UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 20, 2015

Commission File No. 1-14588

NORTHEAST BANCORP

(Exact name of registrant as specified in its charter)

|

Maine |

|

01-0425066 |

|

(State or other jurisdiction of incorporation) |

|

(IRS Employer Identification Number) |

|

500 Canal Street

Lewiston, Maine |

|

04240 |

|

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (207) 786-3245

Former name or former address, if changed since last Report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

☐ Pre-commencement to communications pursuant to Rule 13e-4(c) under the Exchange Act

|

Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On November 20, 2015, the shareholders of Northeast Bancorp (the “Company” or “Northeast”) approved the Company’s Senior Executive Incentive Plan (the “Incentive Plan”). The results of the shareholder vote on the Incentive Plan are set forth below under Item 5.07 of this Current Report on Form 8-K. A summary of the key terms of the Incentive Plan is included in the Company’s Definitive Proxy Statement on Schedule 14A for the Annual Meeting of Shareholders filed on October 9, 2015. The foregoing description of the Incentive Plan is qualified in its entirety by reference to the full text of the Incentive Plan attached hereto as Exhibit 10.1 and incorporated herein by reference.

On November 20, 2015, the Compensation Committee of the Board of Directors (the “Compensation Committee”) of the Company amended the terms of certain stock option and restricted stock awards previously granted to Claire Bean, the Company’s Chief Operating Officer, in connection with her previously announced retirement from the Company, effective December 31, 2015 (the “Retirement Date”), and in recognition of Ms. Bean’s service and contributions to the Company. The Compensation Committee sent Ms. Bean a letter (the “Letter”) memorializing the amendments, which are as follows:

| |

● |

59,404 stock options granted on December 29, 2010 shall remain outstanding and may become exercisable in accordance with their terms as though Ms. Bean remained an employee of the Company. |

| |

● |

33,059 stock options granted on January 31, 2013, which vest on the Retirement Date pursuant to the terms of the award agreement, shall be exercisable for a period of three years following the Retirement Date. |

| |

● |

5,277 restricted shares of voting common stock of the Company granted on January 31, 2013 shall fully vest on the Retirement Date. |

The foregoing description of the Letter is qualified in its entirety by reference to the full text of the Letter attached hereto as Exhibit 10.2 and incorporated herein by reference.

|

Item 5.07. |

Submission of Matters to a Vote of Security Holders. |

On November 20, 2015, the Company held its 2015 annual meeting of shareholders. At the annual meeting, the shareholders elected each of Matthew B. Botein, Cheryl Lynn Dorsey and Peter W. McClean as a director for a term of three years and until their respective successors are duly elected and qualified. In addition, the shareholders (i) approved, on an advisory, non-binding basis, the named executive officer compensation; (ii) ratified the appointment of RSM US LLP (formerly McGladrey LLP) as Northeast’s independent registered public accounting firm for the fiscal year ending June 30, 2016 and (iii) approved the Northeast Bancorp Senior Executive Incentive Plan.

The voting results of each of the proposals submitted at the 2015 annual meeting of shareholders are set forth below:

1. To elect the three nominees named in the proxy statement as Class II directors, each to serve for a three-year term and until their respective successors are duly elected and qualified:

|

|

|

FOR |

|

WITHHELD |

|

BROKER NON-VOTES |

|

|

Matthew B. Botein |

|

6,736,543 |

|

59,615 |

|

808,268 |

|

|

Cheryl Lynn Dorsey |

|

6,736,743 |

|

59,415 |

|

808,268 |

|

|

Peter W. McClean |

|

6,736,243 |

|

59,915 |

|

808,268 |

|

2. To approve the advisory, non-binding proposal to approve the compensation of Northeast’s named executive officers:

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

|

|

6,030,895 |

|

760,898 |

|

4,365 |

|

808,268 |

|

3. To ratify the appointment of RSM US LLP as Northeast’s independent registered public accounting firm for the fiscal year ending June 30, 2016:

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

|

|

7,603,753 |

|

400 |

|

273 |

|

— |

|

4. To approve the Northeast Bancorp Senior Executive Incentive Plan:

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

BROKER NON-VOTES |

|

|

6,721,115 |

|

43,830 |

|

31,213 |

|

808,268 |

|

|

Item 9.01. |

Financial Statements and Exhibits |

(d) Exhibits.

| |

10.1 |

Northeast Bancorp Senior Executive Incentive Plan |

| |

10.2 |

Letter dated November 24, 2015 |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunder duly authorized.

|

|

NORTHEAST BANCORP |

|

|

|

|

|

|

|

|

|

By: |

/s/ Brian Shaughnessy |

|

|

Name: |

Brian Shaughnessy |

|

|

Title: |

Chief Financial Officer and Treasurer |

Date: November 24, 2015

2

Exhibit 10.1

NORTHEAST BANCORP

SENIOR EXECUTIVE INCENTIVE BONUS PLAN

This Senior Executive Incentive Bonus Plan (the “Incentive Plan”) is intended to provide an incentive for superior work and to motivate eligible executives of Northeast Bancorp (the “Company”) and its subsidiaries toward even higher achievement and business results, to tie their goals and interests to those of the Company and its shareholders and to enable the Company to attract and retain highly qualified executives. The Incentive Plan is for the benefit of Covered Executives (as defined below).

From time to time, the Compensation Committee of the Board of Directors of the Company (the “Compensation Committee”), which consists of at least two non-employee directors, each of whom satisfies the requirements of Section 162(m), may select certain key executive officers of the Company (the “Covered Executives”) to be eligible to receive bonuses hereunder. Participation in this Incentive Plan does not change the “at will” nature of a Covered Executive’s employment with the Company.

The Compensation Committee shall have the sole discretion and authority to administer and interpret the Incentive Plan in good faith, including to satisfy the requirements for tax deductibility for payments in accordance with Section 162(m). Such authority includes the selection of the performance criterion or criteria for any applicable Performance Period and any Covered Executive. Decisions of the Compensation Committee shall be final, conclusive and binding on all parties including the Company, its shareholders and Covered Executives and their beneficiaries.

(a) Corporate Performance Goals. A Covered Executive may receive a bonus payment under the Incentive Plan based upon the attainment of one or more performance objectives that are established by the Compensation Committee and relate to on or more of the following financial and operational metrics with respect to the Company or any of its subsidiaries (the “Corporate Performance Goals”): revenue; earnings before interest, taxes, depreciation and amortization; net income (loss) (either before or after interest, taxes, depreciation and/or amortization); changes in the market price of the Company’s common stock; economic value-added; acquisitions or strategic transactions; operating income (loss); return on capital, assets, equity, or investment; shareholder returns; return on sales; gross or net profit levels; productivity; expense efficiency; margins; operating efficiency; working capital; earnings (loss) per share of the Company’s common stock; sales or market shares; number of customers, number of new customers or customer references; operating income and/or net annual recurring revenue; credit quality; loan loss reserve; capital strength; financial or credit ratings; assets under management; balance sheet assets; market to book ratio; risk management; and strategic management, any of which may be (A) measured in absolute terms or compared to any incremental increase, (B) measured in terms of growth, (C) compared to another company or companies or to results of a peer group, (D) measured against the market as a whole and/or as compared to applicable market indices and/or (E) measured on a pre-tax or post-tax basis (if applicable). Further, any Corporate Performance Goal may be used to measure the performance of the Company as a whole or a business unit or other segment of the Company, or one or more product lines or specific markets. The Corporate Performance Goals may differ from Covered Executive to Covered Executive.

(b) Calculation of Corporate Performance Goals. Within 90 days after each Performance Period begins (or such other date as may be required or permitted under Section 162(m)), the Compensation Committee shall establish a target bonus opportunity for each Covered Executive and the Corporate Performance Goal(s) that must be satisfied in order for a Covered Executive to receive an award hereunder for such Performance Period. Corporate Performance Goals will be calculated in accordance with the Company’s financial statements, generally accepted accounting principles, or under a methodology established by the Compensation Committee at the beginning of the Performance Period and which is consistently applied with respect to a Corporate Performance Goal in the relevant Performance Period.

(c) Target; Minimum; Maximum. Each Corporate Performance Goal shall have a “target” (100 percent attainment of the Corporate Performance Goal) and may also have a “minimum” hurdle and/or a “maximum” amount. Any provision of this Incentive Plan notwithstanding, in no event shall any Covered Executive receive an award hereunder in respect of any Performance Period in excess of $3,309,921.

(d) Bonus Requirements. Except as otherwise set forth in this Section 4(d): (i) any bonuses paid to Covered Executives under the Incentive Plan shall be based upon objectively determinable bonus formulas that tie such bonuses to one or more performance targets relating to the Corporate Performance Goals, (ii) bonus formulas for Covered Executives shall be adopted within 90 days of the beginning of the Performance Period by the Compensation Committee and communicated to each Covered Executive at the beginning of each Performance Period and (iii) no bonuses shall be paid to Covered Executives unless and until the Compensation Committee has certified in writing the attainment of the performance targets relating to the Corporate Performance Goals. Notwithstanding the foregoing, the Compensation Committee at its sole discretion may reduce (but may not increase) the amount of a performance award determined using the applicable payment schedule(s) or formula(s) for a given Covered Executive.

(e) Employment Requirement. Except as set forth in Section 4(f) below, the payment of a bonus to a Covered Executive with respect to a Performance Period shall be conditioned upon the Covered Executive’s employment by the Company on the bonus payment date; provided, however, that the Compensation Committee may, in its sole discretion, make exceptions to this requirement. If a Covered Executive was not employed for an entire Performance Period, the Compensation Committee may pro rate the bonus based on the number of days employed during such period.

(f) Death or Disability. If a Covered Executive dies or becomes disabled prior to the last day of the Performance Period for which an award is payable hereunder, such Covered Executive may receive an award hereunder equal to the amount such Covered Executive would have received under the Incentive Plan if such Covered Executive had remain employed through the payment date, multiplied by a fraction, the numerator of which is the number of days that have elapsed during the Performance Period in which the Covered Executive’s death or disability occurs prior to and including the date of the Covered Executive’s death or disability and the denominator of which is the total number of days in the Performance Period, or such lesser amount as the Compensation Committee may deem appropriate.

(g) Change of Control. In the event of a Change of Control, the Compensation Committee (as constituted immediately prior to the Change of Control) shall, in its sole discretion, determine whether and to what extent the Corporate Performance Goals and objectives have been met for the Performance Period in which the Change of Control occurs.

(h) Forfeiture of Performance Award. Notwithstanding anything herein to the contrary, each Covered Executive shall, in the discretion of the Compensation Committee, reimburse the Company for the amount of any award received by such individual under the Plan to the extent such award or the value of such award was based on materially inaccurate financial statements or any other materially inaccurate performance metric criteria. Notwithstanding anything herein to the contrary, any awards paid pursuant to this Incentive Plan shall be subject to the Company’s clawback policy, as in effect from time to time.

(a) Except as otherwise provided hereunder, payment with respect to Corporate Performance Goals will be measured as of the end of each such Performance Period (e.g., the end of each fiscal year) after the Company’s financial reports with respect to such period(s) have been published. Following certification that such Corporate Performance Goals are met, bonus payments will be made as soon as practicable, but not later than December 31 after the end of the relevant fiscal year.

(b) The Compensation Committee shall determine whether any award payable under the Incentive Plan is payable in cash, or in stock, restricted stock or options.

The following terms shall have the following meanings:

(a) “Change of Control” means (i) the sale of all or substantially all of the assets of the Company on a consolidated basis to an unrelated person or entity, (ii) a merger, reorganization or consolidation pursuant to which the holders of the Company’s outstanding voting power immediately prior to such transaction do not own a majority of the outstanding voting power of the resulting or successor entity (or its ultimate parent, if applicable) immediately upon completion of such transaction, or (iii) the sale of all of the stock of the Company to an unrelated person or entity.

(b) “Performance Period” means the period during which performance is measured to determine the level of attainment of a bonus award, which shall be the Company’s fiscal year.

(c) “Section 162(m)” means Section 162(m) of the Internal Revenue Code of 1986, as amended, and any regulations promulgated thereunder (including any proposed regulations).

(a) Effective Date of the Incentive Plan. The Incentive Plan shall be effective for the Company’s 2017 fiscal year and for each of the three subsequent fiscal years, unless terminated earlier by the Compensation Committee, provided that the Incentive Plan is approved by the affirmative vote of a majority of the votes cast at the Company’s 2015 Annual Meeting of the Shareholders.

(b) Amendment to the Incentive Plan. The Compensation Committee may terminate, amend or otherwise modify the Incentive Plan from time to time as it deems appropriate to service the Plan’s purposes. However, the Compensation Committee shall not amend the Incentive Plan, without the appropriate approval of shareholders of the Company, if such amendment would result in payments not qualifying for deductibility under Section 162(m) as determined by the Compensation Committee in good faith.

(c) Designation of Beneficiary. Each Covered Executive may designate a beneficiary or beneficiaries (which beneficiary may be an entity other than a natural person) to receive any payments which may be made following the Covered Executive’s death. Such designation may be changed or canceled at any time without the consent of any such beneficiary. Any such designation, change or cancellation must be made in a form approved by the Compensation Committee and shall not be effective until received by the Compensation Committee. If no beneficiary has been named, or the designated beneficiary or beneficiaries shall have predeceased the Covered Executive, the beneficiary shall be the Covered Executive’s spouse or, if no spouse survives the Covered Executive, the Covered Executive’s estate.

(d) No Right to Continued Employment. Nothing in this Incentive Plan shall be construed as conferring upon any Covered Executive any right to continue in the employment of the Company.

(e) No Limitation on Corporate Actions. Nothing contained in the Incentive Plan shall be construed to prevent the Company from taking any corporate action which is deemed by it to be appropriate or in its best interest (including, without limitation, the payment of bonuses or issuance of equity awards under other incentive compensation plans established or utilized by the Company), whether or not such action would have an adverse effect on any awards made under the Incentive Plan. No employee, beneficiary or other person shall have any claim against the Company as a result of any such action.

(f) Taxes. Any amount payable to a Covered Executive or a beneficiary under the Incentive Plan shall be subject to any applicable United States federal, state and local income and employment taxes and any other amounts that the Company is required by law to deduct or withhold from such payment.

(g) Severability. If any provision of this Incentive Plan is held unenforceable, the remainder of the Incentive Plan shall continue in full force and effect without regard to such unenforceable provision and shall be applied as though the unenforceable provision were not contained in the Incentive Plan.

(h) Governing Law. The validity, construction and effect of the Incentive Plan and any actions taken under or relating to the Incentive Plan shall be determined in accordance with the laws of the State of Maine and applicable federal law.

4

Exhibit 10.2

November 24, 2015

Claire Bean

c/o Northeast Bancorp

500 Canal Street

Lewiston, ME 04240

Dear Ms. Bean:

On October 23, 2015, you gave notice of your intention to retire from Northeast Bancorp (the “Company”) effective December 31, 2015 (the “Retirement Date”).

As you know, the Company granted you (1) an option to purchase 59,404 shares of voting common stock of Northeast Bancorp, par value $1.00 per share (“Voting Common Stock”), on December 29, 2010, pursuant to the Northeast Bancorp Amended and Restated 2010 Stock Option and Incentive Plan (the “Plan”) and subject to the restrictions and conditions set forth in the Amended and Restated Non-Qualified Performance-Based Stock Option Agreement dated March 22, 2013 (“2010 Option Agreement”), and the Plan; (2) an option to purchase 33,059 shares of Voting Common Stock (the “2013 Stock Option Award”) on January 31, 2013, pursuant to the Plan and subject to the restrictions and conditions set forth in the Non-Qualified Stock Option Agreement dated January 31, 2013 and the Plan, and (3) 5,277 restricted shares of Voting Common Stock (the “2013 Restricted Stock Award”) pursuant to the Plan and subject to the restrictions and conditions set forth in the Restricted Stock Award Agreement dated January 31, 2013 and the Plan.

In recognition of your service and contributions to the Company, the Compensation Committee of the Board of Directors of the Company has determined the following with regard to your outstanding and unvested equity awards described above, consistent with the terms of the Plan and, in each case, effective as of the Retirement Date:

| |

(a) |

Section 3 of the 2010 Option Agreement shall be amended by deleting Section 3 in its entirety and replacing it with the following: |

| |

|

|

| |

|

“3. Termination of Employment. Notwithstanding anything herein or in the Plan to the contrary, if the Optionee’s employment by the Company or a Subsidiary (as defined in the Plan) is terminated for any reason other than for Cause (as such term is defined in the Employment Agreement by and between the Company and the Optionee), this Stock Option shall remain outstanding until the Expiration Date and, to the extent such Stock Option is not exercisable as of the date of such termination of employment, may become exercisable subject to satisfaction of the terms and conditions set forth in Section 1 of this Agreement; provided, however, any portion of this Stock Option that is not exercisable as of the seventh anniversary of the Grant Date shall terminate immediately and be of no further force or effect.” |

| |

(b) |

All of the 2013 Stock Option Award shall become fully exercisable and may thereafter be exercised for a period of three years from the Retirement Date. |

| |

(c) |

The 2013 Restricted Stock Award shall be fully vested. |

With best regards,

/s/ Peter W. McClean

Peter W. McClean

Chairman, Compensation Committee of the

Northeast Bancorp Board of Directors

2

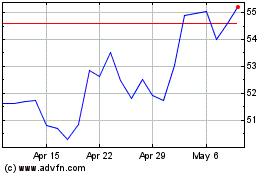

Northeast Bank (NASDAQ:NBN)

Historical Stock Chart

From Mar 2024 to Apr 2024

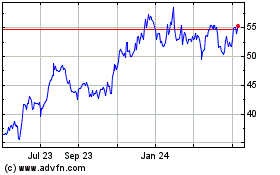

Northeast Bank (NASDAQ:NBN)

Historical Stock Chart

From Apr 2023 to Apr 2024