Regulators Recommend Approval of Charter-Time Warner Cable Deal -- Update

April 25 2016 - 5:23PM

Dow Jones News

By Shalini Ramachandran and John D. McKinnon

Federal regulators moved to approve Charter Communications

Inc.'s $55 billion acquisition of Time Warner Cable Inc. but said

the combined cable giant would have to live under several stringent

conditions that single it out among industry rivals.

In separate statements, the Justice Department and Federal

Communications Commission Chairman Tom Wheeler said the conditions

would mitigate threats to online video competition posed by the

merger, which will create the second-largest cable company after

Comcast Corp., serving more than 17 million video customers. As

part of the deal, Charter also agreed to merge with smaller

operator Bright House Networks for about $10.4 billion.

Mr. Wheeler circulated a draft order to the four other FCC

commissioners, and the matter is expected to be voted on in coming

days. The Justice Department reached a settlement with the

companies.

As part of the package of conditions with the FCC, Charter has

agreed to build out high-speed broadband service to 2 million more

homes. One million of those homes will be in markets where Charter

will compete with another Internet provider offering the FCC's

definition of broadband at 25 megabits per second.

That would require some amount of "overbuilding" cable

companies, a person familiar with the deal said. Historically,

cable companies haven't competed against each other in the same

geographic areas, but the emergence of Internet broadband service

could be changing that dynamic. Charter would be able to acquire

other providers to achieve expansion in up to 250,000 homes,

provided the acquired firm wasn't planning to upgrade its

service.

The deal would also require the combined company to swear off

data caps and usage-based billing for as long as seven years -- a

restriction no other broadband provider faces today.

The company also wouldn't be able to charge companies such as

Netflix Inc. for so-called interconnection deals that govern

traffic handoffs between networks for that period. When regulators

approved AT&T Inc.'s deal to buy DirecTV last year, they didn't

impose a similar ban on interconnection fees.

In practice, the seven-year limit could be shortened by federal

regulators after five years, if economic conditions have changed

sufficiently. The time frame was one of the big sticking points in

the negotiations over the conditions, according to people familiar

with the talks.

Charter's settlement with the Justice Department also bans the

cable company from imposing contract provisions that would limit

media companies in any way from licensing their programming to

rival online video providers. Big pay-TV distributors have long

used "most-favored nation" and similar clauses to make sure they

get the best deals from TV programmers.

Saying that Time Warner Cable had been "the industry leader" in

seeking such restrictive clauses, the Justice Department said

Charter wouldn't be able to enforce provisions already in place,

retaliate against programmers for licensing to online entrants, or

avail itself of such clauses in rival distributors' contracts.

Regulators will require Charter to retain an independent monitor

to ensure its compliance with the conditions.

Charter said it is pleased with steps taken by Mr. Wheeler and

the Justice Department and it is confident it will "soon receive

final approval from federal regulators as well as the California

[Public Utilities Commission]," the state regulatory body.

Charter's shares closed up 4.6% to $207.01 in Monday trading,

while Time Warner Cable gained 4.1% to $209.63.

Comcast's planned takeover of Time Warner Cable collapsed last

year when regulators were prepared to block the deal. Officials

said they couldn't see a combination of conditions that would have

sufficiently addressed the threat to competition.

Write to Shalini Ramachandran at shalini.ramachandran@wsj.com

and John D. McKinnon at john.mckinnon@wsj.com

(END) Dow Jones Newswires

April 25, 2016 17:08 ET (21:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

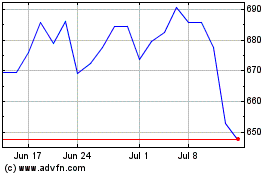

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

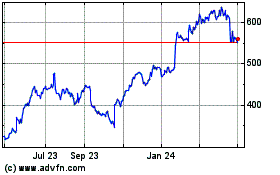

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024