By Alexandra Wexler

JOHANNESBURG -- Africa's biggest company is challenging the

world's largest video-on-demand service in the race to lure African

eyeballs -- and wallets.

South African media giant Naspers Ltd. launched streaming

service ShowMax across Africa last year while sector giant Netflix

Inc. did the same in January.

Netflix may have blockbuster original content such as "Narcos"

and "Unbreakable Kimmy Schmidt," but ShowMax, which is available in

45 African countries and territories and 28 others to serve the

continent's diaspora, is hoping its more local flavor will give it

an edge. Some of its popular local titles include: "The Real

Househelps of Kawangware," "Auntie Boss!" and "Boer Soek 'n Vrou,"

(Afrikaans for "Farmer Looks for a Woman").

"Africans watch different things," said Bob van Dijk, chief

executive of Naspers, adding that many Africans "don't have credit

cards and they don't have bandwidth, [so] we should be able to do

this better ourselves."

The scuffle for video-on-demand customers here spotlights the

increasingly competitive environment in which companies are

attempting to lure African consumers who have been enriched and

empowered by internet infrastructure upgrades and higher wages.

ShowMax advertises heavily, with billboards touting the service

lining the busiest commuter streets in Johannesburg. Meanwhile,

Netflix's African service is pared down, with popular shows like

"The Walking Dead" unavailable and only seasons one and two of its

own original series "Orange is the New Black" available, as the

rights were previously licensed to other TV channels in South

Africa, including Naspers-owned M-Net.

Netflix announced last month it would allow subscribers to

download shows and movies to Apple and Android phones and tablets,

though many of the streaming service's popular shows aren't

available for offline viewing. Subscribers to ShowMax have had the

option to download content rather than stream it since last year.

That allows users to tap networks at places like the office and

then enjoy shows later at home.

"The ability to download is the most important thing I think,"

said Chloe Hackland, who works in communications in Johannesburg.

She binge-watched three seasons of "Brooklyn Nine-Nine" in one

week, and enjoys ShowMax's Afrikaans romantic comedy films:

"[Netflix], they don't have downloads on everything. With ShowMax,

you can download everything."

Ms. Hackland, 35, also likes that she can purchase vouchers for

subscriptions to ShowMax through her bank, and has given them to

friends as birthday gifts. ShowMax costs 99 South African rand

($7.10) a month, while Netflix costs between $7.99 and $11.99 a

month.

"Once we watched ShowMax, we realized we hadn't watched [TV] for

like a month," she said.

It's not yet clear whether Naspers can triumph over the Netflix

juggernaut, though Mr. van Dijk concedes that the size of the

African middle class limits the scale that a video-on-demand

service can achieve here.

For six months ended Sept. 30, Naspers' video-entertainment

business reversed a decline in subscribers, with its direct-to-home

business adding 591,968 subscribers, compared with a drop of

164,300 in the same period last year as the continent's consumers

reeled from the commodities crisis.

Naspers, which is secretive about its more than 40 businesses'

performance and plans, has yet to release any subscription figures

for ShowMax. The company transformed from a local publisher to a

media juggernaut valued at $60.9 billion after buying a stake in

China's Tencent Holdings Ltd. in 2001. Naspers still owns 34% of

the internet giant.

Netflix doesn't break out its subscription figures for Africa,

though it beat expectations for subscriber additions in the

September quarter thanks in large part to better-than-expected

performance in international markets. Netflix, which is available

in more than 190 countries, had more than 86 million subscribers

globally as of Sept. 30. A Netflix spokesman said the streaming

service carries "a wide range of global content," but declined to

comment further on its African business.

Some consumers disagree. "The Netflix here, I find it's good,

but it doesn't have a great lot of content," said Craig Jackson,

37. "Now I'm using ShowMax and I'm using it a hell of a lot."

Mr. Jackson, an actor based in Johannesburg, particularly likes

the ability to download shows and watch them on an airplane, and he

knows that Netflix recently came out with the same feature. Still,

"there's nothing at the moment that would make me go back to

Netflix," Mr. Jackson said.

Naspers says its knowledge of the African consumer has allowed

it to tailor its services for local viewers. For example, to

attract subscribers in Kenya, one of the continent's most-developed

economies, ShowMax launched a two-tier subscription option earlier

this year. The service offers customers a choice between a standard

and a premium package, which has more international content and

newer shows. Subscribers can also now pay via the mobile-payment

service M-Pesa instead of with a credit card.

The company has also developed a way to mitigate the high cost

of data in Africa, which -- in contrast to the U.S. -- is almost

always capped and paid for per megabyte. ShowMax subscribers can

choose the quality of their downloads to eek out more content at a

lower resolution, something Netflix also introduced last month with

a similar two-tiered download option.

It's not the first time that Naspers has set its eye on an

industry giant. The media and internet conglomerate is going toe to

toe with Craigslist Inc. in the U.S. with a mobile app called

LetGo.

Still, global powerhouse Netflix is stiff competition. Bronwyn

Price, who works in banking in Johannesburg, started subscribing to

Netflix this year. She likes the streaming service because there's

"none of the rubbish on TV," and enjoys watching series such as

"Gilmore Girls" and Netflix's "The Crown."

She isn't considering trying out ShowMax. "There is more than

enough on Netflix," Ms. Price said.

Write to Alexandra Wexler at alexandra.wexler@wsj.com

(END) Dow Jones Newswires

December 24, 2016 09:14 ET (14:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

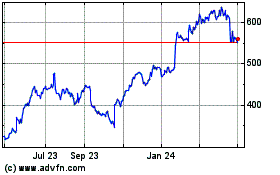

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

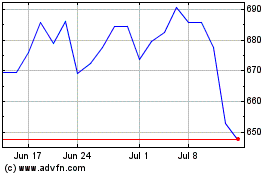

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024