatively impact our cash flow. In addition, while we may not be

contractually obligated to accept returned products, we may determine that it is in our best interest to accept returns in order to maintain good relations with our customers. As we describe in more

detail in our Quarterly Report on Form 10-Q for the three and nine months ended September 27, 2014, we have experienced a significant decline in sales of NVvault™ to our key

customer, Dell, and we did not have any sales of NVvault™ to Dell during the nine months ended September 27, 2014. This loss of sales to Dell has had a significant impact on our

revenues and gross profit.

A limited number of relatively large potential customers dominate the markets for our products.

Our target markets are characterized by a limited number of large companies. Consolidation in one or more of our target markets may

further increase this industry

concentration. As a result, we anticipate that sales of our products will continue to be concentrated among a limited number of large customers in the foreseeable future. We believe that our financial

results will depend in significant part on our success in establishing and maintaining relationships with, and effecting substantial sales to, these potential customers. Even if we establish and

successfully maintain these relationships, our financial results will be largely dependent on these customers' sales and business results.

If a standardized memory solution which addresses the demands of our customers is developed, our net

sales and market share may decline.

Many of our memory subsystems are specifically designed for our OEM customers' high performance systems. In a drive to reduce costs and

assure supply of their memory module demand, our OEM customers may endeavor to design JEDEC standard DRAM modules into their new products. Although we also manufacture JEDEC modules, this trend could

reduce the demand for our higher priced customized memory solutions which in turn would have a negative impact on our financial results. In addition, customers deploying custom memory solutions today

may in the future choose to adopt a JEDEC standard, and the adoption of a JEDEC standard module instead of a previously custom module might allow new competitors to participate in a share of our

customers' memory module business that previously belonged to us.

If

our OEM customers were to adopt JEDEC standard modules, our future business may be limited to identifying the next generation of high performance memory demands of OEM customers and

developing solutions that addresses such demands. Until fully implemented, this next generation of products may constitute a much smaller market, which may reduce our net sales and market share.

We may not be able to maintain our competitive position because of the intense competition in our

targeted markets.

We participate in a highly competitive market, and we expect competition to intensify. Many of our competitors have longer operating

histories, significantly greater resources and name recognition, a larger base of customers and longer-standing relationships with customers and suppliers than we have. As a result, some of these

competitors are able to devote greater resources to the development, promotion and sale of products and are better positioned than we are to influence customer acceptance of their products over our

products. These competitors also may be able to respond better to new or emerging technologies or standards and may be able to deliver products with comparable or superior

S-17

Table of Contents

performance

at a lower price. For these reasons, we may not be able to compete successfully against these competitors. We also expect to face competition from new and emerging companies that may enter

our existing or future markets. These potential competitors may have similar or alternative products which may be less costly or provide additional features.

In

addition to the competition we face from DRAM and logic suppliers such as SK hynix, Samsung, Micron, Inphi and IDT, some of our OEM customers have their own internal design groups

that may develop solutions that compete with ours. These design groups have some advantages over us, including direct access to their respective companies' technical information and technology

roadmaps. Our OEM customers also have substantially greater resources, financial and otherwise, than we do, and may have lower cost structures than ours. As a result, they may be able to design and

manufacture competitive products more efficiently or inexpensively. If any of these OEM customers are successful in competing against us, our sales could decline, our margins could be negatively

impacted and we could lose market share, any or all of which could harm our business and results of operations. Further, some of our significant suppliers are also competitors, many of whom have the

ability to manufacture competitive products at lower costs as a result of their higher levels of integration.

We

also face competition from manufacturers of DIMMs operating on the memory channel that employ NAND flash either alone or in combination with DRAM. For example, manufacturers

such as Micron, AgigA Tech, Smart Modular, Viking, and SK hynix offer NVDIMM products that compete with our NVvault™ NVDIMM. The ULLtraDIMM product manufactured by SanDisk also uses NAND

flash on the memory channel and competes with NVDIMMs from Netlist and other manufactures. NVDIMMs and the ULLtraDIMM will also compete with our future products that combine DRAM and

NAND flash on the memory channel, such as our HyperVault™ product.

We

expect our competitors to continue to improve the performance of their current products, reduce their prices and introduce new or enhanced technologies that may offer greater

performance and improved pricing. If we are unable to match or exceed the improvements made by our competitors, our market position would deteriorate and our net sales would decline. In addition, our

competitors may develop future generations and enhancements of competitive products that may render our technologies obsolete or uncompetitive.

If we fail to protect our proprietary rights, our customers or our competitors might gain access to

our proprietary designs, processes and technologies, which could adversely affect our operating results.

We rely on a combination of patent protection, trade secret laws and restrictions on disclosure to protect our intellectual property

rights. We have submitted a number of patent applications regarding our proprietary processes and technology. It is not certain when or if any of the claims in the remaining applications will be

allowed. As of September 27, 2014, we had 49 U.S. patents issued, 2 foreign patents granted and over 30 pending applications worldwide. We intend to continue filing patent applications with

respect to most of the new processes and technologies that we develop. However, patent protection may not be available for some of these processes or technologies.

It

is possible that our efforts to protect our intellectual property rights may not:

- •

- prevent challenges to, or the invalidation or circumvention of, our existing intellectual property rights;

- •

- prevent our competitors from independently developing similar products, duplicating our products or designing around any patents that

may be issued to us;

- •

- prevent disputes with third parties regarding ownership of our intellectual property rights;

- •

- prevent disclosure of our trade secrets and know-how to third parties or into the public domain;

S-18

Table of Contents

- •

- result in valid patents, including international patents, from any of our pending or future applications; or

- •

- otherwise adequately protect our intellectual property rights.

Others

may attempt to reverse engineer, copy or otherwise obtain and use our proprietary technologies without our consent. Monitoring the unauthorized use of our technologies is

difficult. We cannot be certain that the steps we have taken will prevent the unauthorized use of our technologies. This is particularly true in foreign countries, such as the PRC, where we have

established a manufacturing facility and where the laws may not protect our proprietary rights to the same extent as applicable U.S. laws.

If

some or all of the claims in our patent applications are not allowed, or if any of our intellectual property protections are limited in scope by the USPTO or by a court or

circumvented by others, we could face increased competition with regard to our products and be unable to execute on our strategy of monetizing our intellectual property. Increased competition or an

inability to monetize our intellectual property could significantly harm our business, our operating results and prospects. Currently five of our patents are the subject of inter partes reexamination

proceedings with the USPTO, or appeals therefrom, and we cannot assure you that any of these proceedings will result in an outcome favorable to us.

Our operating results may be adversely impacted by worldwide economic and political uncertainties

and specific conditions in the markets we address, including the cyclical nature of and volatility in the memory market and semiconductor industry.

Adverse changes in domestic and global economic and political conditions have made it extremely difficult for our customers, our

vendors and us to accurately forecast and plan

future business activities, and they have caused and could continue to cause U.S. and foreign businesses to slow spending on our products and services, which would further delay and lengthen sales

cycles. In addition, sales of our products are dependent upon demand in the computing, networking, communications, printer, storage and industrial markets. These markets have been cyclical and are

characterized by wide fluctuations in product supply and demand. These markets have experienced significant downturns, often connected with, or in anticipation of, maturing product cycles, reductions

in technology spending and declines in general economic conditions. These downturns have been characterized by diminished product demand, production overcapacity, high inventory levels and the erosion

of average selling prices and may result in reduced willingness of potential licensees to enter into license agreements with us.

We

may experience substantial period-to-period fluctuations in future operating results due to factors affecting the computing, networking, communications, printers, storage and

industrial markets. A decline or significant shortfall in demand in any one of these markets could have a material adverse effect on the demand for our products. As a result, our sales will likely

decline during these periods. In addition, because many of our costs and operating expenses are relatively fixed, if we are unable to control our expenses adequately in response to reduced sales, our

gross margins, operating income and cash flow would be negatively impacted.

During

challenging economic times our customers may face issues gaining timely access to sufficient credit, which could impair their ability to make timely payments to us. If that were

to occur, we may be required to increase our allowance for doubtful accounts and our days sales outstanding would be negatively impacted. Furthermore, our vendors may face similar issues gaining

access to credit, which may limit their ability to supply components or provide trade credit to us. We cannot predict the timing, strength or duration of any economic slowdown or subsequent economic

recovery, worldwide, or in the memory market and related semiconductor industry. If the economy or markets in which we operate do not continue to improve or if conditions worsen, our business,

financial condition and results of operations will likely be materially and adversely affected. Additionally, the combination

S-19

Table of Contents

of

our lengthy sales cycle coupled with challenging macroeconomic conditions could compound the negative impact on the results of our operations.

Our lack of a significant backlog of unfilled orders, and the difficulty inherent in forecasting

customer demand, makes it difficult to forecast our short-term production requirements to meet that demand, and any failure to optimally calibrate our production capacity and inventory levels to meet

customer demand could adversely affect our revenues, gross margins and earnings.

We make significant decisions regarding the levels of business that we will seek and accept, production schedules, component

procurement commitments, personnel needs and other resource requirements, based on our estimates of customer requirements. We do not have long-term purchase agreements with our customers. Instead, our

customers often place purchase orders no more than two weeks in advance of their desired delivery date, and these purchase orders generally have no cancellation or rescheduling penalty provisions. The