Netflix Reports Surge in New Members

October 17 2016 - 5:10PM

Dow Jones News

Netflix Inc. reported a larger-than-expected increase in new

members as the streaming video service's recent expansion helped to

offset increased competition and price increases.

Monday's disclosure that it had added 3.57 million streaming

subscribers in the most recent period comes a quarter after it

reported the weakest subscriber expansion in two years. In July,

Netflix had projected 2.3 million in additional subscribers for the

September quarter.

Shares surged 20% to $119.76 in after-hours trading. Before

that, the stock had fallen 13% this year as the streaming video

giant has struggled to keep up the pace of subscriber growth,

despite an ambitious expansion abroad.

In the U.S., Netflix added 370,000 subscribers in the September

quarter, ahead of its forecast of 300,000, though it still slowed

sharply from the year-ago quarter when it added 880,000 domestic

subscribers.

Internationally, Netflix added 3.2 million subscribers, compared

with its guidance of 2 million. While that is a boost from the

year-ago quarter's 2.74 million subscribers, it is a relatively

small gain considering that it launched in more than 130 countries

in between.

For the current quarter, Netflix expected 1.45 million new

additions in the U.S. and 3.75 million abroad, beating analysts'

projections for an additional 1.3 million domestic subscribers and

3.3 million abroad, according to analysts surveyed by FactSet.

Netflix said in a letter to shareholders that it is going to

explore opportunities to license its shows to other online players

in China, a way to build Netflix's brand. Mr. Hastings recently

said "it doesn't look good" for Netflix's prospects of entering

China as a stand-alone streaming service.

The video company said the revenue contribution from China

licensing will be "modest." In the long term, it still hopes to

"serve the Chinese people directly, and hope to launch our service

in China eventually."

Netflix said it added more international subscribers than

expected in part because the impact of its original show and movie

premieres was "greater than anticipated across many of our

markets." The company said it expects to lose more money

internationally next quarter as it invests in more original content

across its global markets.

In addition, Netflix said it plans to boost its spending on

content to $6 billion next year from $5 billion this year, as it

increases the number of original programming hours to more than

1,000 next year from 600 hours this year. It reiterated that it

expects to start delivering material global profits next year.

The company said it ended the September quarter with about 83.3

million paid memberships.

Over all, Netflix reported third-quarter profit of $51.5

million, or 12 cents a share, up from $40.76 million, or 9 cents a

share.

Revenue rose to $2.29 billion from $2.1 billion.

Analysts surveyed by Thomson Reuters had projected earnings of 6

cents a share on $2.28 billion in revenue.

For the current quarter, Netflix projected earnings of 13 cents

a share, compared with the average analyst estimate of 7 cents a

share, according to Thomson Reuters.

Write to Maria Armental at maria.armental@wsj.com and Shalini

Ramachandran at shalini.ramachandran@wsj.com

(END) Dow Jones Newswires

October 17, 2016 16:55 ET (20:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

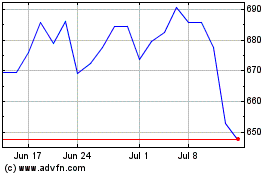

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

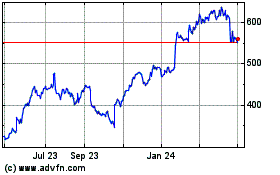

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024