UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

|

Date of Report: July 11, 2014

(Date of earliest event reported)

|

New Hampshire Thrift Bancshares, Inc.

(Exact name of registrant as specified in its charter)

|

|

DE

(State or other jurisdiction

of incorporation)

|

0-17859

(Commission File Number)

|

02-0430695

(IRS Employer

Identification Number)

|

|

9 Main Street, PO Box 9, Newport, New Hampshire

(Address of principal executive offices)

|

|

03773

(Zip Code)

|

603-863-0886

(Registrant's telephone number, including area code)

|

|

Not Applicable

(Former Name or Former Address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

- o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

- o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

- o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

- o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02. Results of Operations and Financial Condition

On July 11, 2014, New Hampshire Thrift Bancshares, Inc. issued a press release announcing its financial results for the second quarter of 2014. A copy of the press release is funished as Exhibit 99.1 hereto and is hereby incorporated by reference into this Item 2.02.

The information contained in this Item 2.02, including Exhibit 99.1, shall not be deemed "filed" with the Securities and Exchange Commission nor incorporated by reference in any registration statement filed by the Company under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

99.1 Press Release of New Hampshire Thrift Bancshares, Inc. dated July 11, 2014

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be

signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: July 11, 2014

|

NEW HAMPSHIRE THRIFT BANCSHARES, INC.

By: /s/ Laura Jacobi

Laura Jacobi

FSVP/ Chief Financial Officer

|

|

Exhibit Index

|

| Exhibit No. |

Description |

| 99.1 |

Press Release of New Hampshire Thrift Bancshares, Inc. dated July 11, 2014 |

New Hampshire Thrift Bancshares, Inc. Announces Earnings for Second Quarter of 2014

NEWPORT, NH -- (Marketwired - July 11, 2014) - New Hampshire Thrift Bancshares, Inc. ("we," "us," "our" or the "Company") (NASDAQ: NHTB), the holding company for Lake Sunapee Bank, fsb (the "Bank"), today reported consolidated net income for the six months ended June 30, 2014 of $4.5 million, or $0.53 diluted earnings per common share, compared to $3.8 million, or $0.52 diluted earnings per common share, for same period in 2013, an increase of $638 thousand, or 16.58%. For the quarter ended June 30, 2014, we reported consolidated net income of $2.3 million, or $0.28 diluted earnings per common share, compared to $1.8 million, or $0.25 diluted earnings per common share, for the quarter ended June 30, 2013, an increase of $544 thousand, or 30.27%.

"The financial results for the second quarter of 2014 reflect strong loan growth, due in part to our expanded footprint, which now extends from Nashua in southern New Hampshire to Randolph in central Vermont," President and Chief Executive Officer, Steve Theroux, commented. "As the refinance market waned, we shifted our emphasis to the purchase mortgage and commercial real estate markets, which has produced increased interest income to help offset the decrease of approximately $1.4 million in mortgage banking fees for the first six months of 2014. Additionally, fees generated through our wealth management and insurance subsidiaries continue to incrementally add to non-interest income."

Financial Highlights

- Total assets increased $67.4 million, or 4.73%, to $1.5 billion at June 30, 2014 from $1.4 billion at December 31, 2013.

- Net loans increased $67.3 million, or 5.93%, to $1.2 billion at June 30, 2014 from $1.1 billion at December 31, 2013.

- During the six months ended June 30, 2014, the Company originated $190.8 million in loans, an increase of 7.49%, compared to $177.5 million during the same period in 2013. During the quarter ended June 30, 2014, we originated $110.9 million in loans, an increase of 11.12%, compared to $99.8 million during the same period in 2013.

- Our loan servicing portfolio was $408.0 million at June 30, 2014, compared to $417.3 million at December 31, 2013.

- Total deposits increased $23.1 million, or 2.12%, to $1.1 billion at June 30, 2014 from $1.1 billion at December 31, 2013.

- Net interest and dividend income for the six months ended June 30, 2014 was $20.9 million compared to $16.0 million for the same period in 2013. Net interest and dividend income for the three months ended June 30, 2014 was $10.7 million compared to $7.8 million for the same period in 2013.

- Net income available to common stockholders was $4.4 million for the six months ended June 30, 2014, compared to $3.7 million for the same period in 2013. Net income available to common stockholders was $2.3 million for the three months ended June 30, 2014, compared to $1.7 million for the same period in 2013.

- As a percentage of total loans, non-performing loans decreased to 1.47% at June 30, 2014 from 1.86% at December 31, 2013.

Earnings Summary for the Six Months Ended June 30, 2014

Net income of $4.4 million for the six months ended June 30, 2014 represents the combined impacts of a changing revenue landscape for us. Net interest and dividend income, our core source of earnings, increased $5.0 million for the six months ended June 30, 2014, compared to the same period in 2013. This increase represents the combined impact of our acquisition of Randolph National Bank in October 2013 and our origination and organic portfolio growth, as well as the additional the benefits of our improving spreads and our cost of funds management.

The provision for loan losses increased $133 thousand to $709 thousand required based on adequacy calculations for the six months ended June 30, 2014, compared to $576 thousand for the same period in 2013.

Noninterest income increased $3.0 million, or 44.99%, to $9.5 million for the six months ended June 30, 2014, compared to $6.6 million for the same period in 2013. Within noninterest income, we can more clearly see the manifestation of the previously referenced changing revenue landscape. In recent years, we have recognized revenue within our mortgage banking operations as a result of the high volume of refinance activity into long-term fixed-rate mortgages, which we typically sell into the secondary market while retaining servicing for fee revenue and customer relationships. Additionally, markets during recent years have been favorable to providing opportunities within our investment portfolio. With the increases in long-term market rates, which began in the summer of 2013, these opportunities have waned and the anticipated impacts have been realized as we disclose lower net gains on sales of loans and sales of securities. Net gains on sales of loans decreased $1.4 million, or 89.43%, to $170 thousand for the six months ended June 30, 2014, compared to the same period in 2013. This is primarily driven by a change in volume from $63.4 million of loans sold in the six months ended June 30, 2013, compared to $12.7 million for the same period in 2014, a decrease of $50.7 million, or 79.93%. Gains on sales of securities, net, decreased $338 thousand, or 43.28%, to $443 thousand for the six month period ended June 30, 2014, compared to $781 thousand for the same period in 2014.

While we have seen some revenue streams decline, we have increased others. The most significant addition to noninterest income is $4.2 million from trust and investment management fees representing revenue from our subsidiary, Charter Trust Company. This represents an increase of $3.9 million over our realized income from our 50% ownership of Charter Trust Company for the six month period ended June 30, 2013. We completed the acquisition of Charter Holding Corp., the holding company of Charter Trust Company, in September 2013.

Noninterest expense increased $7.1 million, or 43.27%, to $23.4 million for the six months ended June 30, 2014, compared to $16.3 million for the same period in 2013. Within noninterest expense, salaries and employee benefits increased $3.7 million, or 44.03%, to $12.1 million for the six months ended June 30, 2014, compared to $8.4 million for the same period in 2013. This increase includes expenses related to additional staff and operations for Charter Trust Company and The Randolph National Bank and its eight branches, which represent over 70% of the increase in salaries and employees benefits. Occupancy expense increased $851 thousand, or 39.95%, to $3.0 million for the six month period ended June 30, 2014, compared to $2.1 million for the same period in 2013. The occupancy expenses from Charter Holding Corp. and former The Randolph National Bank branches represent $357 thousand and $537 thousand, respectively. Depositors' insurance increased $162 thousand, or 42.74%, due to the growth in deposits comparing June 30, 2014 to June 30, 2013. The increase of $693 thousand in outside services for the six months ended June 30, 2014, compared to the same period in 2013 includes $449 thousand related to Charter Trust Company operations and increases of $82 thousand related to our core processing provider and $47 thousand related to statement rendering, an increase of 81.14%, which is primarily related to newly introduced regulations that required us to provide monthly statements for all conventional mortgage accounts beginning in January 2014. Amortization of intangible assets increased $489 thousand, or 128.68%, to $869 thousand for the six months ended June 30, 2014, compared to $380 thousand for the same period in 2013 due to the additional core deposit intangible from the acquisition of The Randolph National Bank and the customer list intangible from the acquisition of Charter Holding Corp. Other expenses increased $588 thousand to $3.1 million for the six months ended June 30, 2014, including $370 thousand from Charter Trust Company operations and an increase of $128 thousand in contributions, including an increase of $105 in tax-qualified contributions.

Balance Sheet Summary as of June 30, 2014

Total assets were $1.5 billion at June 30, 2014, compared to $1.4 billion at December 31, 2013, an increase of $67.4 million, or 4.73%. Securities available-for-sale decreased $13.7 million to $111.6 million at June 30, 2014, from $125.2 million at December 31, 2013. Net loans held in portfolio increased $67.3 million, or 5.93%, to $1.2 billion at June 30, 2014, from $1.1 billion at December 31, 2013. Conventional real estate loans increased $37.0 million and commercial real estate loans increased $24.8 million, representing 54.97% and 36.86%, respectively, of the net loan growth. The allowance for loan losses was $9.8 million at June 30, 2014, compared to $9.8 million at December 31, 2013. The change of $46 thousand in the allowance for loan losses is the net effect of provisions of $709 thousand, charge-offs of $948 thousand and recoveries of $294 thousand in addition to net charge-offs of $13 thousand to the reserve for the overdraft protection program. Additionally, the Bank had a credit mark of $6.1 million at June 30, 2014 related to acquired loan balances of $174.8 million. During the six months ended June 30, 2014, we originated $190.8 million in loans, an increase of 7.49%, compared to $177.5 million during the same period in 2013. During the quarter ended June 30, 2014, we originated $110.9 million in loans, an increase of 11.12%, compared to $99.8 million during the same period in 2013.

Goodwill increased $191 thousand, or 0.43%, to $44.8 million at June 30, 2014, from $44.6 million at December 31, 2013. Intangible assets decreased $869 thousand, or 7.89%, to $10.2 million at June 30, 2014, compared to $11.0 million at December 31, 2013. This reflects ordinary amortizations of intangible assets of $869 thousand during the six months ended June 30, 2014.

Total deposits increased $23.1 million, or 2.12%, to $1.1 billion at June 30, 2014, from $1.1 billion at December 31, 2013, including an increase of $30.2 million in brokered deposits used in conjunction with additional advances to fund loan growth. Advances from the Federal Home Loan Bank increased $49.3 million, or 40.46%, to $171.0 million at June 30, 2014, from $121.7 million at December 31, 2013. Securities sold under agreements to repurchase decreased $7.0 million, or 25.26%, to $20.8 million at June 30, 2014 from $27.9 million at December 31, 2013.

Stockholders' equity of $152.8 million resulted in a book value of $15.74 per common share at June 30, 2014 based on 8,241,228 shares of common stock outstanding. The Bank remains well capitalized with a Leverage Capital ratio of 8.15% at June 30, 2014.

Quarterly Dividend

On July 10, 2014, we declared a regular quarterly cash dividend of $0.13 per share payable July 31, 2014 to stockholders of record as of July 24, 2014.

About New Hampshire Thrift Bancshares, Inc.

New Hampshire Thrift Bancshares, Inc. is the holding company of Lake Sunapee Bank, fsb, a federally chartered savings bank that provides a wide range of life-cycle banking and financial services. Lake Sunapee Bank has four wholly owned subsidiaries: Lake Sunapee Financial Services Corp.; Lake Sunapee Group, Inc., which owns and maintains all buildings and investment properties; McCrillis & Eldredge Insurance, Inc., a full-line independent insurance agency; and Charter Holding Corp., which wholly owns Charter Trust Company, a trust services and wealth management company. New Hampshire Thrift Bancshares, Inc., through its direct and indirect subsidiaries, operates 29 offices in New Hampshire in Grafton, Hillsborough, Merrimack and Sullivan counties and 18 offices in Vermont in Orange, Rutland and Windsor counties.

Forward-Looking Statements

The Company wishes to caution readers not to place undue reliance on any such forward-looking statements contained in this press release, which speak only as of the date made. Actual results may differ materially from those indicated by such forward-looking statements as a result of various important factors discussed under the caption "Risk Factors" in our Annual Report on Form 10-K for the year ended December 31, 2013, and in subsequent filings with the Securities and Exchange Commission. In addition, the forward-looking statements included in this press release represent our views as of the date of this release. The Company and Lake Sunapee Bank do not undertake and specifically decline any obligation to publicly release the result of any revisions that may be made to any forward-looking statements to reflect events or circumstances after the date of such statements or to reflect the occurrence of anticipated or unanticipated events.

New Hampshire Thrift Bancshares, Inc.

Selected Financial Highlights

Three Months Six Months

(Dollars in thousands except Ended June 30, Ended June 30,

for per share data) 2014 2013 2014 2013

--------- ---------- ---------- ----------

Net Income $ 2,342 $ 1,797 $ 4,485 $ 3,847

Per Common Share Data:

Basic Earnings 0.28 0.25 0.53 0.52

Diluted Earnings (1) 0.28 0.25 0.53 0.52

Dividends Paid 0.13 0.13 0.26 0.26

Dividend Payout Ratio 46.43% 52.00% 49.06% 50.00%

As of

(Dollars in thousands except June 30, December 31,

for per share data) 2014 2013

------------- -------------

Total Assets $ 1,491,269 $ 1,423,870

Total Securities (2) 123,690 134,998

Loans, Net 1,201,357 1,134,110

Total Deposits 1,111,240 1,088,092

Federal Home Loan Bank Advances 170,988 121,734

Stockholders' Equity 152,756 149,257

Book Value per Common Share $ 15.74 $ 15.37

Common Shares Outstanding 8,241,228 8,216,747

Leverage (Tier I) Capital 8.15% 8.29%

Number of Offices:

Banking Offices 38 38

Insurance Offices 3 3

Trust Offices 7 6

(1) Diluted earnings per share are calculated using the weighted-average

number of shares outstanding for the period, including common stock

equivalents, as appropriate.

(2) Includes available-for-sale securities shown at fair value and Federal

Home Loan Bank stock at cost.

New Hampshire Thrift Bancshares, Inc.

Consolidated Balance Sheets

June 30, December 31,

(Dollars in thousands) 2014 2013

------------ ------------

ASSETS (Unaudited)

Cash and due from banks $ 43,662 $ 12,005

Overnight deposits - 21,573

------------ ------------

Cash and cash equivalents 43,662 33,578

Interest-bearing time deposits with other banks 996 1,743

Securities available-for-sale 111,554 125,238

Federal Home Loan Bank stock 12,136 9,760

Loans held-for-sale 1,335 680

Loans receivable, net 1,201,357 1,134,110

Accrued interest receivable 3,438 2,628

Premises and equipment, net 24,655 23,842

Investments in real estate 3,607 3,681

Other real estate owned 297 1,343

Goodwill 44,823 44,632

Intangible assets 10,151 11,020

Bank owned life insurance 19,863 19,544

Other assets 13,395 12,071

------------ ------------

Total assets $ 1,491,269 $ 1,423,870

------------ ------------

LIABILITIES AND STOCKHOLDERS' EQUITY

LIABILITIES

Deposits:

Noninterest-bearing $ 101,517 $ 101,446

Interest-bearing 1,009,723 986,646

------------ ------------

Total deposits 1,111,240 1,088,092

Federal Home Loan Bank advances 170,988 121,734

Securities sold under agreements to repurchase 20,840 27,885

Subordinated debentures 20,620 20,620

Accrued expenses and other liabilities 14,825 16,282

------------ ------------

Total liabilities 1,338,513 1,274,613

------------ ------------

STOCKHOLDERS' EQUITY

Preferred stock, $.01 par value per share:

2,500,000 shares authorized, non-cumulative

perpetual Series B; 23,000 shares issued and

outstanding at June 30, 2014 and December 31,

2013; liquidation value $1,000 per share - -

Common stock, $.01 par value per share:

10,000,000 shares authorized, 8,675,557

shares issued and 8,241,228 shares

outstanding at June 30, 2014 and 8,651,076

shares issued and 8,216,747 shares

outstanding at December 31, 2013 87 87

Warrants - -

Paid-in capital 101,316 100,961

Retained earnings 60,580 58,347

Unearned restricted stock awards (598) (490)

Accumulated other comprehensive loss (1,878) (2,897)

Treasury stock, 434,329 shares as of June 30,

2014 and December 31, 2013, at cost (6,751) (6,751)

------------ ------------

Total stockholders' equity 152,756 149,257

------------ ------------

Total liabilities and stockholders' equity $ 1,491,269 $ 1,423,870

------------ ------------

New Hampshire Thrift Bancshares, Inc.

Consolidated Statements of Income (unaudited)

Three Months Ended Six Months Ended

(Dollars in thousands, June 30, June 30, June 30, June 30,

except for per share data) 2014 2013 2014 2013

---------- ---------- ---------- ----------

Interest and dividend income

Interest and fees on loans $ 11,635 $ 9,024 $ 22,985 $ 18,205

Interest on debt investments:

Taxable 395 286 720 810

Dividends 46 10 81 23

Other 178 212 348 351

---------- ---------- ---------- ----------

Total interest and dividend

income 12,254 9,532 24,134 19,389

---------- ---------- ---------- ----------

Interest expense

Interest on deposits 1,068 1,081 2,170 2,106

Interest on advances and

other borrowed money 523 633 1,048 1,317

---------- ---------- ---------- ----------

Total interest expense 1,591 1,714 3,218 3,423

---------- ---------- ---------- ----------

Net interest and dividend

income 10,663 7,818 20,916 15,966

Provision for loan losses 709 162 709 576

---------- ---------- ---------- ----------

Net interest and dividend

income after provision for

loan losses 9,954 7,656 20,207 15,390

---------- ---------- ---------- ----------

Noninterest income

Customer service fees 1,539 1,266 2,977 2,452

Gain on sales of securities,

net 435 614 443 781

Net gain on sales of loans 118 675 170 1,608

Net gain on sales of premises

and equipment 10 4 12 4

Net loss on other real estate

and property owned 197 25 195 25

Rental income 172 185 347 368

Bank owned life insurance

income 153 148 302 276

Income from equity interest

in Charter Holding Corp. - 143 - 241

Mortgage servicing income,

net of amortization of

mortgage servicing rights 54 (14) 133 1

Insurance and brokerage

service income 318 334 802 819

Trust fees 2,076 - 4,152 -

---------- ---------- ---------- ----------

Total noninterest income 5,072 3,380 9,533 6,575

---------- ---------- ---------- ----------

Noninterest expenses

Salaries and employee

benefits 6,091 4,101 12,093 8,396

Occupancy expenses 1,403 1,054 2,981 2,130

Advertising and promotion 281 213 436 312

Depositors' insurance 270 202 541 379

Outside services 658 349 1,361 668

Professional services 447 317 719 653

ATM processing fees 199 162 420 313

Supplies 134 121 298 250

Telephone expense 271 172 566 335

Amortization of intangible

assets 434 188 869 380

Other expenses 1,502 1,379 3,078 2,490

---------- ---------- ---------- ----------

Total noninterest expense 11,690 8,258 23,362 16,306

---------- ---------- ---------- ----------

Income before provision for

income taxes 3,336 2,778 6,378 5,659

Provision for income taxes 994 981 1,893 1,812

---------- ---------- ---------- ----------

Net income $ 2,342 $ 1,797 $ 4,485 $ 3,847

---------- ---------- ---------- ----------

Net income available to common

stockholders $ 2,285 $ 1,740 $ 4,370 $ 3,646

---------- ---------- ---------- ----------

For additional information contact:

Laura Jacobi

First Senior Vice President

Chief Financial Officer

603-863-0886

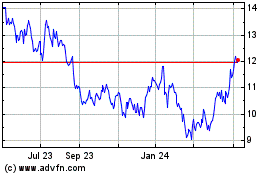

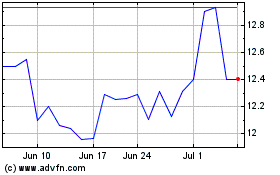

South32 (PK) (USOTC:SOUHY)

Historical Stock Chart

From Mar 2024 to Apr 2024

South32 (PK) (USOTC:SOUHY)

Historical Stock Chart

From Apr 2023 to Apr 2024