After spending nearly $50 billion in the summer of 2015 to

acquire DirecTV, AT&T Inc. is preparing to roll out an internet

video service that could upend its satellite-television business

along with the rest of the pay-TV industry.

The service, called DirecTV Now and expected to launch by

year-end, will stream dozens of live channels to televisions and

mobile devices without the need for a satellite dish, cable box or

annual contract. Unlike Netflix or Hulu, this over-the-top service

is intended to provide a full cablelike lineup for households.

AT&T executives aren't concerned that a lower-priced

internet video service—observers expect around $50 a month—could

eat into its existing TV business, which had 25.3 million

subscribers who paid an average monthly bill of $117 in the latest

quarter. "That means you have found something that the market

really, really wants," Chief Executive Randall Stephenson said last

month, at an investor conference.

DirecTV Now will enter a promising but increasingly crowded

marketplace with customers paying as little as $20 a month to

stream almost 30 channels from Dish Network Corp.'s Sling TV

service to as much as $75 a month for a bundle of more than 100

channels, including HBO and Showtime, from Sony Corp.'s PlayStation

Vue service.

AT&T says it is going after 20 million U.S. households that

don't pay for home TV, including cord-cutters and younger

customers. But the telecom giant isn't planning a so-called skinny

bundle. It boasts of having more than 100 channels signed up for

DirecTV Now, including ESPN, Discovery Channel and Nickelodeon.

"We think skinny bundles have very small application in the

market over time," said John Stankey, head of AT&T's

entertainment business, at an industry conference earlier this

year. People in a household are going to want to watch different

things, he said. "There's a reason to look at a much broader

offering of content."

The big bundle strategy opposes moves from channels that have

tried reaching viewers on their own, like CBS Corp. and Time Warner

Inc.'s HBO.

It is also an attempt to get ahead of others reportedly lining

up wider cablelike services, including Apple Inc., Amazon.com Inc.,

Alphabet Inc. and Hulu, which is owned by Comcast Corp., Time

Warner, Walt Disney Co. and 21st Century Fox Inc. (21st Century Fox

and News Corp, which owns The Wall Street Journal, share common

ownership.)

Mr. Stephenson said DirecTV Now would have a "very, very

aggressive price." The company hasn't disclosed details. UBS

analysts project the monthly price at $50 while Barclays estimates

$50 to $60. The number of streams people can view at the same time

will be limited to two, according to a person familiar with the

company's plans.

"It will be the first indication for the public demand of this

type of product," said UBS analyst John Hodulik, referring to a

cable-replacement product from a major pay-TV service. "This is the

first big launch."

UBS projects that AT&T will have 2.5 million subscribers for

the service by 2020. Mr. Hodulik expects a short-term hit to

margins as the company spends to set up and market the product.

Mr. Stephenson says the profits on the new service will be

"thinner than what we are accustomed to" but stressed the product

won't require a lot of capital investment. Compared with the

traditional satellite service, DirecTV Now won't require hardware

or visits by technicians. Sign-up and billing will be done

online.

AT&T's content chief Dan York, who held the same role at

DirecTV before the deal, has spent the past year renegotiating with

content providers to get the necessary rights. AT&T still has

deals to close, including with CBS and 21st Century Fox.

AT&T has put together other pieces it needs; In June, it

bought Quickplay Media, which built the platform for the service.

AT&T also has a joint venture with media mogul Peter Chernin

called Otter Media that focuses on producing online video.

The company plans to bundle DirecTV Now with its home broadband

service and wireless plans, which could help reduce customer churn.

Wireless data used to watch DirecTV Now on smartphones or tablets

will be free for AT&T's more than 77 million mainstream

wireless subscribers.

The cable companies aren't sitting still. Both Comcast Corp. and

Charter Communications Inc.—the largest U.S. broadband

providers—recently said they plan to begin selling wireless phone

service to their customers.

Comcast CEO Brian Roberts, however, has signaled he isn't

planning to follow AT&T's lead, saying the economics are

unproven for over-the-top services. "Out of footprint, it's not

clear that that's the right strategy for us," he said in July.

Meanwhile, AT&T is under pressure to deliver gains from the

DirecTV deal, which boosted video revenue to about a fifth of its

total business. While AT&T has added satellite users, it has

lost almost 200,000 pay-TV subscribers overall since closing the

deal.

"They are going to where the people are and that is increasingly

[over-the-top] and mobile," said Peter Csathy, chairman of

CreatvMedia, an advisory firm. "It is a smart strategy."

Ryan Knutson and Shalini Ramachandran contributed to this

article.

Write to Thomas Gryta at thomas.gryta@wsj.com

(END) Dow Jones Newswires

October 19, 2016 17:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

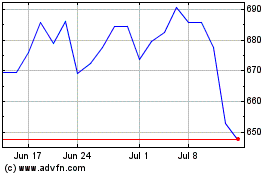

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

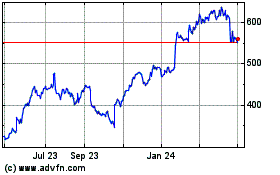

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024