Fox Nominates ValueAct CEO to Board

September 29 2015 - 9:30AM

Dow Jones News

21st Century Fox has nominated to its board Jeffrey Ubben, the

chief executive of activist investment fund ValueAct Capital

Management LP, part of a broader agreement in which ValueAct agreed

not to launch a proxy fight or other hostile action against the

company for the length of the board term, the company announced

Tuesday.

ValueAct, a hedge fund known to be on the friendlier end of the

spectrum of investor activism, disclosed in August 2014 that it had

made a sizable investment in Fox. ValueAct currently owns 5.9% of

21st Century Fox's Class B voting stock, according to regulatory

filings.

Mr. Ubben will go up for election to Fox's board at the

company's annual shareholders' meeting later this year. With his

nomination, the company would expand its board from 12 to 13

members. The length of the board term is one year.

21st Century Fox, owner of the Fox broadcast network, several

cable channels including Fox News and the Twentieth Century Fox

film and television studio, was until 2013 part of the same company

as Wall Street Journal-owner News Corp.

Unlike more aggressive activist investors, ValueAct hasn't laid

out publicly any specific things it is seeking to change about

Fox's management. Over the past year, Mr. Ubben has met frequently

with members of the family of media mogul Rupert Murdoch, which

controls the company, and has grown close to management, people

familiar with the matter say. Last week, for example, he was one of

the guests the Murdochs invited to meet with Indian Prime Minister

Narendra Modi, the people said.

Mr. Ubben believes that James Murdoch, who succeeded his father

as CEO of 21st Century Fox in July, is doing the right things, and

just believes he can add value as an adviser, according to people

familiar with the matter.

Fox abandoned its bid for Time Warner—a deal that would have

reshaped the media landscape—after the companies failed to agree on

price and Fox's stock fell, making it a less valuable currency.

Some on Wall Street cheered Fox's discipline because it didn't keep

raising its bid. In the wake of the failed bid, Mr. Ubben told

Reuters that Fox should "retain the opportunity later to revisit

the deal," though he supported the company's decision to walk

away.

Mr. Ubben believes a challenge for Fox and the whole media

industry is how to deal with the rise of Netflix Inc., according to

a recent letter to ValueAct investors. Some media analysts believe

the streaming giant is undermining the ad-supported TV ecosystem,

helping to accelerate "cord-cutting"—pay TV disconnections—and drag

down ratings.

The letter to ValueAct investors suggested Netflix's impact on

media stock valuations is a catalyst for "fundamental change in

strategy."

The letter, reviewed by The Wall Street Journal, said James

Murdoch has demonstrated a "facility for technology that we have

not witnessed among other industry leaders" and suggested Fox could

"pull an Adobe." The letter didn't elaborate on the reference, but

ValueAct helped the software maker Adobe Systems Inc. turn to a

subscription model, which the fund has held up as a way to

transform investor sentiment and defend the company's content

against piracy.

James Murdoch hinted at a Goldman Sachs conference last week

that Fox had been rethinking its dealings with such services. While

Netflix remains an important partner, he said, Fox has done more

deals of late with rival Hulu. (Fox co-owns Hulu with Walt Disney

Co. and Comcast Corp.)

"I think certainly the business rules around how we sell to

[streaming video] providers are changing and our thinking is

evolving," Mr. Murdoch said at the conference.

Fox shares are down 34.4% so far this year, amid broad losses

for media companies as investors fret about cord-cutting.

"Jeff will bring our board a great perspective as a global

investor and a shared belief in building long-term value for

shareholders," said Rupert and Lachlan Murdoch, executive chairmen

of 21st Century Fox, in a statement. "Our board and senior

management team have developed a highly-valued relationship with

Jeff and we are pleased he has accepted the board's invitation to

stand for election."

"I have been extremely impressed with 21st Century Fox's senior

leadership team and directors and their collective vision for the

company's continued growth in a dynamic industry," Mr. Ubben said

in a statement. "The rapidly changing media landscape presents

significant opportunities, and I believe 21st Century Fox is

uniquely positioned to leverage its global presence and market

leadership to create further long-term value for shareholders."

Write to Keach Hagey at keach.hagey@wsj.com and David Benoit at

david.benoit@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 29, 2015 09:15 ET (13:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

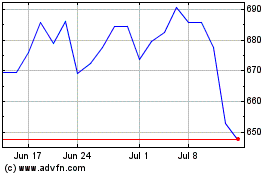

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Mar 2024 to Apr 2024

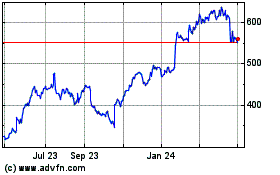

Netflix (NASDAQ:NFLX)

Historical Stock Chart

From Apr 2023 to Apr 2024