Navient unveils a virtual lab to test ideas that could transform student loan servicing

March 08 2017 - 8:00AM

Today, Navient announced the launch of Navient Labs, a digital lab

built to test new ideas and technology to enhance the student loan

experience. Navient Labs is a prototype built in response to

insights gleaned from student loan borrowers, focus groups, and

usability testing. This launch invites borrowers, consumer

advocates, policymakers, and other experts to review the ideas and

provide feedback.

“We gathered extensive feedback from call listening and other

research to develop a vision for what the future of student loan

servicing could look like and we are excited to test these ideas

for the future," said Navient CEO Jack Remondi. “2017 offers the

opportunity to reimagine the student loan experience from

origination to repayment. Every stage of the student loan life

cycle deserves careful review and innovative improvements so

students and their families can maximize the return on their

college investment. We look forward to working with policymakers to

find solutions that will holistically enhance the entire student

loan lifecycle."

Navient has a history of innovation to support the success of

student loan borrowers, pioneering efforts such as applying plain

language principles to student loan communications, establishing

"Voice of the Customer" panels to enhance processes, adopting a

human-assisted interactive voice telephone system, and creating an

online pay-by-loan option.

By focusing on creative solutions, Navient has established a

strong record of supporting borrower success. Forty-nine

percent of Navient balances serviced for the federal government are

enrolled in income-driven repayment programs, more than comparable

servicers. Further, Navient-serviced federal borrowers are 31

percent less likely to default.

The ideas developed through Navient Labs provide an added

opportunity to take a holistic look at policy reforms that could

improve the current student loan system. Navient has made concrete

recommendations to policymakers to address the most common issues,

including:

- Facilitate better lending and borrowing decisions using tools

such as a four-year award letter that provide borrowers with

information on the full cost of financing a degree before they

enter school.

- Simplify federal student loan repayment options, including

streamlining plans and reforming enrollment processes to make it

easier for customers to choose an affordable option.

- Help borrowers understand the value of paying off their loans

more quickly rather than extending loan repayment, which can

increase total cost.

- Encourage borrowers to connect with their servicers. Nine times

out of 10 when the company reaches struggling federal loan

borrowers, Navient can help them avoid default.

To learn more and to share feedback, visit

www.NavientLabs.com.

Connect with @Navient on Facebook, Twitter, LinkedIn

and Medium.

About NavientNavient (Nasdaq:NAVI) is a Fortune

500 company that provides asset management and business processing

services to education, healthcare, and government clients at the

federal, state, and local levels. The company helps its clients and

millions of Americans achieve financial success through services

and support. Headquartered in Wilmington, Del., Navient employs

team members in western New York, northeastern Pennsylvania,

Indiana, Tennessee, Texas, Virginia, and other locations. Learn

more at navient.com.

Contact:

Media: Patricia Nash Christel, 302-283-4076, patricia.christel@navient.com

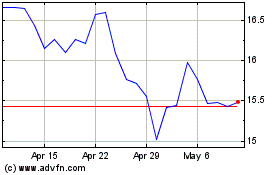

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Navient (NASDAQ:NAVI)

Historical Stock Chart

From Apr 2023 to Apr 2024