UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 9, 2015

New Hampshire Thrift Bancshares, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

000-17859 |

|

02-0430695 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

9 Main Street, P.O. Box 9

Newport, New Hampshire 03773

(Address of principal executive offices, zip code)

Registrant’s telephone number, including area code: (603) 863-0886

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On April 9, 2015, the Compensation Committee of the Board of Directors (the “Board”) of New Hampshire Thrift Bancshares, Inc.

(the “Company”) approved the Incentive Bonus Program for the year ending December 31, 2015 (the “Bonus Program”). The intended recipients under the Bonus Program are the Company’s President and Chief Executive Officer,

Executive Vice President and Chief Operating Officer, First Senior Vice President and Chief Financial Officer, and First Senior Vice President and Chief Credit Officer (each, an “Executive”).

The Bonus Program provides a set of key goals based on the financial and operational performance of the Company for the year ending

December 31, 2015. Upon partial or full attainment of these goals, a lump sum amount shall be paid to each Executive, based on the attained bonus percentage of each Executive’s base salary in effect as of December 31, 2015. Bonus

computations are predicated on a point system whereby points will be awarded based on the attainment of certain benchmarks. A maximum total of 130 points can be earned, with a maximum of 100 points being available for bonus calculation. Computations

will be made by multiplying the points earned, up to 100 points, by 10%. Bonus amounts may range from 0% of base salary to a maximum of 10% of base salary.

The description of the Bonus Program does not purport to be complete and is qualified in its entirety by reference to the Bonus Program, a

copy of which is filed hereto as Exhibit 10.1 and which is incorporated herein by reference.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Exhibit Description |

|

|

| 10.1 |

|

Incentive Bonus Program – Year Ending December 31, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NEW HAMPSHIRE THRIFT BANCSHARES, INC. |

|

|

|

|

| Date: April 14, 2015 |

|

|

|

By: |

|

/s/ Laura Jacobi |

|

|

|

|

|

|

Laura Jacobi |

|

|

|

|

|

|

First Senior Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Exhibit Description |

|

|

| 10.1 |

|

Incentive Bonus Program – Year Ending December 31, 2015. |

Exhibit 10.1

Executive Officer

New

Hampshire Thrift Bancshares

Incentive Bonus Program

Year ending December 31, 2015

Intended Recipients: The four Executive Officers of New Hampshire Thrift Bancshares (The Company): President & Chief Executive Officer;

Executive Vice President & Chief Operating Officer, First Senior Vice President & Chief Financial Officer, and First Senior Vice President & Chief Credit Officer.

Purpose: To provide an incentive bonus to the Executive Officers to incentivize and reward effective operational performance and ongoing financial

growth of the Company.

Plan: To provide a clear and prioritized set of key goals based on the financial and operational performance of the Company

for the year ending December 31, 2015. Upon partial or full attainment of these goals, a lump sum amount shall be paid to each Executive, based on the attained bonus percentage of each Executive’s base salary in effect as of

December 31, 2015.

Risk-Management: The plan has several components designed to ensure that this plan does not encourage unnecessary and

excessive risks to the New Hampshire Thrift Bancshares or Lake Sunapee Bank, and to eliminate any features of these plans that would encourage the manipulation of reported earnings to enhance the compensation of any employee. These components

include the provision that the Bank’s regulatory ratings must be a ‘2’ or above in both Safety and Soundness and Compliance for the incentive bonus to be granted; the awards are paid after the year-end financials are fully reviewed by

the external audit firm; the plan is reviewed by the Chief Risk Officer and Compensation Committee at least on an annual basis; and the Compensation Committee must actively approve any bonus plan payments prior to their being made to the Executives.

A claw-back provision also applies to these awards—in the event that a material discrepancy or error occurs with respect to the year-end financial

reporting, or regulatory exam results, which may have resulted in a bonus being paid when it otherwise would not have, the named executives shall be required to pay back the specific amounts they received due to the error or discrepancy.

Specific Bonus Computations:

Bonus computations will be

predicated on a point system whereby points will be awarded based upon the attainment of certain benchmarks. A maximum total of 130 points can be earned, with a maximum of 100 points being available for bonus calculation. Computations will be made

by multiplying the points earned, up to 100 points, by 10%. Bonus amounts may range from 0% of base salary to a maximum of 10% of base salary.

The following are the key components to be used in the bonus calculations. All listed metrics are based on the

value of each as of December 31, 2015, in relationship to the value of that metric as of December 31, 2014, and are based upon the consolidated financials of the Company:

|

|

|

|

|

|

|

| |

|

|

|

Key Targets: |

|

| 1) |

|

Meet or exceed prior year net income |

|

|

= 50 points |

|

| 2) |

|

Exceed prior year EPS |

|

|

= 20 points |

|

| 3) |

|

Increase Return on Assets (ROA) |

|

|

= 10 points |

|

| 4) |

|

Improve Efficiency Rating of the Bank |

|

|

= 10 points |

|

| 5) |

|

Increase Tier I Book Value |

|

|

= 10 points |

|

| 6) |

|

Successful Attainment of Executive Performance Goals |

|

|

= up to 30 points |

* |

|

|

|

|

|

Total points: |

|

|

130 |

|

| * |

The number of points awarded in this category is at the discretion of the Compensation Committee. |

With the

approval of the Board’s Compensation Committee, significant events not anticipated or budgeted which may have a material and quantifiable impact on the financial metrics for the year may be carved out of the calculation of these financial

performance metrics for the purpose of this bonus determination.

Board Approval: The Board determines the budgeted net earnings for the year as

part of the annual budget process, and the Compensation Committee reviews and determines the annual incentive program each year.

Payment of Bonus:

The payment of each earned bonus will be made in a lump sum on or before February 15th of each year, and in no case shall be paid later than March 15th.

Adopted: April 9, 2015

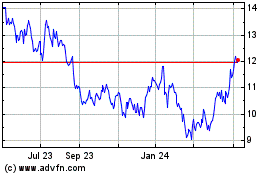

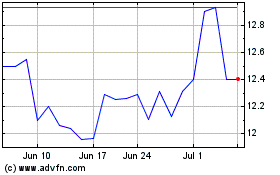

South32 (PK) (USOTC:SOUHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

South32 (PK) (USOTC:SOUHY)

Historical Stock Chart

From Apr 2023 to Apr 2024