Movies Aren't Main Motive in Comcast's Pursuit of DreamWorks Animation

April 27 2016 - 6:20PM

Dow Jones News

Comcast Corp.'s talks to purchase DreamWorks Animation SKG Inc.,

the studio behind "Shrek" and "Kung Fu Panda," are about everything

except the movies, people familiar with the deal discussions

said.

Rather, the potential $3 billion-plus acquisition is meant to

accelerate consumer products and theme park businesses and grow

synergies between film and television at NBCUniversal, the

Comcast-owned entertainment conglomerate, those people said.

Negotiations for Comcast to purchase DreamWorks could be

completed in the next few weeks but also may still fall apart, said

the knowledgeable people. The Wall Street Journal first reported on

the deal talks late Tuesday.

A Universal spokeswoman declined to comment.

Rather than continuing as an independently run subsidiary,

DreamWorks Animation would be mined for intellectual property

ranging from "Madagascar" to Lassie that could be used in toys,

T-shirts and theme park attractions, these people said. In

addition, the studio has in the past few years built a small but

potent television business which NBCUniversal hopes could make it

more competitive in children's programming and help it to adapt

other movie properties, from "Fast and Furious" to "Pitch Perfect,"

for the small screen.

In perhaps the clearest sign that the company won't continue in

its current form following a sale, DreamWorks Animation Chief

Executive Jeffrey Katzenberg is expected to exit as part of a deal.

The veteran Hollywood mogul, who previously ran Walt Disney Co.'s

movie business, is the "K" in "SKG" and has been part of DreamWorks

since its founding in 1994. Ten years later, he became CEO of

DreamWorks Animation when it spun out as a public company.

It isn't clear what the 65-year-old, who has been one of the

Democratic Party's most active fundraisers, would do following a

sale of the company. Mr. Katzenberg declined to comment when

reached Wednesday.

When it comes to DreamWorks' movie production assets, Comcast

executives haven't yet determined what to do with them going

forward. They plan to leave that decision to Chris Meledandri, the

producer who oversees Universal's animation business Illumination

Entertainment. Since releasing its first movie in 2010,

Illumination has become one of the industry's top players with the

hit "Despicable Me" series and its "Minions" spinoff.

It has also gained notice for producing its movies outside the

U.S. at significantly lower budgets than competitors such as

DreamWorks .

Mr. Meledandri, the knowledgeable people said, would be tasked

with looking under the hood of DreamWorks Animation and determining

what movies it should produce as part of Universal. Illumination,

which is releasing two films this year and in 2017, and DreamWorks

would remain separate consumer brands.

Cutbacks in production and overhead at DreamWorks are likely

following a sale, the knowledgeable people said.

In potentially spending billions to acquire a repository of

intellectual property it can exploit through its numerous business,

Comcast is pursuing a strategy similar to one followed over the

past decade by Walt Disney Co. with acquisitions such as Marvel

Entertainment Inc. and Lucasfilm LLC.

NBCUniversal, whose top ranks include several former Disney

executives such as Chief Executive Steve Burke, has more than

doubled investment in its theme parks, spending $2 billion between

2013 and 2015, and grown its consumer products business to more

than $100 million in annual revenue last year from $30 million

before the cable company took over in 2011.

While still small compared with Disney, those businesses are

growing fast and could accelerate with the infusion of new

intellectual property. NBCUniversal has also lagged behind

competitors such as Disney to date in using its movie franchises on

its suite of television channels.

"The whole strategy of how they think about merchandising their

movies across the theme parks, and even in consumer product and in

their cable products, borrows a page from Disney's," says Craig

Moffett, analyst at MoffettNathanson.

DreamWorks' best-known movie franchises, which also include "How

to Train Your Dragon" and "The Croods," aren't its only brands

attractive to Comcast. The purchase could validate one of Mr.

Katzenberg's little noticed moves of the past few years: His 2012

purchase of Classic Media, which has a portfolio of well-known

characters including Casper the Friendly Ghost, Fat Albert, and

Lassie, for $155 million. Those characters would become a

significant part of the NBCUniversal merchandising machine.

DreamWorks is already producing a television series based on

Classic's "Voltron" for Netflix. In November, it will release a

movie based on the Troll dolls, which it acquired the rights to in

2013.

Shalini Ramachandran contributed to this article.

Write to Ben Fritz at ben.fritz@wsj.com and Erich Schwartzel at

erich.schwartzel@wsj.com

(END) Dow Jones Newswires

April 27, 2016 18:05 ET (22:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

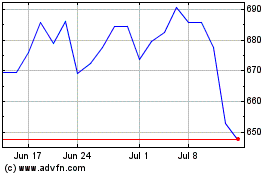

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

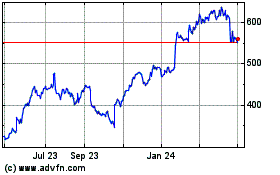

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024